September 21, 2018

In last week’s part one, we examined how the Carter Administration worked with two members of the House Ways and Means Committee to put the Highway Trust Fund on a form of “accrual accounting” so that the full long-term cost of new funding commitments was constantly weighed against future revenues. At the same time, the House Public Works Committee was pushing an aggressive four-year highway bill with a massive increase in highway spending that would “spend down” all Trust Fund balances and put the highway program on a path to put the Trust Fund into bankruptcy two years after the bill’s authorizations expired. That article took us through early August 1978, when the Ways and Means Committee decided not to decide the issue and leave it up to the full House.

This week marks the 40th anniversary of the House of Representatives deciding this dispute. But first, a slight digression into what was happening in the Senate at the time.

Mass transit and the Senate – jurisdiction. Traditionally, mass transit was not viewed by Congress as being an essential part of transportation. The federal role in mass transit started as an offshoot of urban development policy, which was under the jurisdiction of the House and Senate Banking Committees. (The federal role in housing began with mortgage guarantees, which were obviously part of banking, which led to other housing programs including public housing, which led to a federal role in urban development generally.)

This is why federal funding for mass transit started under the Housing and Home Finance Agency and then moved to the new Department of Housing and Urban Development. The Johnson Administration eventually decided that transit had more in common with transportation policy than with housing policy, so it moved transit from the Department of Transportation to HUD in 1968. (See ETW’s recent series on this issue (part 1 part 2 part 3 part 4) for more of the how and why.)

Congress, as usual, was slow to respond to this evolving definition of just what comprised “transportation.” Traditionally, Congress had viewed public works – no matter their purpose – as being their own thing, while transportation was something that happened, sometimes (but not always) using public works.

In the Great Reform year of 1946, Congress established House and Senate Committees on Public Works, which had jurisdiction over roads and bridges, river and harbor upgrades, and public buildings. But transportation was still considered a subset of the federal role in the regulation of interstate and foreign commerce, so jurisdiction over aviation, railroads, the economic and safety regulation of trucking, the inland waterways system, and other kinds of transportation were under the Commerce Committees. (The House and Senate differed on maritime transportation – it was under Commerce in the Senate but had its own committee in the House.) Mass transit, of course, was not a federal issue in 1946.

In the post-Watergate Great Reform Year of 1974, the House reorganized its standing committees. A select committee on the issue (under Richard Bolling (D-MO)) recommended that Banking lose mass transit and Commerce lose aviation, railroads, and trucking regulation and that, instead, these programs be given to Public Works which would be renamed Public Works and Transportation. The House Commerce chairman, Harley Staggers (D-WV), fought hard and was able to convince his colleagues to let Commerce keep railroads, but the final resolution giving aviation, trucking, inland waterways and mass transit to Public Works took effect in January 1975.

The Senate tried its own committee reorganization starting in 1976, with a Temporary Select Committee to Study the Senate Committee System, chaired by Adlai Stevenson III (D-IL). Where the House’s Bolling Committee concentrated transportation in Public Works, taking jurisdiction from Commerce and Banking, the Senate’s Stevenson Committee recommended strengthening the Commerce Committee by giving it highways (from Public Works) and mass transit (from Banking).

The Stevenson Committee filed its report in November 1976 (Senate Rept. 94-1395), and the Senate Rules Committee took up its recommendations in January 1977. The chairman of the Highways subcommittee on Public Works, Lloyd Bentsen (D-TX), testified before Rules that they should not only let Public Works keep highways, but give them mass transit and railroads and inland waterways as well. Banking chairman William Proxmire (D-WI) told Rules that most Banking members were “unalterably opposed to giving up jurisdiction over the urban mass transit program.”

As it happens, longtime Banking member Harrison Williams (D-NJ), the father of the federal mass transit program, was a member of the Rules panel at this point as well. When it came time to amend the Stevenson Committee’s plan, Williams and fellow Banking member (also on Rules) John Tower (R-TX) decided to protect the status quo for both highways and transit. Williams offered an amendment to keep transit at Banking, followed immediately by a Tower amendment to keep highways at Public Works, and Rules adopted both by voice vote. (Public Works was also given extra authority over environmental programs and became Environment and Public Works.)

As a result, it was still an open question as the 95th Congress began whether or not future mass transit authorizations would be enacted on their own, or would be rolled in with the highway bill.

Mass transit and the Senate – 1977. As we noted last week, federal aid for mass transit had been funded by multi-year contract authority drawn on the general fund of the Treasury, but the creation of new general fund contract authority had been banned by the Budget Act of 1974. After the Budget Act was signed into law, but before it took effect, Congress enacted a massive increase in mass transit contract authority in November 1974. But that was the last general fund contract authority that was ever going to be created.

Opinions varied greatly as to how much of that contract authority was still left. The Urban Mass Transportation Administration’s January 1977 budget estimates (for fiscal year 1978) estimated that at the end of the ongoing fiscal year, on September 30, 1977, UMTA would still have access to almost $7.9 billion in “unreserved” contract authority, including $4.7 billion for “section 3” discretionary grants, studies, and R&D. The budget level for discretionary grants was $1.25 billion per year, so there was plenty of unreserved contract authority.

But “unreserved” didn’t mean “uncommitted.” Those same FY78 budget estimates claimed that “Continuation of the UMTA program at this level through FY 1980, together with liquidation of those portions of current, multi-year commitments, which fall due after FY 1980, will require the Department to seek, in 1977, $1.1 billion to increase the $7.1 billion authorized by NMTA for the discretionary grant program.”

In January 1977, Pete Williams introduced legislation reauthorizing the mass transit program and increasing general fund authorizations (subject to appropriation) (S. 208, 95th Congress). Senate Banking held hearings on the bill in February 1977. After two days of testimony by transit advocates, the Carter Administration submitted budget revisions (as was the practice in those days, the FY 1978 budget had been submitted by the outgoing Ford Administration, and the newly sworn-in President Carter then submitted a large package of revisions) increasing the transit discretionary request by $100 million in 1978 (from $1.25 billion to $1.36 billion).

New Transportation Secretary Brock Adams testified before Banking on the third day of the hearings and tried to walk back the funding assumptions in the earlier budget estimates. He said that under the Ford Administration, the $7.125 billion in contract authority for section 3 provided by the 1974 law was almost entirely spoken for (only $1.2 billion uncommitted) because the minute that the Ford Administration made a promise, the entire amount of the full cost of the project was set aside, no matter how long it was going to take to build the project.

(Apparently, Secretary Coleman spent the waning days of the Ford Administration traveling the country promising people mass transit projects, even if no cost estimates nor any kind of project paperwork were available yet, and the Carter Administration had to honor those commitments.)

Adams submitted a chart showing how, as of the end of February 1977, $5.9 billion of the 1974 law’s $7.1 billion was “committed” but only $2.9 billion of it was formally “obligated”:

|

|

|

Total |

Obligated |

|

|

|

Committed |

by 3/1/77 |

| Formal, Sum-Certain Commitments |

|

|

|

Baltimore heavy rail |

500 |

176 |

|

Atlanta heavy rail |

680 |

571 |

|

Philadelphia transit tunnel |

240 |

25 |

|

|

Subtotal, Sum-Certain |

1,420 |

772 |

| Commitments in Principle |

|

|

|

Buffalo light rail |

269 |

8 |

|

Detroit (undetermined) |

600 |

0 |

|

Miami (undermined) |

575 |

15 |

|

Northern New Jersey (misc.) |

476 |

115 |

|

Chicago (heavy to O’Hare + misc.) |

209 |

10 |

|

Various downtown people movers |

220 |

0 |

|

|

Subtotal, Commitments in Principle |

2,349 |

148 |

| Bus and Paratransit Commitments |

|

|

|

Denver |

100 |

20 |

|

Seattle |

88 |

50 |

|

|

Subtotal, Bus and Paratransit |

188 |

70 |

|

|

|

|

|

| Other Bus and Rail Grants Through 3/1/77 |

1,932 |

1,932 |

|

|

|

|

|

| GRAND TOTAL |

5,889 |

2,922 |

|

|

|

|

|

| TOTAL N.M.T.A. CONTRACT AUTHORITY |

7,125 |

7,125 |

|

|

|

|

|

| REMAINDER UNCOMMITTED/UNOBLIG. |

1,236 |

4,203 |

Since FY 1977 was only half over, more pending commitments of that year’s $1.25 billion allocation were yet to be made, which would rapidly eat up the remaining $1.2 billion in uncommitted contract authority.

