Eno conducted an analysis of the international market for air travel in November 2018 for the Japan International Transport Institute. This multi-part ETW series details some of the most interesting facts and findings of that work. Although the research does not predict the future or propose any recommendations, the results are instructive for thinking about how international air service has evolved over the past few decades.

The data analyses use three data sources: (1) publicly available data from the U.S. Department of Transportation (T-100 dataset), (2) Sabre Corporation’s Market Intelligence Data and Analytics, and (3) existing reports and other publicly available information. The data from Sabre is not publicly available, but the Eno Center for Transportation was able to gain access through a subscription paid for by the Japan International Transport Institute, USA. Sabre uses public and private data to create a suite of data resources which analyzes traffic trends and fills in gaps missing in the T-100 dataset. The data available during the creation of this report includes a “final” dataset from 2010-2017, where Sabre’s algorithms verify the accuracy and update data points as necessary. The data set also includes “preliminary” MIDT (Marketing Information Data) data from 2002-2009. While this data is not as precise as the final dataset, it can provide enough information for broad trends.

The nature of international long haul flights to and from the United States is changing. Advances in aircraft technology and changes in foreign relations have allowed many airlines to fly more non-stop flights. These changes are spurring a restructuring of the international route network. For example, flights across the Pacific often required layovers in Japan and Korea in the past, and those stops are no longer necessary. This has ramifications both in the U.S. and abroad.

Across the Atlantic, state-backed carriers from the Middle East, such as Etihad, Emirates, and Qatar Airlines, have gained significant market share on many long haul routes, and are geographically well suited to serve the growing Indian market. The three largest domestic carriers in the United States—Delta, American, and United—have long competed with each other and with foreign carriers on international routes. But U.S. carriers have raised concerns that some competitors, particularly Middle East carriers, may violate the terms of Open Skies bilateral agreements to ease rules and regulations on scheduled international air services. New competition from foreign low cost carriers has changed the dynamics of many markets. Public policy and business strategies that respond to this challenge will shape the future of international aviation for decades to come.

This series analyzes the ensuing competition for international travel and its changing nature, focusing on the two largest markets for U.S. travel: Europe and Asia.

International Travel Trends

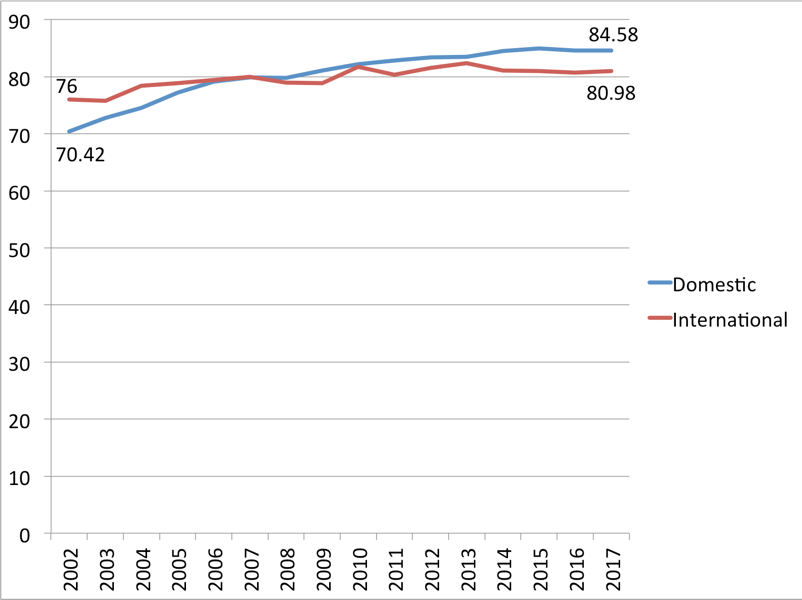

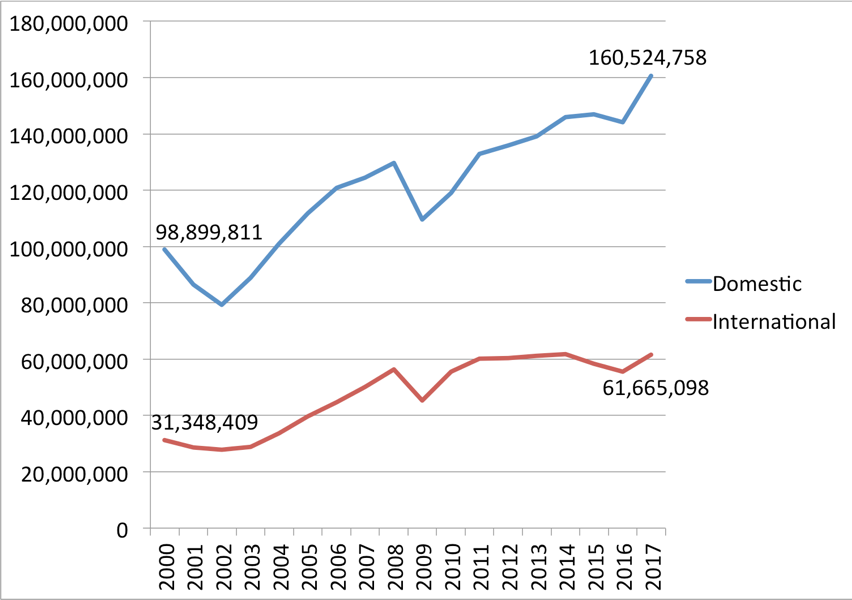

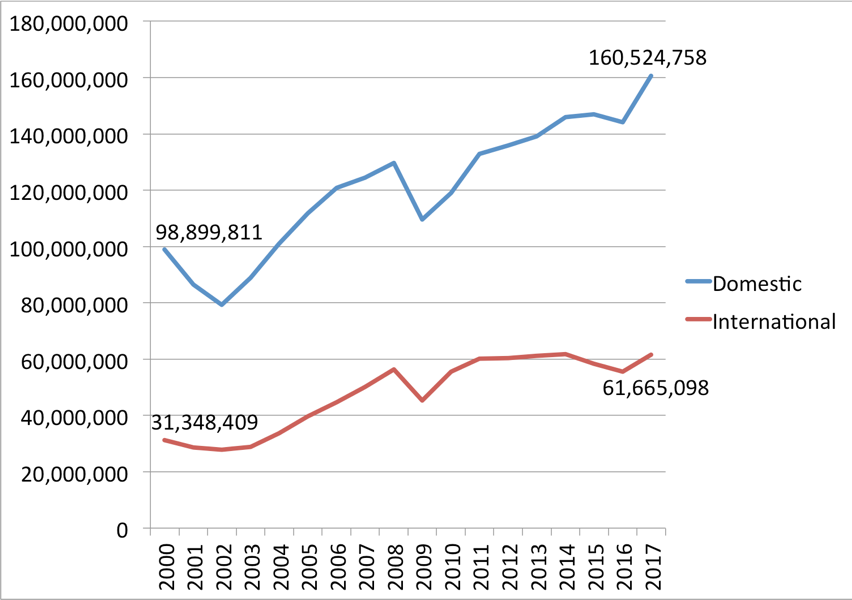

Domestic passengers are by far the largest market for U.S. carriers, totaling more than 740 million in 2017. However, domestic passenger traffic is more volatile with the national economy and has not increased as much as international traffic. While domestic passenger levels increased 35 percent from 2002 to 2017, international traffic increased 75 percent over the same time period as seen in Figure 1.

Figure 1: Passengers and Revenue Passenger Miles (RPM) (1,000s), U.S. Carriers

Source: Bureau of Transportation Statistics T-100 Market data.

Flights, on the other hand, have not increased at the same magnitude as passenger miles. Figure 2 shows a dramatic increase in flights from 2002 to 2004, but a decline since then. While U.S. carriers are flying 35 percent more domestic passengers than they did in 2002, they are doing so with the same number of flights by using larger aircraft and increasing load factors. International flights have increased 40 percent, less than the increase in passenger levels.

Figure 2: Departures, U.S. Carriers

Source: Bureau of Transportation Statistics T-100 Segment data.

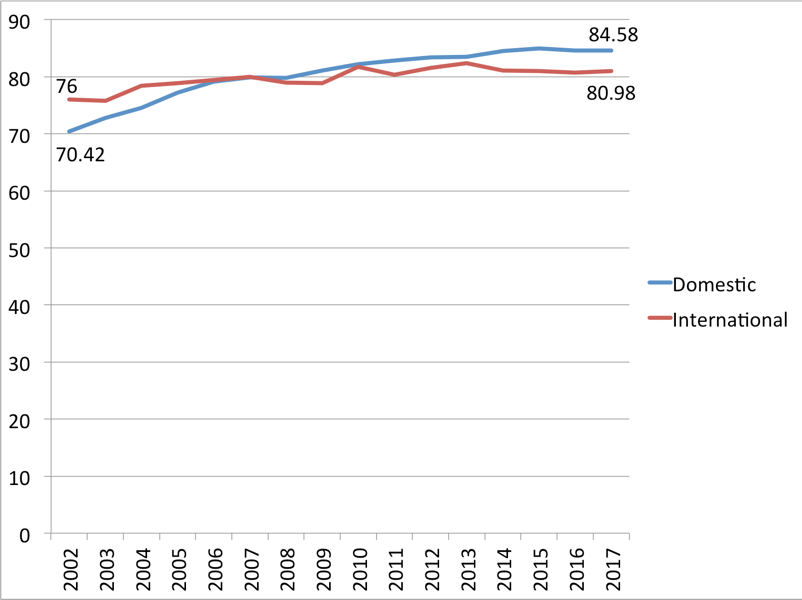

Carriers have been able to fly more people on fewer flights by both increasing the average size of the aircraft and the number of passengers flying on each flight (load factor). Figure 3 shows the average aircraft load factor steadily increasing since 2002, and Figure 4 shows the increases in passengers per flight. Most of the load factor increases have been on domestic flights, and the number of passengers per flight has increased 25 percent since 2002.

Figure 3: Average Load Factor, Percent, U.S. Carriers

Source: Bureau of Transportation Statistics T-100 Segment data.

Figure 4: Passengers per Departure, U.S. Carriers

Source: Bureau of Transportation Statistics T-100 Segment data.

In terms of operating revenues, the domestic market is the most important revenue source by volume for U.S. carriers, and it is growing more quickly than the international market. Figure 5 shows domestic revenues increasing by $50 billion since 2002, and international revenues increasing by $30 billion. Note that international revenues are the same in 2017 as they were in 2011.

Figure 5: Operating Revenues, U.S. Carriers ($1,000s, non-inflation-adjusted dollars)

Source: Bureau of Transportation Statistics F41 Schedule P12 data.

