The U.S. Department of Transportation on November 30 issued a formal request for applications for the next round of multimodal RAISE grants, for which a total of at least $1.5 billion will be available. But at the same time, the Department is falling far behind in negotiating and signing actual grant agreements with project selectees so past appropriations can be put to work.

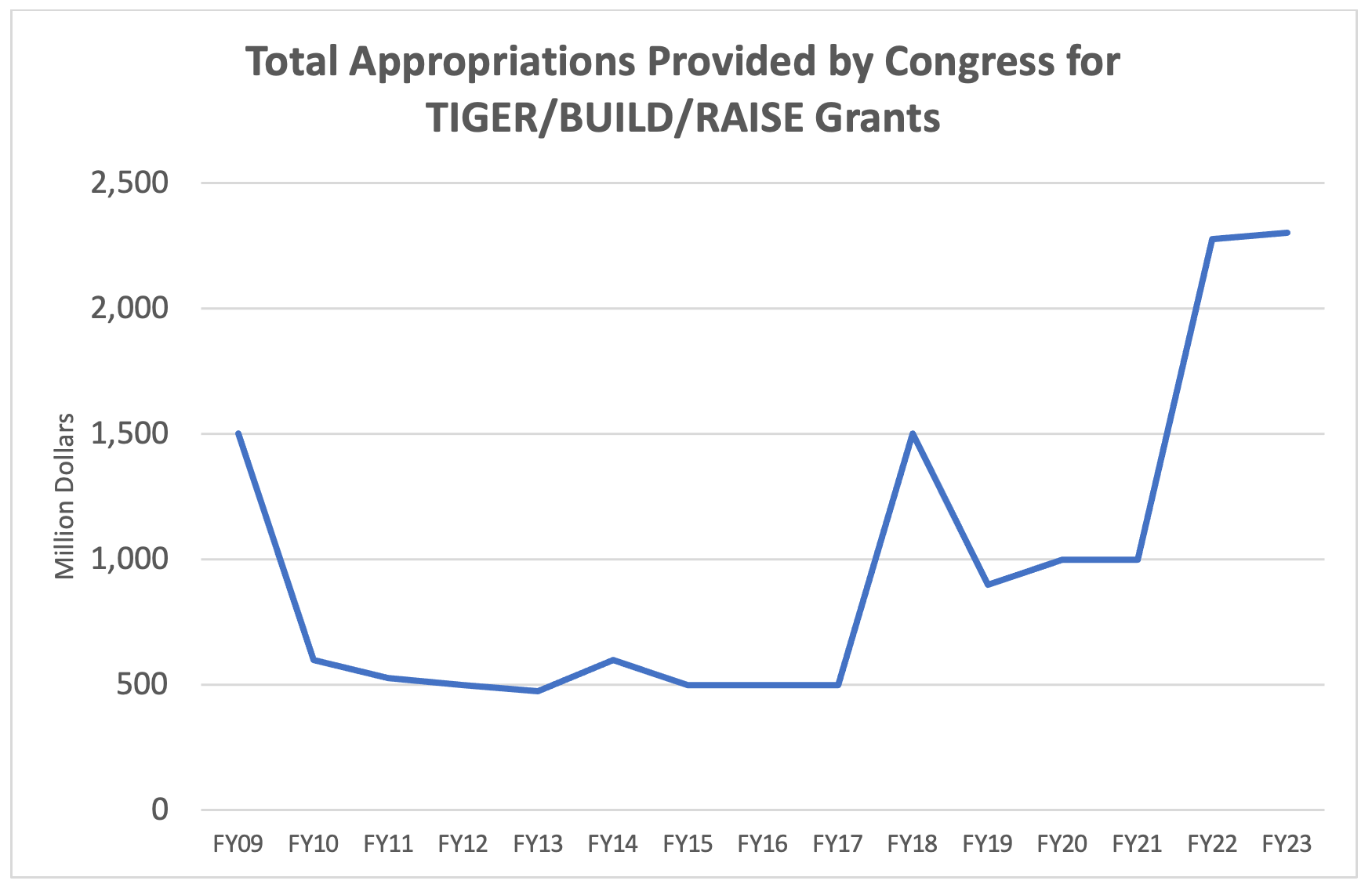

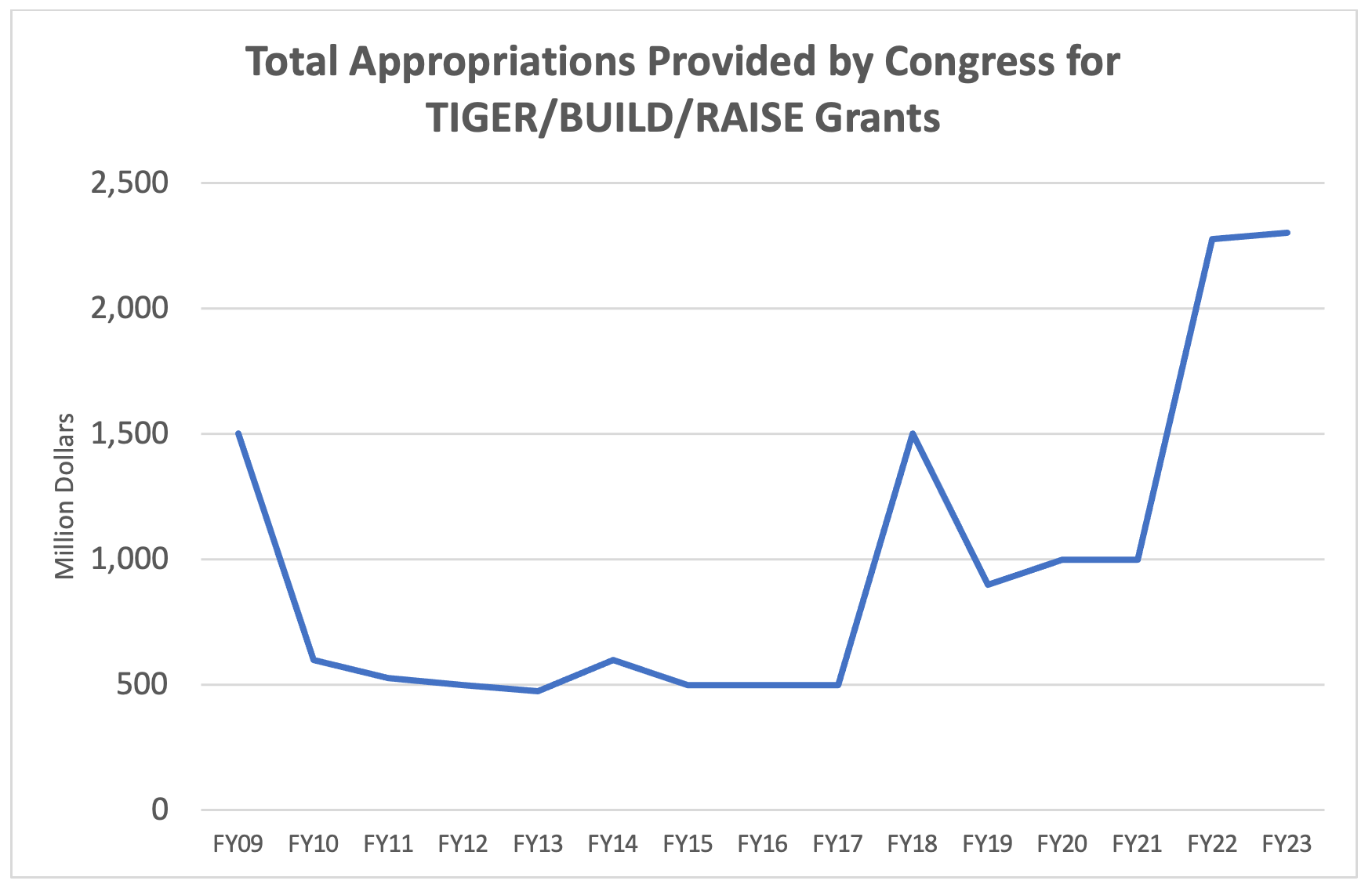

Fiscal 2024 will be the 16th round of funding for the program, which got its start in the fiscal 2009 ARRA stimulus appropriations act. Since then, the program (called TIGER at first, then BUILD, and now RAISE) has provided a total of $13.9 billion in capital funding for 898 different projects. (The program has also funded 197 planning grants, totaling $470 million.)

After ARRA, support for the program was reliant on annual appropriations, which fluctuated fairly widely. But the loosening of federal spending caps starting in 2018, followed by extra money provided each year for five years by the bipartisan infrastructure law (the IIJA), has led to more robust funding of late.

Because Congress has not yet finished the FY 2024 appropriations process, the total amount covered by the new Notice of Funding Opportunity is not yet known. The document promises the $1.5 billion in advance appropriations provided by the IIJA, with the caveat that “If the FY 2024 Appropriations Act, or other subsequent Acts, provide additional funding or significantly alter requirements for the RAISE Grant program, the Department will amend this Notice with guidance on additional requirements.”

