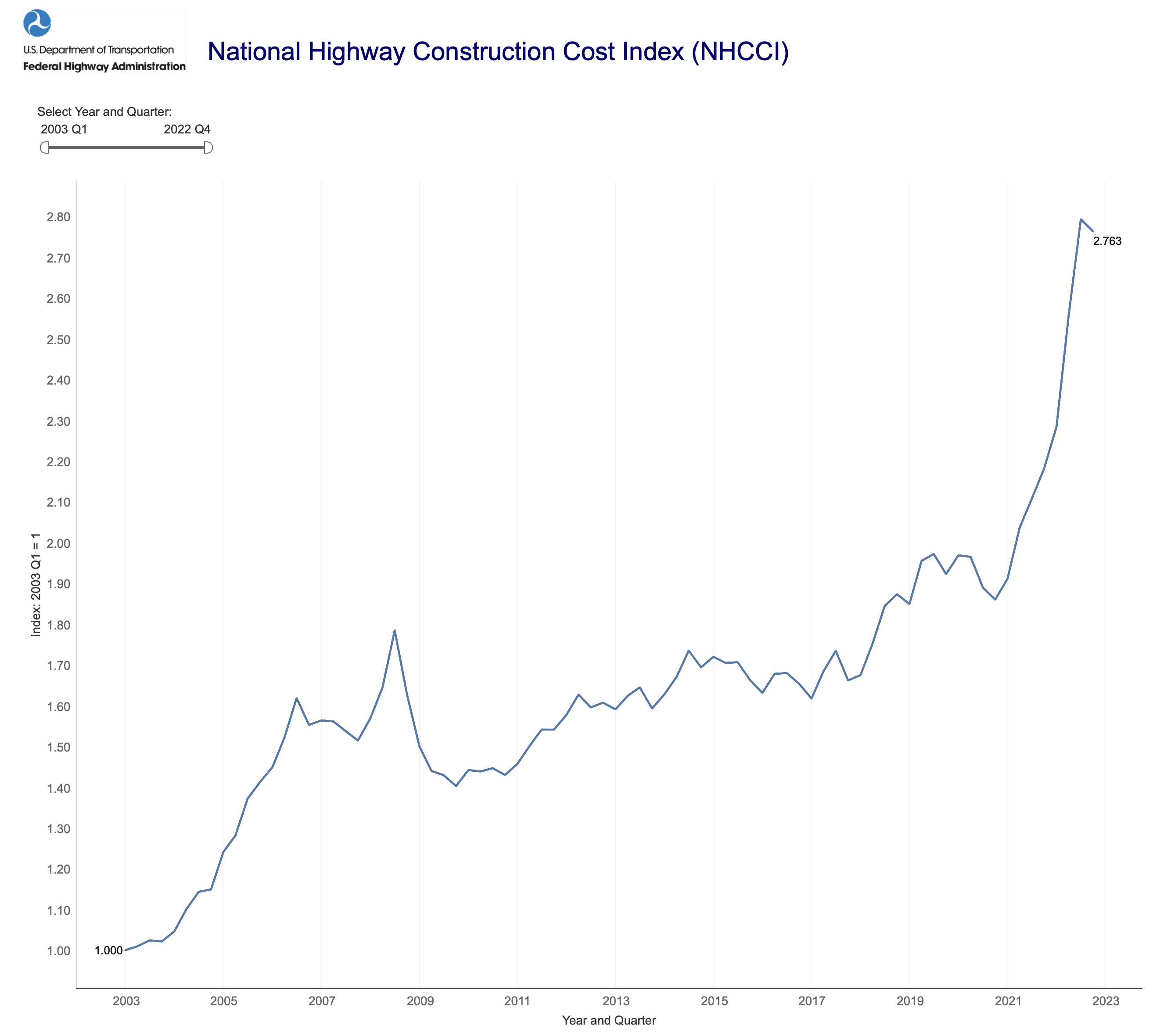

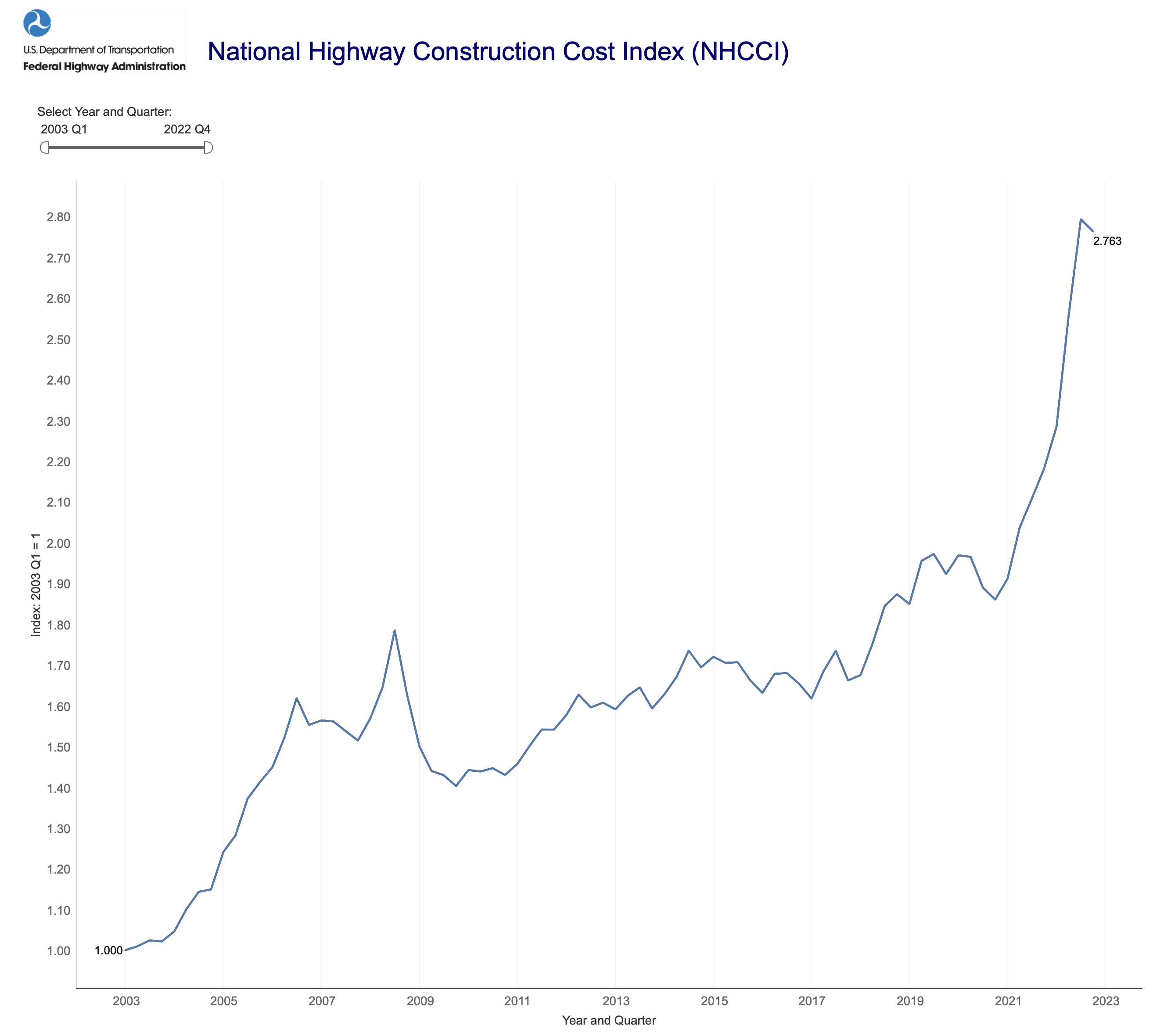

After almost two years of explosive growth, the Federal Highway Administration’s metric of highway construction costs dipped in the fourth quarter of calendar year 2022 according to data released today.

FWHA’s National Highway Construction Cost Index (NHCCI) dropped to 2.763, a 1.1 percent drop from the all-time high in the previous quarter. However, costs are still up 48.5 percent from the level in the October-December 2020 quarter (when the NHCCI was just 1.860).

Digging into the data, a 3.1 percent drop in the cost of asphalt (due to declining oil prices) was somewhat offset by a 2.4 percent increase in the cost of grading and excavation (which is one of the more labor-intensive cost sectors, in a very tight job market).

By our reckoning, the result of the highway construction cost inflation in 2022 and 2023 has been to devalue the construction dollar to the point that FHWA has lost $24.1 billion in buying power, as shown in the calculations below. Obligation data is from usaspending.gov.