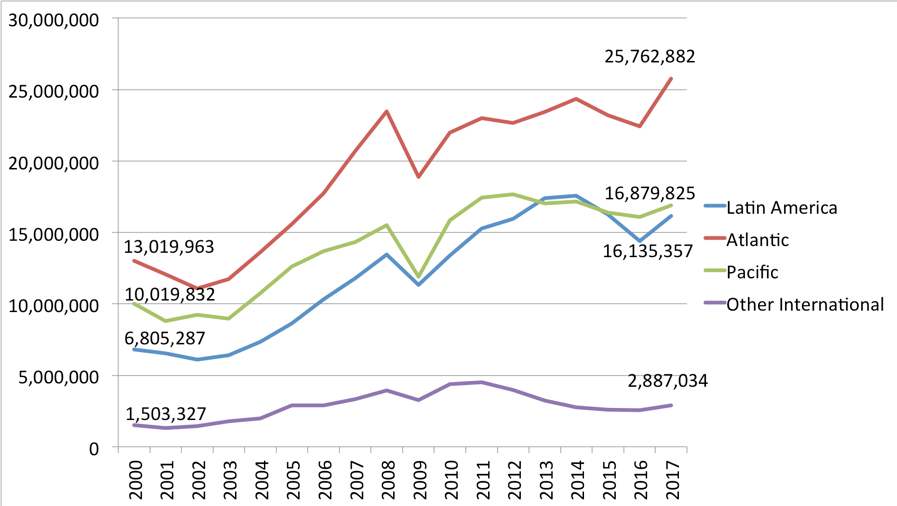

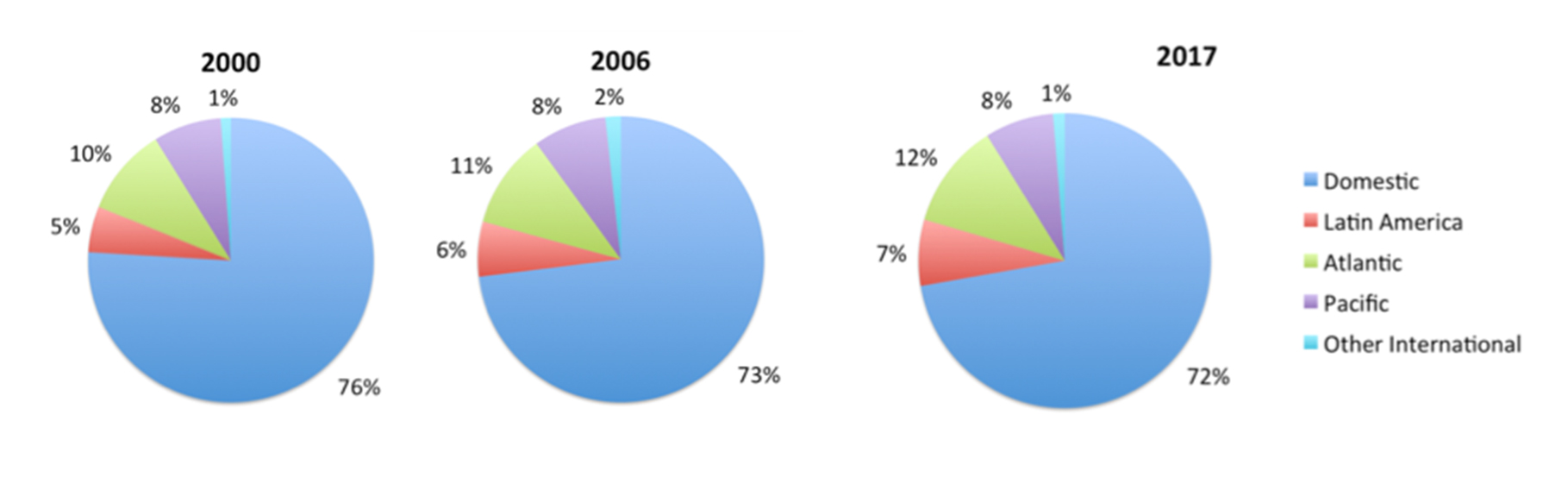

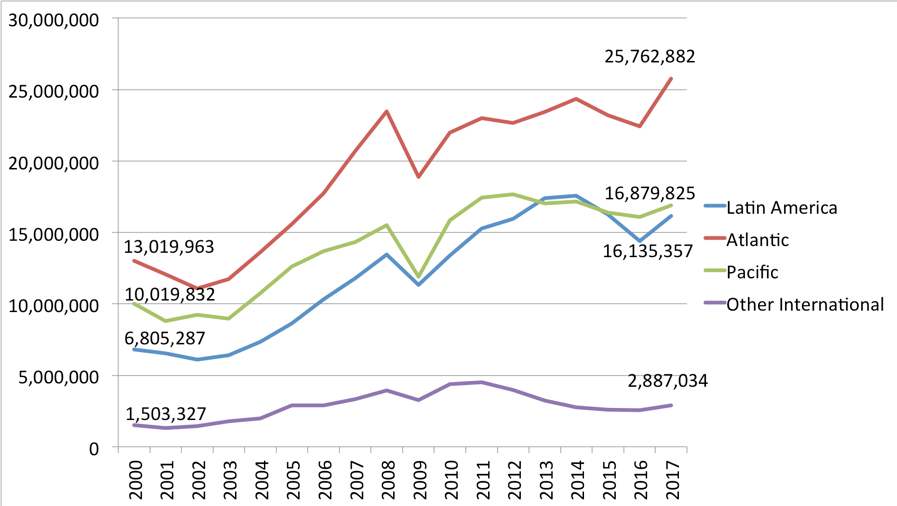

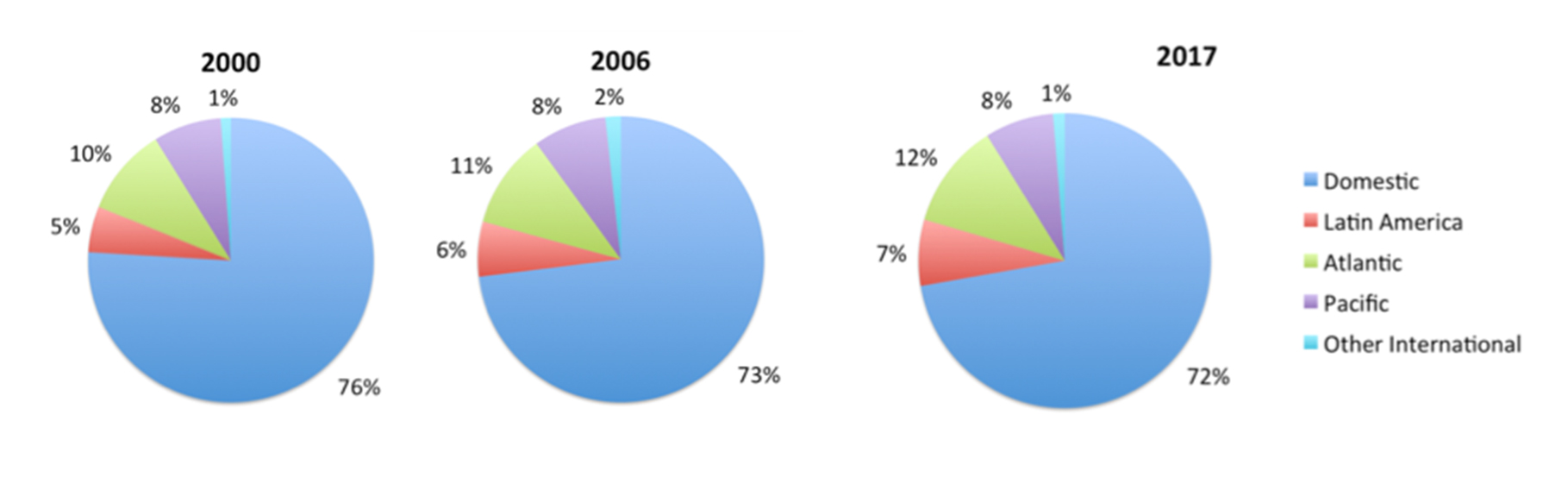

The largest market for international travel is traffic across the Atlantic. Figure 6 shows Latin American traffic increasing the fastest for U.S. carriers, briefly eclipsing revenues from Pacific traffic in 2013 and 2014. In terms of total overall revenues, international travel now represents 27 percent, up from 24 percent in 2002 (Figure 7).

Figure 6: International Market Operating Revenues, U.S. Carriers ($1,000s, non-inflation-adjusted dollars)

Source: Bureau of Transportation Statistics F41 Schedule P12 data. “Other International” includes Canada and Africa.

Figure 7: Percent of Operating Revenues from All Market, U.S. Carriers (2000, 2006, and 2017)

Source: Bureau of Transportation Statistics F41 Schedule P12 data.

