Most USDOT Spending Back to Normal Levels Amidst “Shutdown”

Spending by the U.S. Department of Transportation was back to the $1 billion per day mark this week after a standard beginning-of-year accounting hold. This spending – primarily reimbursements for grant work already completed by grant recipients – takes place despite the rest of government being, technically, shut down.

The Treasury does not report budget outlays on a daily basis. But the Daily Treasury Statement does report the daily transactions of something similar.

Imagine that we were back in the early 1800s, when all real money came in the form of gold and silver coins. Congress could pass whatever appropriation bills it wanted, and the Treasury could plan however it liked, but when it came time for the federal government to pay real money to someone outside the federal government, no simple ledger entry could suffice – somebody had to take gold or silver coins out of a box somewhere in order to make that payment.

The Treasury General Account (TGA) at the Federal Reserve Bank of New York is the modern-day equivalent of the vault where the government keeps all the gold and silver coins. It’s where all of the real dollars actually are. All taxes and duties are deposited there, and whenever anyone purchases Treasury debt, the proceeds are deposited there as well. The various federal departments and agencies can attempt to write all of the checks and make all of the electronic funds transfers (EFTs) that they need to in order to fulfill their legal mandates, but in order to make sure that those checks and EFTs actually clear, they have to take real dollars out of the Treasury General Account.

The need to take real dollars out of the TGA exists whether or not those dollars are recorded as part of the federal budget. So if an agency is making a direct loan to a non-federal partner, the face value of the loan has to be withdrawn from the TGA in order for the check to clear, even though the face value of loans are no longer recorded as part of the budget. Similarly, the money to write tax refund checks comes from the TGA, even though refunds are recorded in the budget as negative revenues, not as spending.

The federal government may be in a “shutdown” today but this is a lawyer’s shutdown, instituted because the government has run out of legal authority for most employees to come to work and incur the obligation to pay them. The government is not out of money – the closing cash balance in the TGA on October 15 was $852 billion.