Adams proposed getting rid of the “reserve 100 percent of the needed funding at the moment you approve the project” method in favor of a “rolling authorization and appropriation” approach. He proposed a “letter of intent” process whereby UMTA would make promises of future appropriations to project sponsors. These letters of intent would not be legally binding but would be subject to the annual appropriations process (with appropriations to be made a year or two in advance to provide at least a modicum of budget certainty). In principle, it was similar to what Williams was proposing in his bill.

Adams told the committee that there was not an urgent need to solve the problem in 1977: “we feel there’s sufficient money in the authorization at the present time to meet fiscal year 1978 and 1979. Now there will not be by fiscal year 1980.” (Williams’s bill would have taken effect immediately.)

Sen. Paul Sarbanes (D-MD) had a long back-and-forth with Adams on the topic of financial security versus more projects:

Senator SARBANES. …what you’re doing is trading off the guaranteed assurance to a limited number of communities that are brought on that their funding is firm with the exception of the inflationary problem you alluded to, you’re trading that off for being able with the same amount of money to bring on a lot more communities, but you then leave them to some extent hanging as to whether the money will continue to roll in subsequent years with respect to all of them or else they are all ground to a halt. Isn’t that in effect what you’re talking about doing?

Secretary ADAMS. That is a way of explaining what the new budget system does that is being proposed in S. 208 and that we have supported. Otherwise, you’re frozen.

Senator SARBANES. How reasonable do you think it is to States and localities to expect them to undertake and continue these projects when they lose that assurance?

Secretary ADAMS. Well, we could give them, if S. 208 passes, the assurance provided by a 2-year appropriation in advance plus an authorization and that we can do plus giving them an authorization out 3 years beyond that. Now that’s what can be done.

-Senate Banking Committee hearing, February 1977.

Banking reported the Williams bill in May 1977 (S. Rept. 95-183), and it increased general fund authorizations for UMTA (subject to appropriation) by $60 million in 1978, $80 million in 1979, $1.1 billion in 1980, $1.9 billion in 1981, and $2.0 billion in 1982, to reflect the full obligation of the last of the general fund contract authority sometime in mid-1980 and continued program growth in every year.

The Senate debated and passed S. 208 on June 23, 1977 by voice vote. As passed, it would have replaced the “advance commitment in full” system of contract authority with not-legally-binding letters of intent, with the proviso that the sum total of all money promised by such letters of intent could not exceed the unobligated contract authority balance plus the total general fund authorizations under the bill.

But the House took no notice of the Senate bill in 1977 because, as discussed in last week’s article, Public Works and Transportation chairman Jim Howard (D-NJ) was busy trying to get a dedicated trust fund for mass transit (the only way to get more contract authority) through energy taxes that were being debated as part of President Carter’s energy plan. Once that effort failed, since Howard was going to move a highway reauthorization bill in 1978 anyway, he decided to hold back the separate mass transit bill and combine it with the highway reauthorization bill in 1978.

The 1978 highway bill in the Senate. While the House Public Works and Transportation Committee was busy pushing a four-year highway reauthorization bill that would have set the Highway Trust Fund on a path to bankruptcy, the Senate Environment and Public Works panel was taking the opposite approach. That committee reported a bill (S. 3073, 95th Congress) that only provided money for two years, and only at the level that anticipated Trust Fund revenues could support. The bill came to the Senate floor on August 18, 1978, and in his opening remarks, bill manager Lloyd Bentsen (D-TX) said:

The basic question – at least in my mind, Mr. President – is not how much money the program needs, but the measure of resources available to sustain it. We must weight highway needs against available trust fund revenues and do the best we can with the funds we have. To ignore factors such as inflation and deficit financing in developing highway legislation would be easy, but it would also be irresponsible and shortsighted. And it would wreck the Highway Trust Fund.

Mr, President, the Subcommittee on Transportation and the Committee on Environment and Public Works have opted for prudence: we have chosen to live within our means.

That may be a little unusual these days, and particularly so for Members of the Congress.

We have maintained the “user pay” principle. We took a close look at the trust fund, determined the size of the program it could be expected to support, and used that figure as the basis for this legislation. Rather than tinker with the trust fund concept, with some phony accounting approach, we have chosen instead to make better, more effective use of the moneys available to us.

Let us talk about the trust fund for a minute. Obviously, if you raise the Federal gasoline tax, you will generate more revenue into the trust fund, and we can spend more money on highways. If Congress makes this extra money available, we will do our best to see that it is well spent. I have followed this situation with some care, and I can assure you that the trust fund could use more revenue. The 4-cent tax has not been increased since 1959.

But the fact of the matter is that Congress has not increased the Federal gasoline tax; the fact of the matter is that we have $8 billion a year to work with, no more and, hopefully, no less.

-Lloyd Bentsen, August 18, 1978

It is important to note that Bentsen made no mention of the Trust Fund’s built-up cash balance and “spending down” that money, upon which the House bill was predicated.

On August 21, Sen. Robert Morgan (D-NC) went even farther, offering an amendment to the bill (see page 27117 here):

Section 101 of title 23, United States Code, is further amended by adding at the end thereof the following new subsection:

“(f) It is hereby declared to be the national policy that annual authorizations for programs to be financed from Highway Trust Fund be closely related to anticipated annual receipts accusing to the fund in order that the decision on appropriate program levels and the decision on sources of revenue to finance the program be made in conjunction with each other.

“It is further declared that whenever authorizing legislation provides for growth in program levels, such growth should be consistent with (1) the rate of growth of revenues from existing sources, (2) the ability of States responsibly to obligate increased Federal funds, and (c) a sound overall Federal fiscal policy.”

-Morgan amendment #1697 to S. 3073, 95th Congress

After debate, that amendment was agreed to by the Senate by a roll call vote of 86 to 0. So the principle of accrual accounting – limiting spending to available revenues, regardless of whatever the trust fund balance is on paper – had been unanimously supported by the Senate.

Senate Budget Committee chairman Ed Muskie (D-ME) then took to the Senate floor to congratulate Environment and Public Works for staying within the FY 1979 spending ceiling set for the committee by the Congressional budget resolution (S. Con. Res. 80, 95th Congress) two months earlier (a total of $8.2 billion in mandatory budget authority for all EPW programs, almost all of which were Highway Trust Fund programs). The final version of the budget had been adopted by voice vote (unheard of in today’s climate).