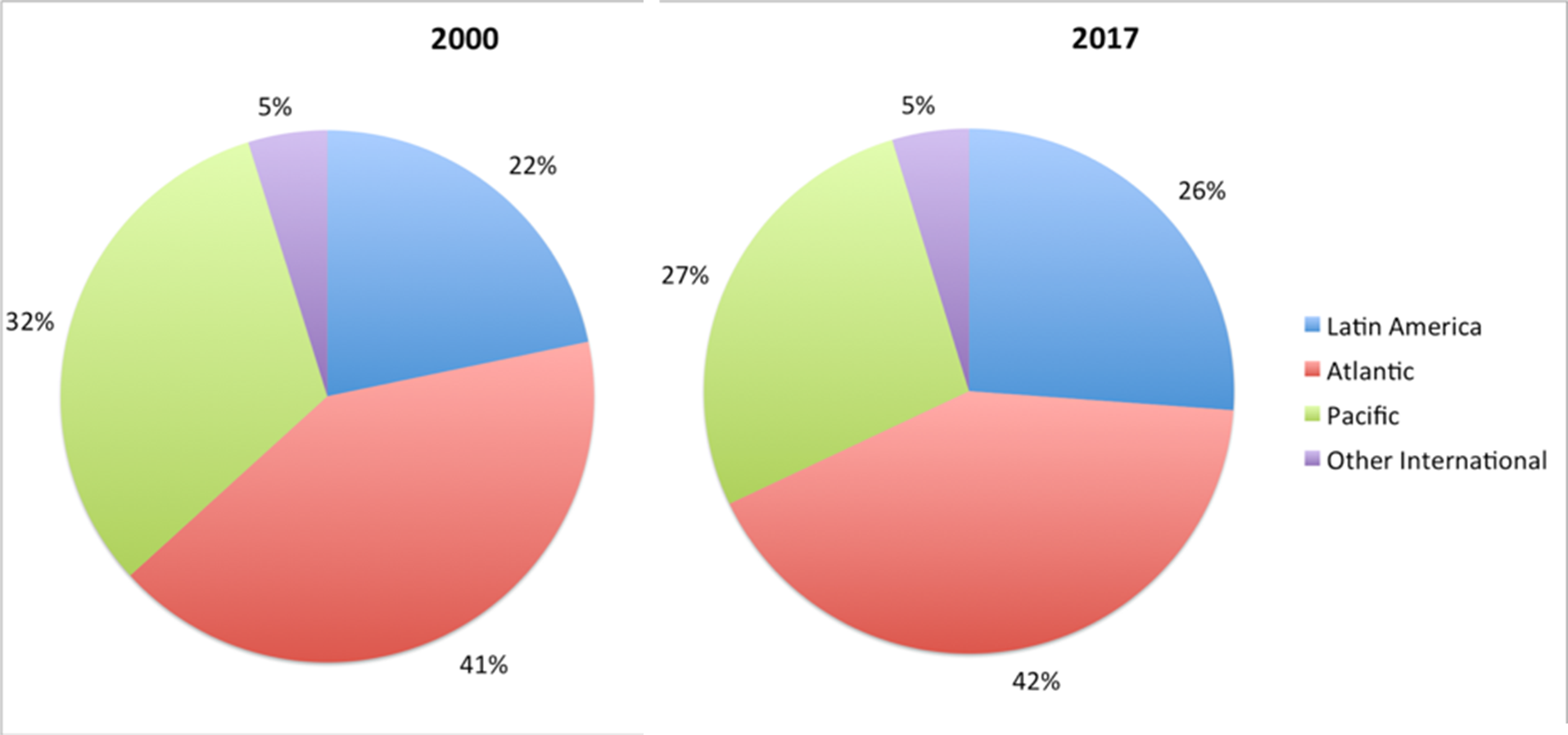

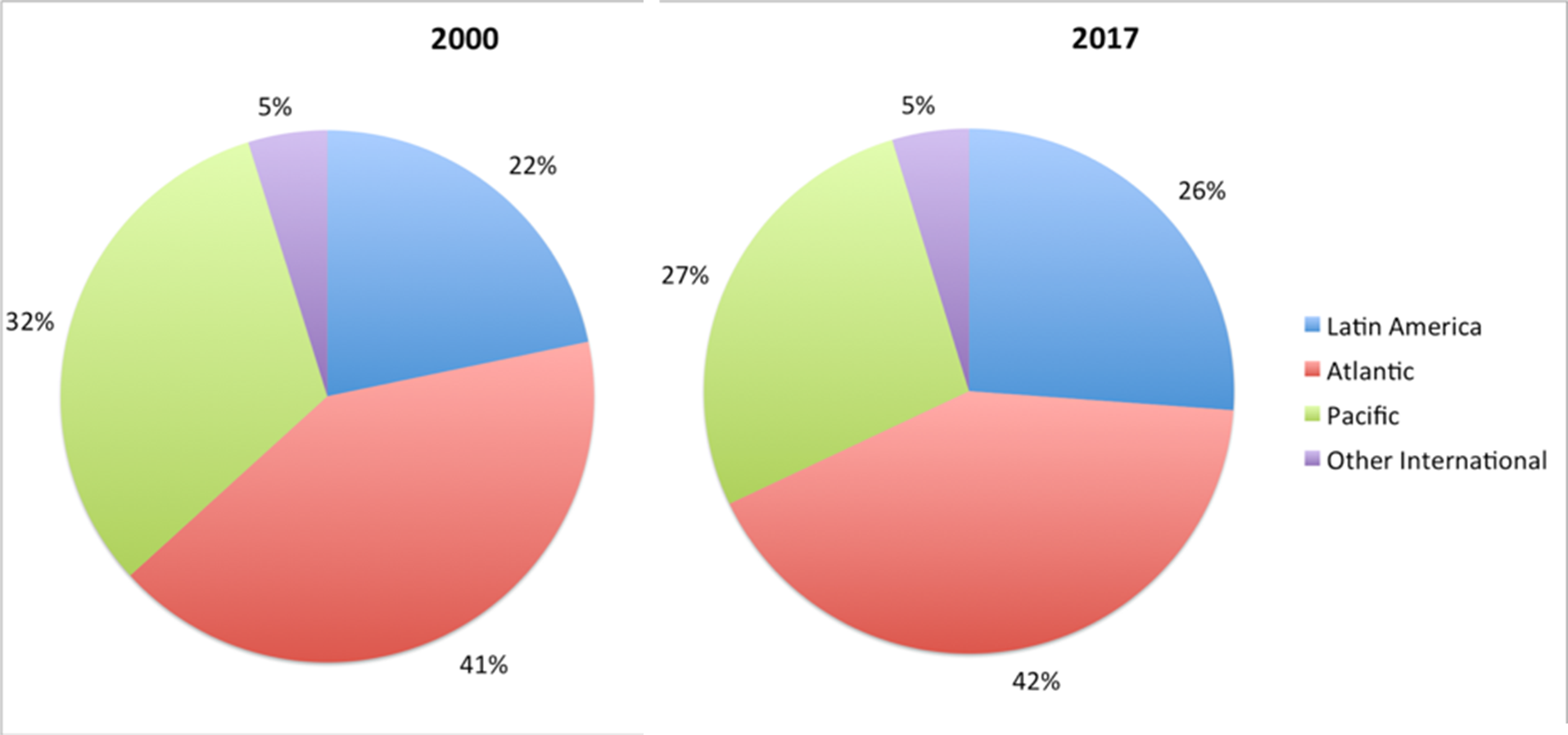

Looking just at the international market, the largest growth has come from the Latin American market. Revenues from the Pacific market have decreased proportionally, from 32 percent in 2000 to 27 percent in 2017.

Figure 8: Percent of Operating Revenues from International Markets, U.S. Carriers (2000 and 2017)

Source: Bureau of Transportation Statistics F41 Schedule P12 data.

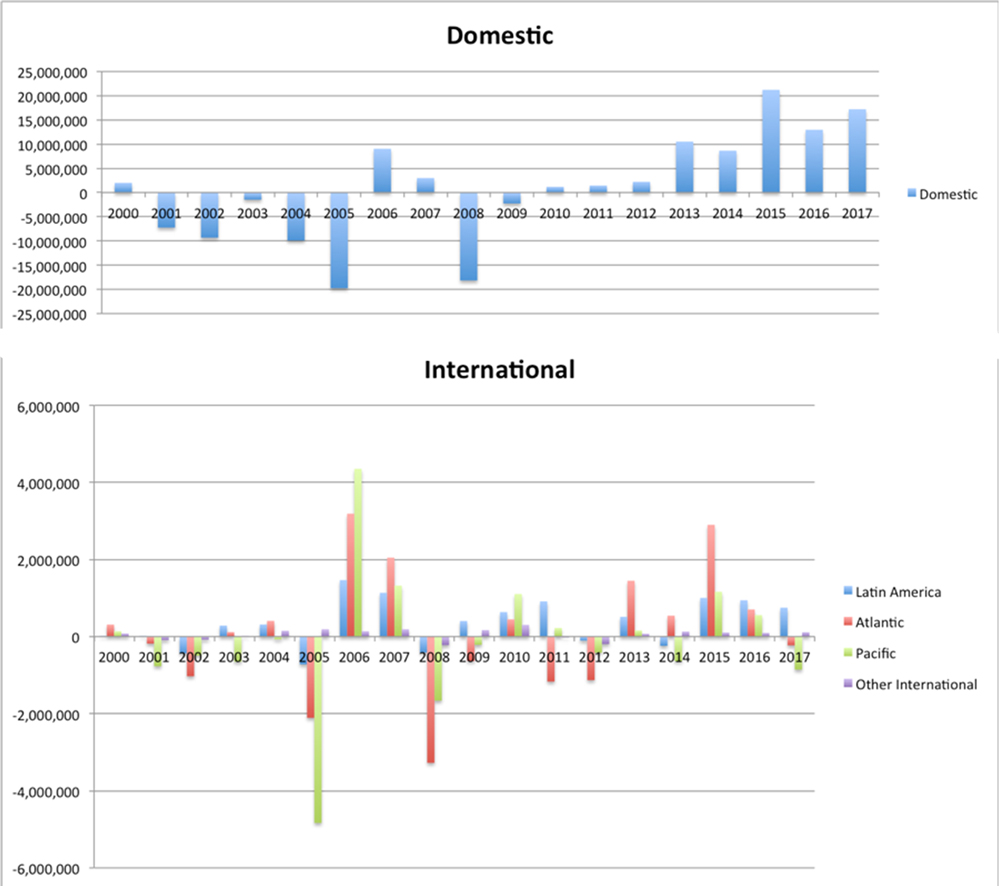

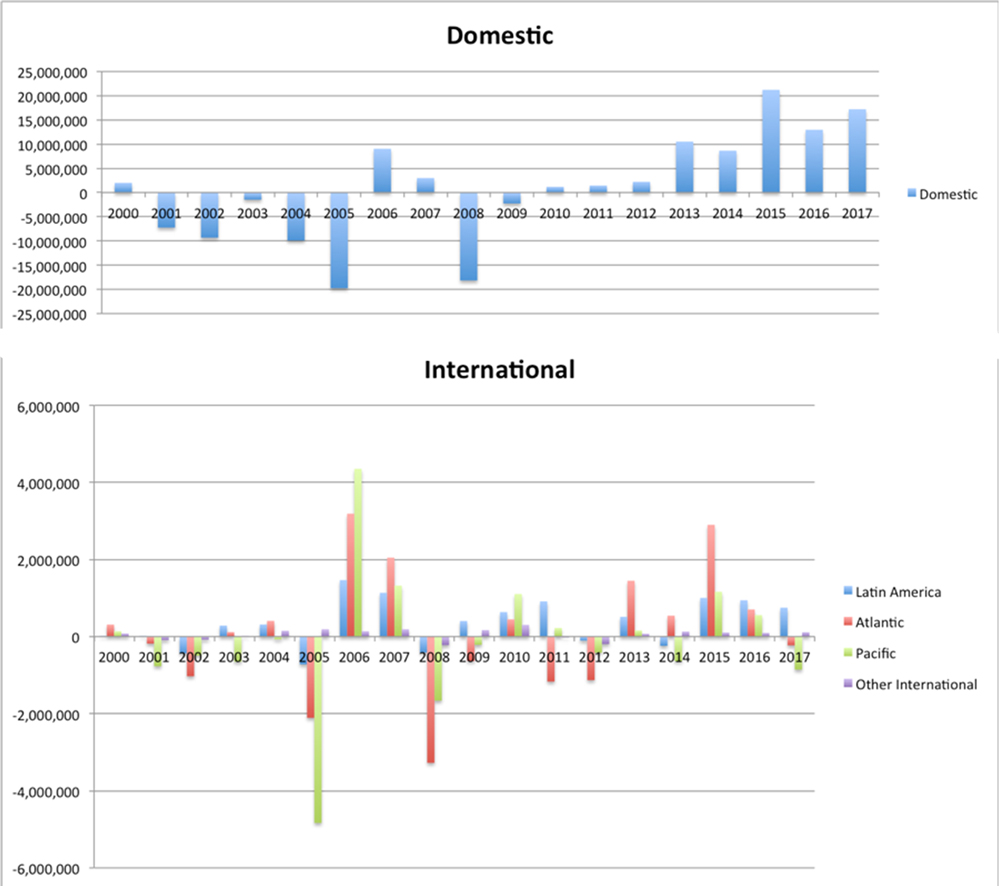

Revenues do not always translate to profits. Figure 9 shows the profits and losses of U.S. carriers since 2000. The industry overall has been very cyclical but has enjoyed consistent profitability overall since 2010.

Figure 9: Net Income, U.S. Carriers ($1,000s, non-inflation-adjusted dollars)

Source: Bureau of Transportation Statistics F41 Schedule P12 data.

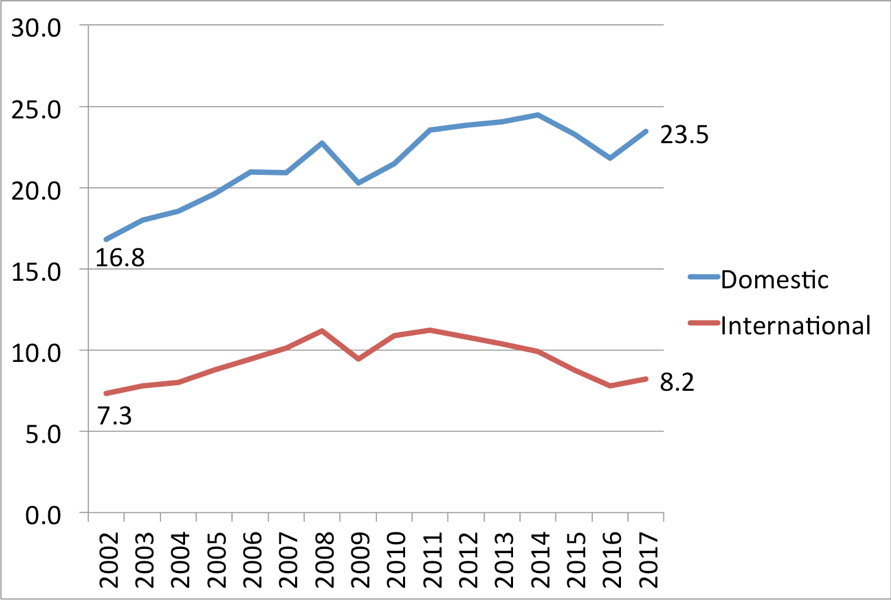

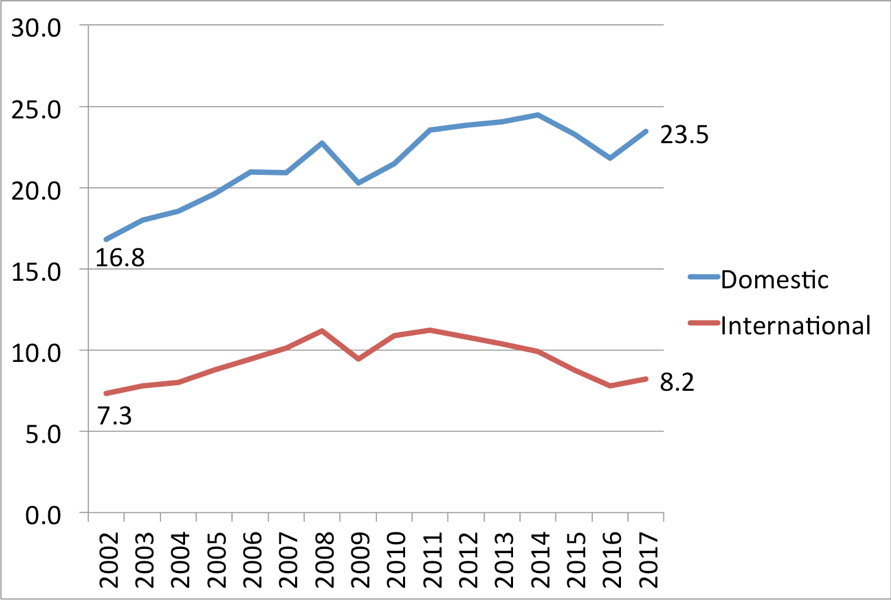

An important metric that airlines use to gauge their profitability is yield, the amount of revenue they receive from a passenger mile of service. Figure 10 shows that yields on domestic traffic have increased 40 percent since 2002 but yields on international passengers have increased only 12 percent.

Figure 10: Yield, U.S. Carriers (cents per passenger mile, non-inflation-adjusted)

Source: Bureau of Transportation Statistics F41 Schedule P12 and T-100 Segment data.

Furthermore, yields for international passenger miles declined between 2011 and 2014 while they were increasing in the domestic sphere. This suggests are higher volatility along with the lower overall rates for the international market as compared to domestic.

