October 26, 2018

When most people think of federal financial support for state and local infrastructure spending, they think of the billions of dollars per year that the federal government spends making grants to those governments (usually with some kind of state/local matching share required). In fiscal 2017, these grants from the Department of Transportation totaled $58 billion: $43.9 billion for highways, $9.8 billion for mass transit, $3.1 billion for airports, and $1.3 billion for TIGER, highway safety and motor carrier safety grants.

But the federal government also plays a less visible role in subsidizing a massive amount of state and local government spending on infrastructure through tax preferences for municipal bonds, endowing revolving funds, and giving direct federal loans and loan guarantees. The actual cost to the federal government of most of these subsidies aren’t listed anywhere in the federal budget, but a new report from the Congressional Budget Office attempts to make them clear.

Definitions. The CBO study analyzes four kinds of financing mechanisms used by state and local governments:

- Tax-Exempt Bonds. These are the workhorse of state and local infrastructure – debt issued by municipalities that pay interest that is exempt from federal income tax and is thus more attractive to buyers, who are willing to take a lower interest rate in exchange for the tax break. (This category also includes qualified private activity bonds.)

- Tax Credit Bonds. For transportation and water infrastructure, this category only includes the temporary Build America Bonds program that was available in 2009 and 2010 through the ARRA stimulus law. They allow state and local governments to issue debt that provides a refundable federal tax credit or a federal payment to the issuer or bondholder.

- State Revolving Funds or Infrastructure Banks. Used primarily for water utilities, these programs use federal appropriations to endow state entities that make low-interest loans to local governments, but once the loans are repaid, the returned principal and interest is then used again to make new loans.

- Direct Federal Credit. These are direct loans and loan guarantees made by the federal government under the TIFIA and RRIF programs and the new WIFIA program.

Totals. The CBO study estimates that over a decade (calendar years 2007-2016), in constant dollars, these federally supported financing mechanisms have supported an average of $64.4 billion per year in state and local spending on transportation and water infrastructure:

Average Annual Amount of Federally Supported New Financing, 2007-2016

|

| Billions of 2017 Dollars |

|

Highways |

Transit |

Aviation |

Water |

Total |

| Tax-Exempt Bonds |

14.0 |

8.8 |

6.1 |

14.5 |

43.5 |

| Tax Credit Bonds |

3.5 |

1.8 |

0.3 |

2.6 |

8.2 |

| SRFs/I-Banks |

0.2 |

* |

0.0 |

8.8 |

9.0 |

| Direct Fed. Credit |

1.5 |

0.8 |

0.0 |

1.3 |

3.7 |

| TOTAL |

19.8 |

11.5 |

6.4 |

27.3 |

64.4 |

CBO says that the above amount represents about one-third of total state and local spending on these programs (the remainder comes from annual operating budgets or from debt that is subject to federal tax).