Total FHWA Obligations (Excluding Emergency Relief)

|

|

Nominal |

|

|

NHCCI |

“Real” |

Real Are |

|

Obligations |

|

NHCCI |

Rebased to |

Obligations |

Less Than |

|

Million $ |

|

Actual |

FY21 Q1 |

Million $ |

Nominal by: |

| FY21 Q1 |

4,506 |

|

1.8601 |

1.0000 |

4,506 |

0 |

| FY21 Q2 |

9,859 |

|

1.9112 |

1.0274 |

9,596 |

-263 |

| FY21 Q3 |

14,775 |

|

2.0363 |

1.0947 |

13,497 |

-1,278 |

| FY21 Q4 |

23,238 |

|

2.1075 |

1.1330 |

20,510 |

-2,728 |

| FY22 Q1 |

3,628 |

|

2.1821 |

1.1731 |

3,093 |

-535 |

| FY22 Q2 |

8,490 |

|

2.2841 |

1.2279 |

6,914 |

-1,576 |

| FY22 Q3 |

19,301 |

|

2.5555 |

1.3738 |

14,049 |

-5,252 |

| FY22 Q4 |

31,279 |

|

2.7930 |

1.5015 |

20,832 |

-10,447 |

| FY23 Q1 |

6,175 |

|

2.7628 |

1.4853 |

4,157 |

-2,018 |

|

|

|

|

|

|

|

| TOTAL |

121,252 |

|

|

|

97,154 |

-24,098 |