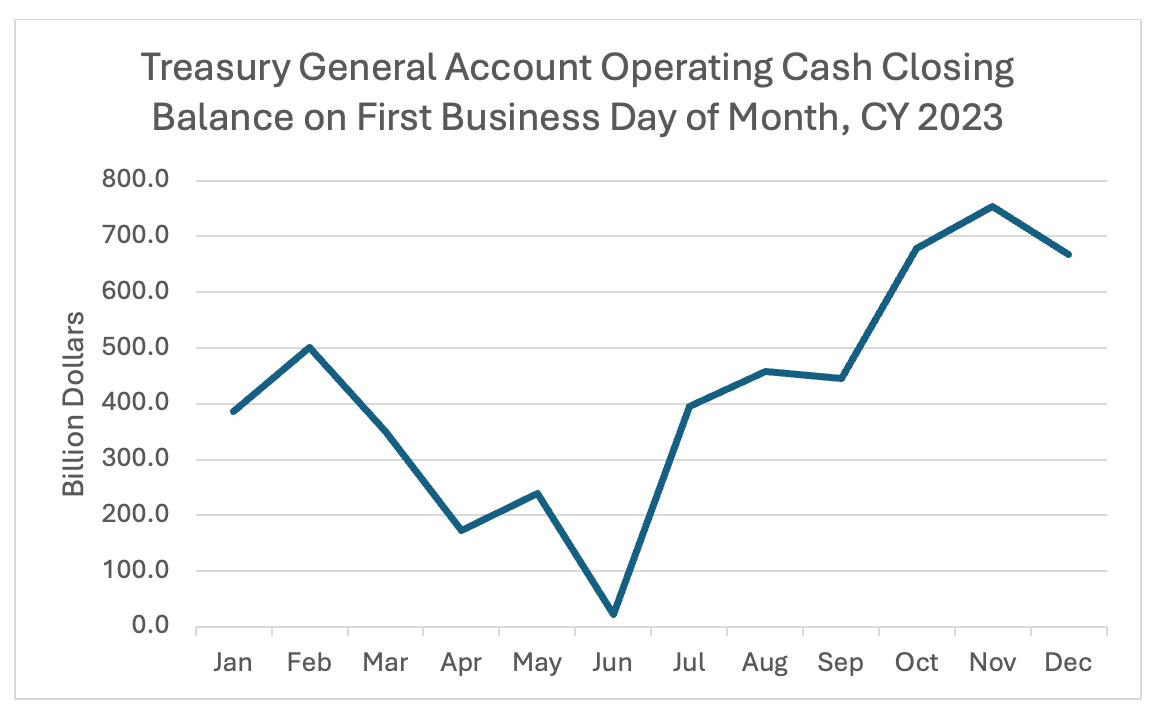

If the TGA were ever to run dry, we would have a real government shutdown where Social Security checks bounce and the Treasury lacks money to pay bills on a day-to-day basis. This almost happened in 2023, during the debt ceiling crisis – the TGA end-of-day balance dropped as low as $22.9 billion on June 1, 2023 before President Biden signed the bill increasing the debt ceiling on June 3. (A typical Social Security payday, which happens four times a month, withdraws around $25 billion from the TGA, and a monthly Medicare provider payment is around $50 billion, so a $22.9 billion balance is precariously low.)

We looked at the Daily Treasury Statements for the first ten business days of fiscal 2025 and compared them to the first ten business days of fiscal 2024 and 2023. One thing is clear: it is routine for the Department of Transportation to turn off its spending systems for the first week of the new year in order to perform accounting summaries for the just-ended fiscal year and to otherwise clean house and do maintenance and upkeep. So the lack of any withdrawals from TGA for the first week has nothing to do with the purported ongoing government shutdown.

The Federal Transit Administration restarts its money machine around the 7th or 8th business day of the new year. The Federal Highway Administration, which is by far the largest average daily spender, used to do so as well. But in 2024 and 2025, they delayed things, taking more time to restart the machine. This year, they did not reopen FMIS (the software system that highway grant recipients use to update status and request reimbursements) until October 15, the tenth business day of the new year. On that date, FHWA withdrew $889 million from the TGA, pushing the Department’s total over $1 billion on the day, which is roughly normal for this time of year.

| USDOT Withdrawals From the Treasury General Account | |||||||||||

| Millions of Dollars, by Business Day of the New Fiscal Year | |||||||||||

| BD1 | BD2 | BD3 | BD4 | BD5 | BD6 | BD7 | BD8 | BD9 | BD10 | ||

| FY 2024 | |||||||||||

| FAA | 0 | 1 | 0 | 0 | 0 | 1 | 19 | 133 | 63 | 74 | |

| FHWA | 42 | 0 | 0 | 0 | 0 | 170 | 692 | 887 | 507 | 250 | |

| FRA | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 1 | 1 | 0 | |

| FTA | 0 | 0 | 0 | 0 | 0 | 0 | 252 | 115 | 98 | 91 | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 40 | 62 | 22 | 199 | |

| DOT Total | 42 | 1 | 0 | 0 | 0 | 171 | 1,005 | 1,198 | 691 | 614 | |

| FY 2025 | |||||||||||

| FAA | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 23 | 91 | 41 | |

| FHWA | 100 | 0 | 0 | 0 | 0 | 1 | 9 | 3 | 5 | 167 | |

| FRA | 0 | 0 | 0 | 0 | 0 | 2 | 3 | 2 | 0 | 5 | |

| FTA | 0 | 0 | 0 | 0 | 0 | 1 | 2 | 143 | 132 | 61 | |

| Other | 0 | 0 | 0 | 11 | 0 | 38 | 28 | 20 | 33 | 15 | |

| DOT Total | 100 | 0 | 0 | 11 | 0 | 42 | 42 | 191 | 261 | 289 | |

| FY 2026 | |||||||||||

| FAA | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 163 | 129 | 80 | |

| FHWA | 41 | 0 | 0 | 0 | 0 | 6 | 8 | 6 | 6 | 889 | |

| FRA | 0 | 0 | 0 | 0 | 0 | 8 | 3 | 191 | 1 | 7 | |

| FTA | 0 | 0 | 0 | 0 | 0 | 1 | 53 | 184 | 58 | 18 | |

| Other | 0 | 0 | 0 | 0 | 0 | 19 | 71 | 22 | 29 | 28 | |

| DOT Total | 41 | 0 | 0 | 0 | 0 | 34 | 135 | 566 | 223 | 1,022 | |

The fact that DOT is still spending a lot of money reimbursing grant recipients during a “shutdown” should not obscure the facts of what isn’t being spent – they are not spending money on paying the salaries of most FAA, FRA, MARAD, PHMSA, and OIG employees.