Yesterday, the Federal Highway Administration updated its quarterly index of highway construction costs, revealing that the cost index (the NHCCI) increased by 6.0 percent in the July-September 2023 quarter over the previous April-June 2023 quarter, an annualized rate of 23.9 percent per year.

This was the 11th straight quarter of cost increases. The July-September 2023 NHCCI of 3.456 is a 69 percent increase in highway construction costs since the October-December 2020 quarter.

|

|

Increase Over |

| Quarter |

NHCCI |

Prior Quarter |

| Oct.-Dec. 2020 |

1.8601 |

|

| Jan.-Mar. 2021 |

1.9112 |

+2.7% |

| Apr.-Jun. 2021 |

2.0363 |

+6.5% |

| Jul.-Sep. 2021 |

2.1075 |

+3.5% |

| Oct.-Dec. 2021 |

2.1821 |

+3.5% |

| Jan.-Mar. 2022 |

2.2841 |

+4.7% |

| Apr.-Jun. 2022 |

2.5555 |

+11.9% |

| Jul.-Sep. 2022 |

2.7820 |

+8.9% |

| Oct.-Dec. 2022 |

2.7840 |

+0.1% |

| Jan.-Mar. 2023 |

2.8426 |

+2.1% |

| Apr.-Jun. 2023 |

2.9680 |

+4.4% |

| Jul.-Sep. 2023 |

3.1456 |

+6.0% |

|

|

|

| July.-Sep. 2023 increase over Oct.-Dec. 2020 |

+1.2855 |

+69.1% |

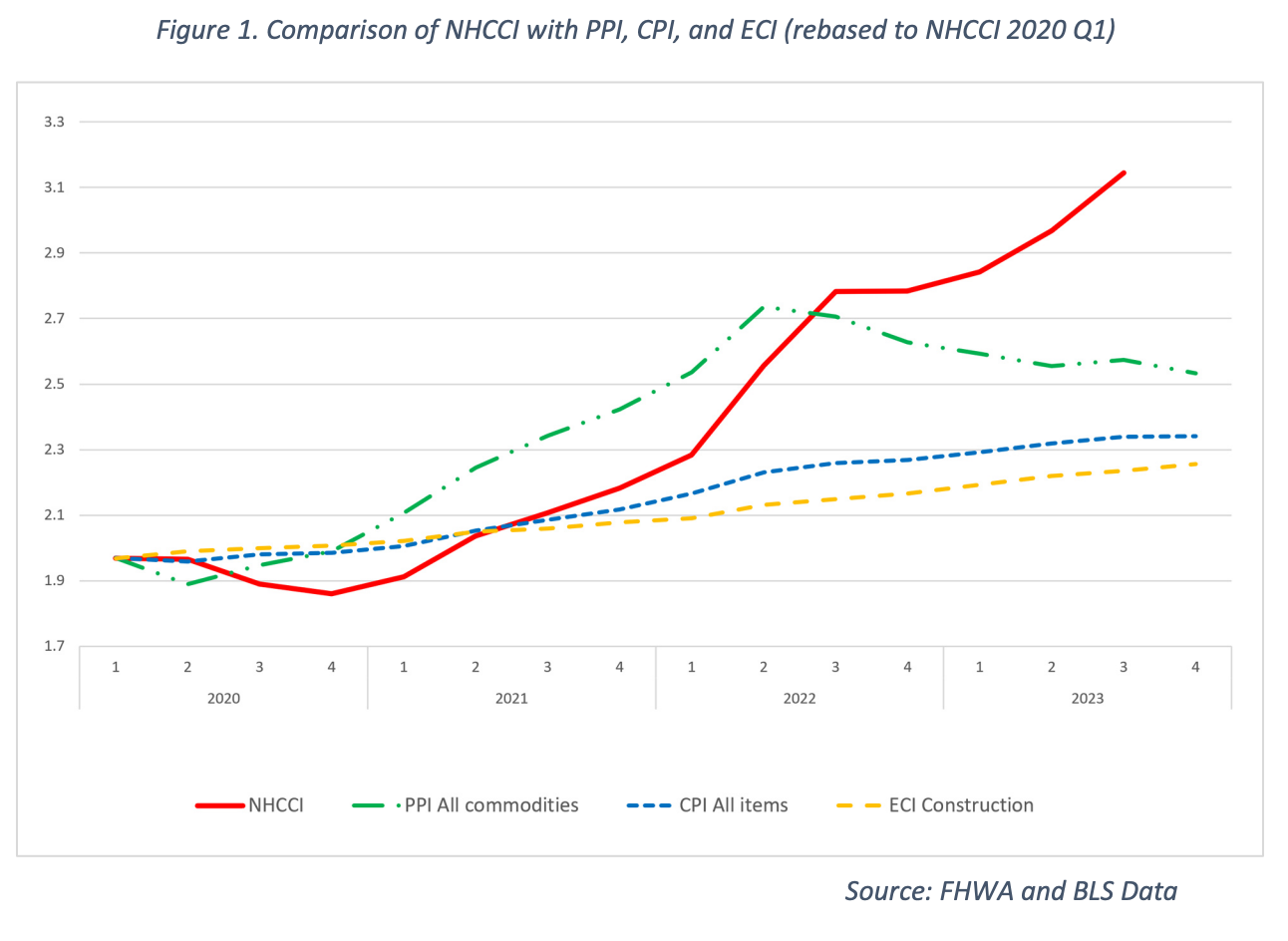

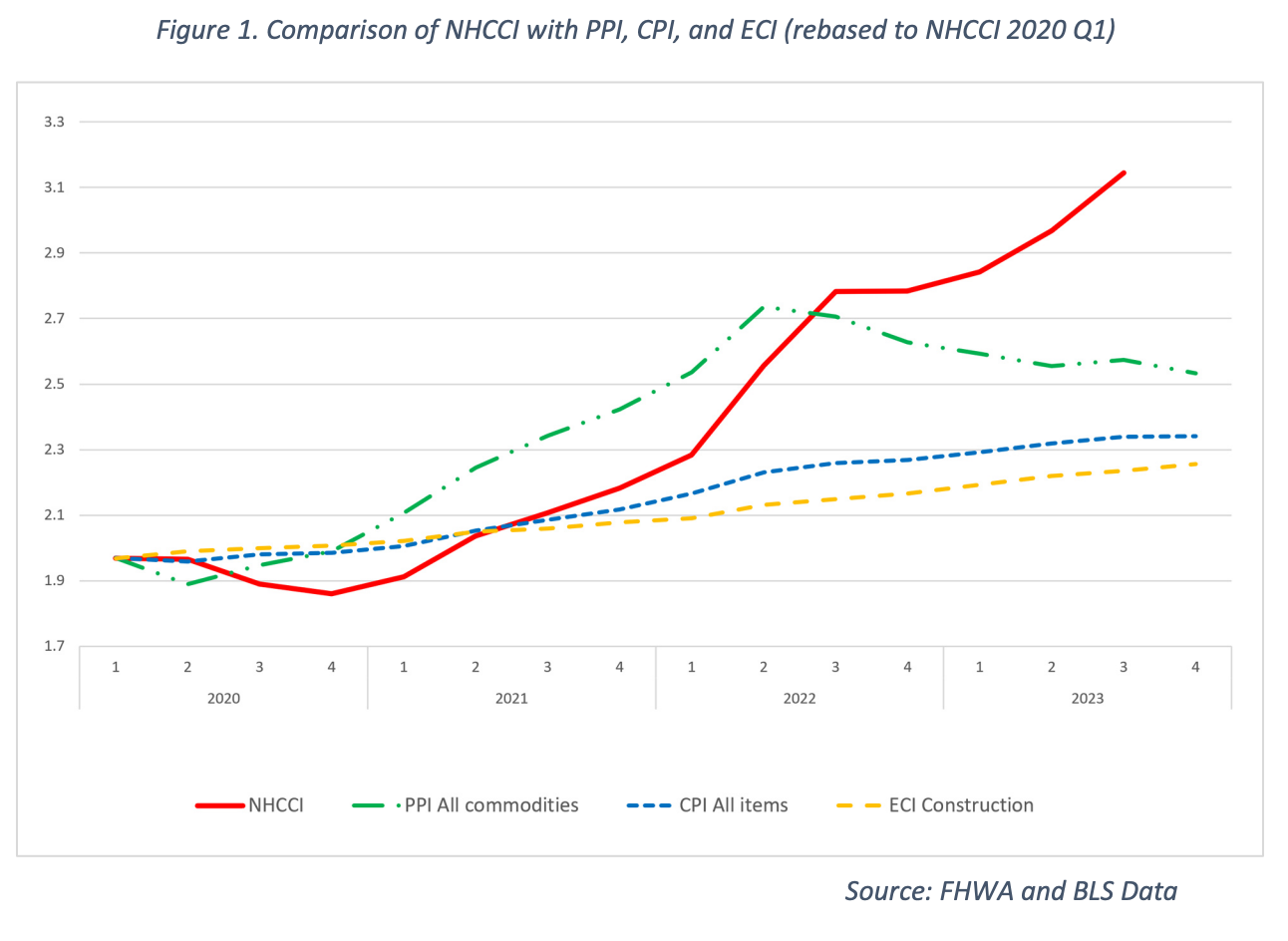

In its written analysis, FHWA indicates that highway construction costs continue to rise at a higher pace than several other measures of changing prices (including labor costs, the yellow dashed line):

