Identifier

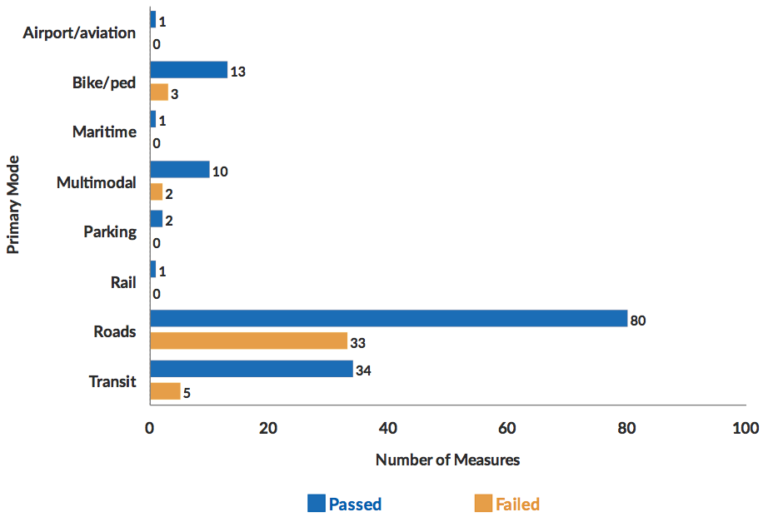

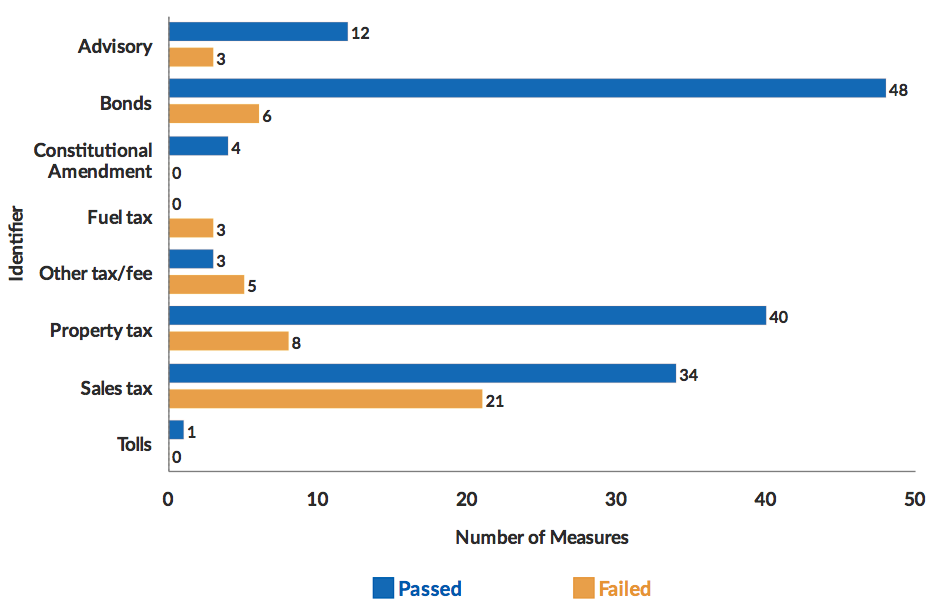

Ballot measures raise revenue for transportation measures in a wide variety of ways. The most common in 2018 were sales taxes (55 measures), bonds (54), and property taxes (48). Bonds were the most popular at the ballot box, enjoying an 88.89 percent success rate. Eighty-three percent of property tax increases were passed, and sales taxes enjoyed a lower success rate of 61.8 percent.

Figure 3. Ballot Measures Approved by Identifier, 2018

*Does not include Michigan and Ohio local road millages, which are property tax assessments.

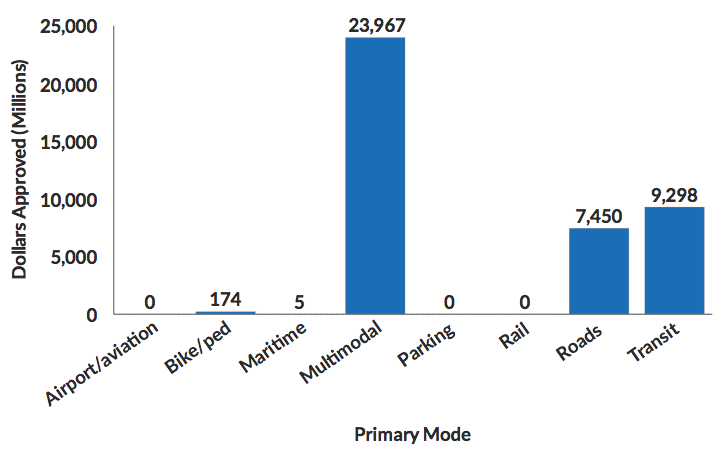

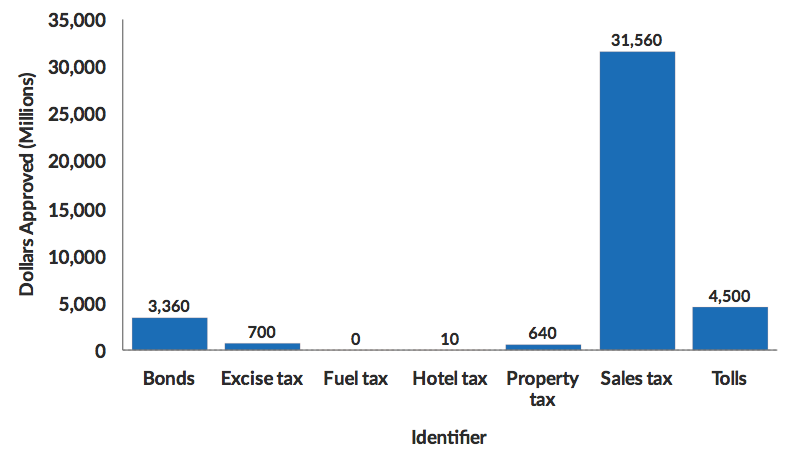

That said, voters approved far more money for transportation through sales tax increases ($31.7 billion) than through bonds ($3.36 billion) or property tax increases ($640 million). This is thanks in large part to the penny sales tax increases passed in Broward County and Hillsborough County, FL.

Figure 4: Total Funding Approved by Identifier, 2018 (Millions)

*Does not include Michigan and Ohio local road millages, which are property tax assessments.

Transportation-specific user fees like tolls and vehicle registration fees were scarce, with only one measure for each of those sources. Fuel taxes were also uncommon, and all three were rejected by voters, including statewide measures to raise the state’s gasoline tax in Missouri and Colorado. California voted against repealing the 2017 gas tax increase. While we did not include a dollar amount associated with this initiative because voters were asked whether to eliminate an existingrevenue stream, studies have found repeal would have cost the state $100 billion over 20 years, far more than any of the other measures considered on Election Day.