On Halloween, the National Railroad Passenger Corporation (Amtrak) added an extra level of spookiness when it announced its preliminary end-of-fiscal-year ridership and financial totals.

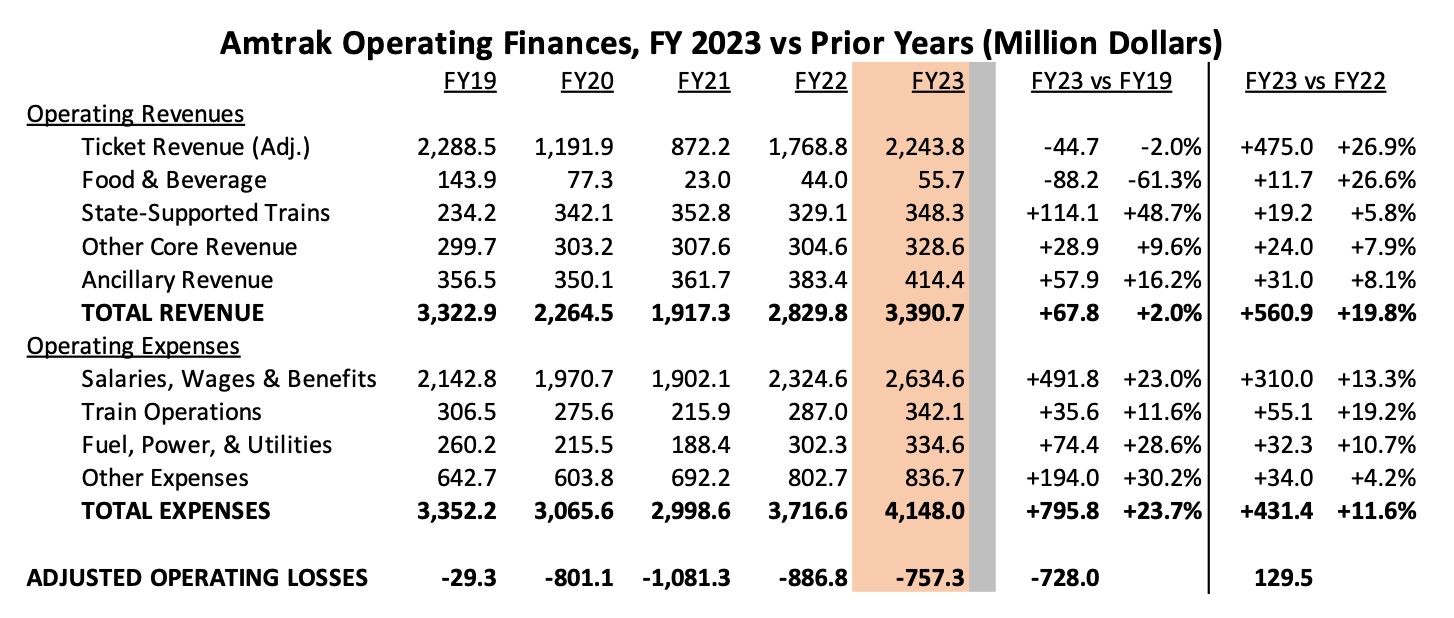

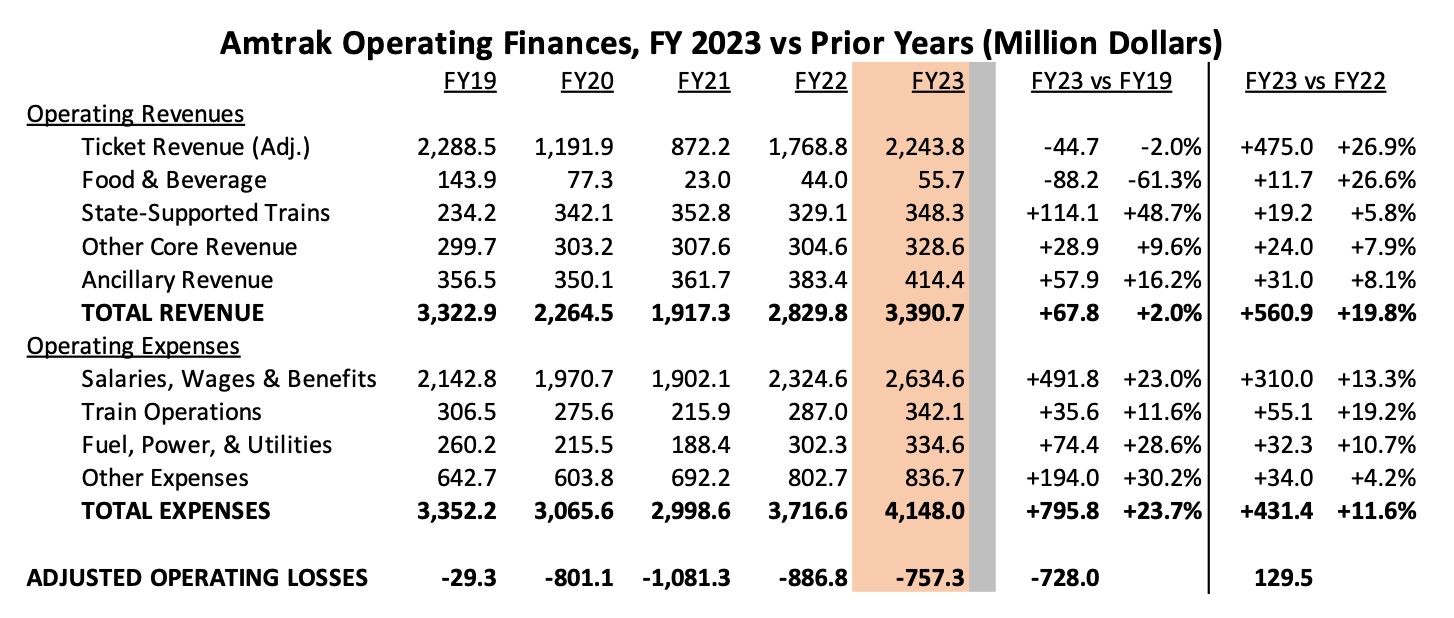

The nation’s passenger railroad posted an operating loss of $757 million, or an average of nearly $27 per passenger. This is measurably better than the $869 million operating loss in fiscal 2022 ($39 per passenger), but still short of the almost-breakeven annus mirabilis of FY 2019, when the operating losses were just $29 million (just under $1 per passenger).

