November 16, 2016

In an attempt to make the budget totals of the legislation balance, section 1438 of the FAST Act of 2015 orders that, on July 1, 2020, $7.569 billion in unobligated balances of highway contract authority apportioned to states via formula will be rescinded (canceled).

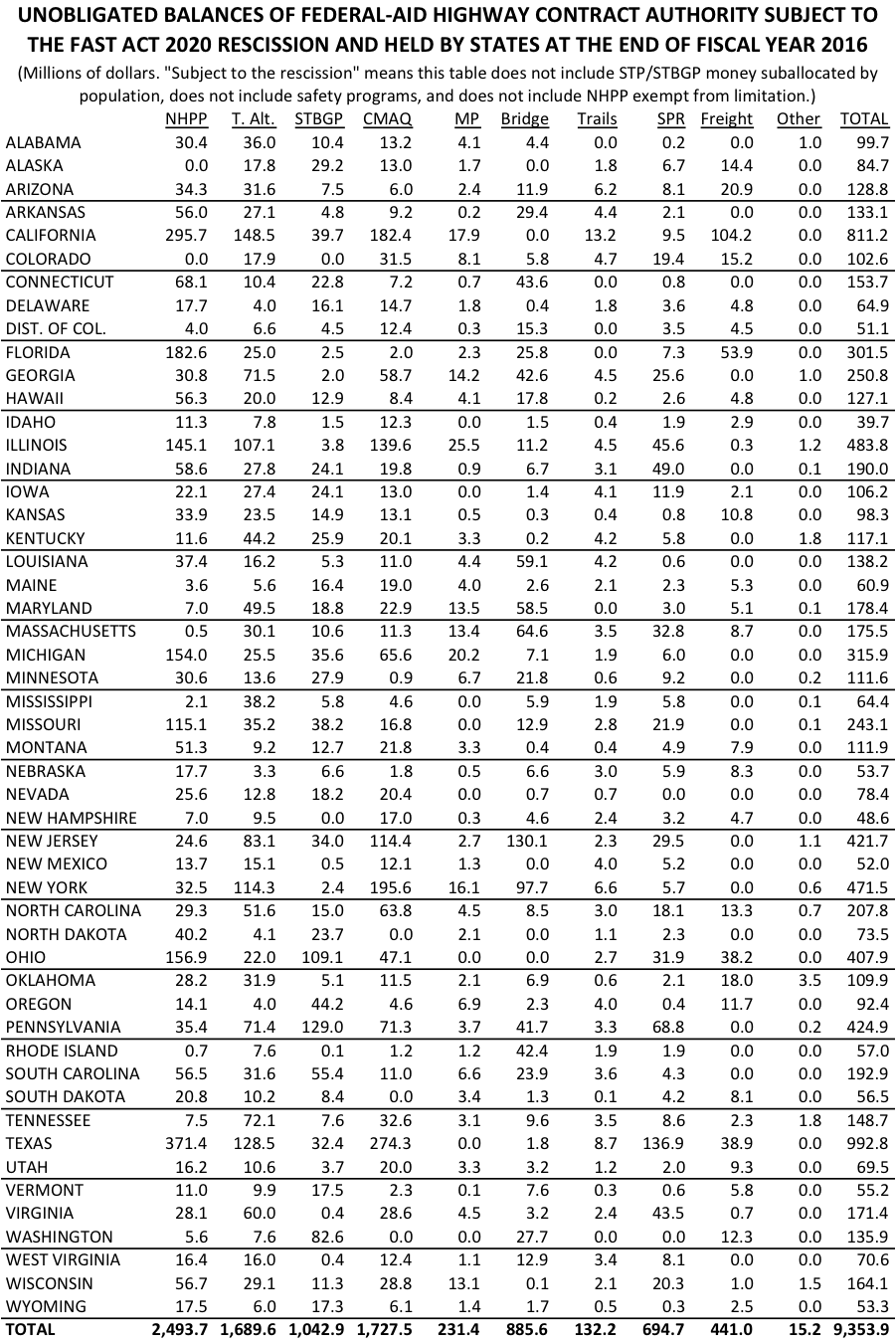

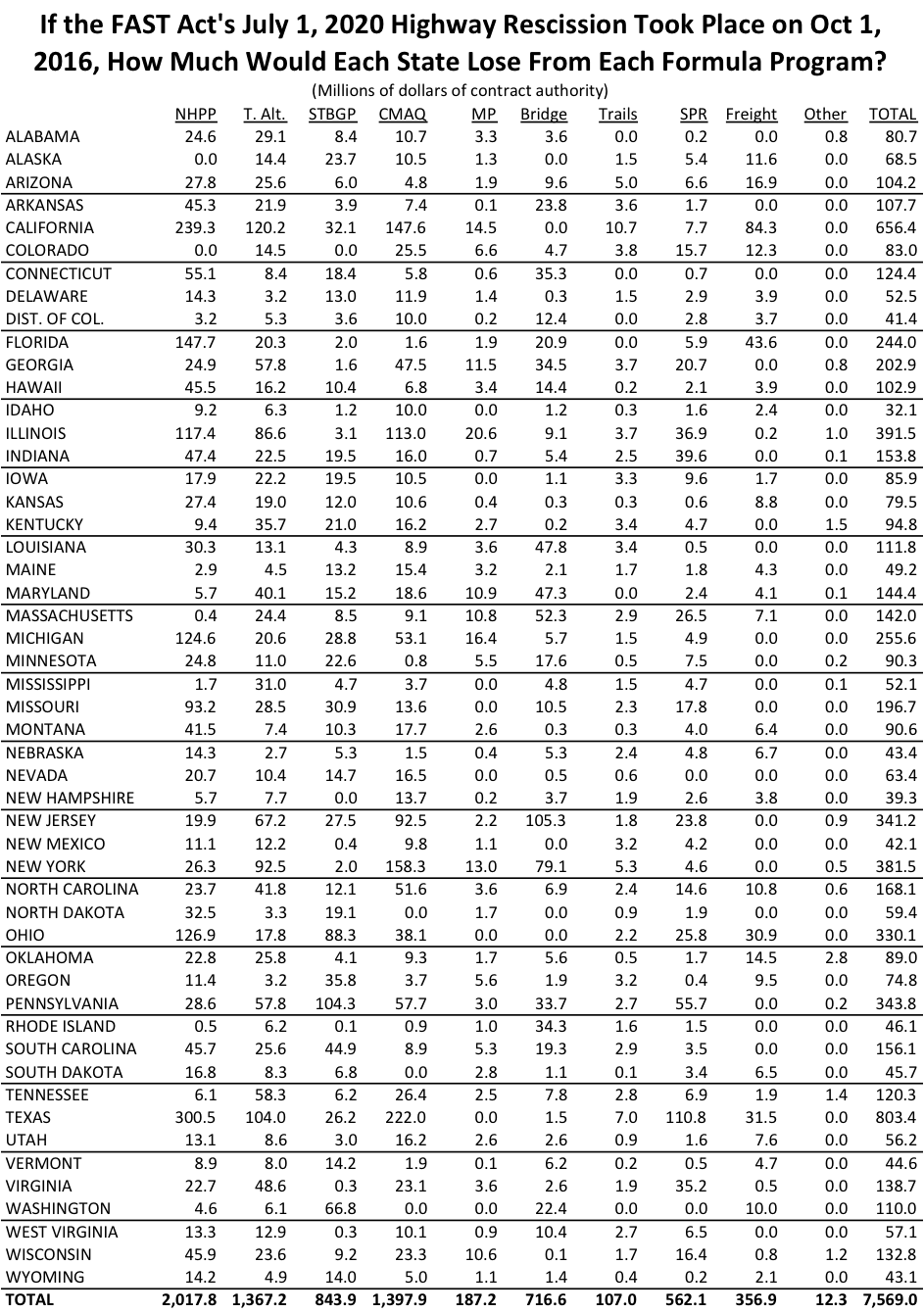

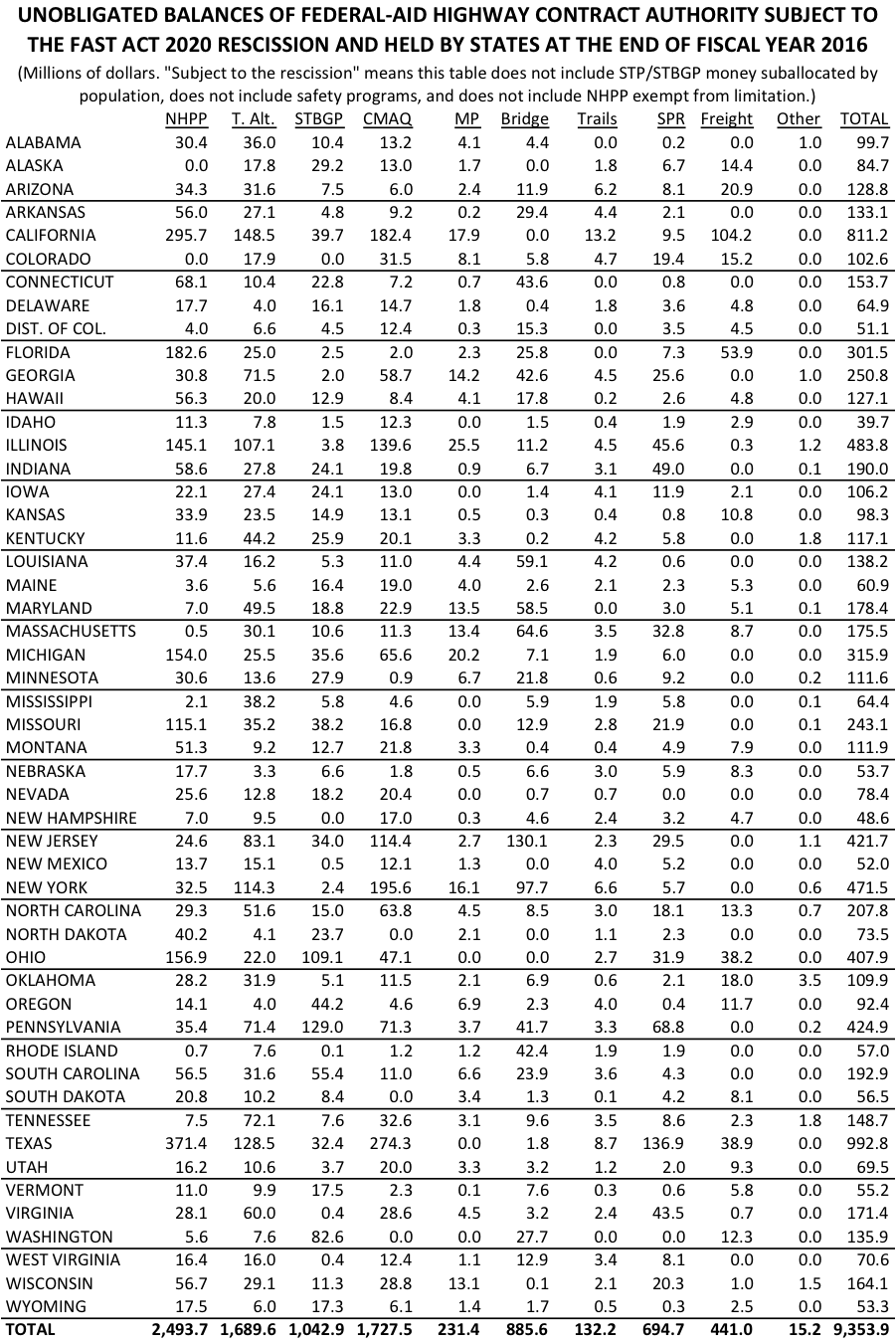

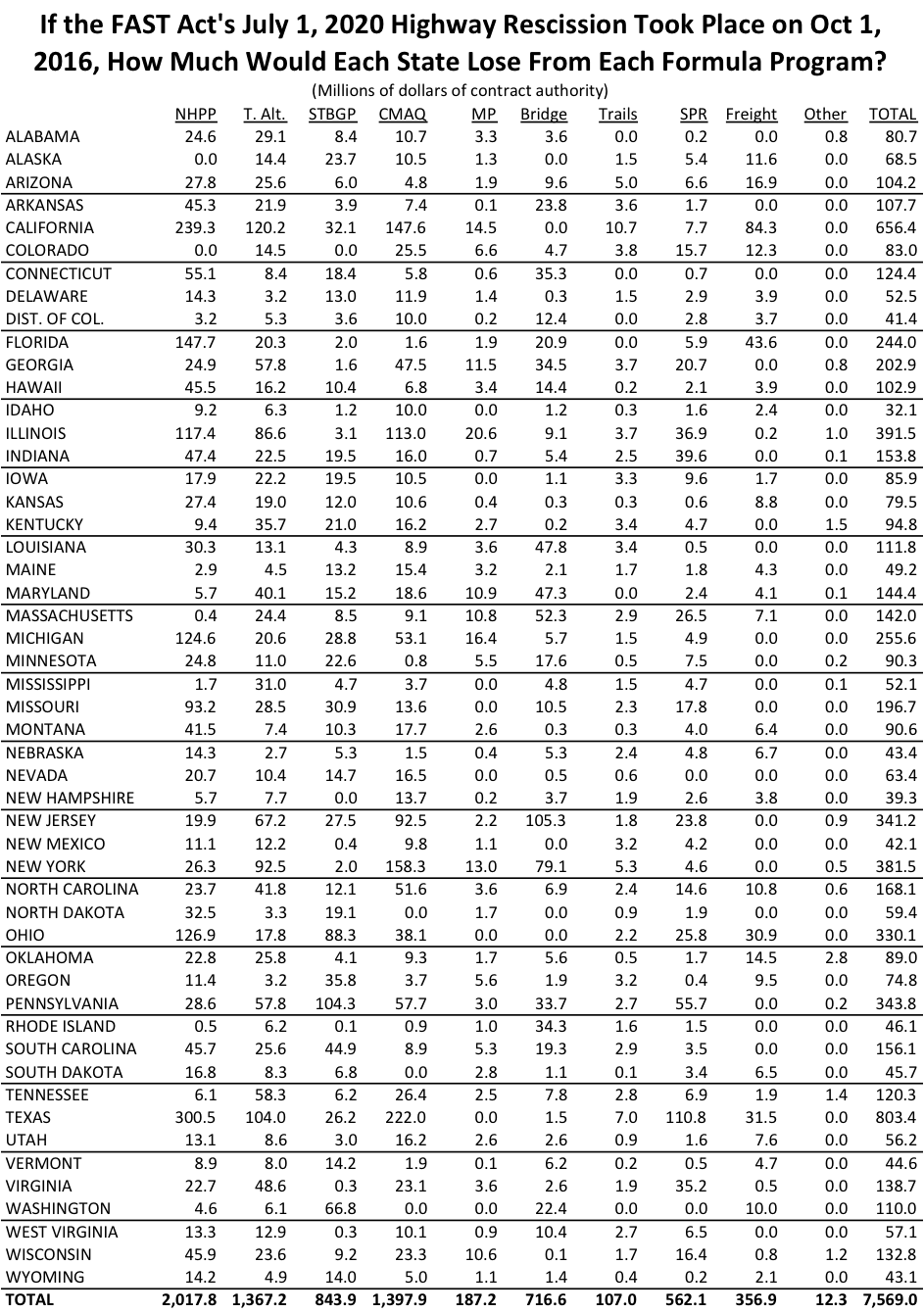

The Federal Highway Administration has updated its “what if” forecast to help states plan for the rescission. While no one can know with certainty exactly how much unobligated money states will have lying around at the end of June 2020, FHWA knows exactly how much each state held on September 30, 2016 (the close of fiscal year 2016). FHWA has sent a table to states showing how the $7.569 billion would have been implemented had it been executed on October 1, 2016.