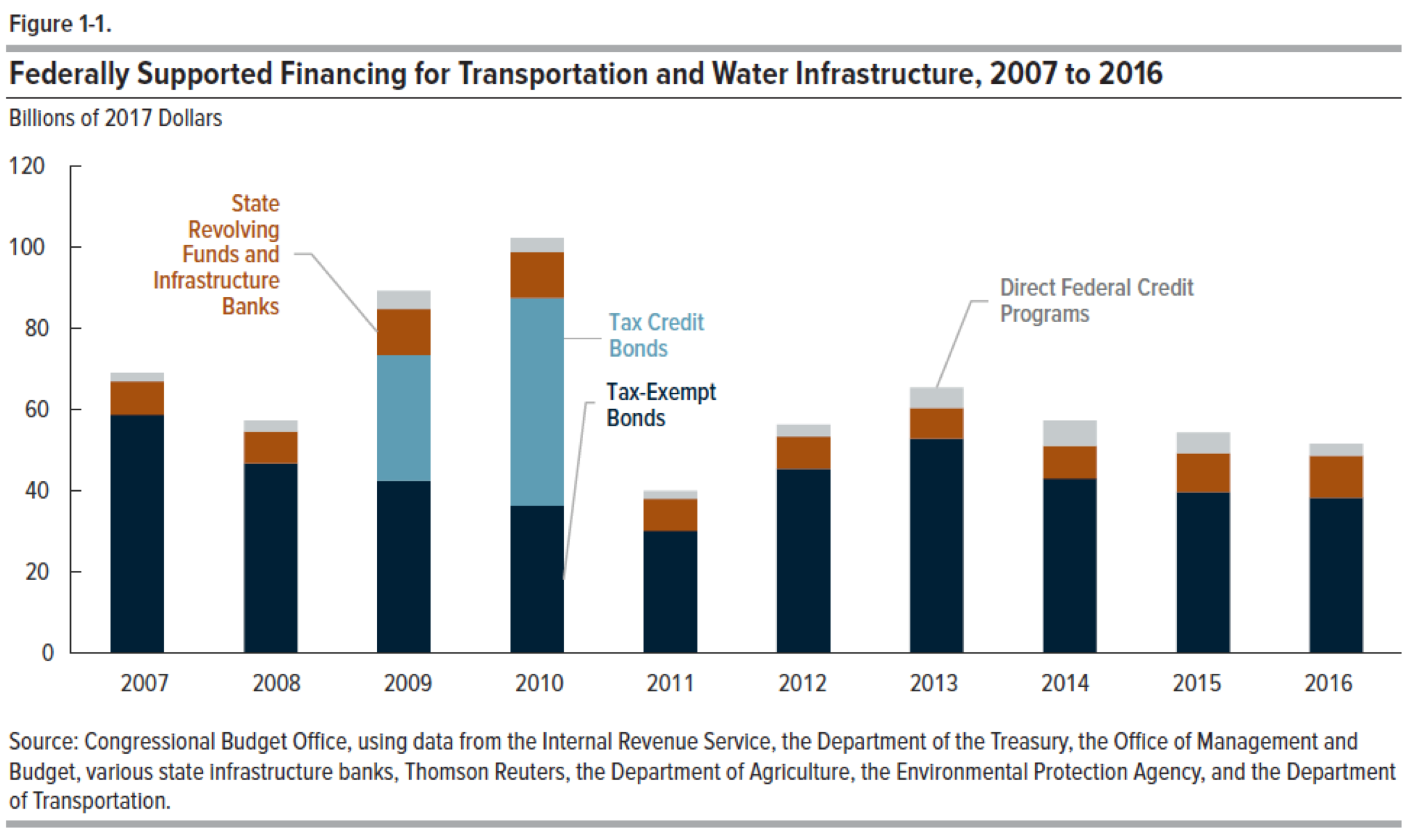

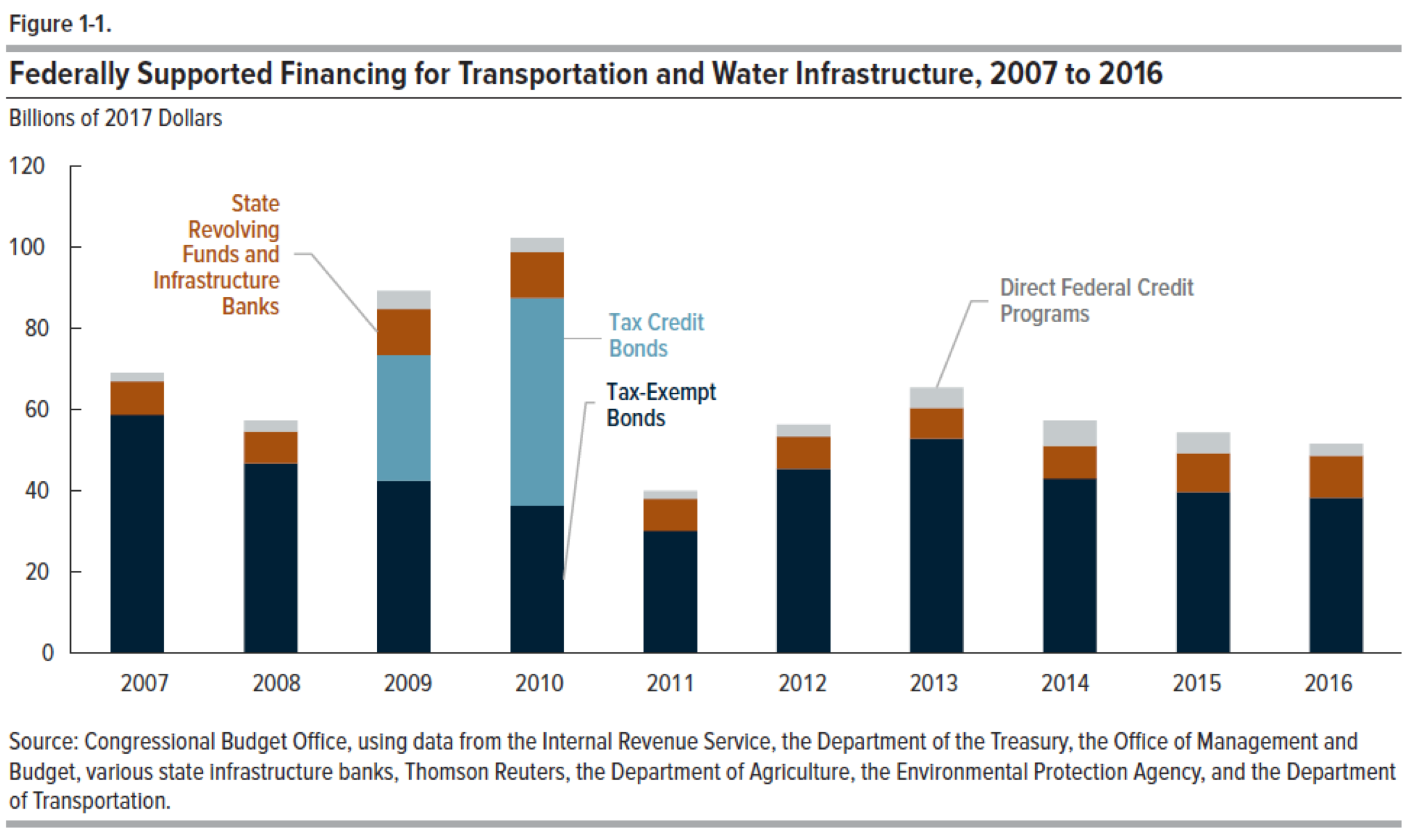

The study also shows how this kind of financing has varied by year, principally because the entirety of the Build America Bonds were issued in 2009 and 2010 (the light blue bar in the chart below) and because the Great Recession, and the displacement caused by the BABs and the direct 100 percent federal share money from the ARRA stimulus bill, decreased regular muni bond issuances in 2009-2011:

Determining the costs to the federal government. For the bulk of this money (muni bonds), the federal government never has to make an appropriation – the federal subsidy shows up as foregone revenue when rich individuals pay their income taxes each year. For most of American history, foregone revenue from tax breaks was more or less invisible, but in the 1960s, a very clever man popularized the concept of the “tax expenditure” as an analytical tool to allow decision-makers to compare the cost of a tax break with the cost of a spending program that served a similar purpose. Figuring out these costs is primarily about multiplying estimated interest payments by the estimated marginal tax bracket of whoever owns the bonds.

The subsidy for Build America Bonds, whether as a refundable tax credit or as a direct payment to the issuer, is recorded on the spending (outlay) side of the budget, not the tax side and is thus easier to find. The annual appropriations endowing state revolving funds are also easy to find (right there in the annual EPA budget).

The actual cost to the federal government of direct loans and loan guarantees is a bit trickier. At present, the cost is measured under the Federal Credit Reform Act of 1990 (FCRA) that requires a complicated series of ongoing estimates and re-estimates of the lifetime cost of the loan to Uncle Sam in terms of borrowing cost, default risk, etc. by loan cohort. CBO has lately been promoting the use of an alternate form of valuation, fair-value accounting, for federal credit programs, which includes an estimate of the risk premium that private investors would require to accept similar amounts of market risk, as a better way of accounting for risk (fair-value was used by CBO to measure the cost of the TARP and Fannie/Freddie bailouts) – but, notably, GAO disagrees.

