Mass transit agencies received nearly $25 billion in federal appropriations last week to make up for lost farebox revenues and local tax revenues due to coronavirus. Amtrak received $1 billion. Airlines and their contractors should soon receive up to $25 billion in their own appropriations to make up for lost revenues; airports will get $10 billion. State DOTs have requested nearly $50 billion in federal appropriations to make up for anticipated massive reductions in their own dedicated tax revenue streams.

Now, the operators of toll roads, bridges, and express lanes have requested their own special line of federal support. In an April 7 letter to Congress, the International Bridge, Tunnel and Turnpike Association (IBTTA) requested “$9.245 billion in flexible federal funding to offset the huge loss in toll revenues expected in the next 12 months.”

The letter says “In normal times, the 342 toll facilities run by 128 operators in 34 states are self-sustaining. They support more than 8.5 billion freight and passenger trips per year and generate more than $20 billion in toll revenues annually to pay for maintenance and upgrades on 6,300 miles of highways, bridges and tunnels.” However, the letter says that because of coronavirus-related travel restrictions and lack of demand, “toll facilities have suffered traffic and revenue declines of 50% to 90%.”

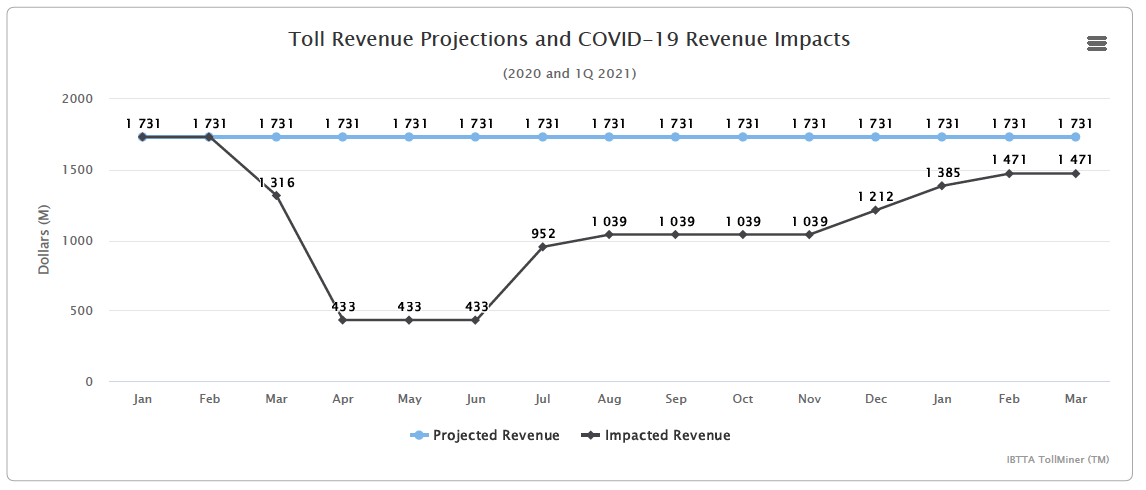

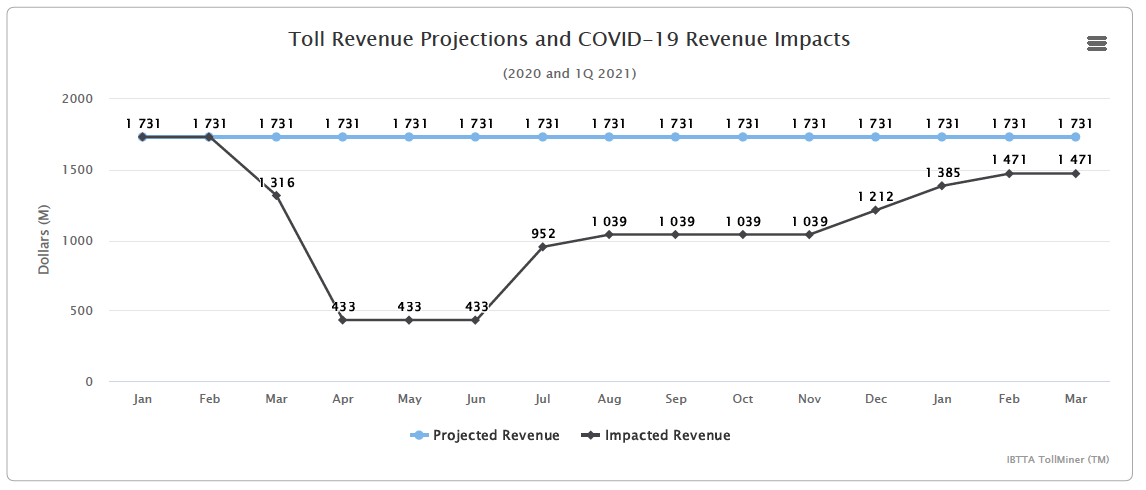

In terms of total revenues, the letter came with a revenue estimate that saw total toll facility revenues dropping from an average of $1.7 billion per month to $1.3 billion in March 2020 and bottoming out at just over $400 million per month in April, May and June before rebounding slowly and only getting back to just under $1.5 billion per month by March 2021.

The estimated losses for the rest of calendar 2020 and the first quarter of calendar 2021 total the $9.25 billion requested. (The state DOT request asks for revenue replacement through September 2021, not March 2021.)

The IBTTA letter keeps comparing lost tolls to lost mass transit farebox revenues, but in terms of their financial situation, toll facility operators are more like airports. Most local transit agencies don’t issue their own bonds, but most commercial service airports do – and so do most, if not all, toll facility operators. For toll facility operators and airports, the loss of operating revenue directly threatens their ability to pay their debt service costs. The IBTTA letter says:

