In last week’s ETW, we pointed out that under the Congressional Budget Office’s new baseline, the fiscal 2024 Transportation-HUD appropriations bill is in a bind and will need billions of additional dollars just in order to “freeze” what the enacted fiscal 2023 law was trying to do in fiscal 2023.

A closer look at the baseline shows that other non-defense programs are in a similar bind, and if House Republicans adopt a budget plan for the year that matches what they promised in early January, the non-defense budget (excluding veterans health programs) would be cut by over 25 percent from the fiscal 2023 levels.

“WODI Freeze”

CBO produces two kinds of baselines for discretionary appropriations – with annual inflation increases, and without. These get abbreviated as WIDI and WODI. The WIDI baseline totals are used in the “big picture” government-wide budget presentations like the Outlook released last week. But the WODI baseline is also provided to Congress, and the Appropriations Committees find it useful in answering a simple question:

“If we just took the text of the 12 general appropriations bills enacted last year (Divisions A through L of the FY 2023 omnibus), and moved every date in those bills ahead one year, and then re-enacted them for fiscal 2024, how much would that cost?”

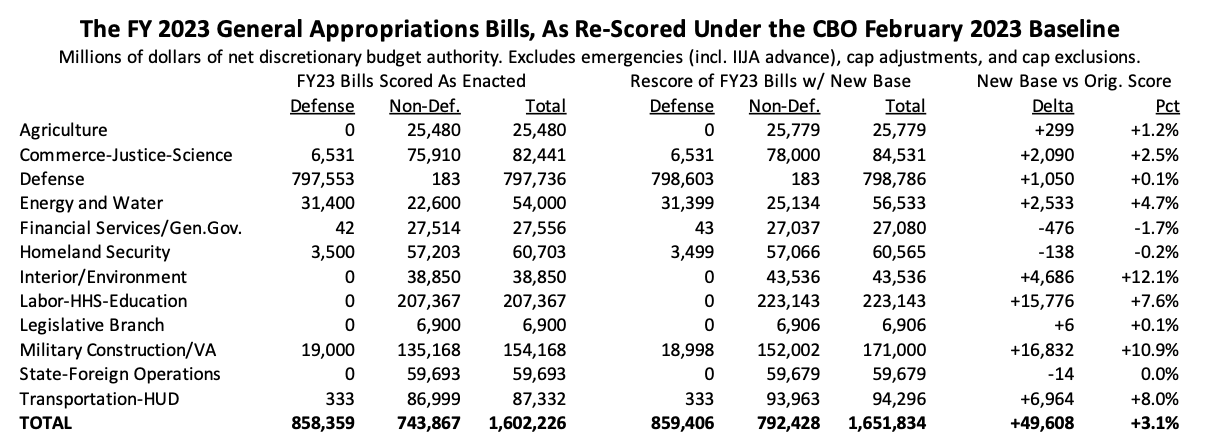

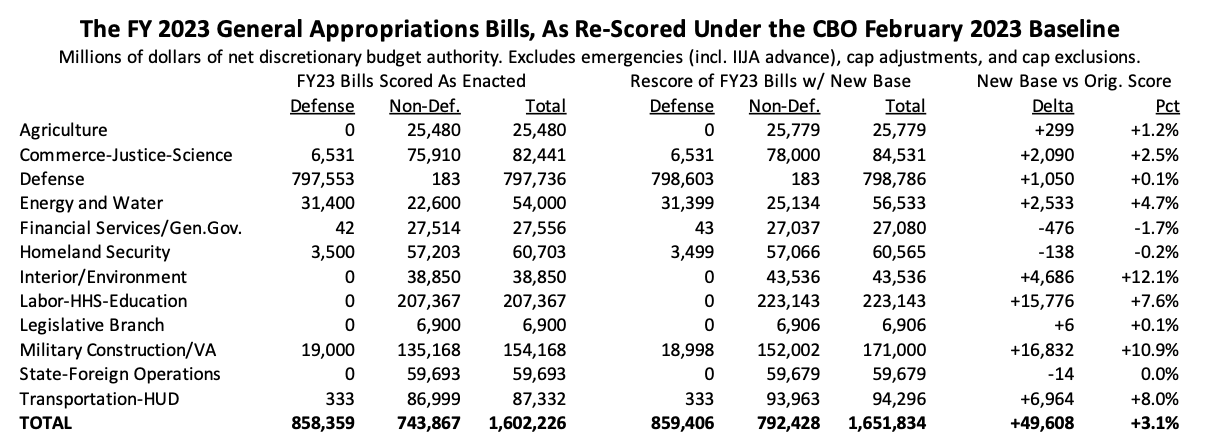

The “base” discretionary funding level for those 12 bills collectively, as scored against CBO’s May 2022 baseline and enacted last year, totaled $1.602 trillion in budget authority (not counting emergencies (like the Bipartisan Infrastructure Law), designated disaster relief, wildfire suppression, program integrity adjustments, 21st Century CURES Act, and Harbor Maintenance Trust Fund balance draw-down).

The new February 2023 baseline makes three types of changes that affect those totals:

- Assumptions for offsetting collections and receipts change from baseline to baseline and affect the net total provided by the bill, even though the gross total (the numbers written in the text of the bill itself) don’t change. (Remember – the gross total is the funding provided by Congress to the department/agency, but this is offset by money paid by the public to the department/agency, leaving the net total as the overall cost to the government.)