International Travel to Europe

This section examines past trends (from 2000 to 2017) of the services of trans-Atlantic providers. The European market differs in its nature from the Asian market, and the countries involved tend to be developed nations with slower economic growth than many Asian counterparts.

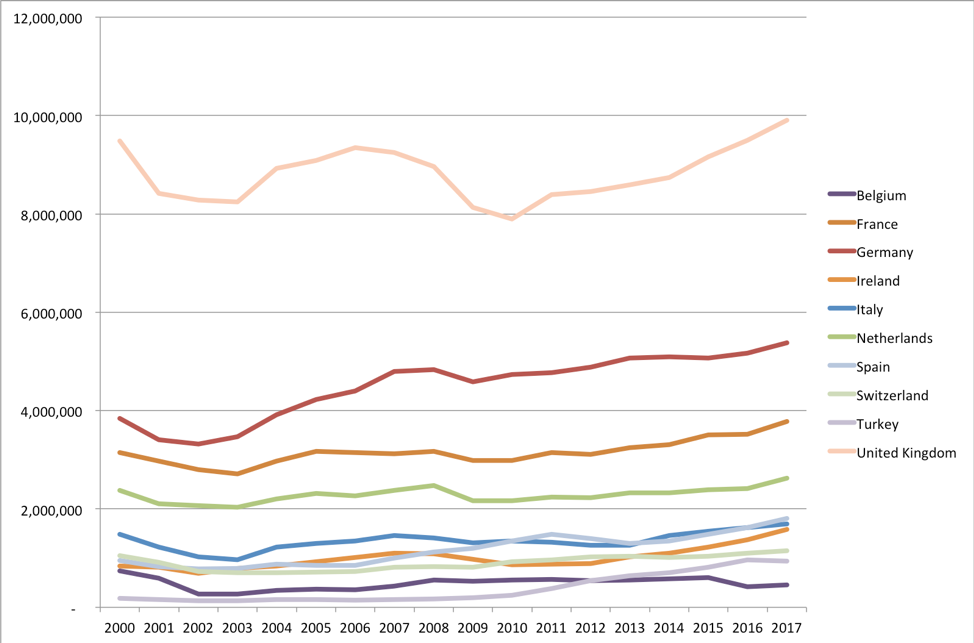

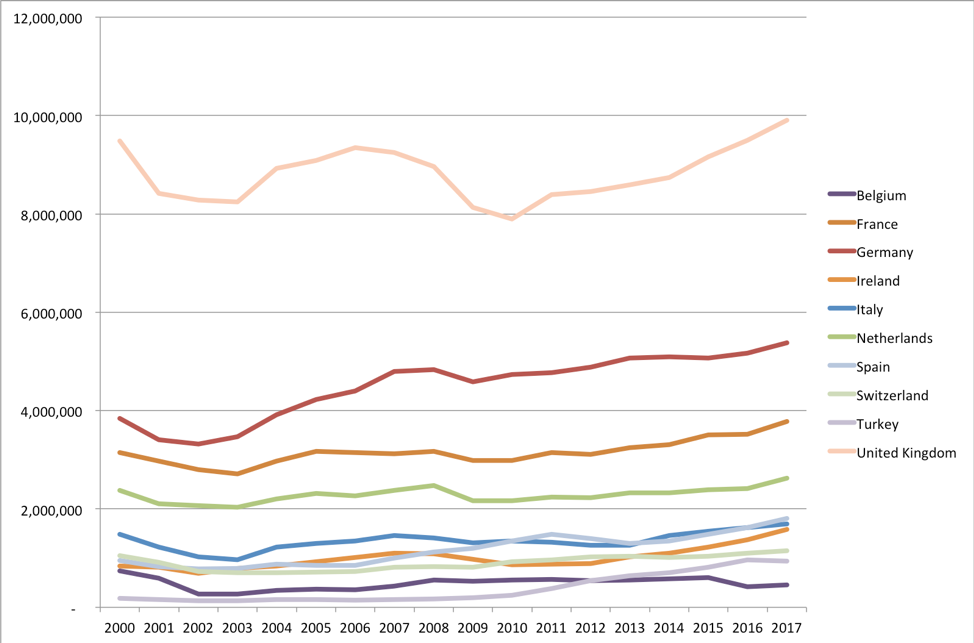

Figure 11 shows that the United Kingdom, Germany, France, and the Netherlands are consistently the most frequent gateway countries to Europe. These four countries consist of a third of all traffic to Europe. The UK passenger traffic saw the most volatility during the 2008 financial downturn, but passenger levels across the continent have slowly increased since 2000.

Figure 11: Departing Passengers by Country, Europe

Source: Bureau of Transportation Statistics, T-100 International Market (All Carriers)

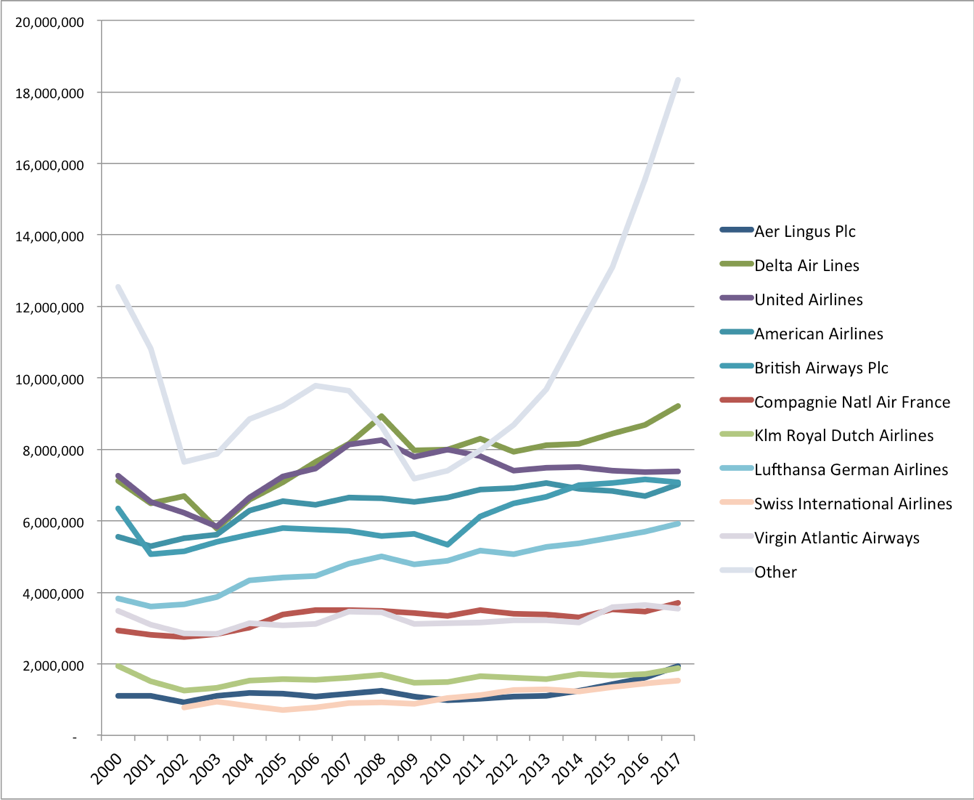

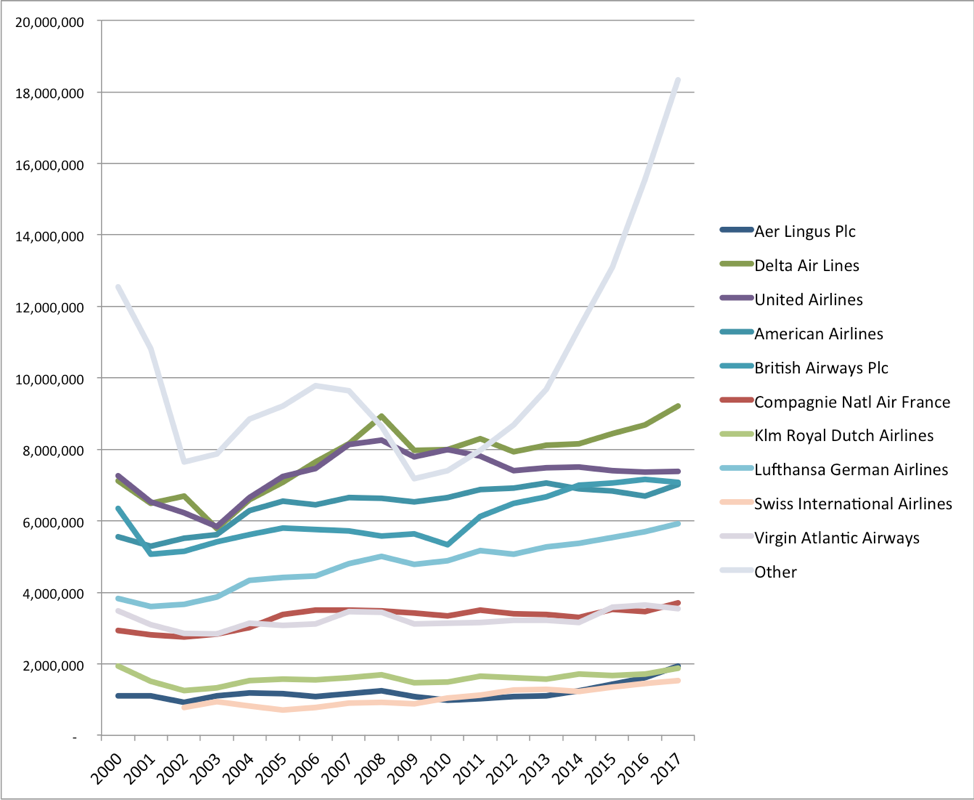

More volatile is the traffic on individual airlines. Figure 12 shows the largest eight legacy airlines, United, Delta, American, Lufthansa, British, KLM, Air France, and Virgin Atlantic, dominating most of the traffic. Figure 12 combines all “other” airlines and graphs them against the largest eight, showing a 150 percent increase since 2009.

Figure 12: Departing Passengers by Airline, Europe

Source: Bureau of Transportation Statistics, T-100 International Market (All Carriers)