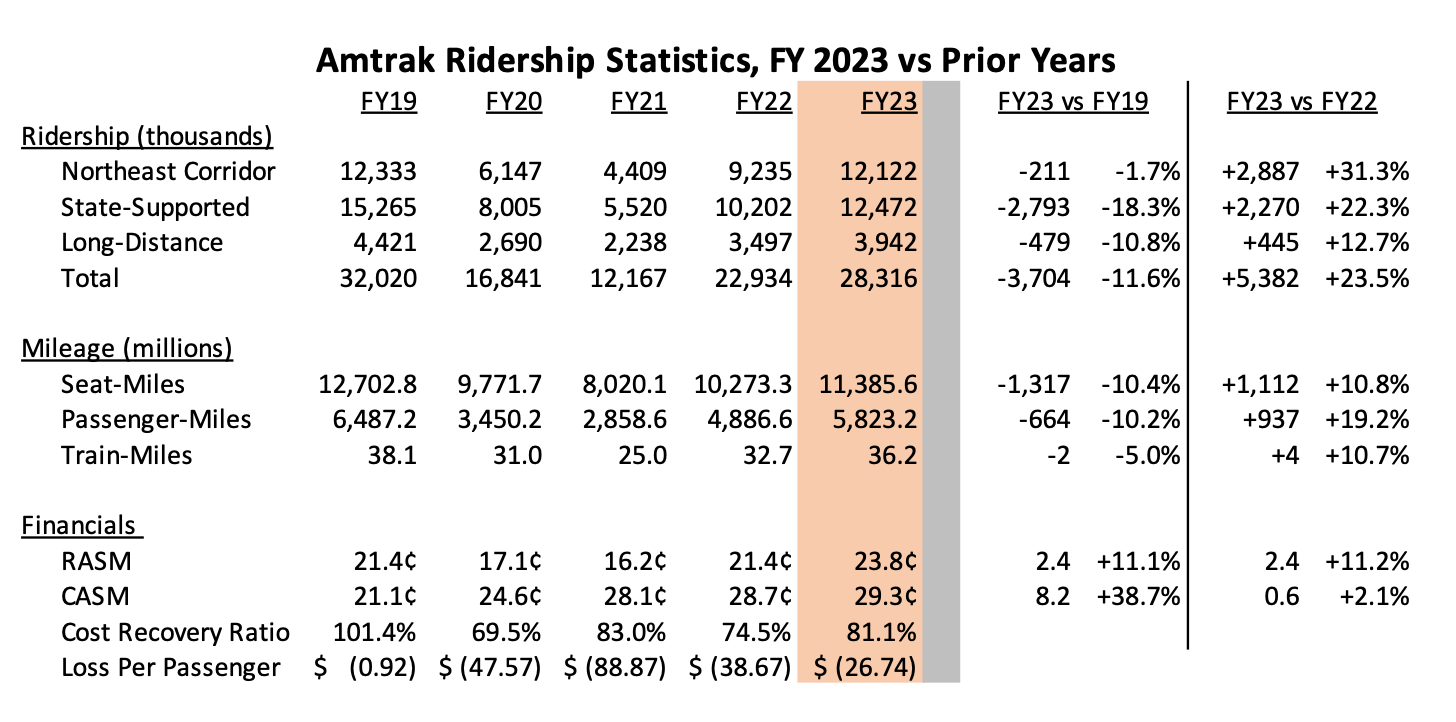

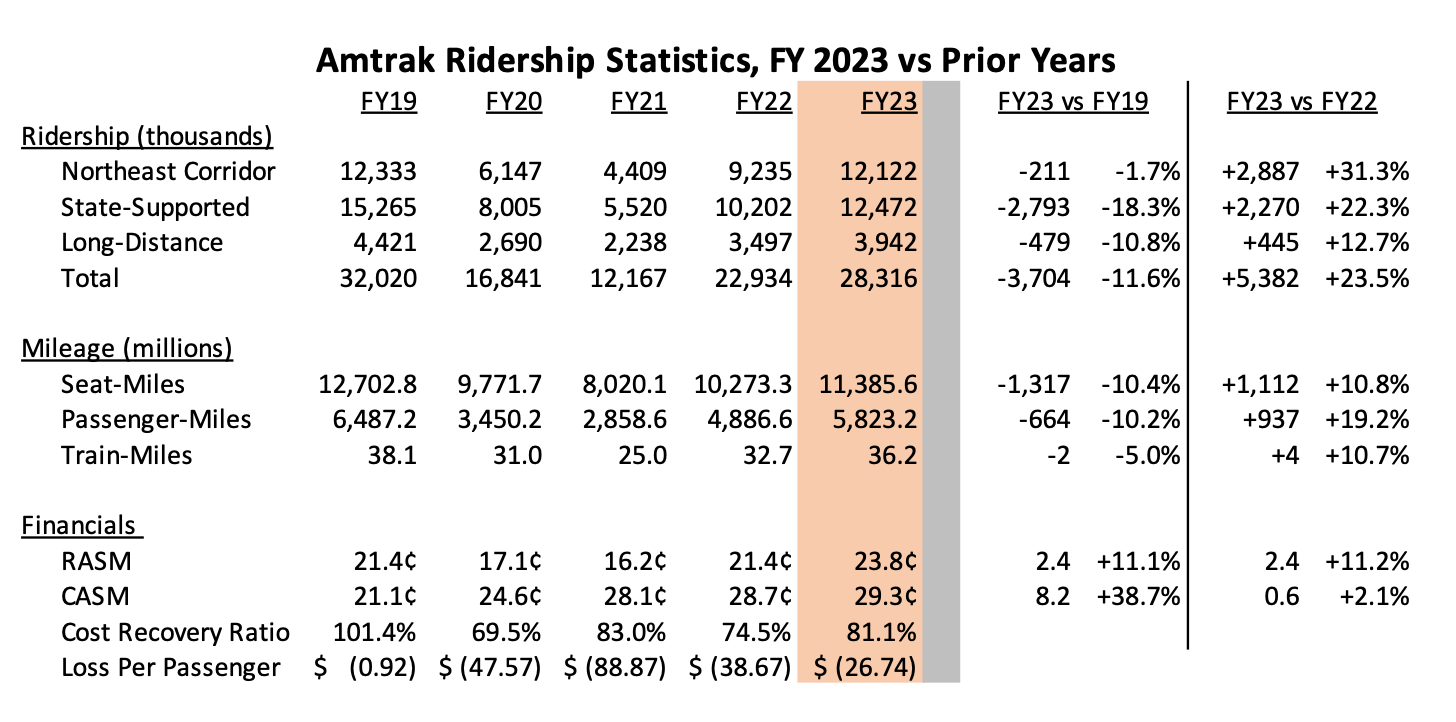

The difference between FY 2023 and FY 2019 financial totals is particularly sharp given that, in 2023, ridership was back to 88.4 percent of its pre-COVID, FY 2019 levels, including 98.3 percent of the 2019 level on the moneymaking Northeast Corridor.