- Advance appropriations provided in prior years but becoming available in the budget year change from year to year. This is big in veterans health programs, most of which are funded one year in advance.

- Some rescissions and changes in mandatory programs (CHIMPS) used as offsetting cuts are not carried forward.

If you add those things together, a WODI freeze of the fiscal 2023 appropriations bills, as written, would cost $49.6 billion more under the new baseline than the exact same legislative language did under the old baseline, three months ago. The new total is $1.652 trillion, as follows.

Defense spending doesn’t change much from baseline to baseline, and some subcommittees change more than others. The highlights are:

- Commerce-Justice-Science loses a $372 million Crime Victims Fund CHIMP, a $500 million asset forfeiture rescission, and a $700 million working capital fund rescission.

- Energy and Water loses a one-time rescission of $2.1 billion in Strategic Petroleum Reserve Fund balances.

- The jump in Interior/Environment is mostly a new advance appropriation for Indian Health Services.

- Labor-HHS-Education loses its usual $14.6 billion Child Enrollment Contingency Fund CHIMP.

- Military Construction/VA has a huge increase in advance appropriations for medical care.

- Transportation-HUD sees the estimates for HUD offsetting collections drop by $6.9 billion.

What’s the plan?

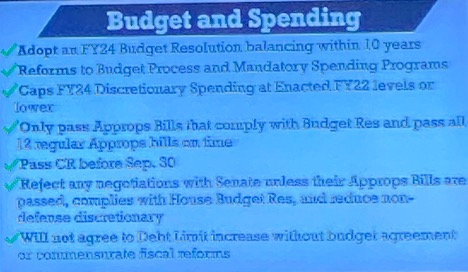

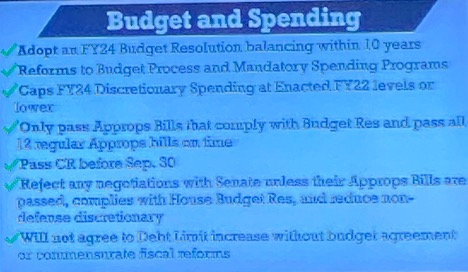

In early January, when House Republican leader Kevin McCarthy (R-CA) was scrambling for the last few holdout GOP votes to get himself elected Speaker of the House, some of those holdout votes made demands on the budget process. A written summary of what was agreed to was never made public, but some Congressman helpfully took a picture of a PowerPoint slide in a closed-door Republican conference and sent it to a reporter:

“Caps FY24 Discretionary Spending at Enacted FY22 levels or lower” is the pertinent phrase here. The enacted fiscal 2022 base total was $1.471 trillion – $131.4 billion less than the $1.602 trillion score of the fiscal 2023 bills.

A simple across-the-board cut from $1.602 to $1.471 would be a cut everywhere of 8.2 percent – but it’s never that simple.

Republicans are not likely to cut defense – not while the war in Ukraine continues across one ocean and China continues saber-rattling (and balloon-floating) across the other ocean. Even if they don’t give defense spending yet another $50+ billion increase in 2024 (as they did in 2022 and 2023), let’s assume they just freeze it at the 2023 level. That would mean that $859 billion of the $1.471 trillion is already spoken for.

Then you have to pull veterans medical care out, (a) because it’s politically untouchable and (b) because it’s mostly advance appropriations, and even though those decisions were made in the last budget cycle, they count against this budget cycle. Vets medical care spending totaled $110.4 billion in FY 2023 but, under the new baseline and with the newly increased advance appropriations, now counts $135.2 billion against the 2024 cycle. All you have left is $476.2 billion:

| House R’s adopt the FY22 base discretionary total |

1,470,848 |

| Freeze defense (050) at new base |

-859,406 |

| Give veterans medical care full funding |

-135,213 |

| Remainder |

476,229 |

In the table at the top of the article, the new “freeze” total for non-defense appropriations was $792.4 billion. Take away the $135.2 billion in vets medical care and that leaves $657.2 billion in non-defense appropriations trying to fit into a bag that only holds $476.2 billion. This would require $181 billion in spending cuts to those remaining non-defense programs, an average of 27.5 percent.

| Remaining budget space |

476,229 |

| Remaining non-defense freeze spending demands |

657,215 |

| Spending cuts needed |

-180,986 |

|

-27.5% |

Is that even possible? Unlikely. What this situation would do is force House Appropriations to be very creative and use all of the gimmicks and cheat codes at their disposal in order to meet unrealistically low bill allocations. Expect all of the CHIMPS to come back even larger (child enrollment and S-CHIP at Labor-HHS, Crime Victims, and whatever else they can think up). More reclassifying regular funding as emergencies or advances is also possible.

And it would make it extremely difficult to reconcile any House-passed bills (if the House can actually pass any bills) with any Senate counterpart bills, because the Senate is going to adopt a spending total nowhere near as small as $1.471 trillion.

Such a discrepancy does make a year-long continuing resolution more likely. A clean CR would be the “WODI Freeze” score with the CHIMPS added back in. It would still have a slightly higher score than the FY 2023 enacted score, but politically speaking, the anti-spending legislators would probably be so busy congratulating themselves on stopping a cycle of earmarks (because a year-long CR means no new earmarks) that they would let a few billion dollars of scoring differences slide.