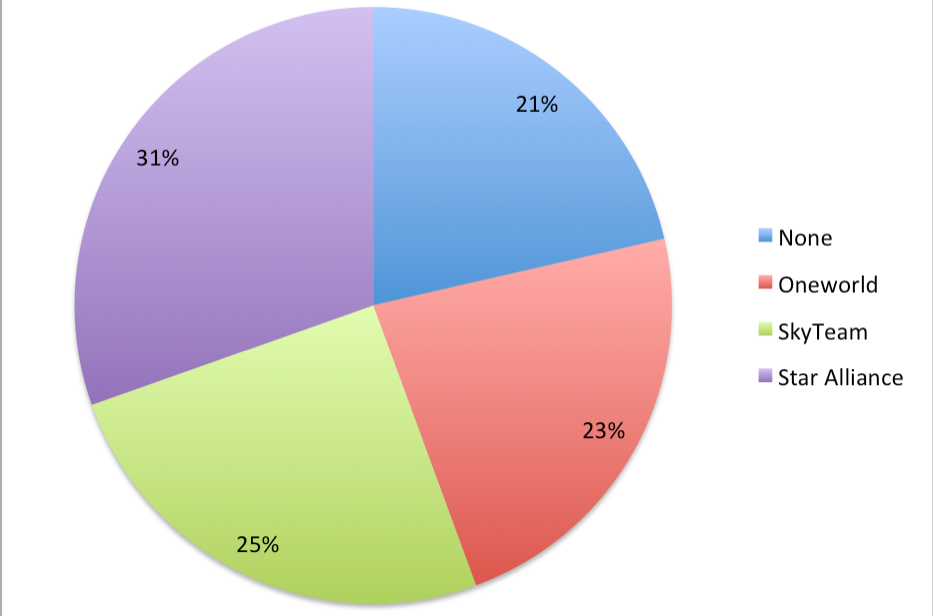

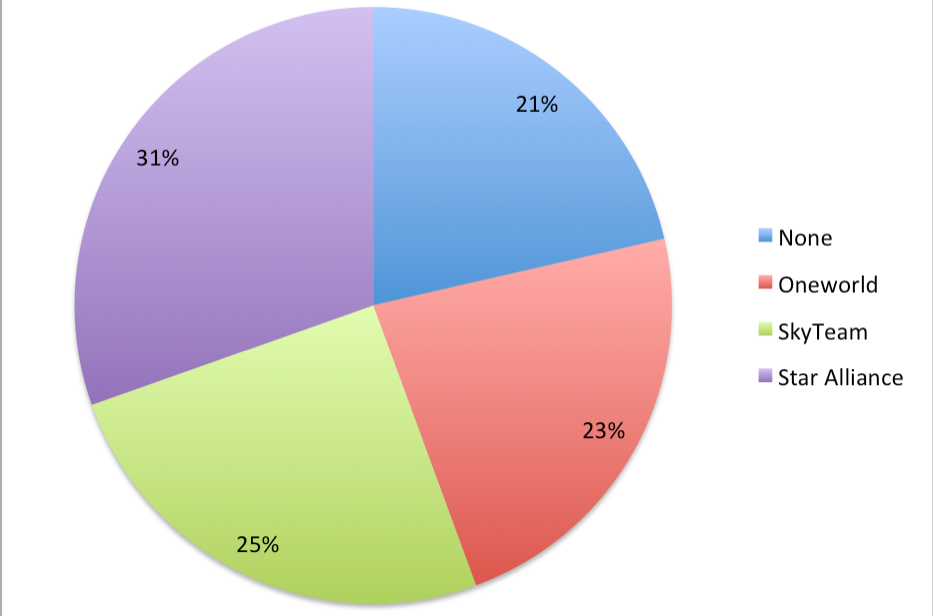

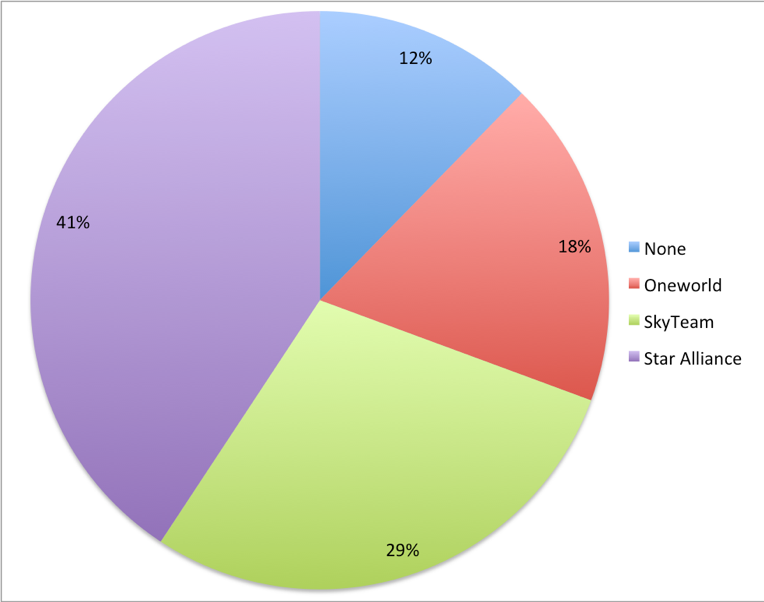

Note that in 2007, the same year that the U.S. signed a non-Open Skies agreement with China, the U.S. signed an Open Skies agreement with the European Union and its member states. Shortly thereafter, Atlantic traffic gained access to no-frills, low cost trans-Atlantic service, tapping into a new market, with the fastest growing airlines emerging as Air Berlin, Norwegian Air Shuttle, Thomas Cook Airlines, Turkish Airlines, and WOW Air (WOW filed for bankruptcy in April 2019). None of the airlines with the largest growth participate in an airline alliance. Despite the increase in low cost carriers, the three alliances capture 77 percent of the market, shown in Figure 13.

Figure 13: Passengers from the U.S. to Europe, by alliance, 2017

Source: Bureau of Transportation Statistics, T-100 International Market (All Carriers)

The European market has long been stable, dominated by business and leisure traffic from developed nations and established airlines. Without the rapid development of Asian or Latin American countries, the European market has had little cause for disruption. The most significant change came after the U.S – EU Open Skies agreement in 2007 (which went fully into effect in 2010), with the dramatic increase in new market entrants. Instead of cutting into the passenger levels of established airlines, the new entrants have opened a new market segment that attracts passengers that can tolerate low frills and demand low fares.

International Travel Across the Pacific

This section examines the services of trans-Pacific flights of all major airports from 2000-2017, with some figures’ date range varying due to available data. This analysis does not include every country in the continent of Asia but focuses on those in the East and South where there is most potential for growth and change in the international air travel market. Many of these countries are not large enough to attract non-stop passenger service and will not appear on figures or tables if there is no or negligible service. The following countries are included in “Asia” as defined for the purposes of this analysis.

– Japan

– China

– Hong Kong

– Taiwan

– South Korea

– India

– Indonesia

– Mongolia

– Thailand

– Myanmar

– Philippines

– Cambodia

– Laos

– Vietnam

– Malaysia

– Singapore

– Bangladesh

– Sri Lanka

– Brunei

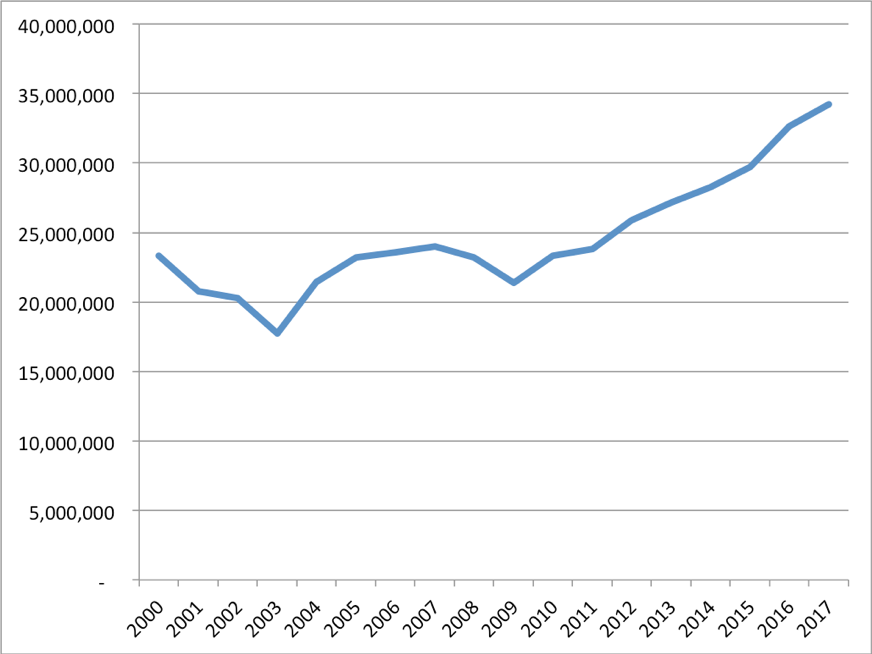

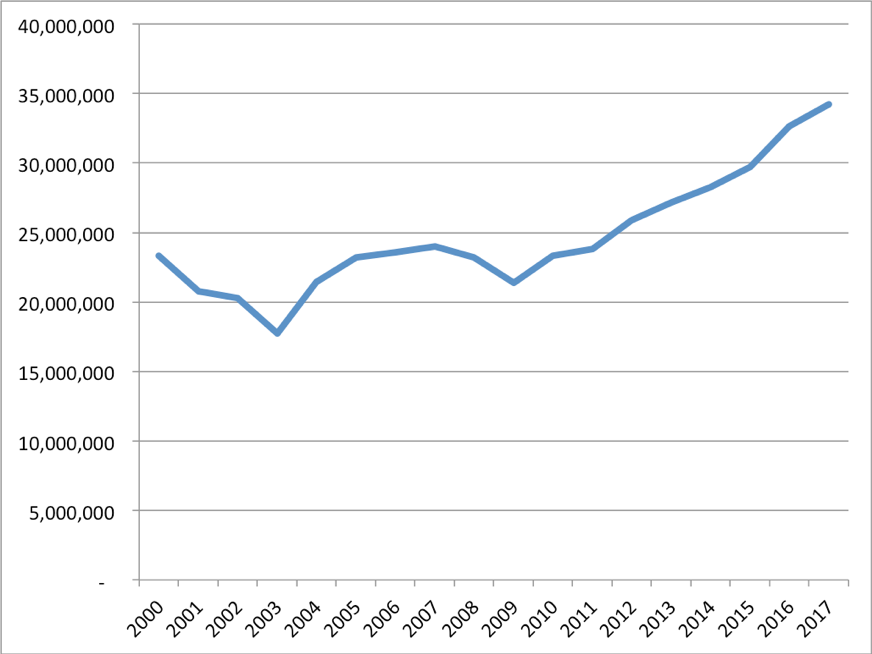

After declining air travel following the September 11, 2001 attacks and the 2008 recession, total passengers traveling from the U.S. to Asia increased rapidly, expanding more than 50 percent since 2009.

Figure 14: Total passengers to Asia from US

Source: Bureau of Transportation Statistics, T-100 International Market (All Carriers)

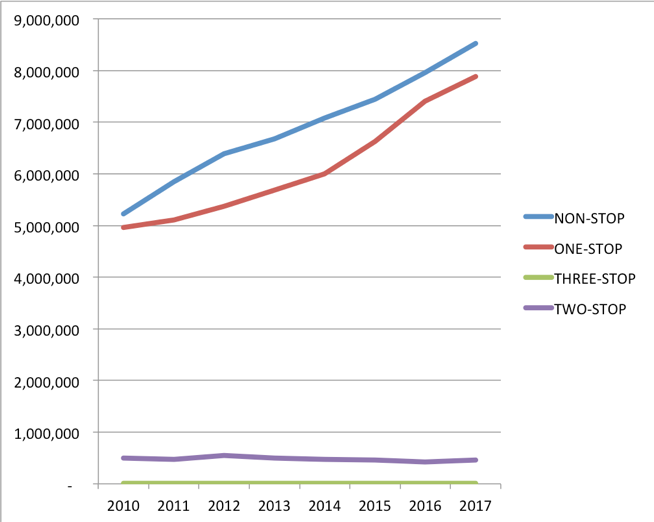

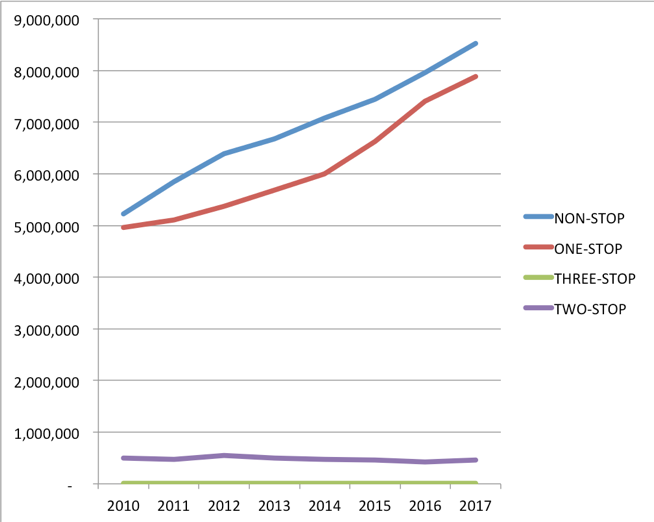

When traveling to Asia, nearly all passengers from the U.S. take non-stop or one-stop flights (See Figure 15). Both non-stop and one-stop flights have grown in tandem, while two and three-stop flights have declined. Only 2.7 percent of all trips involved two or more stops to reach final destinations once leaving the U.S. As such, this analysis does not include two-stop itineraries, as they are not representative of common travel patterns.

Figure 15: Passengers from U.S. to Asia, by itinerary (stops once left U.S.)