Unless toll facilities receive immediate relief, many will be forced to comply with bond covenant requirements, which could necessitate: reductions in workforce, adding to the rapidly swelling ranks of unemployment; delays in capital projects, slowing the economic recovery that will be desperately needed; and increased pressure on elected officials to consider toll rate increases. Without the immediate relief that Congress can provide, credit rating agencies may downgrade toll agencies’ credit ratings (some of which could be downgraded to “junk” status), accelerating the steep economic contraction caused by the pandemic.

Many of the operators of newer toll facilities have received a federal loan or loan guarantee from the TIFIA innovative finance program established in 1998. The IBTTA letter also seeks modifications in the TIFIA program (most of which would require amendments to chapter 6 of title 23, United States Code). Those requested modifications include:

- “Provide for a borrower to seek a one-time amendment to reduce the interest rate on outstanding TIFIA loans.”

- “If final project costs of a current TIFIA loan exceed 33%, allow a borrower in good standing to amend the TIFIA loan agreement to borrow up to the statutorily allowed 49% of eligible project costs.”

- “Provide the ability to convert TIFIA near-term mandatory debt service payments to scheduled debt service payments for a specific period of time.”

- “Provide the ability for borrowers to eliminate the mandatory pre-payment provisions in outstanding TIFIA loans.”

- “Enhance the ability to refund outstanding TIFIA loans with new TIFIA loans. TIFIA statutes permit the refinancing of TIFIA loans; however this provision has not been implemented. The ability to refinance TIFIA loans allows a borrower to take advantage of reductions in interest rates, lower average annual debt service payments, allow more favorable borrowing terms, or provide for additional funding capacity for the completion, enhancement or expansion of any project that is otherwise eligible for TIFIA financing.”

- “Provide for a borrower to defer debt service payments for up to two years without an interest penalty, similar to recent actions related to federal student loans.”

- “Provide for prompt Build America Bureau evaluation, approval, and implementation of any requests to amend current agreements with any new financing flexibilities granted by Congress.”

The letter also suggests that, in addition to changes in the existing TIFIA program, Congress also consider creating “New programs offering federal loan guarantees, backstops, and letters of credit…Easing credit availability to toll operators and related business entities will allow them to keep taxpayers employed, avoid defaults, and facilitate economic recovery.”