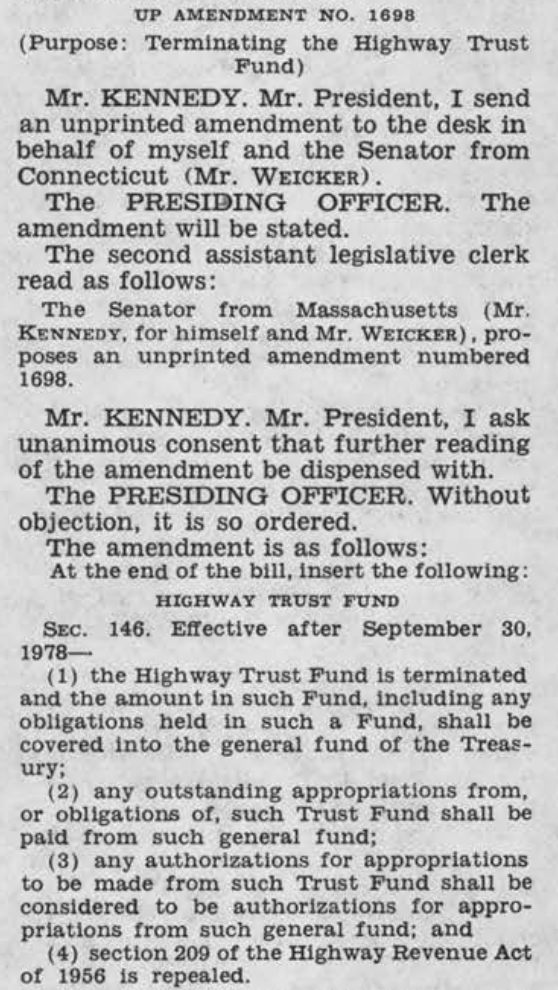

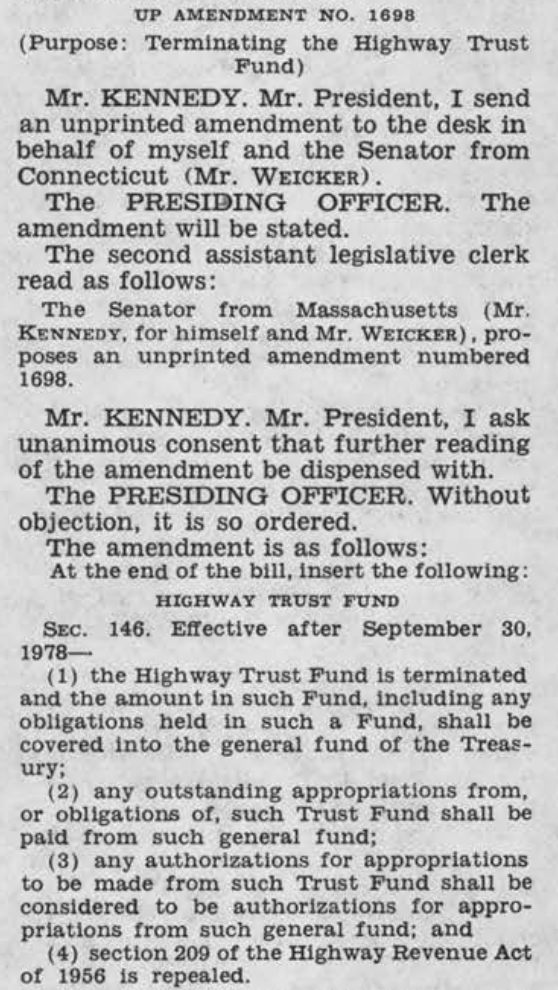

At this time, the only bill before the Senate was the highway bill – S. 3073 did not contain any mass transit authorizations, which were being produced by the Banking Committee in a separate bill (S. 2441, 95th Congress). So, in the context of a highway-only bill, and in a budget situation where mass transit was no longer guaranteed multi-year funding, Sen. Ted Kennedy (D-MA) proposed to abolish the Highway Trust Fund entirely.

At this time, the only bill before the Senate was the highway bill – S. 3073 did not contain any mass transit authorizations, which were being produced by the Banking Committee in a separate bill (S. 2441, 95th Congress). So, in the context of a highway-only bill, and in a budget situation where mass transit was no longer guaranteed multi-year funding, Sen. Ted Kennedy (D-MA) proposed to abolish the Highway Trust Fund entirely.

In his remarks (starting on page 27120 here), Kennedy said, of the Trust Fund, that “This enormous amount of money should not be reserved to one mode of transportation or to transportation as a whole regardless of conditions. Rather, funding should be subject to the regular authorization and appropriations process. If that process is good enough for our national defense, if it is good enough for our health expenditures, if it is good enough for our education programs, it should be good enough for highways.”

Kennedy also specifically cited the March 1978 Congressional Budget Office report that recommended abolition of the Highway Trust Fund (as well as the Airport and Airway Trust Fund) as the overall best public policy choice for transportation funding as a whole.

Bentsen pointed out that because of previous efforts by Kennedy, Weicker and others, the 1973 and 1976 highway acts had given flexibility to the Trust Fund to be used for certain kinds of mass transit spending and to allow cities to substitute mass transit facilities for proposed urban Interstate sections they did not want. Bentsen also alluded to a new hit TV series based on a Marvel Comics character: “Clearly, there is a great deal of flexibility in the highway trust fund; it is not some ‘incredible hulk’ that stands in the path of legislative innovation.”

But everyone knew that Kennedy’s amendment did not have the votes to pass, and it was resoundingly rejected by a vote of 10 yeas, 75 nays. (The ten “yes” votes were Senators Brooke (R-MA), Chafee (R-RI), Cranston (D-CA), Javits (R-NY), Kennedy (D-MA), Mathias (D-MD), Pell (D-RI), Percy (R-IL), Proxmire (D-WI), Weicker (R-CT) – an even split between Republicans and Democrats, which would be impossible today.)

After Senators ran out of amendments to offer to S. 3073, the chairman of the Senate Commerce Committee offered the highway safety authorizations, to be added as title II of the bill, taken from the text of their own bill (S. 2541, 95th Congress). Interestingly, while the highway bill only had two years of authorizations, the highway safety bill ran for four years. At that point, the bill was set aside to await the eventual addition of the mass transit bill.

Trimming back the House bill. The House brought up its surface transportation bill (H.R. 11733, 95th Congress) on September 15. During general debate, Ways and Means ranking minority member Barber Conable (R-NY) explained what had happened in his committee earlier in the summer:

…when this measure came to the Committee on Ways and Means as a result of concurrent jurisdiction, the extremely high level of authorizations provided in the bill when compared to anticipated trust fund revenues would have forced us into uncomfortable options of either a sharp increase in highway excise taxes or share cutbacks in program revenues or, regrettably, a dip into the general revenues for financing to save the fund. Such a choice would have been upon us when the Nation could ill afford any of those options.

Madam Chairman, it is well known that in cooperation with the gentleman from Florida (Mr. GIBBONS), I sponsored an amendment that would have cut back sharply expenditures of the highway trust fund, and the extension of the fund would have been for a considerably shorter period of time.

My concerns were fiscal. I do not doubt for 1 minute the need for the highway program to continue. As a result of the pressures generated by the Gibbons-Conable amendment, the subcommittee of the Committee on Public Works and Transportation, and the chairman and the ranking minority member made a concession of the committee that $1 billion would be taken out of the expenditure side annually and that the duration of the fund would be for 1 year less. This constituted a major concession in the direction of fiscal soundness.

-Barber Conable, September 15, 1978

But, Conable said, even though the promised $1 billion per year cut in authorizations was enough to convince Ways and Means not to back his amendment, the funding levels in the bill were still too high, and left Congress facing stark long-term choices:

I want to emphasize once again, Madam Chairman, the hazards to the American economy which exist in this bill with its substantially increased authorization levels. I believe there is a real danger of the highway trust fund becoming insolvent. There are many whose hearts would be gladdened by the demise of the highway trust fund, and I am not among them. I do urge the Members of this House to carefully consider the long-range ramifications of this bill at this time in our history.

It may be that the bill takes us in the direction that we want to go. However, under the unified budget, I want to point out that the surpluses of the past have worked against Government deficits, and the deficits of the future in this trust fund work to increase the size of our Government deficit. It may be that the Members of the House will want to continue to operate by mortgaging the future of the trust fund.

I hope if we do, that we will do it with the full knowledge that we are committing the Congresses of the future either to a sharp increase in taxes or to some change in the operation of the trust fund, something which I do not think would be necessarily in the interest of the American people. The trust fund has served us well and we must exercise restraint in our fiscal plans if we are not to contribute to its demise.