Source: Sabre Market Intelligence, Final Dataset, 2018

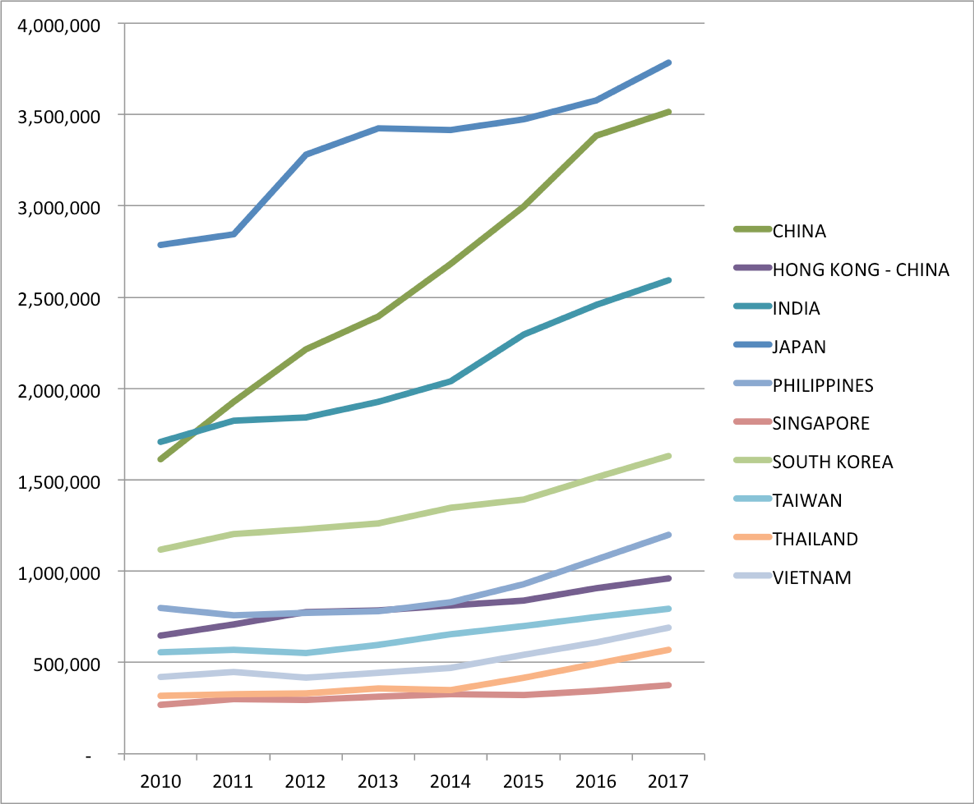

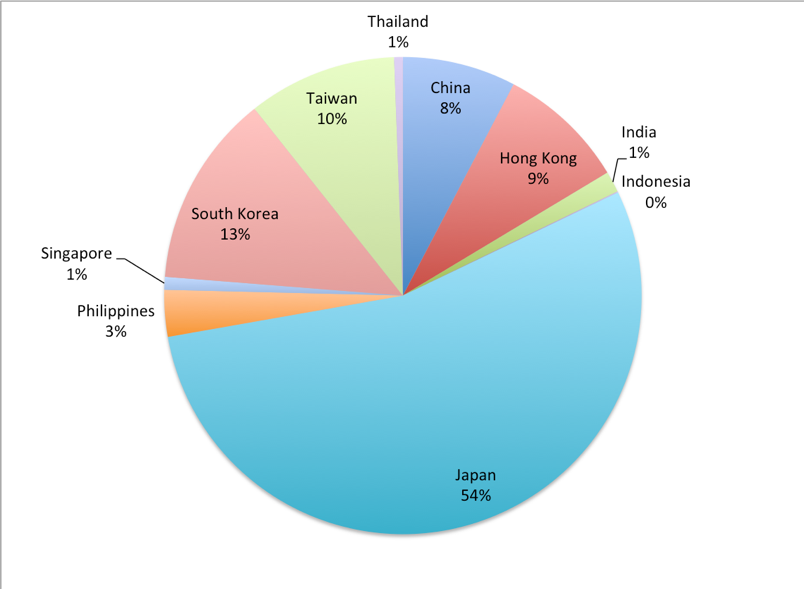

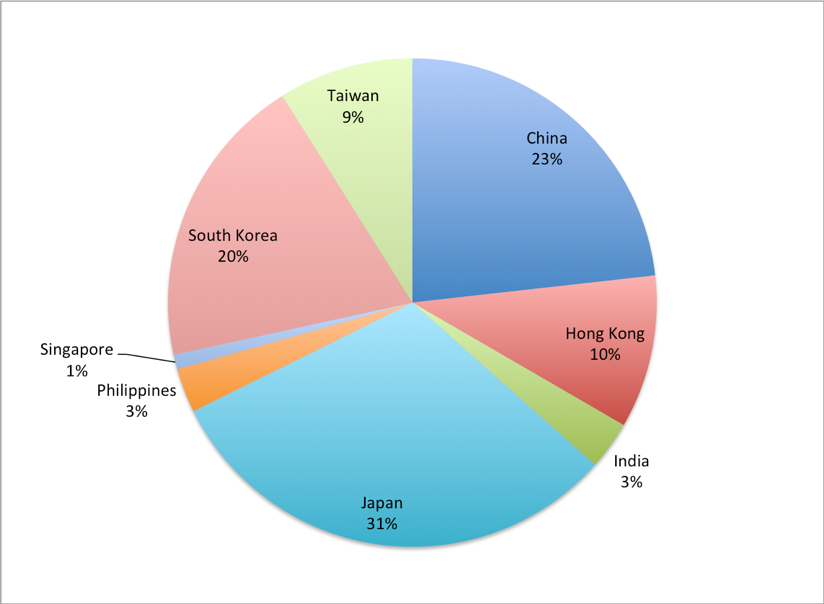

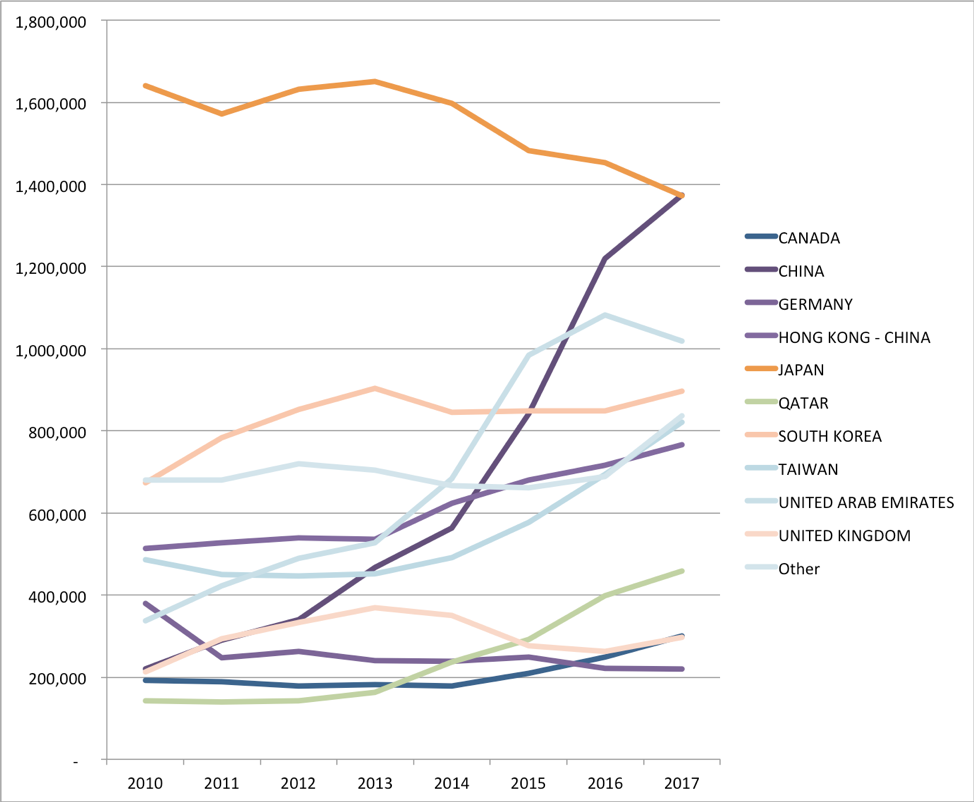

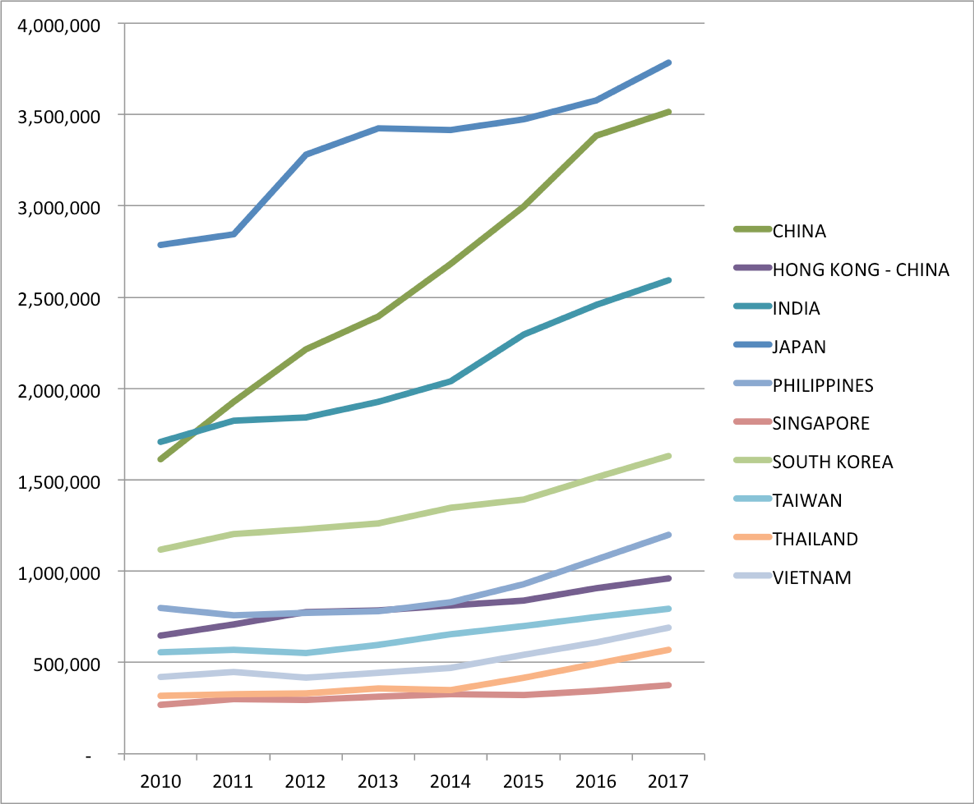

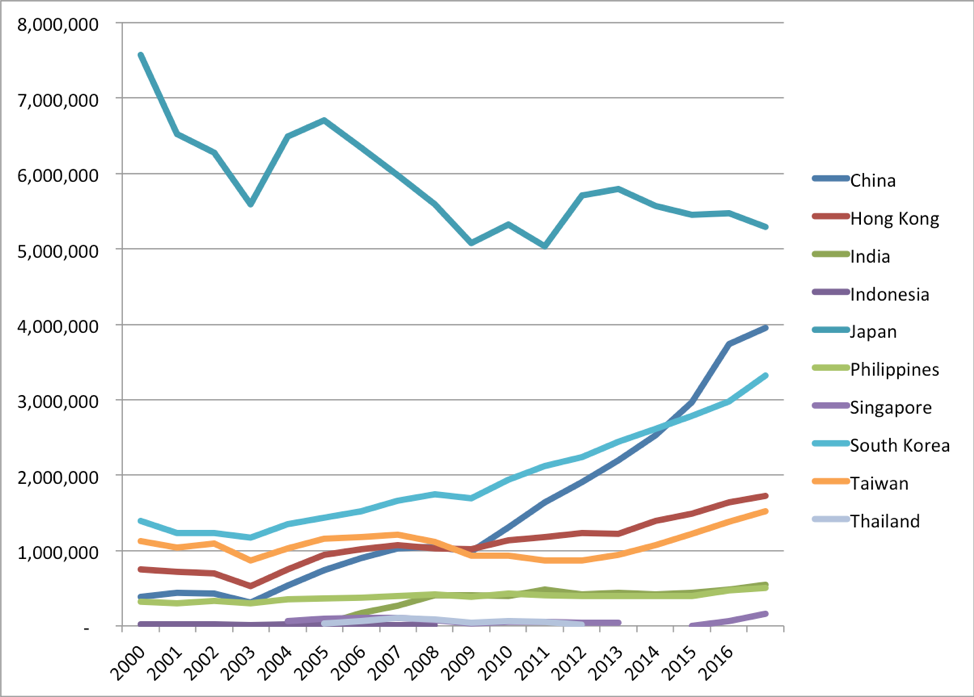

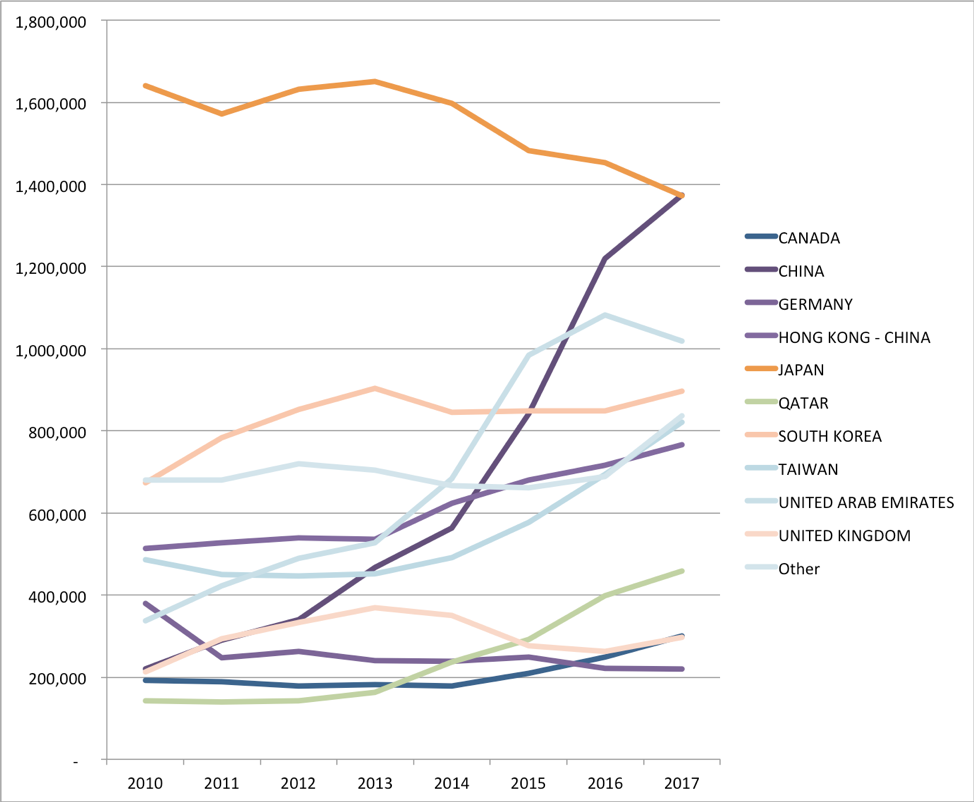

Every Asian market is growing in passengers from the U.S. Japan is still the largest market for U.S. passengers, but China’s rapid growth could overtake Japan sometime in the coming years. Figure 16 shows the top travel destinations in Asia of passengers from the U.S.

Figure 16: Top 10 final destination from US to Asian country, by passenger

Source: Sabre Market Intelligence, Final Dataset, 2018

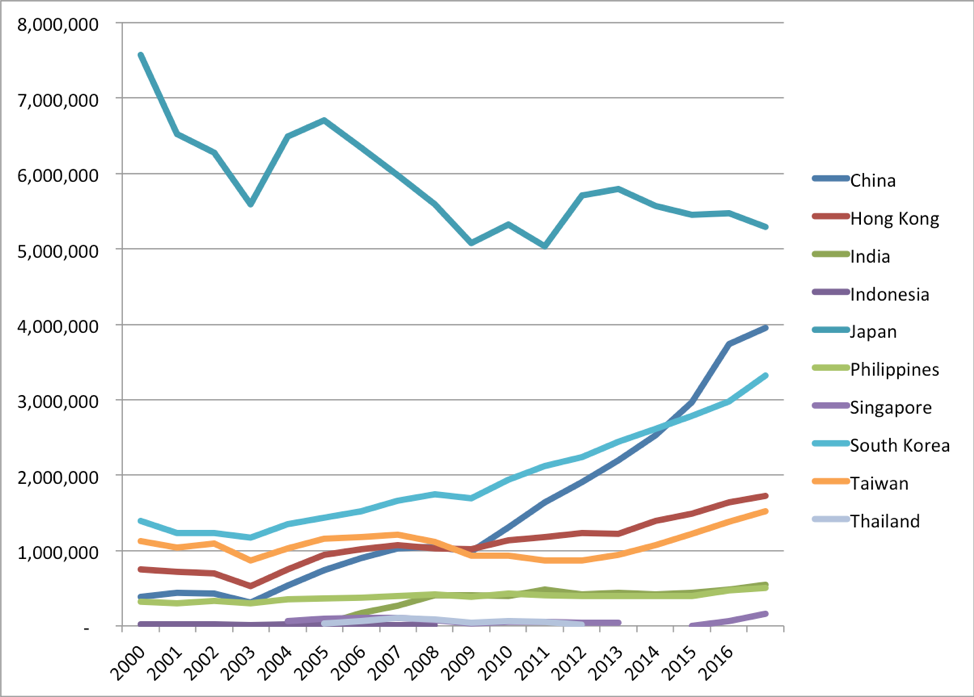

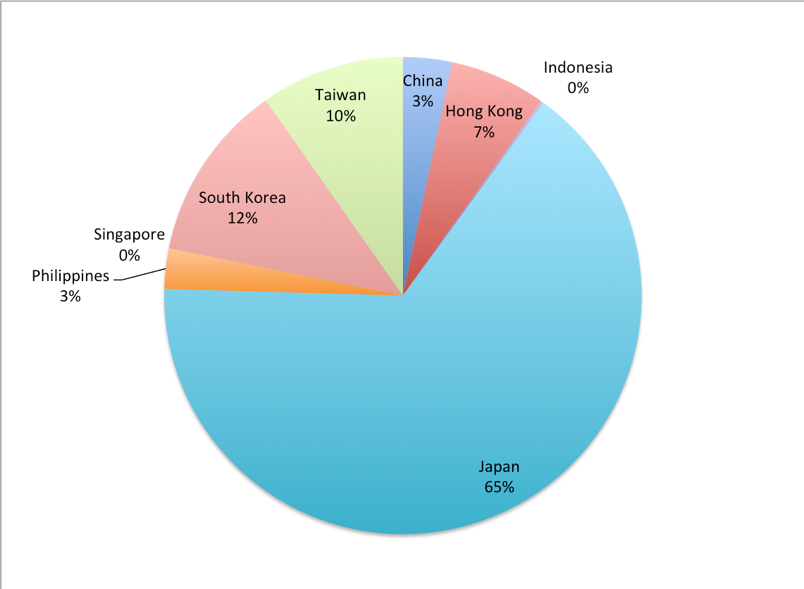

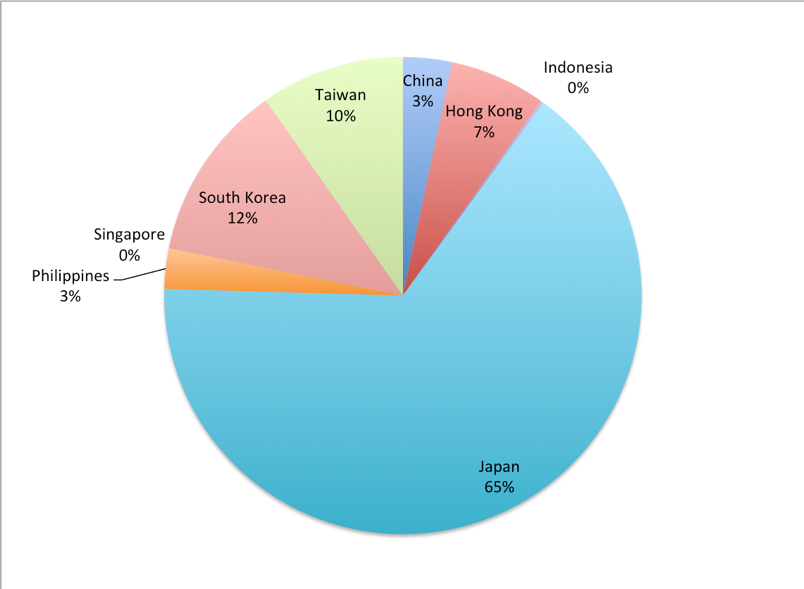

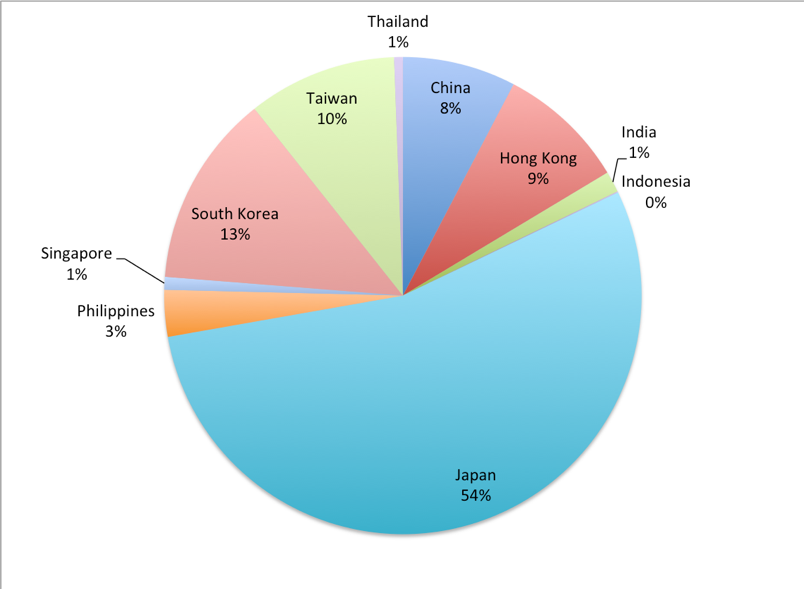

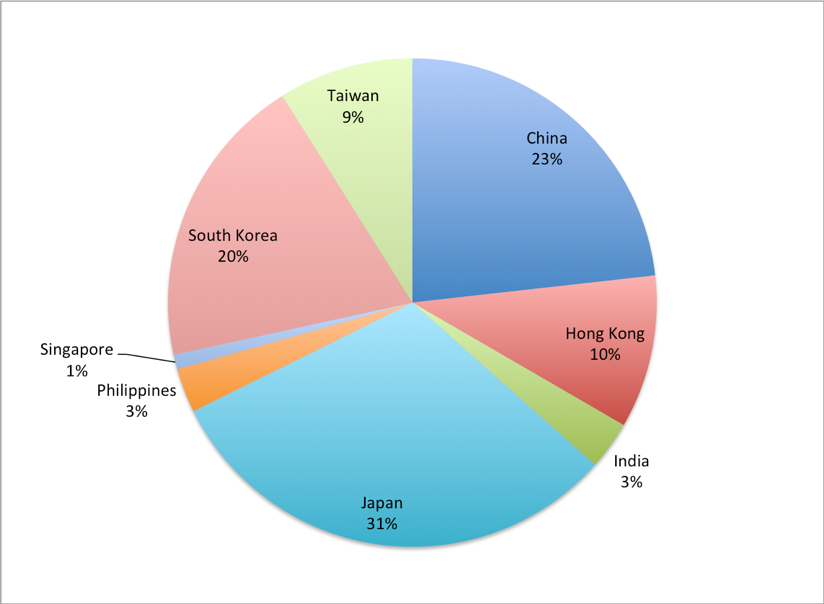

Figure 17 shows the first stop that passengers make when they reach the Asian market. Japan was once the gateway to the rest of Asia, but that has changed since 2000. Whereas 65 percent of all passengers used to end their trip or transfer in Japan, by 2017 this number had decreased to 31 percent. Meanwhile, passenger levels on flights from the US to China have increased tenfold and doubled to South Korea. Other important markets in Asia exist, including Indonesia and Vietnam, but passengers to those countries do not have the option of a non-stop flight from the U.S.

Figure 17: Departing Passengers by Country, Asia

Source: Bureau of Transportation Statistics, T-100 International Market (All Carriers)

Despite the fact that passenger levels to Japan have increased, non-stop traffic to Japan has actually declined. This is in part because more non-stop flights to China and Korea have enabled fewer transfers at Tokyo’s Narita Airport. It is also because more passengers are transferring in other hubs like Incheon and Hong Kong to get to Japan rather than flying to Japan directly. Figures 18 through 21 show how non-stop flights from the U.S. to Asia have changed since 2000.