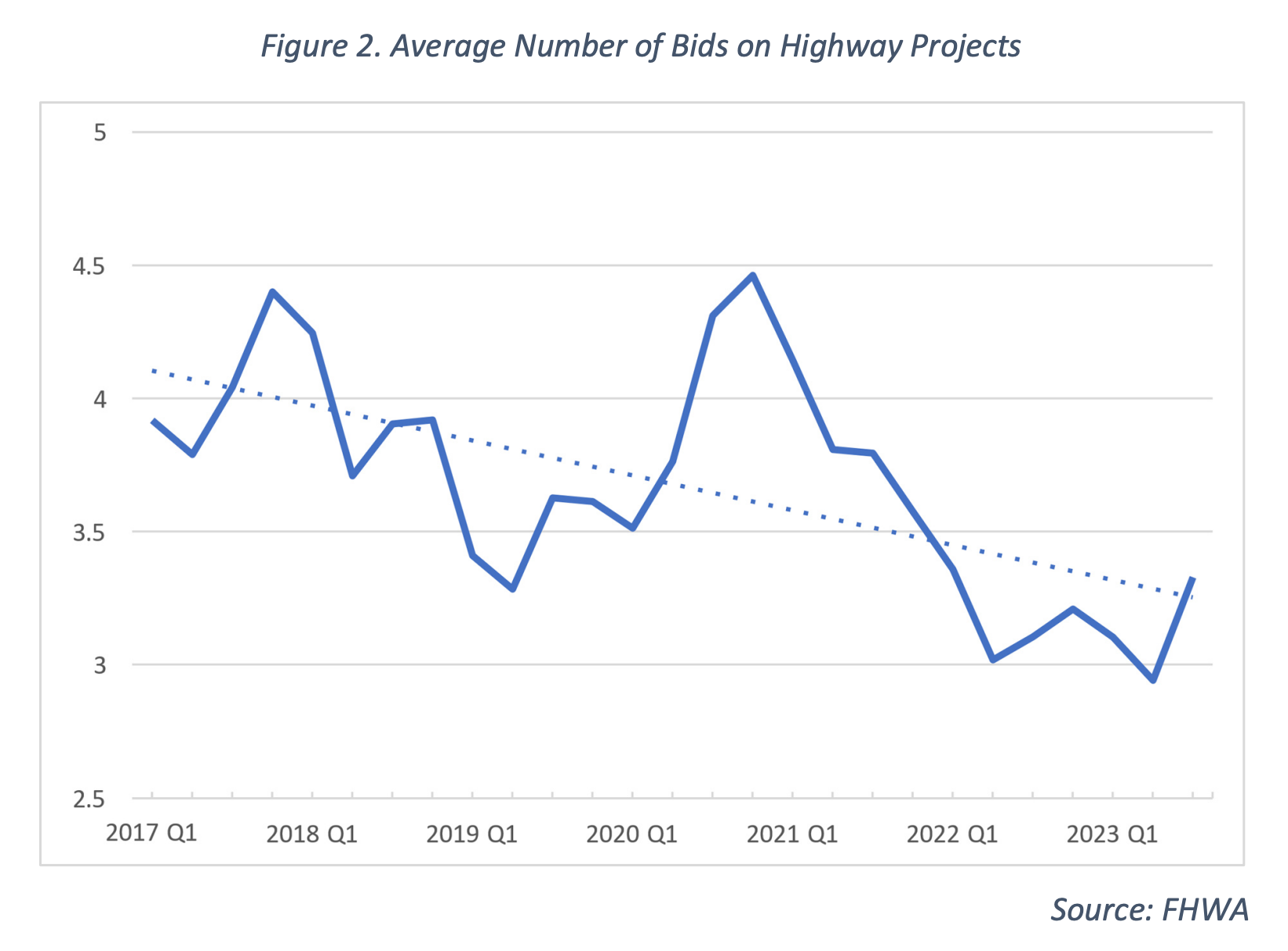

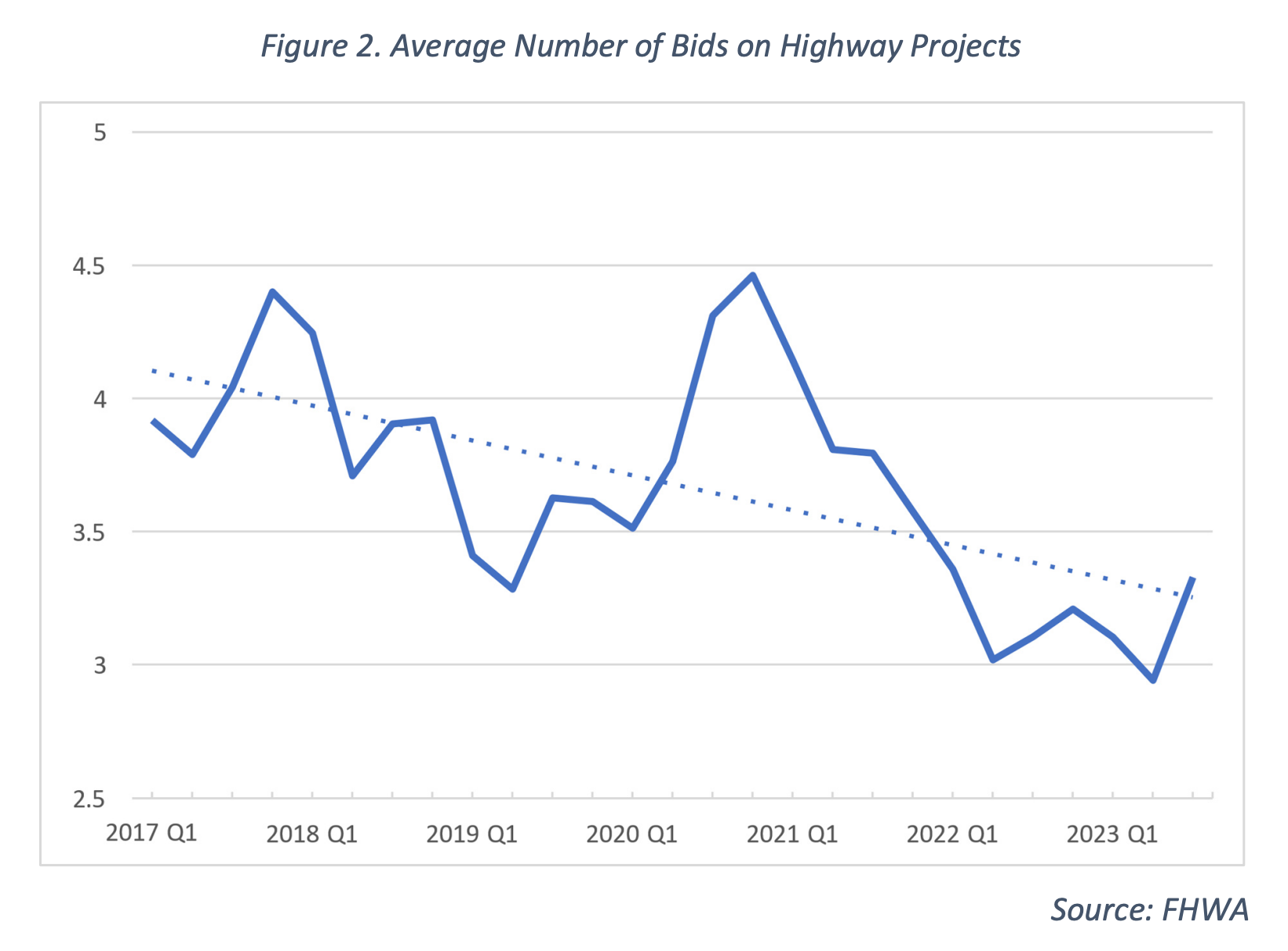

The FHWA analysis states that the high NHCCI “can largely be explained by the combination of higher asphalt and oil prices, an increase in demand and employment in highway construction, and a steady decline in the number of bids on highway projects…” They even include a chart on the average number of bidders per contract:

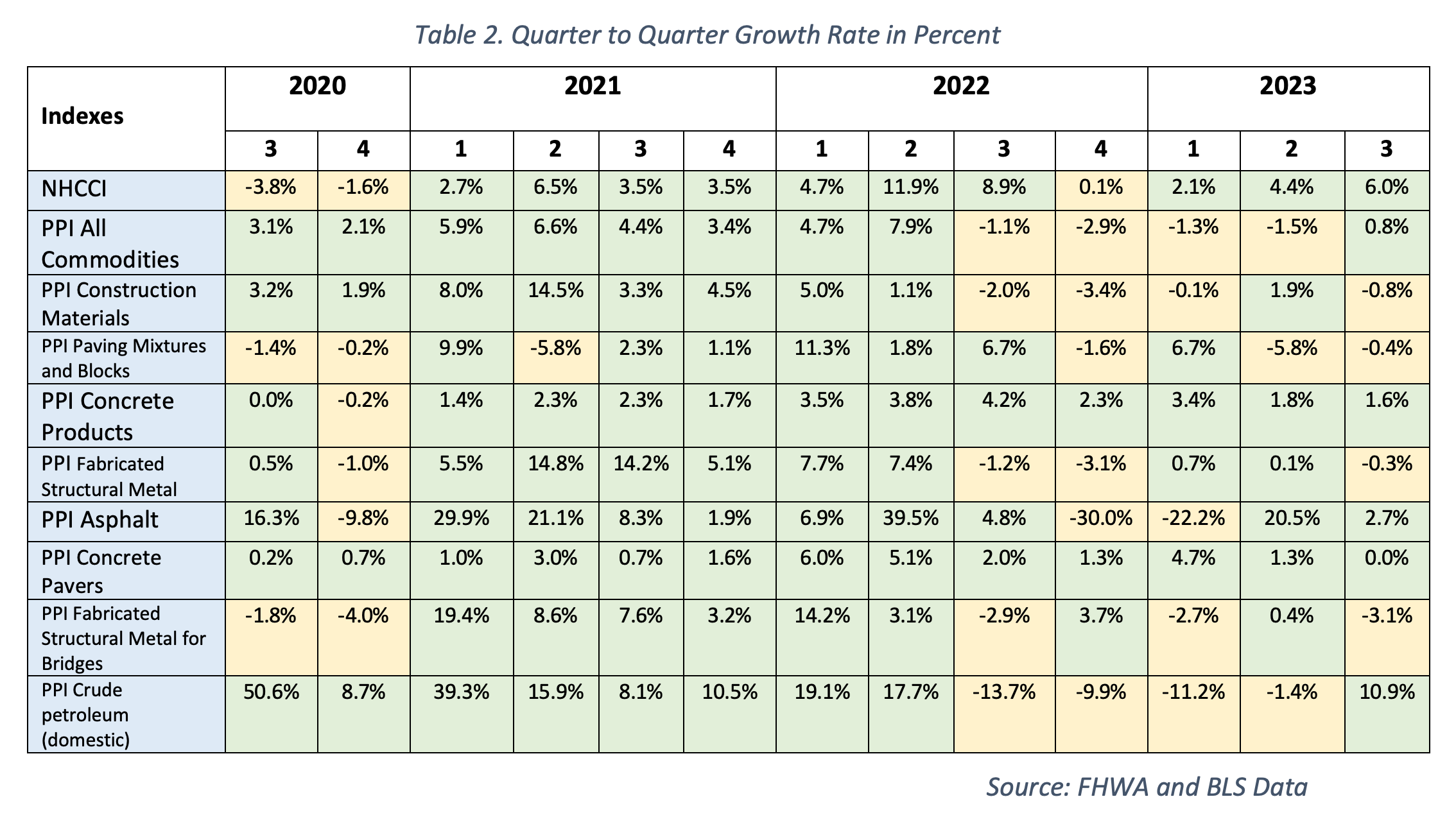

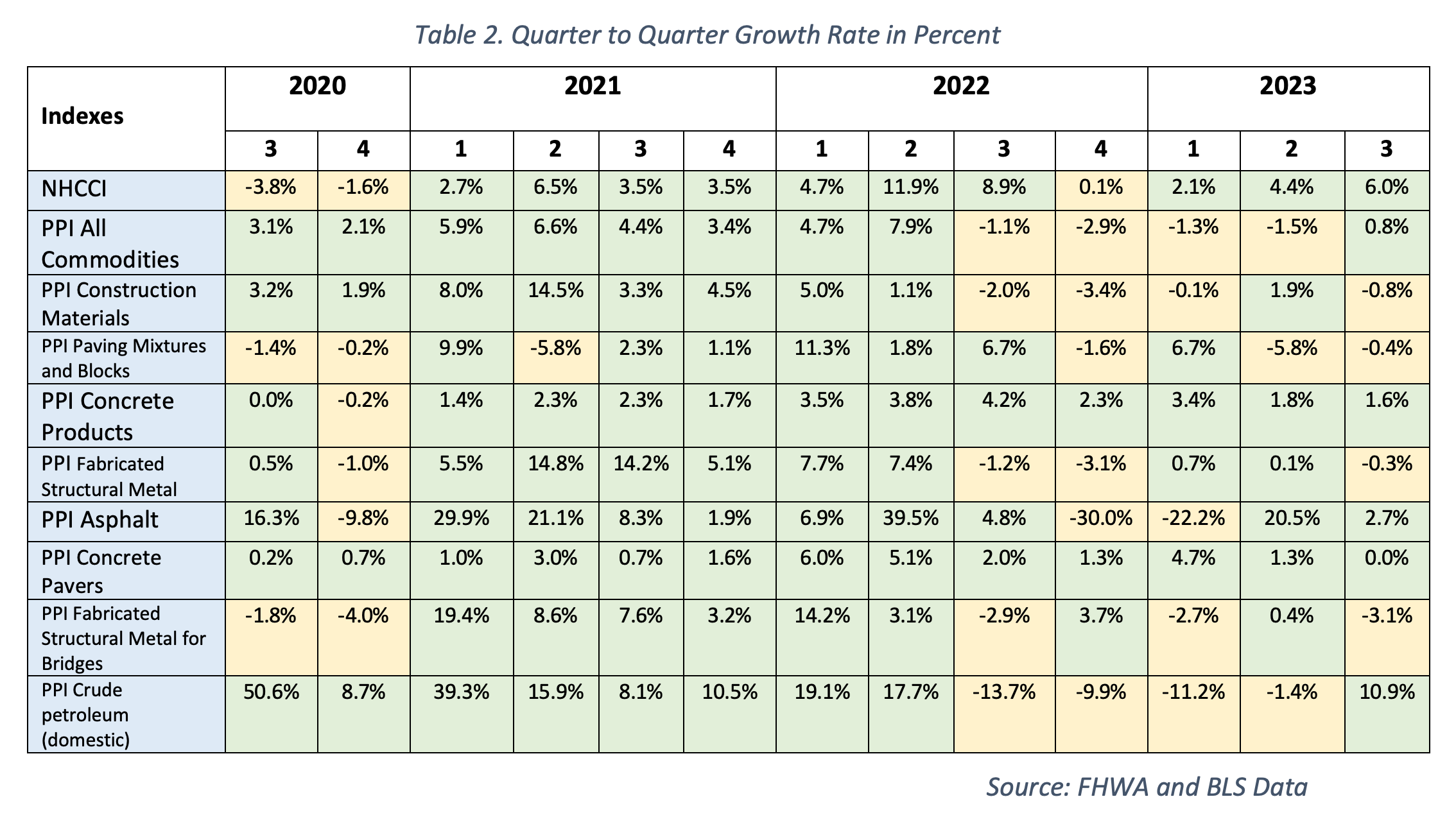

FHWA also included a handy table showing quarterly fluctuations in several kinds of construction commodity going all the way back to mid-2020:

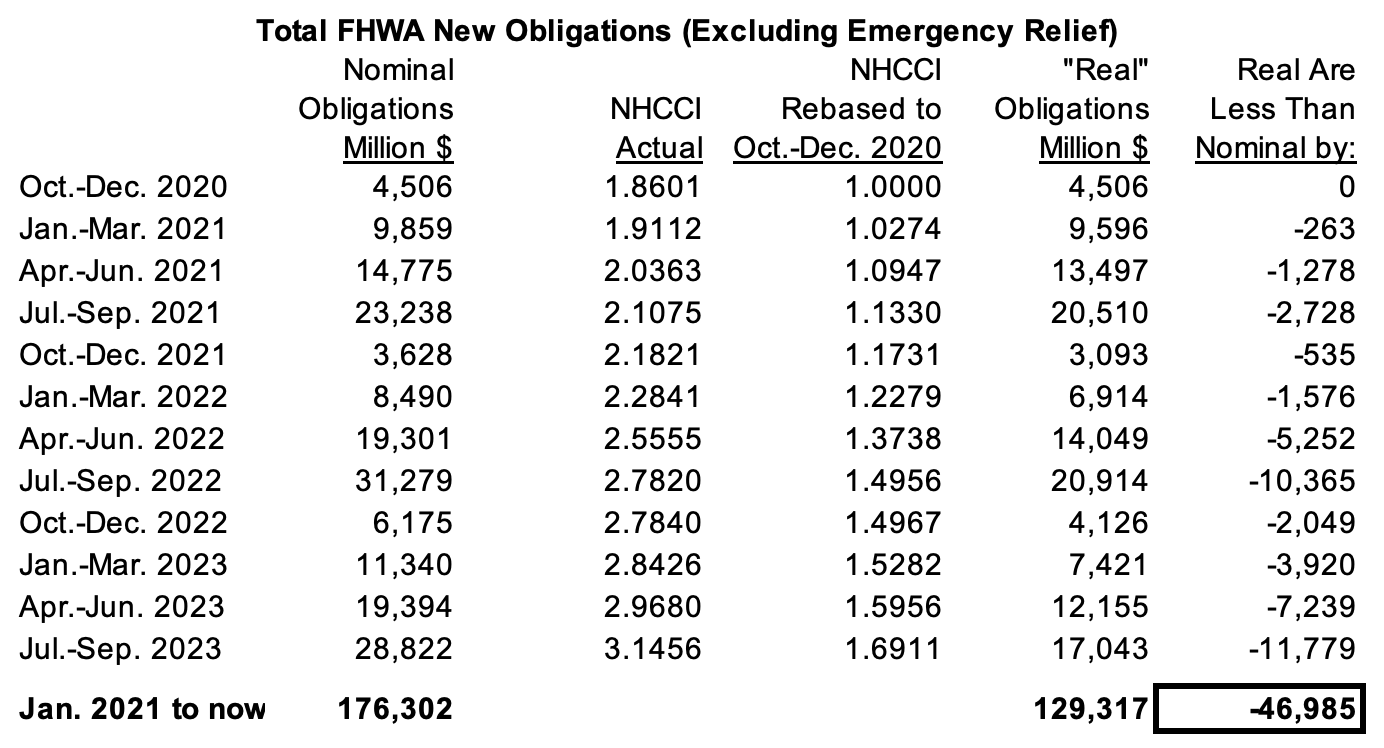

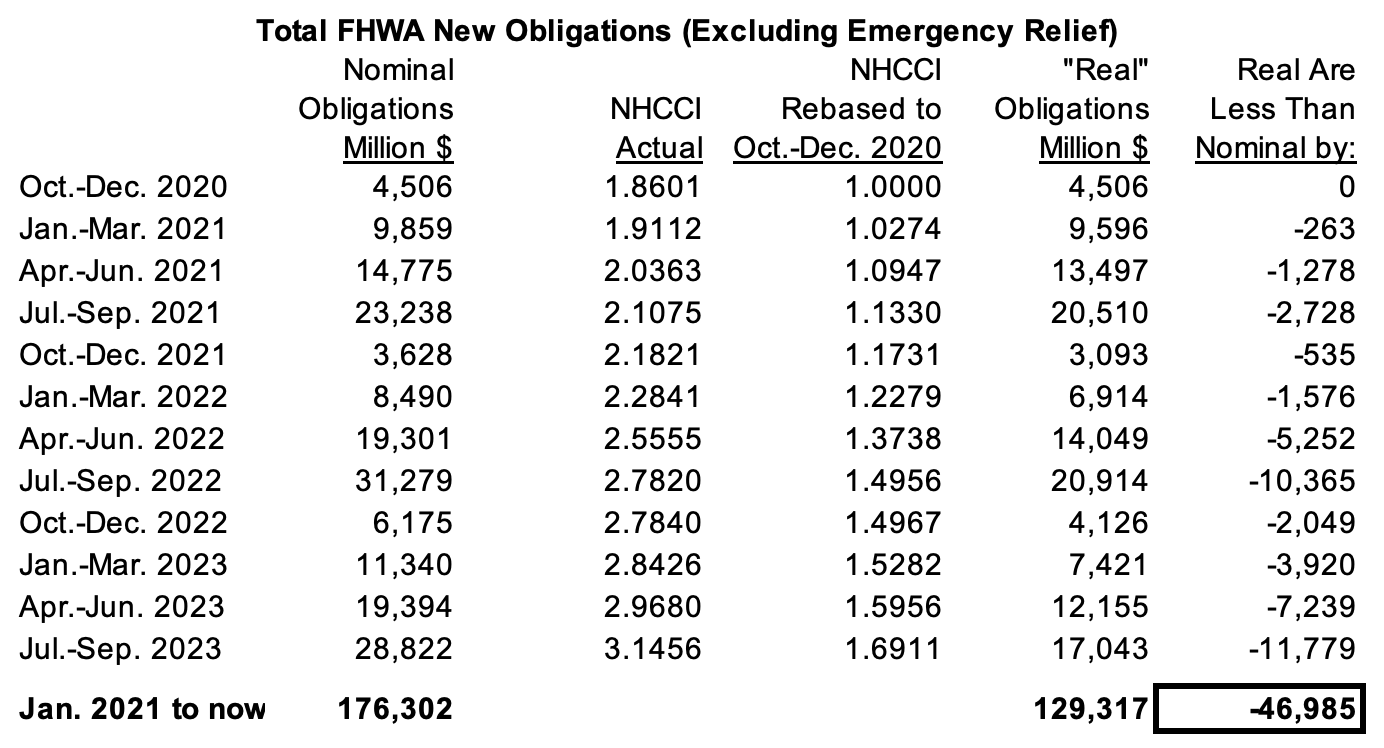

The cost inflation can be quantified in dollar terms. In the July-September 2023 quarter, excluding the emergency relief program, the Federal Highway Administration signed $28.8 billion in new project agreements and other legally binding obligations, which is $5.6 billion (or 24 percent) more than they did in the September 2021 quarter (the last quarter before the bipartisan infrastructure law’s enactment).

But once you use NHCCI to correct both of those quarters and convert them to the bang-for-the-buck that FHWA dollars were getting in October-December 2020, then the July-September 2023 quarter is actually $3.5 billion below the comparable quarter in 2021, a 17 percent cut.

As shown in the following table, once you convert each quarter to what FHWA was getting for its money in October-December 2020, the contracts signed by FHWA have lost $47 billion of their buying power since that time.