-Barber Conable, September 15, 1978

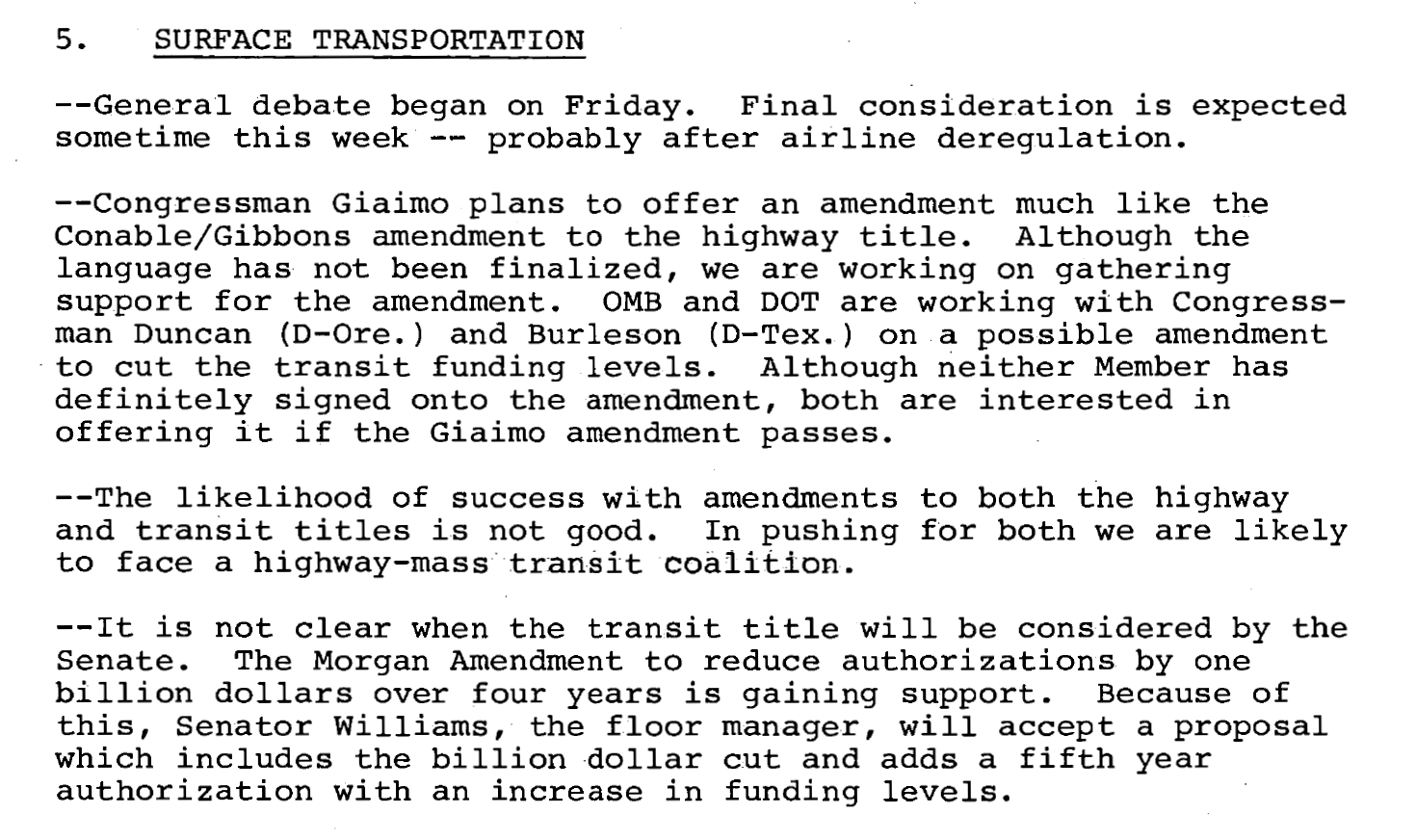

Another opportunity for such restraint would come when the House started considering amendments to H.R. 11733 the following week. A memo to President Carter from Frank Moore, his legislative liaison, on September 16 laid out the plan:

(However, Carter clearly had other things on his mind – that was the weekend of the Camp David summit with Anwar Sadat and Menachem Begin, where the signing of an agreement between Israel and Egypt on the evening of Sunday, September 17 interrupted the world premiere of the pilot movie of Battlestar Galactica on ABC.)

On September 21, the House again took up the bill, this time for amendment. Highways subcommittee chairman Jim Howard (D-NJ), the principal author of the bill, went first and offered his amendment to cut Highway Trust Fund contract authority by $1.0 billion per year. ($300 million per year from the Interstate program – and all of that from the Secretary’s discretionary fund, an indication of dissatisfaction with Secretary Adams – $150 million per year from the federal-aid primary program, $50 million per year from the federal-aid secondary program, and $500 million per year from the new bridge improvement program.) The amendment also reduced the general fund authorizations for mass transit by $400 million per year.

Howard explained:

We feel that if we are going to cut this bill, this the most prudent way in which to do it. We feel justified with the original numbers; but Madam Chairman, there is one point we would like to make. In bringing the highway portion of this bill from $11.3 billion per year down to $10.3 billion per year, we can be assured that not only for the 4 years of this bill, but as far into the future as we can see, if every State is able to use every dollar every year, we can continue this program with no need for any additional gasoline tax increase. It is well below the level where we might, down the road, have to consider a gas tax increase.

-Jim Howard, September 21, 1978

The estimates of Highway Trust Fund cash flow at the time bear out Howard’s assertion to some degree. The bill as originally approved by the Public Works and Transportation Committee would have put the Trust Fund on a pace for insolvency about two-and-a-half years after the bill’s expiration:

| Highway Trust Fund – H.R. 11733 as Reported (Billions of Dollars) |

|

FY79 |

FY80 |

FY81 |

FY82 |

FY83 |

FY84 |

FY85 |

FY86 |

FY87 |

FY88 |

| New authorizations |

11.7 |

11.5 |

11.5 |

11.5 |

11.5 |

11.5 |

11.5 |

11.5 |

11.5 |

11.5 |

| Beginning-of-FY Balance |

11.3 |

10.9 |

9.0 |

6.8 |

4.7 |

2.5 |

0.4 |

-1.4 |

-2.9 |

-4.0 |

| Revenues – High End |

8.1 |

8.3 |

8.4 |

8.6 |

8.8 |

9.0 |

9.3 |

9.6 |

10.0 |

10.4 |

| Outlays |

8.5 |

10.1 |

10.6 |

10.8 |

11.0 |

11.1 |

11.1 |

11.1 |

11.1 |

11.1 |

| End-of-FY Balance |

10.9 |

9.0 |

6.8 |

4.7 |

2.5 |

0.4 |

-1.4 |

-2.9 |

-4.0 |

-4.7 |

With the cuts in the Howard amendment, the “spend-down” curve was flattened to where the Trust Fund would, barely, remain solvent at the end of a ten-year forecast:

| Highway Trust Fund – H.R. 11733 with Howard Amendment Cutting $1 Billion per Year (Billions of Dollars) |

|

FY79 |

FY80 |

FY81 |

FY82 |

FY83 |

FY84 |

FY85 |

FY86 |

FY87 |

FY88 |

| New authorizations |

10.7 |

10.5 |

10.5 |

10.5 |

10.5 |

10.5 |

10.5 |

10.5 |

10.5 |

10.5 |

| Beginning-of-FY Balance |

11.3 |

11.0 |

9.4 |

7.7 |

6.0 |

4.6 |

3.3 |

2.2 |

1.3 |

0.7 |

| Revenues – High End |

8.1 |

8.3 |

8.4 |

8.6 |

8.8 |

9.0 |

9.3 |

9.6 |

10.0 |

10.4 |

| Outlays |

8.4 |

9.8 |

10.1 |

10.2 |

10.3 |

10.4 |

10.4 |

10.5 |

10.5 |

10.5 |

| End-of-FY Balance |

11.0 |

9.4 |

7.7 |

6.0 |

4.6 |

3.3 |

2.2 |

1.3 |

0.7 |

0.6 |

Howard’s amendment was accepted by voice vote. Then, the chairman of the House Budget Committee, Robert Giamo (D-CT), offered his amendment (page 30731 here) to automatically reduce the sum total of all new highway contract authority authorizations via across-the-board cuts in each year to the amount of projected Highway Trust Fund tax receipts and interest for that year (plus $300 million per year). Based on the tax receipt projections available at the time, this would have cut funding to about $2 billion per year below the already-reduced levels in bill as amended by chairman Howard:

|

FY79 |

FY80 |

FY81 |

FY82 |

Total |

| Total HTF Contract Authority |

|

|

|

|

|

| Administration proposal |

7.8 |

7.8 |

8.2 |

8.2 |

32.0 |

| House bill as introduced |

11.7 |

11.5 |

11.5 |

11.5 |

46.2 |

| House bill with Howard amendment |

10.7 |

10.5 |

10.5 |

10.5 |

42.2 |

| Proposed Giamo amendment |

8.3 |

8.4 |

8.7 |

8.8 |

34.2 |

Giamo’s amendment also included the same word-for-word policy statement on limiting trust fund spending levels to revenues that the Senate had adopted unanimously the month before in the Morgan amendment.

