White House Pushes Gardner Out As Amtrak CEO

Amtrak President and CEO Stephen Gardner abruptly resigned his post on March 16. His announcement stated “I am stepping down as CEO to ensure that Amtrak continues to enjoy the full faith and confidence of this administration. I am so proud of what the Amtrak team has accomplished to bring passenger rail service to more people and places across the country over these past 16 years, and I thank the Board for their trust and support.” Reuters and Scripps separately reported that the White House had requested his resignation.

Why now? It may have had to do with Gardner getting crossways with Elon Musk. Back on March 6, Musk was quoted as saying that he wanted to see Amtrak “privatized.”

(Ed. Note: Anyone who says Amtrak should be “privatized” obviously doesn’t know how Amtrak is structured, because it’s already private. It is a private company, its books are not those of the federal government, its employees are not part of the federal workforce and do not draw federal salaries and benefits, and – unlike the any part of the federal government – it can declare bankruptcy at any time in the U.S. District Court for the District of Columbia. Amtrak is, however, a ward of the state in that it would have to declare bankruptcy if it didn’t get hundreds of millions of dollars per year in federal largesse. Not the same thing as being part of the government.)

A few days later, Gardner stood up to Musk directly by releasing a short white paper, “Proposals to Privatize Amtrak,” which attempted to throw cold water onto the whole discourse. A few days after that, Gardner was out.

Amongst railfans, discussion of Gardner’s tenure ended up with “he was pushed out despite record-high ridership and revenues.” And yes, fiscal year 2024 was the first year in which both riders and gross ticket revenue slightly outpaced fiscal year 2019, the pre-COVID year when Amtrak actually broke even (on an adjusted operational basis).

But that statement leaves out something crucial.

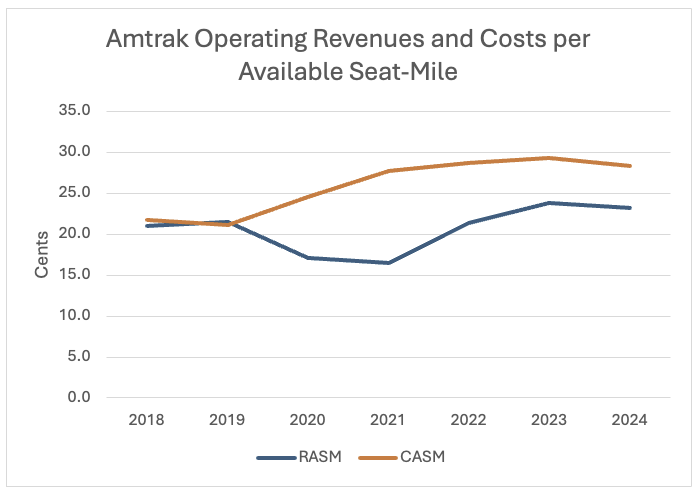

While Amtrak’s revenues are back to the pre-COVID levels, its costs are even higher than that, and the railroad still isn’t close to getting back to breakeven, nor is it trending that way. Here are the actual numbers, in cents:

| Year | RASM | CASM |

| 2018 | 20.9 | 21.7 |

| 2019 | 21.4 | 21.1 |

| 2020 | 17.1 | 24.5 |

| 2021 | 16.4 | 27.7 |

| 2022 | 21.4 | 28.7 |

| 2023 | 23.8 | 29.3 |

| 2024 | 23.2 | 28.3 |

In millions of dollars:

| FY19 | FY22 | FY23 | FY24 | FY24 | |

| Actual | Actual | Actual | Plan | Actual | |

| Gross Tick Rev | 2,354.3 | 1,775.5 | 2,290.5 | 2,524.2 | 2,450.6 |

| Total Op Exp | 2,322.9 | 2,829.8 | 3,390.7 | 3,696.5 | 3,623.1 |

| Adj Op Earn | -29.4 | -886.8 | -772.2 | -625.3 | -705.2 |

Gardner might have been better served by playing along with privatization rhetoric, or “subsidy-free” rhetoric, which only serves to point out Amtrak’s great political strength: The money-losing routes are in red states. On an operational basis, the “Acela Corridor” where all the well-educated Beltway, NYC, and Ivy League elites live and take the train all the time makes an operational profit. It is the long-distance trains, beloved by Republican Senators of the Great Plains and Rocky Mountains, that hemorrhage money.

Any serious discussion of privatizing Amtrak or making it go subsidy-free will quickly make it obvious that all those long east-west routes will either have to be eliminated or else will have to triple, quadruple, or quintuple their fares and see if anyone still rides. Once that becomes clear, Senate Republicans will lead the fight against privatization, allowing Amtrak to focus its energies elsewhere.

Using 2024 data, the pricey Acela charged an average of 0.83 cents per passenger-mile, for an operating profit of $143 million. The NEC Regional trains charged much less, 0.45 cents per pax-miile, and managed to make an operating profit of $146.4 million.

The Auto Train is the only route outside the NEC that is properly priced. At 0.53 cents per pax-mile, it made $6.6 million last year.

But the Southwest Chief, beloved of Sen. Jerry Moran (R-KS), lost $83.3 million in FY 2024 because Amtrak was only able to charge 0.20 cents per passenger-mile. They would have had to almost triple those fares, to 0.58 cents per mile, to break even. The Empire Builder lost $61.7 million selling fares at 0.24 cents per pax-mile and would have had to sell at an average of 0.47 cents per pax-mile in order to break even.

And the Sunset Limited, which was priced at 0.21 cents per pax-mile and lost $47.8 million, would have had to raise fares to 1.14 cents per passenger-mile in order to break even.