Comparing costs to the federal government. The CBO report found that the cost to the federal government varies greatly by the duration of the loan or bond. And of course the interest rate environment is a huge factor. CBO’s latest economic forecast anticipates a period of interest rate volatility that will stabilize in 2023, so the estimates in the report use that year as the base case.

Projected Average Federal Costs, by Mechanism and Financing Term, Fiscal Year 2023

|

| Cents per Dollar Financed |

|

10-Year Financing |

20-Year Financing |

30-Year Financing |

| Tax-Exempt Bonds |

12.8 |

26.5 |

35.6 |

| State Banks’ Leveraged Loans |

20.6 |

42.6 |

57.8 |

| State Banks’ Direct Loans |

|

23.1 |

|

| TIFIA Program (FCRA accounting) |

|

|

7.0 |

| TIFIA Program (Fair-value accounting) |

|

|

33.3 |

If a state issues a $100 million highway bond in 2023, CBO estimates that the federal government will forego $12.8 million in tax receipts on interest if the bond has a 10-year duration, $26.5 million in tax receipts if the bond has a 20-year duration, and $35.6 million in tax receipts if the bond has a 30-year duration.

In terms of how much money state and local government save by getting to issue tax-exempt muni debt at below-market interest rates, the CBO report says:

Given the average tax rates that CBO used for its base-case estimates of federal costs, tax-exempt bonds save their issuers 22 percent in interest costs (the average marginal tax rate for market-clearing buyers) but cost the federal government 30.5 percent of the revenues it would have received if the bonds’ interest had been taxable (the average marginal tax rate for all holders of tax-exempt bonds).