(A few caveats – not all apportioned highway funding is subject to the rescission. Funds sub-allocated by population to metropolitan areas are exempt from the rescission, as are safety programs and the $639 million per year of National Highway Performance Program funding that is outside the annual obligation limitation.)

FHWA says that states collectively had $9.354 billion in unobligated balances subject to the rescission as of the close of business on September 30, 2016. But how would that rescission be applied?

The FAST Act requires that the rescission be applied to each state (and the District of Columbia) based that state’s share of the unobligated balances, so it rewards states that are more efficient spenders of the money. For example, under the FAST Act, Alabama gets 1.94 percent of all the new highway formula money, but they only had 1.07 percent of total balances held by states as of September 30, so they would only feel 1.07 percent of a rescission implemented on October 1. Conversely, New Jersey’s fiscal crisis slowed their spending rate, so even though the state only gets 2.55 percent of new money under the FAST Act, they would take 4.51 percent of the brunt of an October 1 rescission. (Hawaii is even slower for some reason – they get 0.43 percent of highway apportionments but would get 1.36 percent of the rescission.)

Once each state is given a total rescission amount, the FAST Act then requires that the rescission be applied proportionately across all programs with balances held by states as of the date of the rescission. But just as states spend their total apportionments at different rates, so too do different states spend from different programs at different rates.

In particular, many states have difficulty spending all of their Transportation Alternatives money (called Transportation Enhancements prior to the MAP-21 law). This program is primarily about bicycle paths, pedestrian walkways, rail-to-trail, beautification, and environmental mitigation (full list of eligible activities here). This program has received between $800 million and $850 million in new money for many years.

FHWA says that as of October 1, states and D.C. collectively held $1.69 billion in unobligated Transportation Alternatives money – two full years of the program. Even though the T.A. program is only 2.1 percent of the total highway program, state slowness to spend this money means that 18.1 percent of an October 1, 2016 rescission would be taken from the T.A. program. (This would suit most Republicans just fine, since they have historically opposed the T.A. program.)

This varies widely by state – Kentucky, for example, would see 37.7 percent of its rescission taken out of T.A. whereas Oregon would only see 4.3 percent of its rescission taken from T.A.

There is a similar divergence between states in the Congestion Mitigation and Air Quality program. Maine, for example, had almost two full years worth of CMAQ apportionments sitting around unobligated on September 30, meaning that CMAQ would take a disproportionate share of Maine’s rescission. Conversely, North and South Dakota and Washington State managed to obligate every dime of their cumulative CMAQ apportionments by September 30.

Put another way, the National Highway Performance Program gives out over $22 billion per year in new money, and states only had $2.5 billion of it unobligated as of September 30, or a little over ten percent of one year’s new apportionment. CMAQ gives out $2.3 billion per year, but states collectively had $1.7 billion unobligated as of September 30, or about 75 percent of a full year’s apportionment.

States are allowed under 23 U.S.C. §126 to transfer money between programs, subject to some limitations, most particularly a restriction that no more than 50 percent of each year’s apportionment for each program can be transferred to another program. Some states routinely max out their transfers from the CMAQ program to easier-to-spend programs.

FY 2016 was the first year that the new National Highway Freight Program was in existence. A total of 18 states (Alabama, Arkansas, Georgia, Indiana, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Nevada, New Jersey, New Mexico, New York, North Dakota, Pennsylvania, Rhode Island, South Carolina and West Virginia) managed to obligate or transfer every dime of their FY 2016 freight apportionment and had zero left over on September 30. Oddly, California appears to have obligated almost none of its 2016 freight money yet (they received $106.3 million and had $104.2 million of it left unobligated at the end of the fiscal year).

The tables below show tables that indicate how much money (subject to the rescission) that each state had remaining, unobligated, at the close of business on September 30 and how a hypothetical October 1, 2016 rescission would be applied to each state and to each highway program within that state.