The nonpartisan Congressional Budget Office released their annual Budget and Economic Outlook one week ago today, but they did not release the supporting analysis, including the Highway Trust Fund forecast, until earlier today. (Grrrr.)

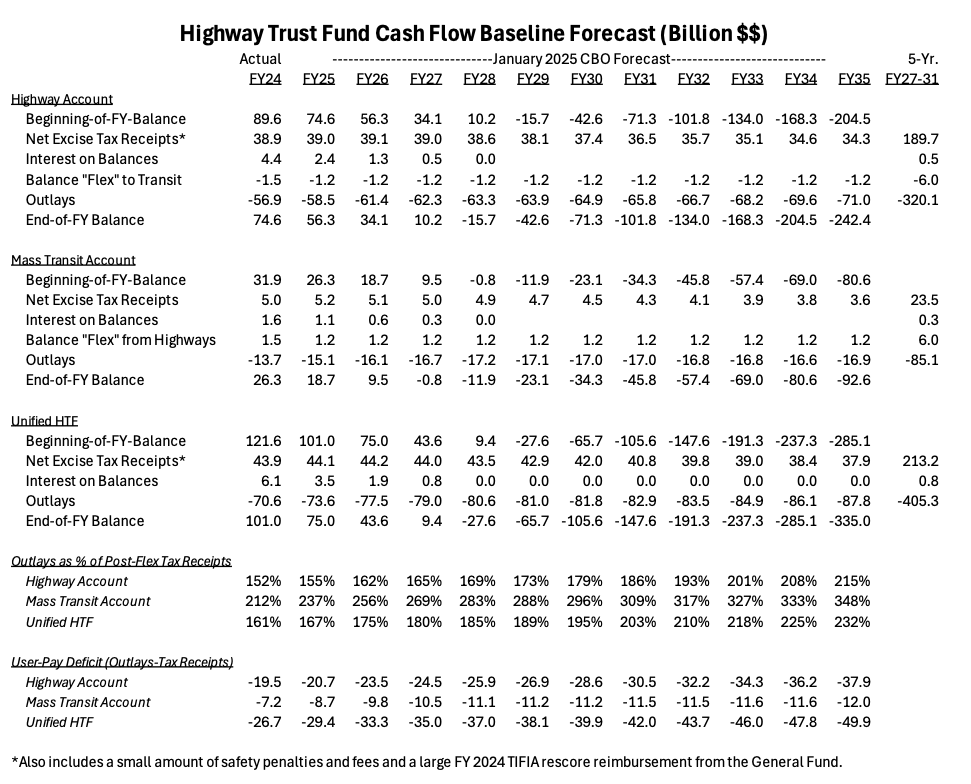

CBO says that, under present tax rates and spending policies, a five-year reauthorization of the Trust Fund from fiscal 2027-2031 would require at least $150 billion in additional bailout transfers from the General Fund (or, ideally, Congress would increase tax revenues or decrease spending, or some combination, to cover that amount.

The user-pay deficit (the amount that spending exceeds real tax receipts) was $26.7 billion in the just-finished fiscal year 2024. CBO projects this to be $33 billion in the final year of the IIJA (FY 2026) and then, in the final two years of a five-year reauthorization bill, that deficit would be around $40 billion per year.

Lest you think that all we have to do is just throw mass transit out of the Trust Fund and things will be solved, Mass Transit Account outlays are only projected to be $17 billion per year at that time, which is less than half of $40 billion.

Taxes. A big part of the problem is that gasoline taxes are projected to wither, based on the regulatory environment that was in place when CBO issued its forecast last week. CBO anticipates tax receipts from the 18.3 cent-per-gallon gasoline tax dropping 39 percent over the decade, from the current $25 billion per year to just $15 billion per year in 2035, based largely on CAFE and EPA GHG regulations discouraging internal combustion engines in motor vehicles. Steady diesel fuel receipts and an increase in trucking taxes would not be enough to prevent an overall 14 percent decline in Trust Fund tax receipts.

| CBO Highway Trust Fund Jan. 2025 Revenue Forecast |

| Billion $$ |

FY25 |

FY35 |

|

| Gasoline |

25.1 |

15.3 |

-39% |

| Diesel |

10.3 |

10.4 |

+1% |

| Truck/Trailer |

6.2 |

9.2 |

+47% |

| Other Trucking |

2.4 |

2.8 |

+20% |

| Total Taxes |

44.1 |

37.9 |

-14% |

Spending side. While yields at current tax rates dwindle, the cash flow from the IIJA’s huge increase in Trust Fund spending continues to ramp up, and when the IIJA ends, the CBO baseline builds an annual inflation boost into the overall spending levels. Total Trust Fund outlays were $71 billion this past year and are projected to break $80 billion in 2028 and then approach $90 billion in 2035, the last year of the forecast.

If one settles on hoping for a five-year IIJA reauthorization (FY 2027-2031), the CBO baseline says that would be $213 billion in real tax receipts trying to offset $405 billion in outlays. (The difference between that $192 billion gap and the $150 billion number at the top of the article is that the last $118 billion General Fund bailout of the Trust Fund, from the IIJA’s won’t be spent by the end of the IIJA. Some of that money will keep the Trust Fund solvent until mid-2028, which lowers the size of the bailout needed to support the next five years.

(People should not congratulate themselves on the last bailout being so big that it keeps the size of the next bailout down somewhat.)

CBO projects that it will be 2030 or 2031 when the Trust Fund crosses the line where less than 50 cents of every dollar being spent from the Trust Fund are actually supported by highway user taxes.

Some FHWA Grants Still on Hold As Confusion over Trump Orders Continue

Scroll to top

Some FHWA Grants Still on Hold As Confusion over Trump Orders Continue

Scroll to top