In his remarks, Giamo pointed out that assuming Trust Fund spending would stay flat-lined forever (as the out-year projections did) was not realistic: “I have yet to see a Federal program that is funded at the rate of $10 billion today which will not grow because of inflation or program growth in the out years.” Under the spending levels in the Howard amendment, any program growth at all would likely cause a Trust Fund default inside of a decade.

Giamo also referenced the debate over Howard’s amendment to increase the gas tax by 5 cents per gallon (half for highways, half for mass transit) a year earlier:

Now, they tried to remedy this a year or so ago when they came in with the gasoline tax increase, and I think that was the way to do it. I voted for that tax increase. I was one of the heroic few around here at that time who did.

I think there were fewer than 100 of us – I believe about 70 – and we said, “If you want to make the trust fund better, if you want to make it more viable, increase the gas tax.”

That did not happen, so they had to look for other alternatives. What are some of the other alternatives?

We could remedy the program so that we can get revenues from general revenue taxes rather than user taxes, but obviously that is not an acceptable alternative. Or we can do what this committee is doing. It is setting up a 4-year program, but it is setting up a revenue trust fund for 5 years. The theory is that ultimately the 5 years of federal revenues will pay for the 4 years of the program, and perhaps they will for the first 4 years.

But what happens at the end of 4 years? We are already using revenues from the year before. At the end of 4 years we are not going to terminate the highway program in this country.

-Robert Giamo, September 21, 1978

Giamo made three other points:

- Inflation. “This is an inflationary program, even with the amendment offered by the gentleman from New Jersey (Mr. HOWARD), will provide us with a 47-percent rate of increase over last year. That is a staggering level of increase, particularly today when we talk about the need to hold the line, the need to get our budget in better shape, and the need to get our deficits down. We will be adding fuel to the flames of inflation if we build up this program and if we force the States to take more money.” (Consumer prices had been increasing at annualized double-digit levels in the first half of 1978.)

- The budget resolution. “the $8.3 billion reflected in the House-passed second budget resolution is a proper level for fiscal year 1979 and provides a responsible 17-percent increase in the program.” (Giamo was referring to the budget resolution that passed the House on August 16, 1978 (H. Con. Res. 683, 95th Congress), which passed on a party-line vote, with Howard in support.)

- Veto. “If the highway bill is much above the $8.3 billion projected for highway trust fund programs as per my amendment, the President has said he will veto the bill. The President will veto the bill not because he is against highways, but because of the inflation, tax and deficit problems associated with the proposed levels of funding in H.R. 11733.”

