Representatives of the U.S. Department of Transportation went to Capitol Hill this week to provide an update on the projected finances of the Highway Trust Fund since coronavirus-related travel and economic changes have begun to drag its revenues downwards. New projections show that the Trust Fund could begin to have trouble paying its bills on a daily basis by late April or early May 2021 and that the Mass Transit Account could become completely insolvent by the end of June 2021. Per their modeling, the Highway Account could run dry only a month or so behind the Mass Transit Account.

Reduced tax revenues to date. As ETW has described before, the estimated taxes transferred from the general fund of the Treasury to the Highway Trust Fund twice a month trail the economic activity that is being taxed by some time (there is a lag between the time that a motorist cuts down his/her fuel purchases at the service station until the refinery (where the fuel is usually taxed on the way out) cuts down its output to meet reduced demand, and there is an additional delay between the time the refiner or blender sends out the fuel and the date that the estimated taxes are paid to Treasury twice a month.

Taking those delays into account, DOT reported to Congress that the last three transfers of tax revenue to the Trust Fund compared to their 2019 equivalents like this (in millions of dollars):

|

|

April 1-15 |

April 16-30 |

May 1-15 |

| Highway Account |

|

|

|

FY 2019 |

1,662 |

1,567 |

1,809 |

|

FY 2020 |

1,224 |

853 |

1,043 |

|

Difference |

-438 |

-714 |

-766 |

|

|

-26% |

-46% |

-42% |

|

|

|

|

|

| Mass Transit Account |

|

|

|

FY 2019 |

245 |

228 |

263 |

|

FY 2020 |

178 |

121 |

147 |

|

Difference |

-67 |

-107 |

-116 |

|

|

-27% |

-47% |

-44% |

It took until the second half of April for the 40-plus percent reduction in the production of gasoline at the refiner/blender level (which happened in late March and very early April) to be felt by the Trust Fund. But since then, tax revenues have been down over 40 percent. Plus, there was a $1.3 billion balance reduction in May 2020 to reflect the quarterly alignment of old estimated tax transfers with actual quarterly returns) for the October-December 2019 period. (These things happen every three months, but this one was a much bigger downwards adjustment than usual.)

Changes in spending to date. DOT reports that, so far in fiscal 2020, Highway Account spending (primarily reimbursement of state DOTs) has been $2 billion higher than by this point in FY 2019. For the Mass Transit Account, DOT reports greater uncertainty because of the $25 billion in funding given to mass transit agencies by the CARES Act – if things work out the way they did when the 2009 ARRA stimulus act was enacted, recipients of some of the money may defer the expenditure of regular federal transit funding in order to expend the more flexible, 100 percent federal share money that was added on top of that. The DOT presentation says “CARES Act funding could displace or supplement regular formula funding depending on if Transit agencies continue capital projects and/or focus efforts on extra safety precautions while operating during COVID-19.”

