The full research report will be released in July 2021.

A growing cadre of researchers, advocates, and experts are asking: why does it cost so much to build infrastructure, particularly public transit, in the United States? Last year, Eno kicked off a major research initiative analyzing cost and timeline drivers affecting the delivery of rail transit in the United States. A crucial aim of this research is to understand if and how costs are high, particularly when compared to other countries.

To learn more about Eno’s transit project delivery research, click here.

To investigate the relative success and challenge of building transit, the Eno team created a database of projects. The database includes construction cost and timeline data for a total of 171 domestic and international rail transit projects completed over the past 20 years. For each project, factors such as number of stations, grade alignment, station spacing, and mode allow for deeper comparisons.

The purpose of this database is to help draw conclusions about the extent to which transit construction costs differ in the United States and peer countries, as well as shed light on the differences between project characteristics and complexity across countries. The initial insights from this data help form the questions and themes we investigate in further detail through regional case studies. The database will be continually updated with more information and insights as they become available.

Database Scope

Geography. The database is limited to examples in the United States, Canada, and Europe. The research team kept the geographical range to these countries and regions because of their comparable political culture, government structures, and infrastructure development and age. Future iterations of this database could include examples beyond these regions, and Eno intends to draw lessons from peer countries in Asia, Oceania, and South America in future research.

Timeframe. The database is largely limited to projects that have been completed between 2000 and 2020. There are some exceptions made on a case-by-case basis to include projects outside this range. For example, the United States and France opened some tunneled transit projects in the 1990s that help provide additional context and comparisons. Similarly, the database generally does not include projects that have not yet opened for service. In part due to common cost overruns, often the full cost of a project is not known until it is completed. But the database does include a few projects in Boston and San Francisco that are set to open in 2021 because of their complexity and importance in the national discussion.

Modes. Defining “modes” of transit is perennial debate, with inconsistencies across and within countries around the world. For the most part, the database focuses on heavy rail and light rail transit projects. Most new transit infrastructure in the United States is light rail, so we included many international examples of light rail projects. In most cases, European trams are similar to U.S. light rail in their grade alignment and right of way.

The database does not include intercity rail projects (like California High Speed Rail or comparable international examples). The database also avoids streetcar projects, which rarely travel in their own right of way and are often loops instead of bidirectional track, making cost comparisons difficult. Some commuter and regional rail projects were included, particularly if they involved building new infrastructure (and are thus similar to heavy rail). But many U.S. commuter rail projects, which primarily run from outlying suburbs to city cores, were also excluded from the database, as the majority of these projects were conversions of existing freight rail infrastructure for commuter rail service, and include little new construction.

Sources. A range of academic, media, industry, and government resources were used to obtain reported construction costs for all new lines entered into the database. It draws from official cost reports wherever possible, either from agencies or other entities directly responsible for construction. When using media reports, we aimed to confirm whether the same – or very similar – cost figure was used across other outlets. Additional project detail collected includes years of groundbreaking and opening for service to the public, project length (kilometers), number of stations, grade alignment (i.e. the share of total alignment that is below ground, at-grade, and above-ground), and station spacing (calculated as average kilometers between stations).

This database also uses inputs from construction cost data collection from the Federal Transit Administration’s Capital Cost Database and by researchers Alon Levy and Eric Goldwyn at the NYU Marron Institute and Yonah Freemark via The Transport Politic.

Adjusting for inflation and conversion to U.S. dollars

To compare projects across geographies and over time, the database adjusts costs so all project costs are compared in 2019 U.S. dollars. This is done with a two-step process.

First, international reported costs were adjusted using purchasing power parity (PPP) rates for projects reported in non-U.S. currency. Currency conversions were based on the OECD’s PPP table, which documents conversion rates for international currencies to U.S. dollars in a given year, taking differing price levels between countries into account (measured as foreign currency needed to purchase $1 worth of goods).

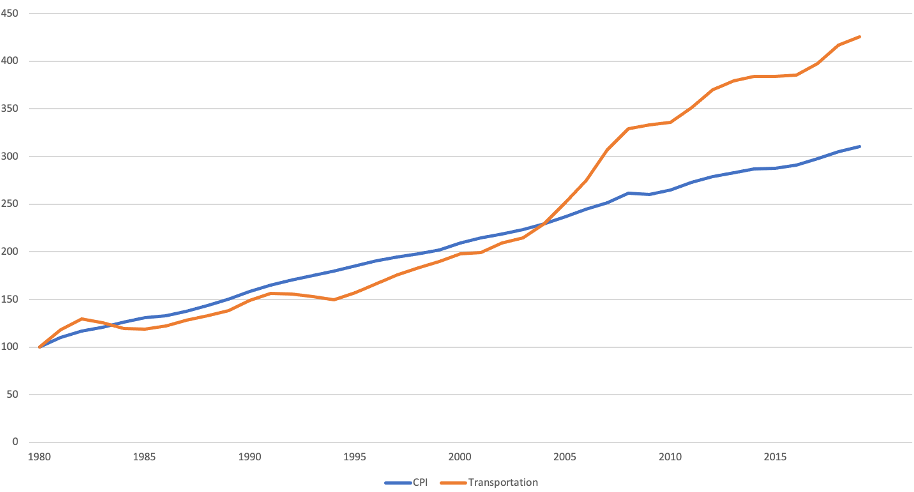

Then, projects were adjusted to 2019 dollars for inflation using the project’s midpoint. Instead of using a standard inflation calculator based on the consumer price index (CPI), the research team decided to use the Bureau of Economic Analysis price index for state and local government investments in transportation, which is a producer price index (PPI). The BEA transportation price index is a more accurate reflection of buying power for investments in infrastructure, as opposed to the CPI, which is based primarily on consumer spending in categories like healthcare, housing, and utilities. (Note that the BEA publishes other producer price indexes for federal transportation and highway costs, which all follow very similar trendlines.)

Figure 1 shows the price indexes for transportation investments and consumer goods grew at a somewhat similar rate from 1980 until 2004, when the cost of transportation investments began to outstrip the increase in the cost of consumer goods. This coincided with a global increase in the cost of key construction materials, such as steel, in the mid-2000s.

Figure 1: CPI vs State/Local Price Index for Fixed Investments in Transportation