Figure 18: Non-Stop Passengers to Asia, by Country, 2000

Source: Bureau of Transportation Statistics, T-100 International Market (All Carriers)

Figure 19: Non-Stop Passengers to Asia, by Country, 2006

Source: Bureau of Transportation Statistics, T-100 International Market (All Carriers)

Figure 20: Non-Stop Passengers to Asia, by Country, 2012

Source: Bureau of Transportation Statistics, T-100 International Market (All Carriers)

Figure 21: Non-Stop Passengers to Asia, by Country, 2017

Source: Bureau of Transportation Statistics, T-100 International Market (All Carriers)

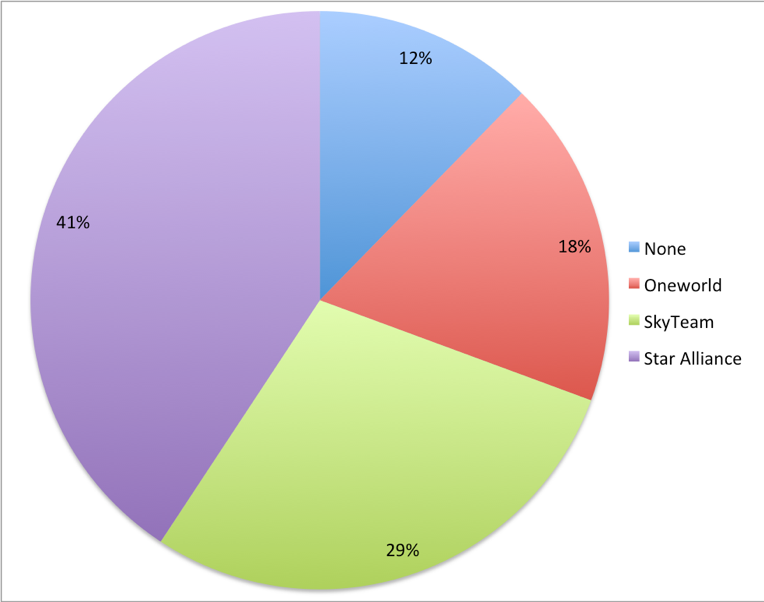

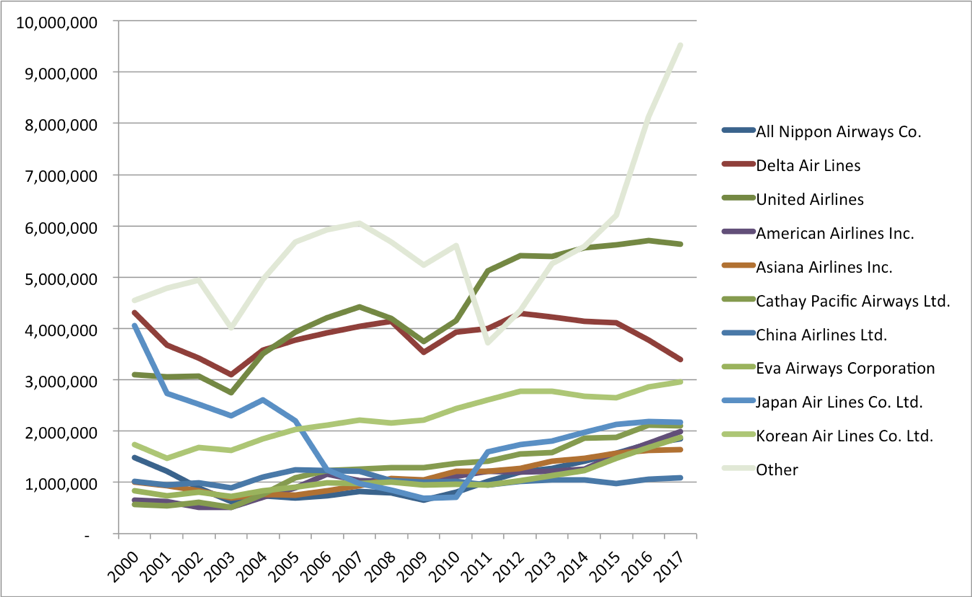

The Asian market is further dominated by the airline alliances than its European counterpart. Less than ten percent of passengers from the U.S. are not flying on one of the three major airline alliances (Figure 22).

Figure 22: Passengers to Asia, by Alliance, 2017

Source: Bureau of Transportation Statistics, T-100 International Market (All Carriers)

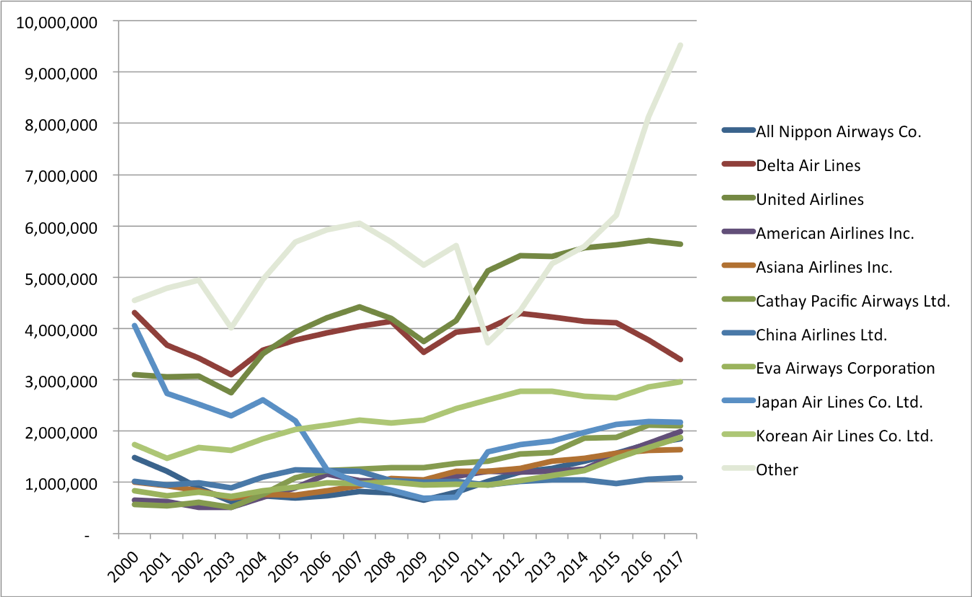

However, Figure 23 shows that new carriers are growing the most. While United nearly doubled its passenger volumes to Asia between 200 and 2017, most airlines have had only modest growth, and some have declined in traffic. “Other” traffic on Figure 23 is new entrants to the market, including Hawaiian Airlines, Jeju Air, Xiamen Airlines, and Hainan Airlines. These have accounted for most of the growth in the passenger volumes.

Figure 23: Departing Passengers to Asia, by Airline

Source: Bureau of Transportation Statistics, T-100 International Market (All Carriers)

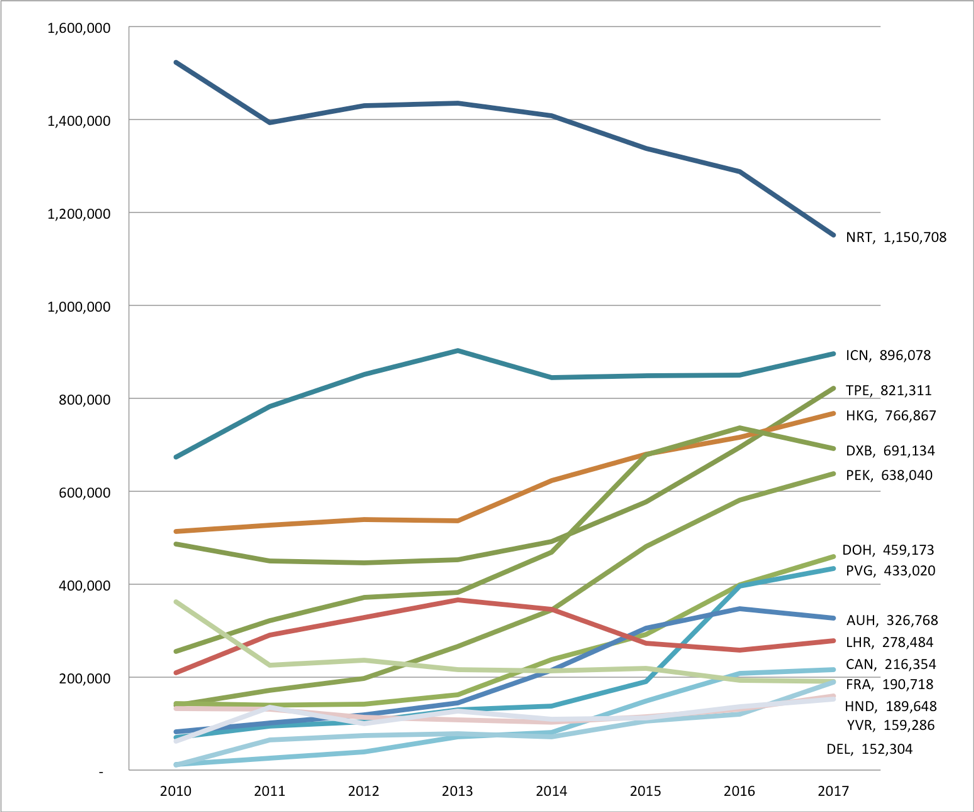

Almost half of all passengers flying from the U.S. to Asia make a foreign connection before arriving at their final destination. Figure 24 shows where connecting passengers make their connections. Given that the Asia region is very large and on the opposite side of the globe, the top ten connection points include Canada, countries in Europe, and in the Gulf. Japan has long been the dominant Asian hub, but China will be the largest hub in 2018. Note that sometimes the final destination is the same country as the connecting. For example, a traveler destined for Osaka might transfer at Tokyo-Narita during her journey.

Figure 24: Connecting Passengers from US to Asia, by Country of Connection (excludes non-stop itineraries)

Source: Sabre Market Intelligence, Final Dataset, 2018

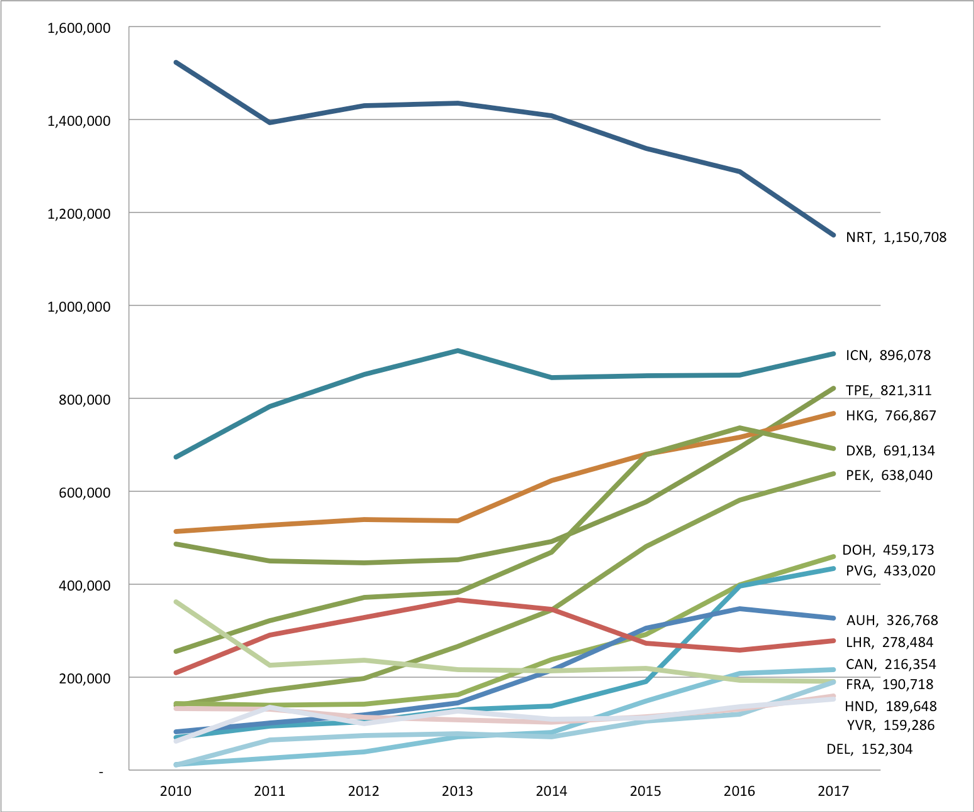

China is a much larger country than Japan, but the Tokyo-Narita airport is still the busiest transfer hub for travelers coming from the U.S. to Asia. Figure 25 shows Narita declining, but given there are so many Chinese hubs, none have a dominant role. In fact, Seoul-Incheon and Hong Kong are bigger connection hubs than any Chinese airport.

Figure 25: Connecting Passengers from US to Asia, by Connecting Airport (excludes non-stop itineraries)

Source: Sabre Market Intelligence, Final Dataset, 2018

[Continued in the second installment, which discusses the role of foreign policy in aviation]