For the state revolving funds and infrastructure banks, CBO broke down the loans into two types: loans made directly from banks’ capital funds or from repayments of previous loans, and loans made from the proceeds of tax-exempt bonds issued by the banks (which accounted for about a quarter of state banks’ lending during the 2007–2016 period, CBO estimates). The cost to the federal government for those leveraged loans rose as high as 57.8 cents on the dollar for a 30-year loan.

The difference between the cost to the government for a TIFIA loan varies dramatically based on which accounting format you use. Were the federal government to switch to fair-value accounting, the cost to the government of loans like TIFIA would increase almost fivefold. The CBO report estimated that the real market risk that the private sector would use in financing these projects would be 150 basis points (1.5 percent interest rate) above the levels used in FCRA accounting, which would make a FY18 TIFIA loan cost 4.76 times as much over the life of the loan. CBO then used that 4.76 multiplier towards estimated future TIFIA costs, which is how it got the 33.3 cent figure.

But as it stands now, under FCRA, loans under TIFIA will only cost the federal government 7 cents on the dollar. This is largely due to the fact that, through a combination of selective loan issuance and good luck, there have been very few TIFIA loan defaults to drive the average subsidy cost upwards.

CBO also noted that under fair value accounting, water loans under the WIFIA program would fare better than transportation loans under TIFIA: “Loans from the Water Infrastructure Finance and Innovation Act program, for example, are likely to involve less market risk because water use tends to be less affected by economic downturns than road use. In a recent analysis of various federal credit programs, CBO estimated that the market risk of TIFIA direct loans is comparable to that of commercial loans rated BB-, whereas the market risk of direct loans from the WIFIA program is comparable to that of commercial loans with a higher rating of BBB-.”

Since there is not a currently existing tax credit loan program for transportation and water infrastructure, CBO did not include it in the above table, but they did hypothesize two ways that a new program might work.

If the new tax credit bond program sets the amount of the tax credit to be equal to the interest savings for municipalities on tax-exempt bonds (which is 22 percent per the quote above) then new tax credit bonds “would cost the federal government 28 percent less than the tax-exempt bonds. For CBO’s base case of 20-year bonds issued in 2023, those tax credit bonds would cost the federal government 19 cents per dollar financed, whereas the tax-exempt bonds cost 26 cents.”

But Congress can set the tax credit rate at whatever level it wants when creating a new program. Per the report: “Alternatively, future tax credit bonds that carried a 35 percent credit rate—the rate of the cash payments offered under the Build America Bonds program—would cost the federal government a bit more than tax- exempt bonds but would provide a much larger subsidy to state and local issuers. Specifically, the federal cost would be 15 percent greater (0.35 ÷ 0.305 = 1.15)— about 30 cents per dollar financed—whereas the savings to issuers would be almost 60 percent greater (0.35 ÷ 0.22 = 1.59).”

Conclusions. The CBO study was careful not to turn its conclusions into policy recommendations. Nevertheless, in terms of “bang for the federal buck,” it is simple to turn the cents-on-the-dollar percentages in the above table and the two different tax credit bond estimates and simply reverse the math. If the federal government were going to increase its tax code support for state and local infrastructure (instead of, or in addition to, increasing its direct federal funding for infrastructure), then direct loans like TIFIA and WIFIA are clear winners under the current FCRA accounting system. But bringing back something like Build America Bonds could be less costly for the federal government than expanding regular tax-exempt municipal bonds or state revolving funds.

Every $1.00 in Federal Costs Can Support How Much Additional Investment?

|

| (Assumes FY 2023 issuance) |

|

10-Year |

20-Year |

30-Year |

| Tax-Exempt Bonds |

$7.81 |

$3.77 |

$2.81 |

| State Banks’ Leveraged Loans |

$4.85 |

$2.35 |

$1.73 |

| State Banks’ Direct Loans |

|

$4.33 |

|

| Tax Credit Bonds (22% subsidy) |

|

$4.54 |

|

| Tax Credit Bonds (35% subsidy) |

|

$2.86 |

|

| TIFIA Program (FCRA accounting) |

|

|

$14.29 |

| TIFIA Program (Fair-value accounting) |

|

|

$3.00 |

Politically, two things need to be made clear. First, for regular tax-exempt muni debt, the tax benefits go to the rich people who buy the bonds. But under tax credit bonds, the tax benefit payments usually go to the issuer (state or local government). And second, the CBO study was requested by Senate Finance Committee chairman Ron Wyden (D-OR), who also happens to be the creator of the Build America Bond program that was included in ARRA (it was based on a proposal that Wyden and former Sen. Jim Talent (R-MO) proposed in 2003). And Wyden has long advocated bringing back Build America Bonds (or establishing a related tax credit).