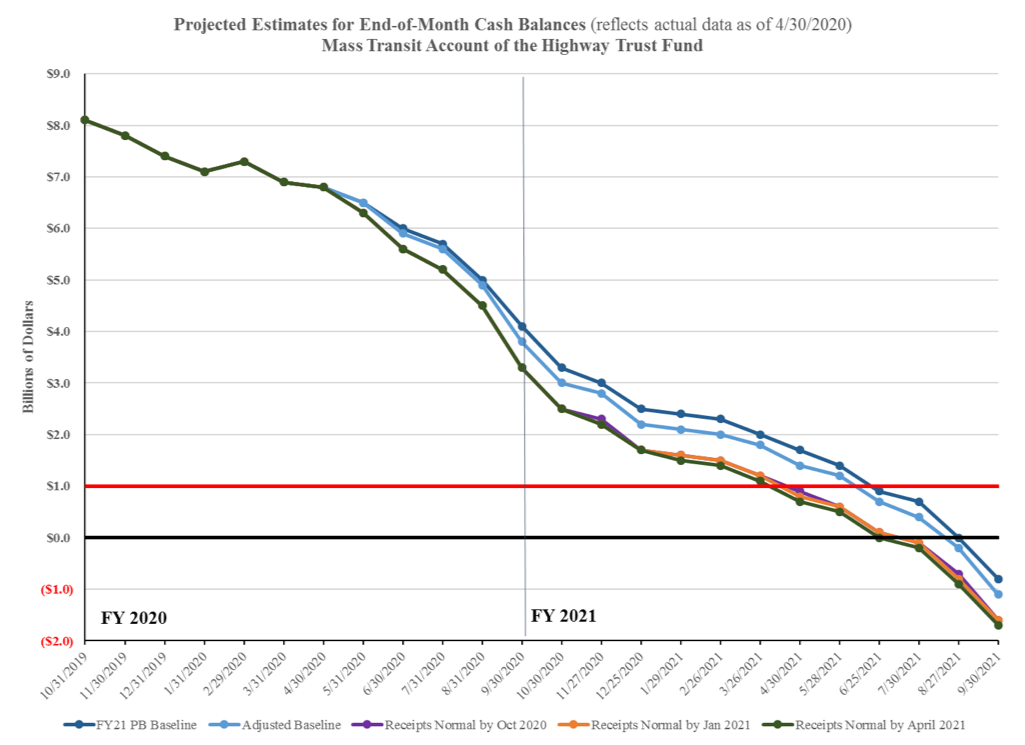

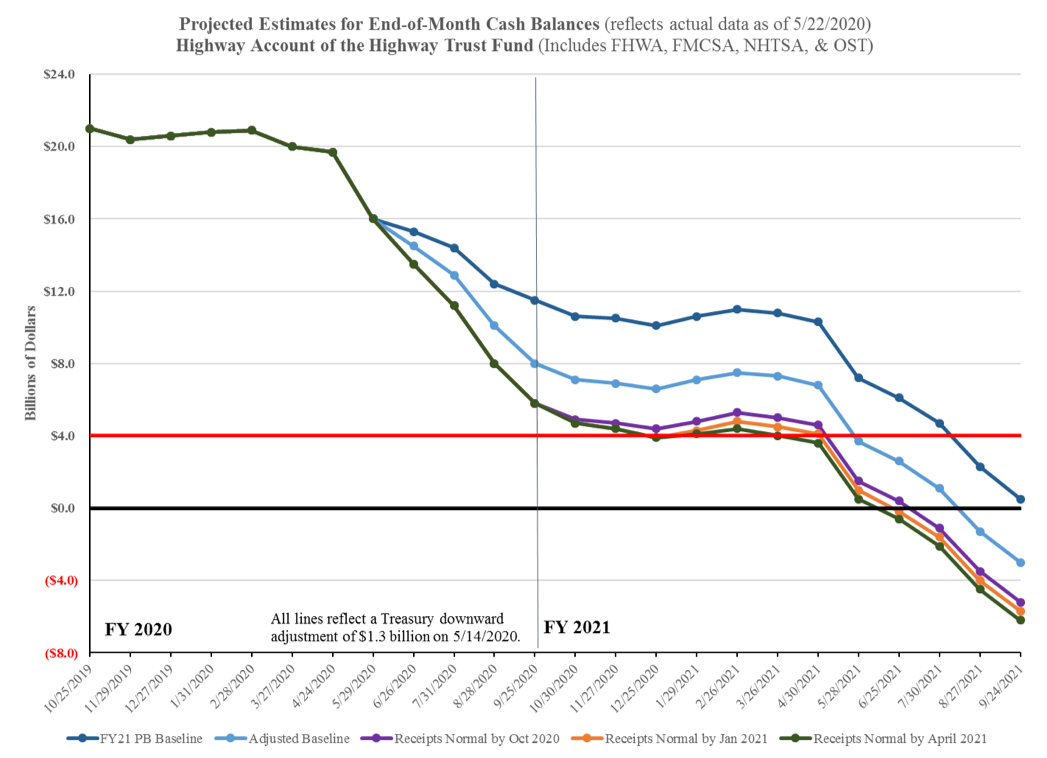

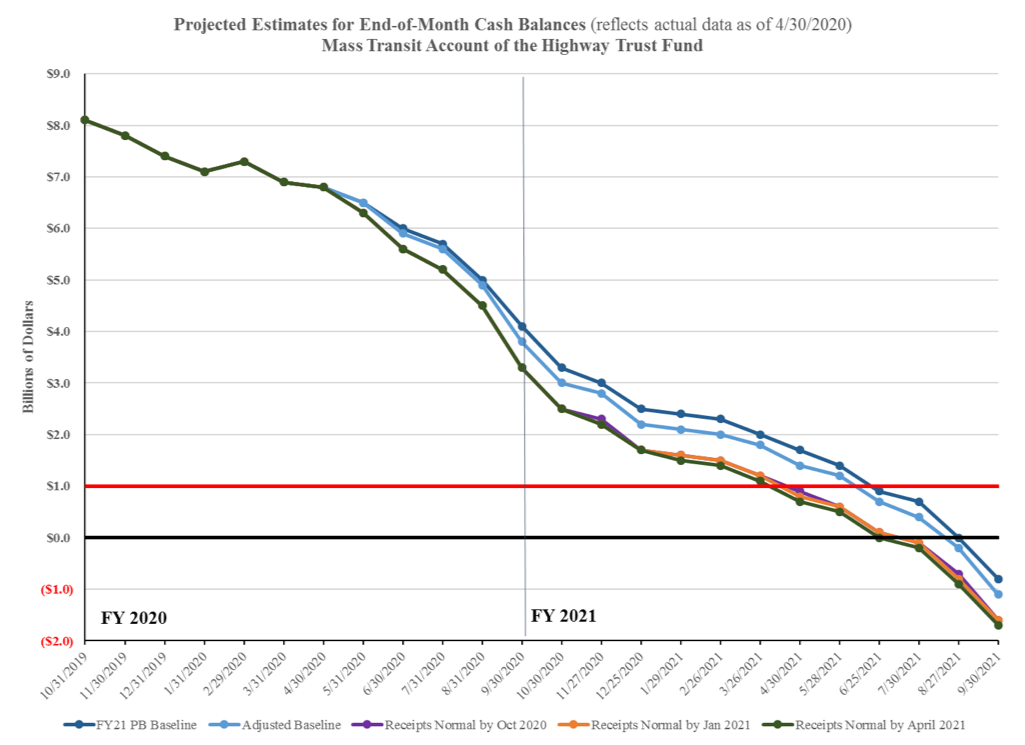

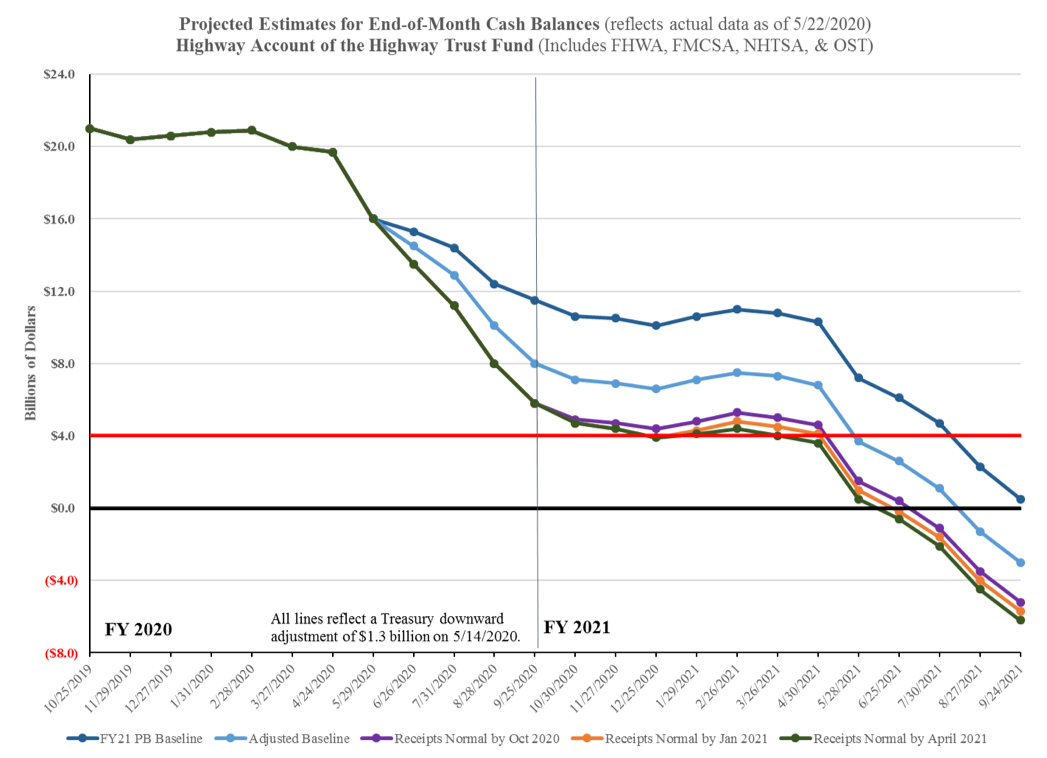

Modeling the future. For both accounts, DOT ran three revenue scenarios: one where tax receipts return to normal by October 2020, one where they return to normal by January 2021, and one where they return to normal by April 2021. They were run against the baseline spending and revenue assumptions from January 2020 (moving forward, from a starting point of actual balances in mid-May, post-adjustment) and against adjusted baseline assumptions that adds another 40 percent drop in receipts in the second half of May the end of May (with recognition that the transit spending assumptions could vary more, and if future laws give more transportation aid, the spending displacement problem could grow).

The chart below shows the results of those projections. For the Highway Account, all the projections show that the balances in the account could brush up against the “safe” $4 billion mark as earlier as November 2020 – but because outlays slow down drastically when cold weather slows down outdoor construction activities, the Trust Fund would then recuperate slightly under those scenarios until April or May 2021, when the account would head below $4 billion and might start running of cash on a day-to-day basis here and there while waiting for the twice-monthly transfer of estimated taxes from the Treasury. The account could then hit a zero balance by June 2021, which would mean significant delays in payments to states, and unpaid bills that would continue to add up until Congress provides another bailout. (This slide was updated to somewhat more pessimistic scenario late on June 12 and the text of this paragraph updated accordingly.)

For the Mass Transit Account, the models show that the account could see its balances drop below the $1 billion safe mark by early April 2021, risking day-to-day cash shortages, and that the account could hit the zero mark by June 2021.