The operating statistics are below, but three stand out:

- Both seat-miles and passenger-miles in 2023 were still 10.4 percent and 10.2 percent below 2019, respectively; and

- Revenue per available seat-mile (RASM) was up 11.1 percent, from 21.4¢/mile in 2019 to 23.8¢/mile in 2023, which largely counteracts the lower total seat-miles, but…

- Costs per available seat-mile (CASM) were up 38.7 percent over 2019, from 21.1¢/mile to 29.3¢/mile.

To put those numbers in modal perspective, United Airlines reports that its last quarterly passenger revenue per ASM was 17.04¢/mile, while its CASM was 16.27¢/mile.

Converting that into dollars, in 2023, Amtrak’s operating revenue was $68 million above 2019, based largely on more money from state governments to run their state-supported routes.

But Amtrak’s operating expenses in 2023 were $796 million higher than in 2019, and that is responsible for the operating deficit. The biggest driver is salaries, wages, and benefits, up $492 million over 2019 (and up $310 million over just last year).

Total gross ticket revenues were $2.3 billion – $496 million (22 percent) from the Acela, another $768 million (34 percent) from other Northeast Corridor trains, $441 million (19 percent) from state-supported routes, and $584 million (26 percent) from the money-losing long-distance trains.

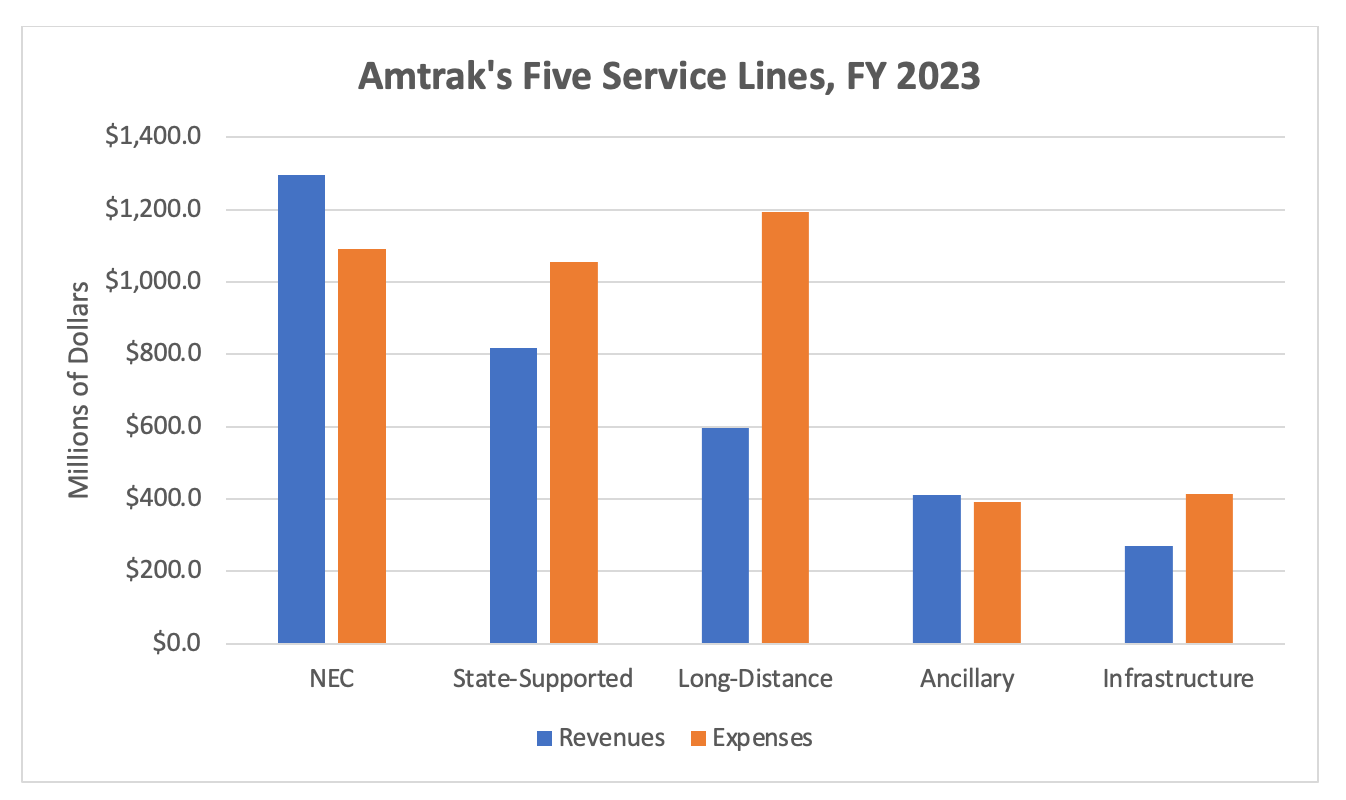

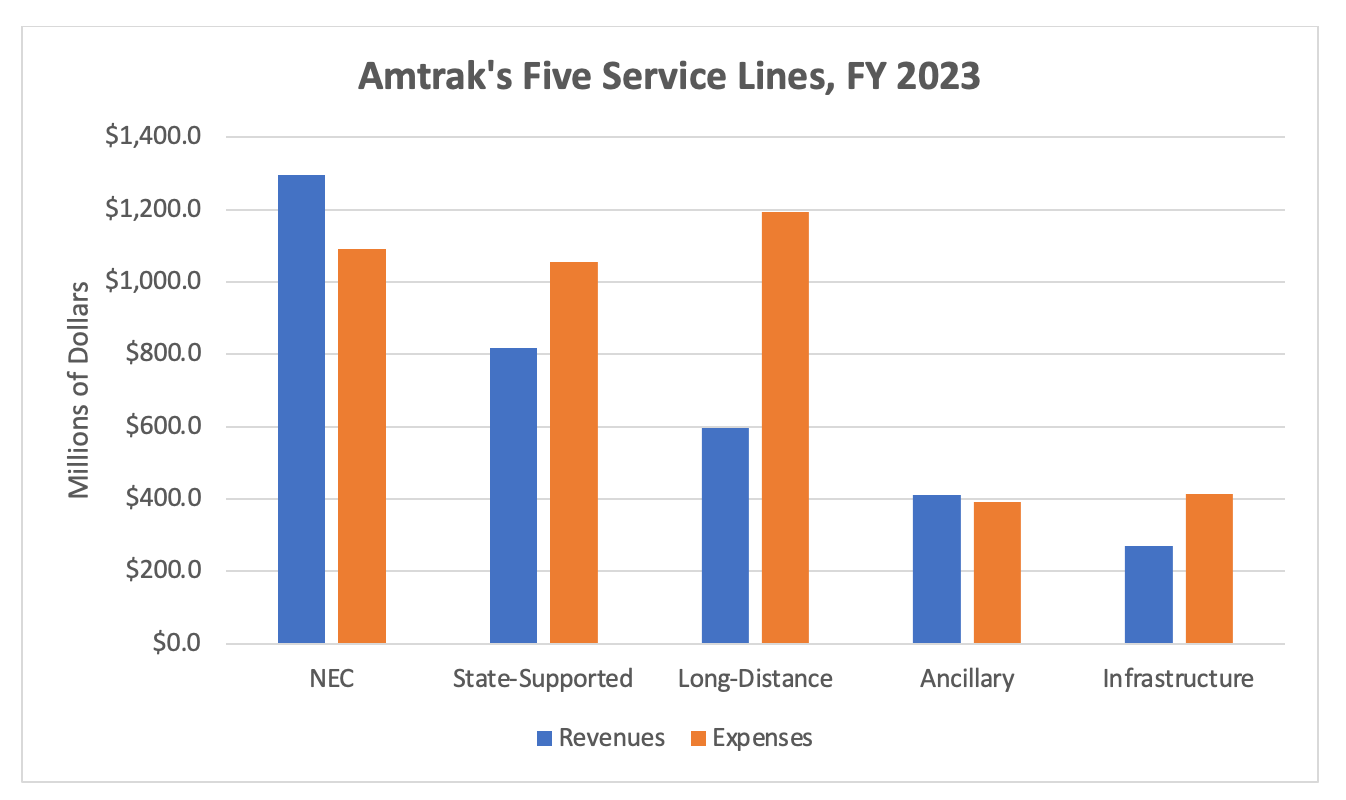

Amtrak divides its business along five “service lines,” and simply charting out the operating expenses and revenues of the five lines for 2023 indicates where the problem areas continue to be:

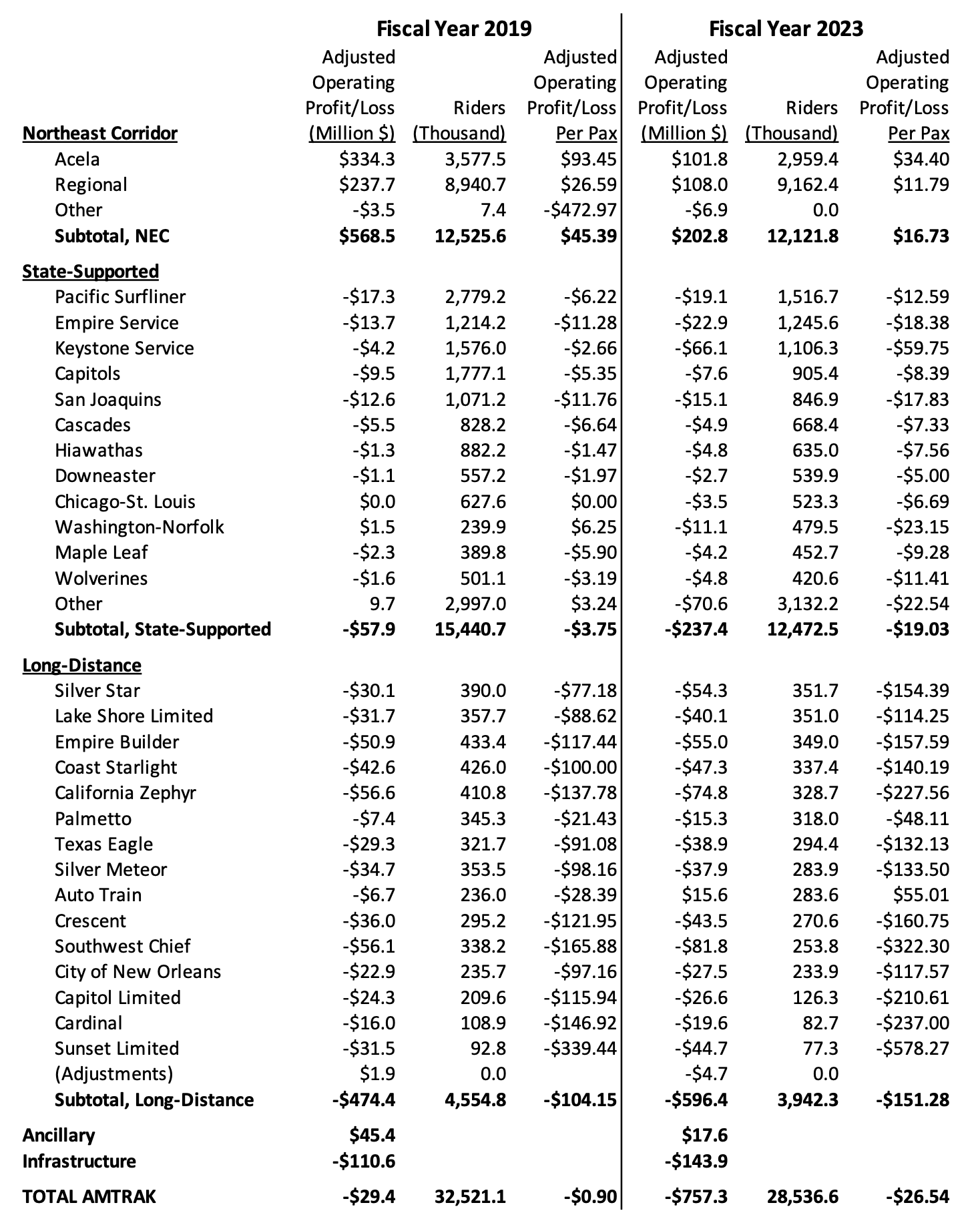

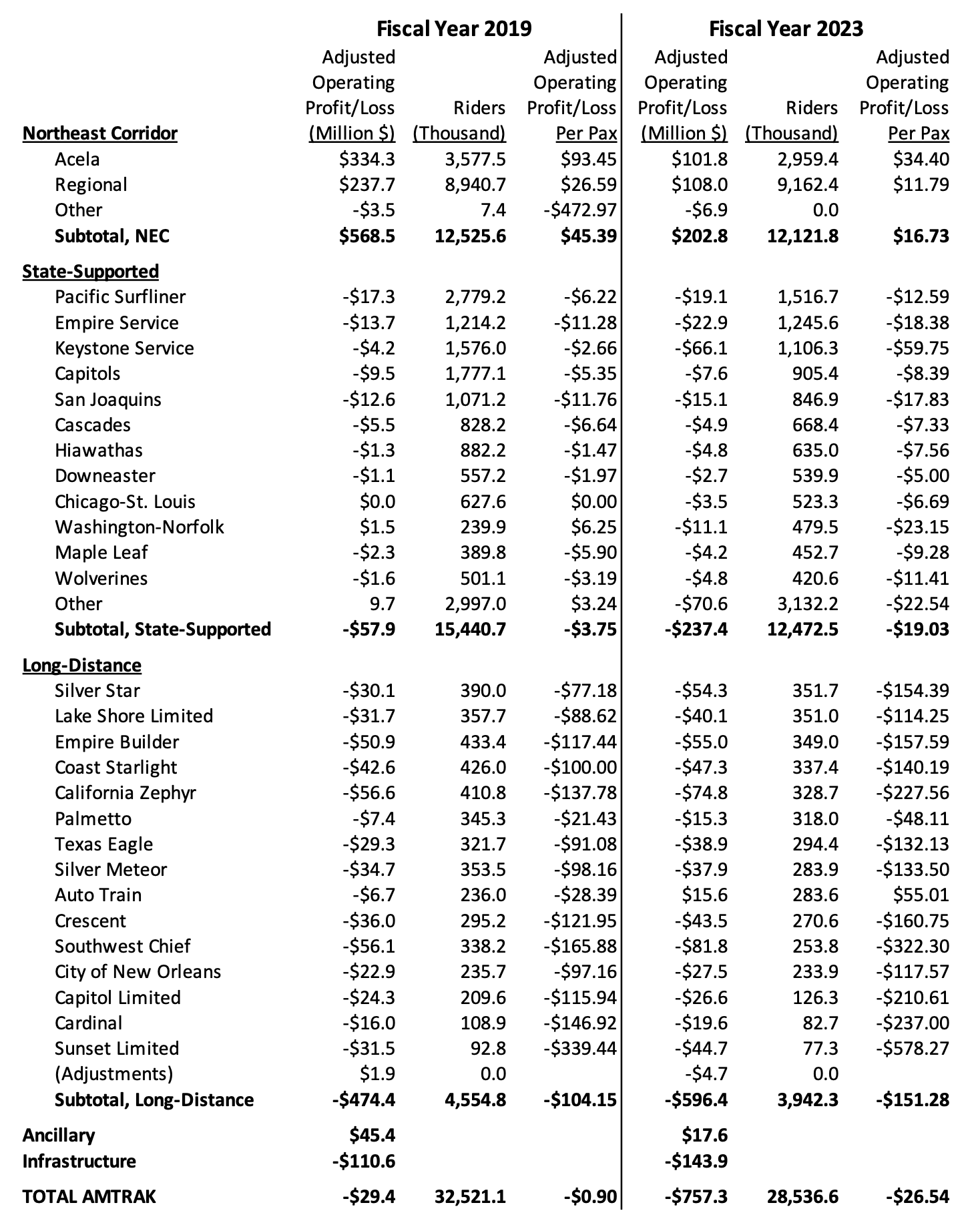

The increased costs become apparent when looking at the performance of individual train routes. Amtrak reported that the Acela trains made $34 per passenger in operating profit in 2023, down from $93 per passenger in 2019. Other NEC service made almost $12 per passenger profit in 2023, down from nearly $27 per passenger in 2019.

In the aggregate, the state-supported routes lost $19 per passenger in 2023, compared with about $3.75 per passenger in 2019.

And the long-distance routes lost around $150 per passenger in 2023, up from around $104 per passenger in 2019. The Sunset Limited once again leads the per-capita losses, with the federal government paying around $578 in subsidies per passenger on that Los Angeles to New Orleans route in 2023. The next biggest subsidy was the Southwest Chief (beloved by Sen. Jerry Moran (R-KS) and others, who prevented Amtrak from closing down the route), with $322 in federal operating subsidies per passenger in 2023,

There may significant rounding errors in the per-passenger totals below because of the rounded numbers in Amtrak’s reporting.