CBO, Treasury Correct Highway Trust Fund Reporting

Over the August recess, both the Treasury Department and the Congressional Budget Office (CBO) made some corrections to their public financial reporting on the Highway Trust Fund.

CBO. Back in January 2025, when they issued their annual Budget and Economic Outlook and their initial ten-year spending and revenue baseline forecast, CBO also published an updated ten-year forecast of Highway Trust Fund cash-flow. This document had a spreadsheet error in the FY 2025 tabulation of Mass Transit Account cash flow. All of the projected receipt and spending levels for both accounts in the Trust Fund were consistent with the projections in the overall budget baseline, but for some reason the HTF run issued in January took a $26.328 billion start-of-year balance, added $6.215 billion in receipts and interest and $1.200 billion in estimated flex transfers from the Highway Account, and then subtracted $15.055 billion in outlays and got an end-of-year balance of $24.287 billion.

That math actually adds up to and end-of-year balance of $18.688 billion, meaning that CBO’s original January projections had Mass Transit Account balances $5.599 billion too high at the start of 2026 and of every subsequent year.

We notified CBO of the error when we first noticed it in April 2025. On August 12, CBO took down the old projection and replaced it with this revised version which corrects the $5.6 billion per year tabulation error. By lowering the end-of-2025 balance, the revision also lowers the estimated interest that carryover balances in the Transit Account will earn in 2026 and 2027, as well.

The important thing is: the old forecast with the spreadsheet error projected that both accounts of the Highway Trust Fund would finish FY 2027 solvent, with breathing room to get into spring 2028 before running dry. Under the revised forecast, the Mass Transit Account will run out of money first, in late summer or early autumn of 2027, while the Highway Account will still be solvent until sometime in early spring 2028.

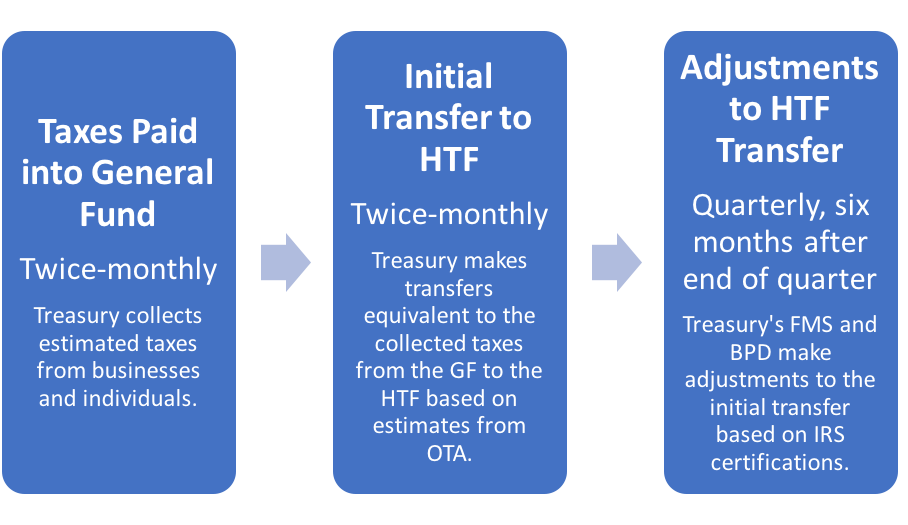

Treasury. CBO’s $5.6 billion tabulation error was very unusual. What happened at Treasury last month regarding the Trust Fund was not unusual in fact, only in extent. The way that motor fuel and other excise taxes make their way into the Highway Trust Fund is as follows:

- Twice a month, taxpayers wire estimated tax payments to the Treasury based on the amount of motor fuel for highway use that they think left the refinery or tank farm. These tax receipts are initially deposited in the General Fund but are then transferred to the Highway Trust Fund immediately.

- No later than one month after the end of a financial quarter, each taxpayer must file Form 720 with the IRS and declare precisely how much motor fuel left the refinery or tank farm during that quarter, and precisely how much fuel tax they owe. This is never precisely as much as the estimated tax payments. Sometimes the estimated payments are closer to the actual tax owed than other times.

- Four times per fiscal year, the Treasury Department reconciles the estimated tax payments that have already been deposited in the Highway Trust Fund with the actual tax amounts owed and declared in the quarterly filings. The IRS examines these, compares them to the estimated payments, and certifies that a “true-up” or “true-down” adjustment to the estimated taxes is required for that period. There is an additional delay between the quarterly filing and the correction – for example, the estimated taxes paid and credited to the Trust Fund for the October-November-December 2024 quarter were then adjusted by the tax returns filed for that quarter by January 31, 2025, but the reconciling adjustment to the Trust Fund was applied to the July 2025 revenue numbers.

When the Federal Highway Administration released the monthly update to Table FE-1 in late August, the new tax numbers for July seemed a bit odd:

Highway Trust Fund Net Tax Receipts |

||

| (Million $ – from Table FE-1) | ||

| May | June | July |

| 4,545 | 3,959 | 261 |

It was clear that one of two things had happened: either oil companies almost completely stopped paying fuel taxes in July, or else Treasury had performed the mother of all true-down adjustments. USDOT confirmed that it was indeed, a very large true-down. (For decades, Treasury made the monthly tax reports for trust funds public, so we could all look and see them and get the details of individual taxes paid and all the cash flow in double-entry bookkeeping. But for some reason, Treasury chose to revoke public access to those forms last year, moving them behind the federal firewall so you have to have a MAX login to view them. No reason was given for the additional secrecy, and now we have to pester DOT for clarity every time something unusual happens.)

The estimated taxes paid and credited to the Trust Fund for the October-December 2024 quarter were originally $11.1 billion. Apparently, the amount on the tax returns filed later was at least $3 billion less than that, perhaps a bit more, so that the true-down dragged the July total down from what should have been $3.7 to $4.0 billion down to just $261 million.

Tax receipts for the fiscal year to date are $35.7 billion, which is still $2.1 billion ahead of the $33.6 billion in tax receipts as of end-of-July last year. But we have one more true-up or true-down to go, the one at the end of the fiscal year for the January-February-March quarter.