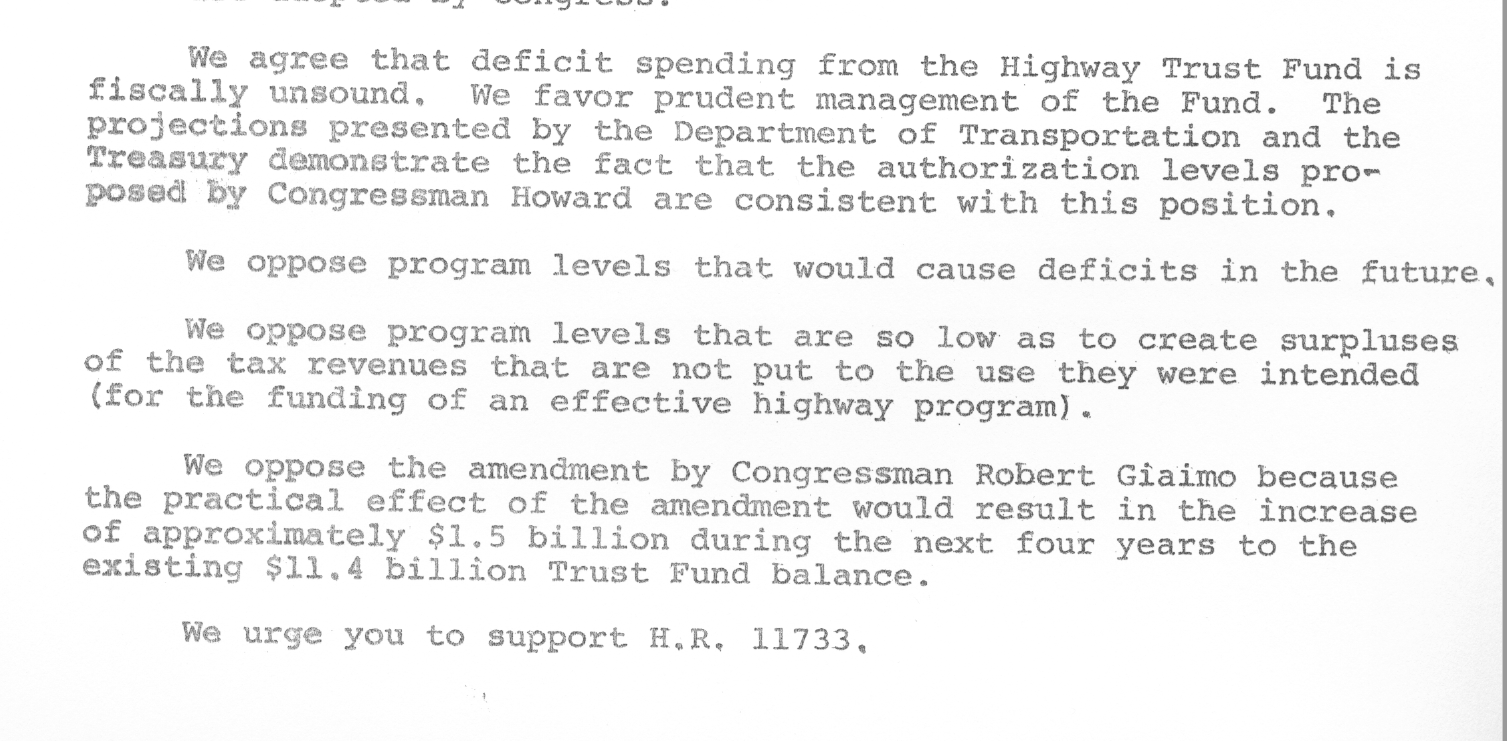

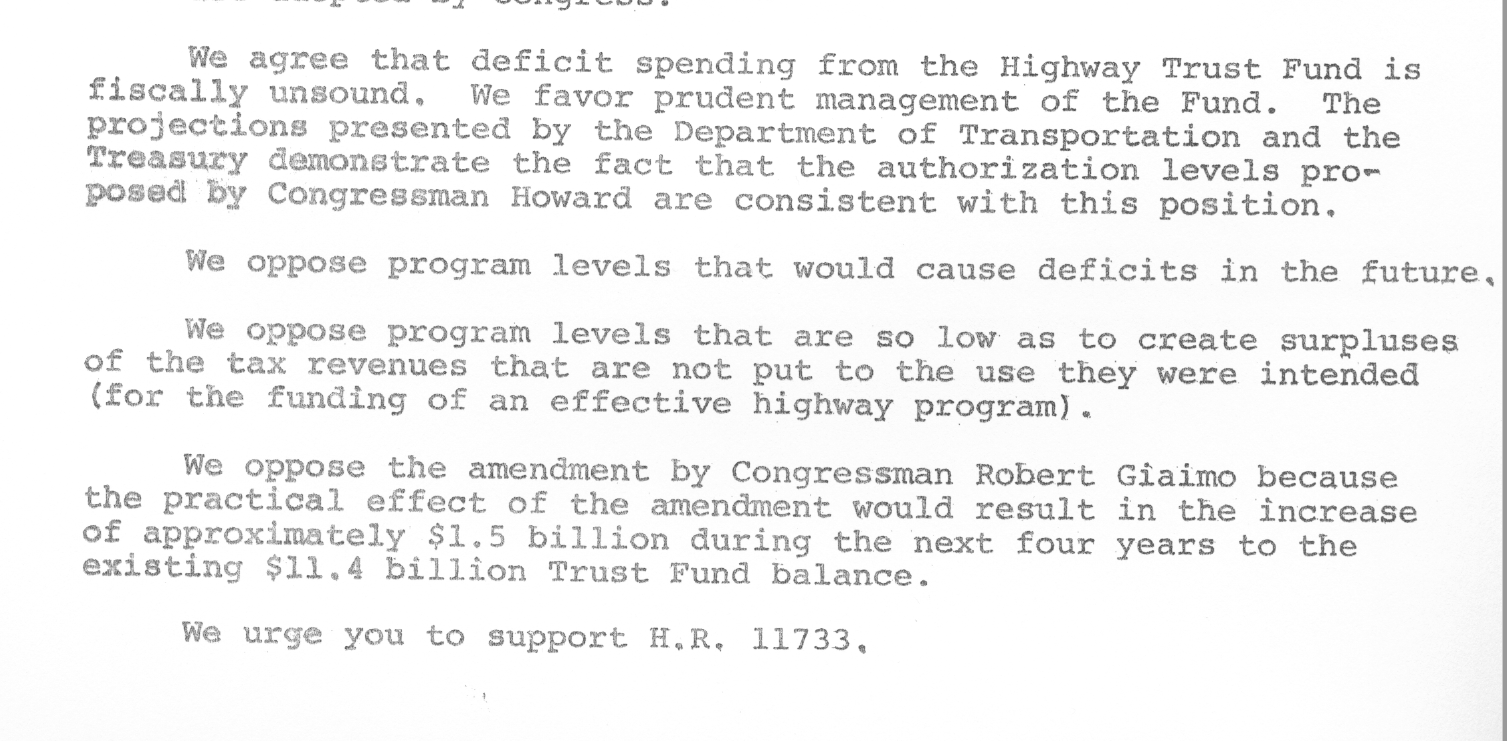

Opponents of Giamo’s amendment didn’t say much. They didn’t have to. Prior to the debate, Public Works members had sent a “Dear Colleague” letter to all House members, with the typical table showing how much less in apportioned highway funding each state would receive under the Giamo amendment. And all of the stakeholder groups that stood to receive a lot of funding under the House bill (AASHTO, APTA, the construction industry) wrote a letter to all House members urging opposition to the Giamo amendment:

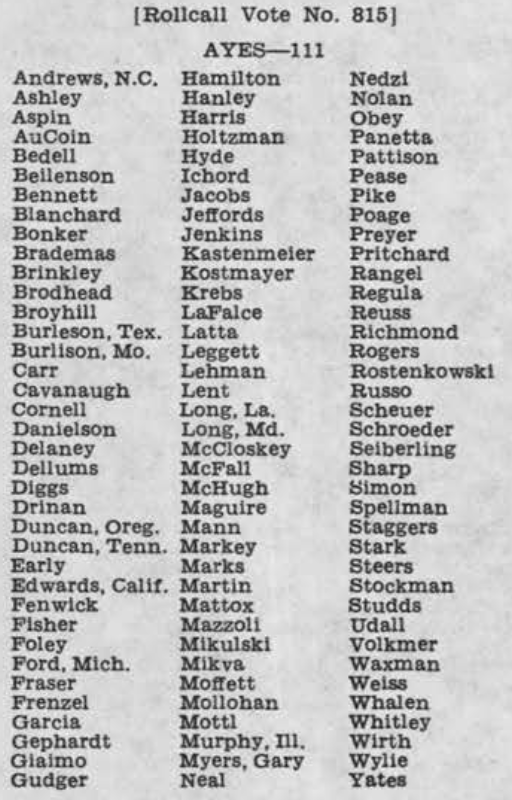

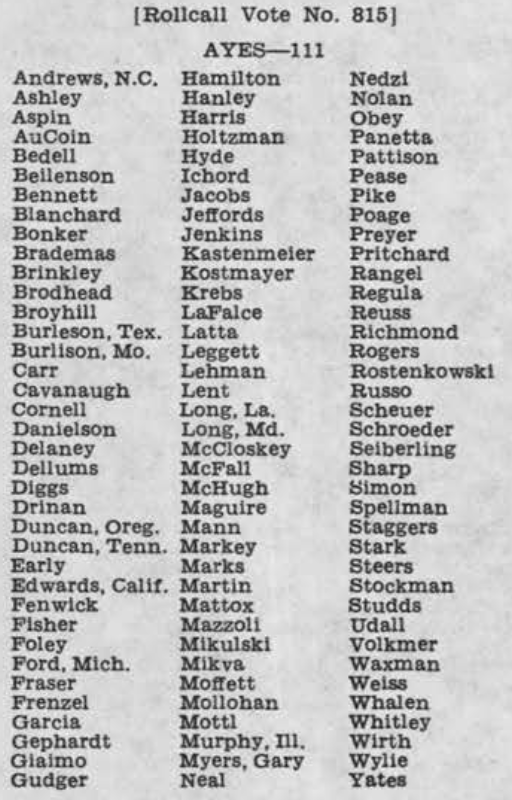

In the end, Budget chairman Giamo was only able to convince 110 of his colleagues to support his amendment limiting Highway Trust Fund funding to the level called for in the budget resolution. The vote was 111 yeas, 238 nays (with 83 absentees). Giamo drew support from most of his Budget colleagues (though not those who also served on Public Works, like Jim Wright (D-TX) and Norm Mineta (D-CA)), and some members of Ways and Means and of Appropriations. But it was no match for Public Works and the powerful highway lobby.

In the end, Budget chairman Giamo was only able to convince 110 of his colleagues to support his amendment limiting Highway Trust Fund funding to the level called for in the budget resolution. The vote was 111 yeas, 238 nays (with 83 absentees). Giamo drew support from most of his Budget colleagues (though not those who also served on Public Works, like Jim Wright (D-TX) and Norm Mineta (D-CA)), and some members of Ways and Means and of Appropriations. But it was no match for Public Works and the powerful highway lobby.

Because the margin on the Giamo amendment was so lopsided, no one bothered to offer a similar amendment cutting the general fund mass transit authorizations in the bill, and H.R. 11733 passed the House on September 28 by a vote of 367 to 28.