The IIJA attempted to standardize the RAISE program, which was re-invented from whole cloth every year by the Appropriations Committees from 2009-2021. This has also standardized the NOFO somewhat. The new NOFO lists the following changes made from the FY 2023 NOFO:

- Simplify the NOFO with the use of plain language and tables to organize information.

- Refine the merit criteria rating rubric. For example, this NOFO provides more examples of project elements that align with a “High” rating under Safety, Environmental Sustainability, and Innovation. Please see the merit criteria rating rubric in Section E for more details.

- Clarify what applicants should provide in the Project Budget document for the Financial Completeness Review.

- Update data used to determine Urban, Rural, and Areas of Persistent Poverty designations, and uses the Climate & Economic Justice Screening Tool (CEJST), created by the White House Council on Environmental Quality (CEQ), to identify Historically Disadvantaged Communities.

The deadline for applications for FY 2024 grants to be filed is midnight on February 28, 2024. (Ed. Note: Why don’t people set deadlines on Leap Day? It only comes around every four years.) Under the IIJA, there is a new statutory requirement that DOT announce the winners no more than four months after the deadline, so the NOFO notes that the grant announcements will be coming by June 27, 2024. (Which, you may note, is a little over three months before Election Day.) They have been meeting this deadline – for FY 2022, the application deadline was January 28 and the winners were announced April 14, and for FY 2023, the deadline was February 28 and the winners were announced June 28.

However, recent end-of-fiscal-year data reporting has exposed a potential problem with this program. While an announcement from DOT that your project has been selected for a $50 million federal grant is welcome, that announcement is only a press release and is not legally binding. To actually access the money, you have to negotiate a legal document called a project agreement with USDOT and then you both have to sign the agreement. That legally obligates the Department to give you the money when you fulfill the terms of the agreement.

While new appropriations and new grant selection press releases have gone up, the rate at which USDOT and selectees have been able to negotiate and execute grant agreements has actually gone down. For the “National Infrastructure Investments” account (069-0143), which includes both the $1 billion MEGA project grant program as well as RAISE, the level of new obligations executed dropped in fiscal 2023 to just $252 million, an 80 percent drop from 2022’s $1.247 billion.

This means that the unobligated balance in the account has gone up from $2.4 billion at the end of fiscal 2021 to $7.4 billion at the end of fiscal 2023.

|

FY 2020 |

FY 2021 |

FY 2022 |

FY 2023 |

| Carryover Unobligated Balance from Prior Year |

2,597 |

1,918 |

2,369 |

4,394 |

| New Appropriations |

+1,000 |

+1,000 |

+3,225 |

+3,234 |

| New Obligations |

-1,689 |

-557 |

-1,247 |

-252 |

| Unobligated Carryover to Next Year |

1,908 |

2,361 |

4,347 |

7,375 |

As you can see from the table above, there was a drop in new obligations in fiscal 2021 as well from fiscal 2020, but the most likely explanation there was the change of Administrations and the difficulty in getting enough warm bodies into the proper offices in January-September 2021.

What’s behind the sudden drop in the rate at which DOT is getting new project agreements signed? We’re not sure yet. It is possible that there are staff constraints within the Office of the Secretary that are causing a slowdown, which could be remedied by providing more resources.

But another, more difficult possibility exists. When a locality applies for a RAISE or MEGA grant, that project has usually been on the drawing board for a long time. And RAISE gives precedence to projects that have applied in previous cycles and been rejected for a technical reason that has now been fixed.

This means that the construction cost estimates for these projects were probably done some time ago, before the massive construction cost inflation of the last two years. (Highway construction costs went up 50 percent from December 2020 to December 2022 and have not significantly retreated.)

Take a typical RAISE grant from FY 2023, where the total project cost was an even $30 million and the locals asked for a $25 million RAISE grant and got $20 million. They have to find another $5 million to make the numbers work, promise DOT they can do so, and get the grant announced. But then the revised cost estimate comes in and the cost has risen by 50 percent, to $45 million and now they have to find another $15 million on top of the earlier $5 million to make the project doable, and they have to find it before they can sign the grant agreement.

If this is the explanation behind the sudden slowdown in RAISE/MEGA grant execution – systemic upwards-ratcheting cost estimates so large that they render the original financial plan invalid – then this problem will be getting worse before it gets better.