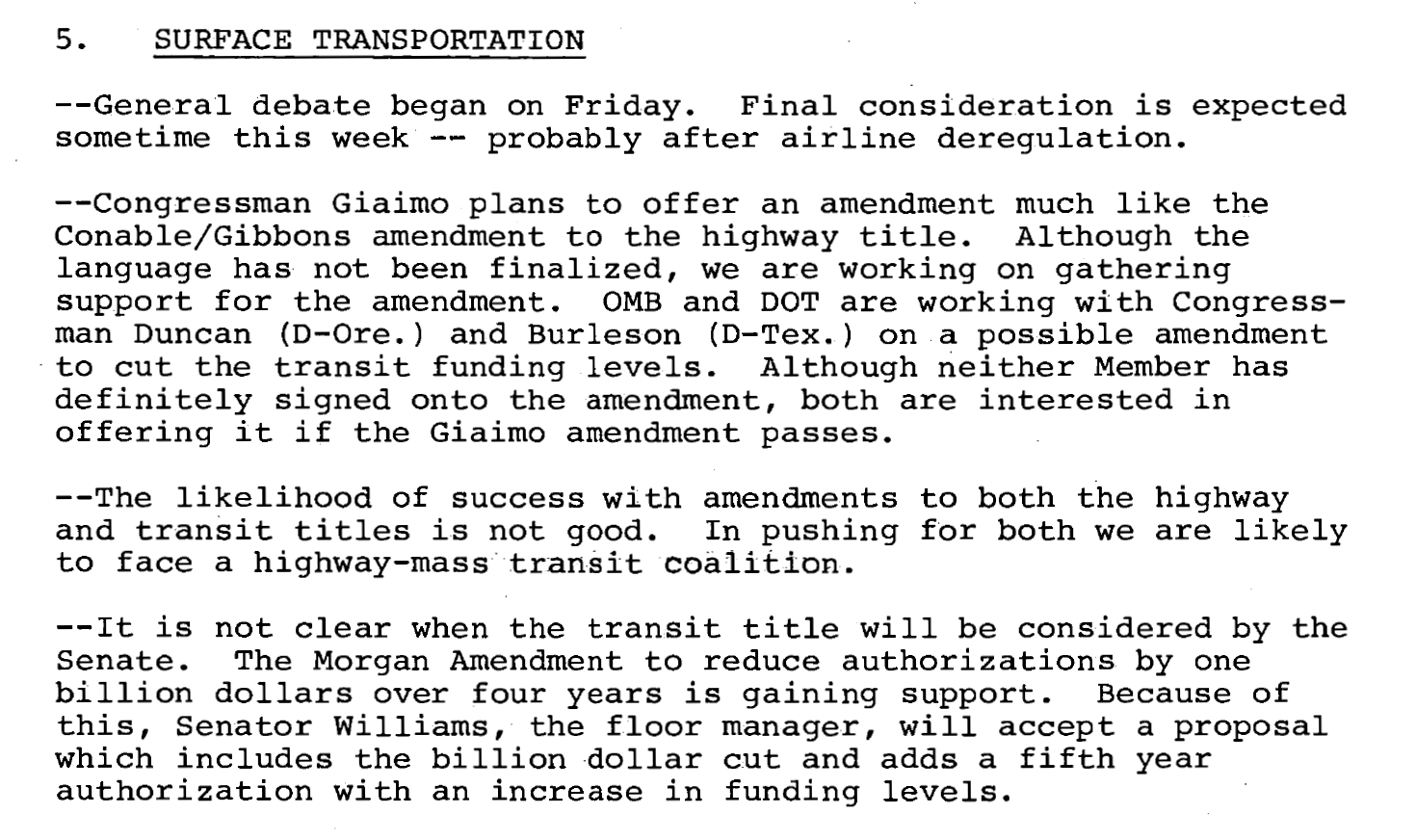

The Senate cuts transit. The same day that the House passed H.R. 11733, the Senate took up the long-delayed mass transit authorization bill (H.R. 2441, 95th Congress) from the Banking Committee.

The bill’s author, Pete Williams (D-NJ), said “The original funding levels contained in S. 2441, as proposed by the administration, were clearly inadequate to continue the great strides that we have made in public transportation, especially in recent years. This is not only my opinion, it is the opinion of every witness that appeared before the Senate Banking Committee with the exception of the Department of Transportation.”

The bill as brought to the floor authorized $14.76 billion to be appropriated from the general fund over four years. The Carter Administration wanted two amendments adopted – one from Budget chairman Ed Muskie (D-ME) eliminating a new operating assistance program that would have cost $891 million, and the other from Robert Morgan (D-NC) cutting total authorizations by $1.00 billion over four years.

Williams had met with Secretary Adams on September 19 and negotiated a deal whereby he would accept both amendments in exchange for the Administration accepting his own amendment adding a fifth year of authorization for the new starts program. This was memorialized in a letter from Adams to Williams dated September 26 (see page 32143 here).

The Muskie amendment was agreed to by a vote of 74 to 15, and the Morgan and Williams amendments were agreed to by voice vote.

|

FY79 |

FY80 |

FY81 |

FY82 |

4-Year |

| S. 2441 as reported |

3.362 |

3.681 |

3.800 |

3.918 |

14.761 |

| Muskie amendment |

-0.127 |

-0.191 |

-0.255 |

-0.318 |

-0.891 |

| Morgan amendment |

-0.291 |

-0.384 |

-0.205 |

-0.120 |

-1.000 |

| S. 2441 as passed |

2.944 |

3.106 |

3.340 |

3.480 |

12.870 |

After amendments ended, the Senate shelved S. 2441 and then brought up the highway bill (S. 3073), added the amended text of S. 2441, added a tax title from the Finance Committee, and and then held it at the desk to await the arrival of the House paperwork on H.R. 11733. That happened on October 3, and then both the House and Senate agreed to go to conference to resolve differences on H.R. 11733.

On October 5, President Carter’s hand was strengthened when the House failed to override his veto of the annual Energy and Water appropriations bill, falling 53 votes short of the 276 votes necessary for two-thirds. Carter had framed the debate as proof of his opposition to wasteful public works projects (which had all been authorized by the Public Works and Transportation Committee) and a need to keep federal spending under control in order to fight inflation.

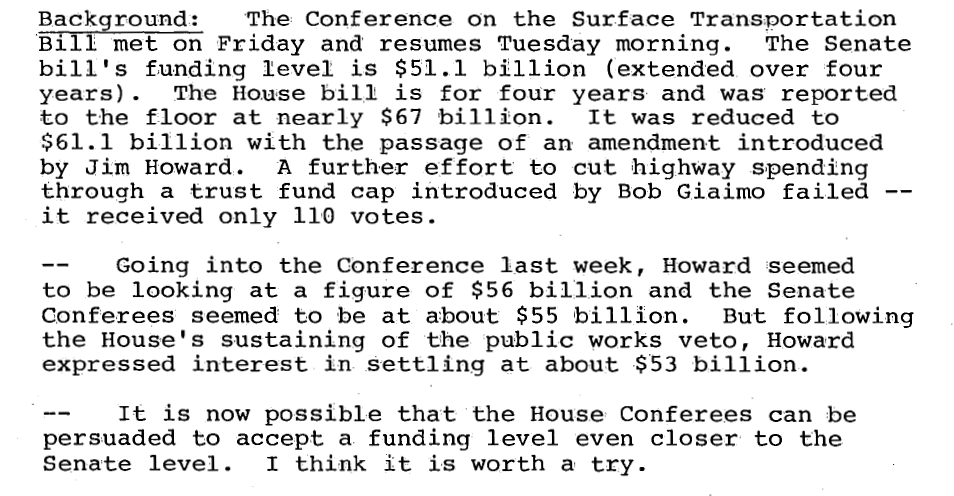

House-Senate conference. An initial conference meeting was held on Friday, October 6. Another conference meeting was scheduled for October 10, and the number of days left before the scheduled pre-election adjournment date of mid-October was running out. President Carter held a private meeting at the White House with the senior conferees at 8:30 a.m. that morning. Carter, always a voracious consumer of memos, had been given competing assessments of the bill from DOT, OMB, his White House policy staff, and his legislative affairs staff (all of which are here – in the various memos you can see what Carter underlined for emphasis as he was reading them).

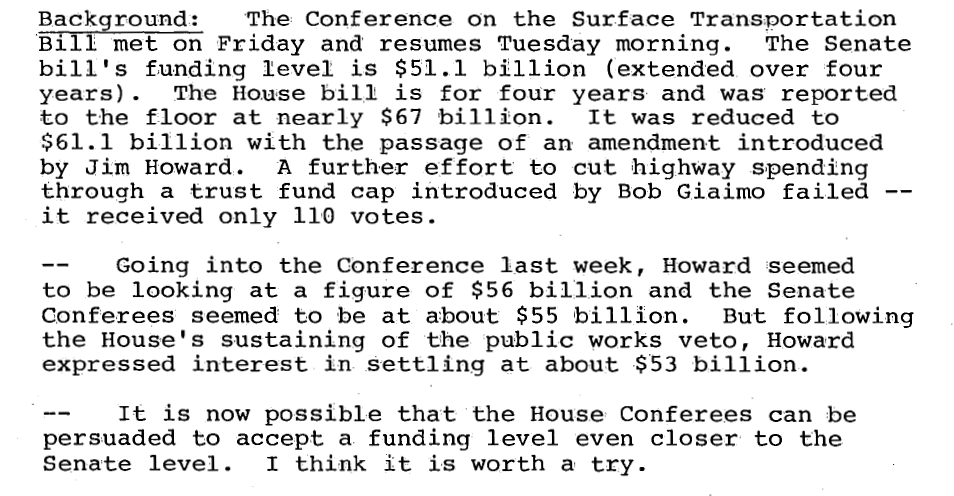

The top memo from legislative liaison Frank Moore said:

Stu Eizenstat, Carter’s policy advisor, wrote that he, OMB and DOT all agreed that “we should accept total spending as high as $52.5 billion — $4.2 billion above our initial recommendation. OMB’s $52.0 billion recommendation is a tactical decision based on the presumption that the conferees would then go up to $52.5. billion”

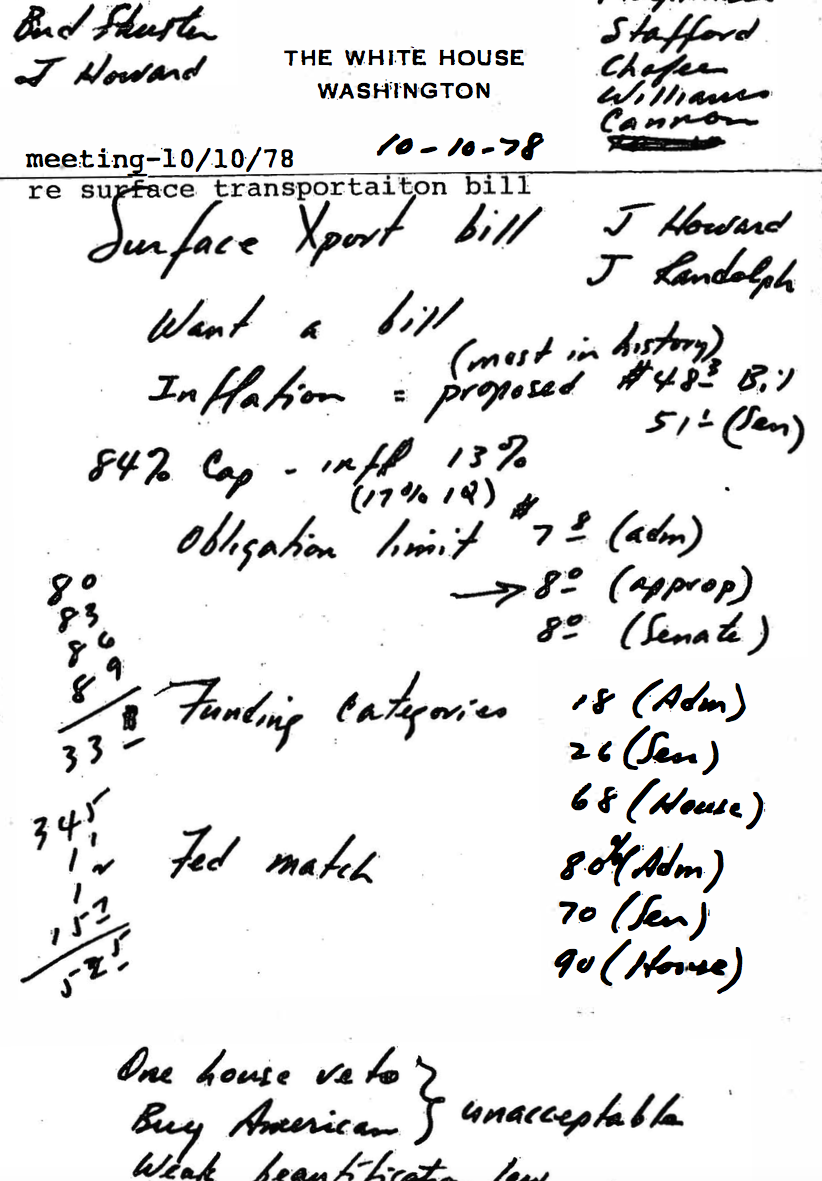

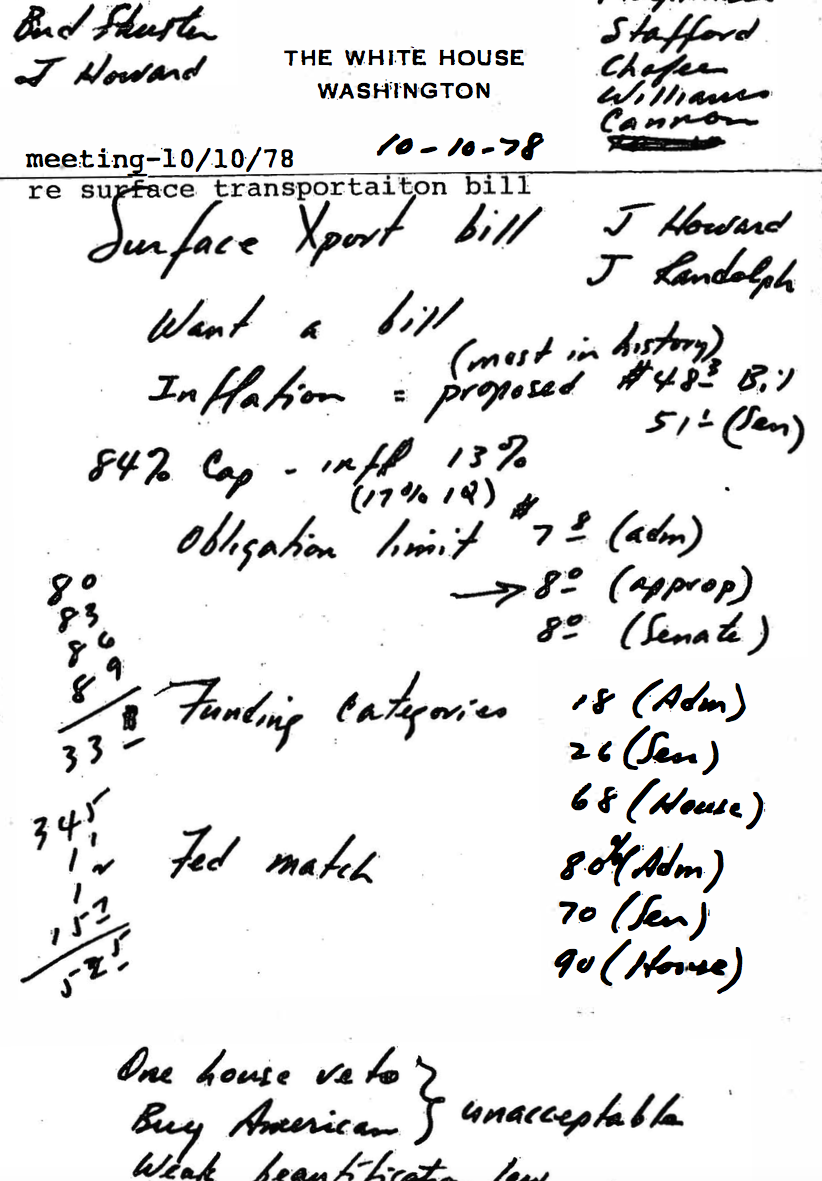

President Carter held the line in the meeting and maintained a veto threat – his own handwritten notes of the meeting indicate that he understood the major differences between the bills clearly:

At the meeting, a “bottom line” spending total of $52.4 billion over four years was discussed. Then the conferees met more or less continuously through October 10-11.

Jack Schenendorf, who was a minority counsel on House Public Works and Transportation at the time, recalls that Senate EPW chairman Randolph was in the midst of a tough re-election campaign and was constantly getting up from the conference meeting to take phone calls from West Virginia. The policy issues were resolved first, leaving funding questions open. At that point, Randolph turned control of the conference over to Bentsen, which Schenendorf took as a sign that the Senate was not going to yield on overall funding issues.

Schenendorf recalls that the House conferees caucused amongst themselves, where PWT ranking minority member Bill Harsha (R-OH) told Jim Howard that the House could not win a media war with President Carter on the annual funding levels in the event of a veto fight, and Howard literally broke down and wept. Senate conferees insisted on getting funding in the bill down to a level that Carter would sign, which was not much above the Senate-passed level. Howard’s staff apparently had no “Plan B” for how to divide funding up amongst programs if they were forced to reduce overall spending levels in the bill, so the House Republican backup plan was used to allocate the money amongst different programs.

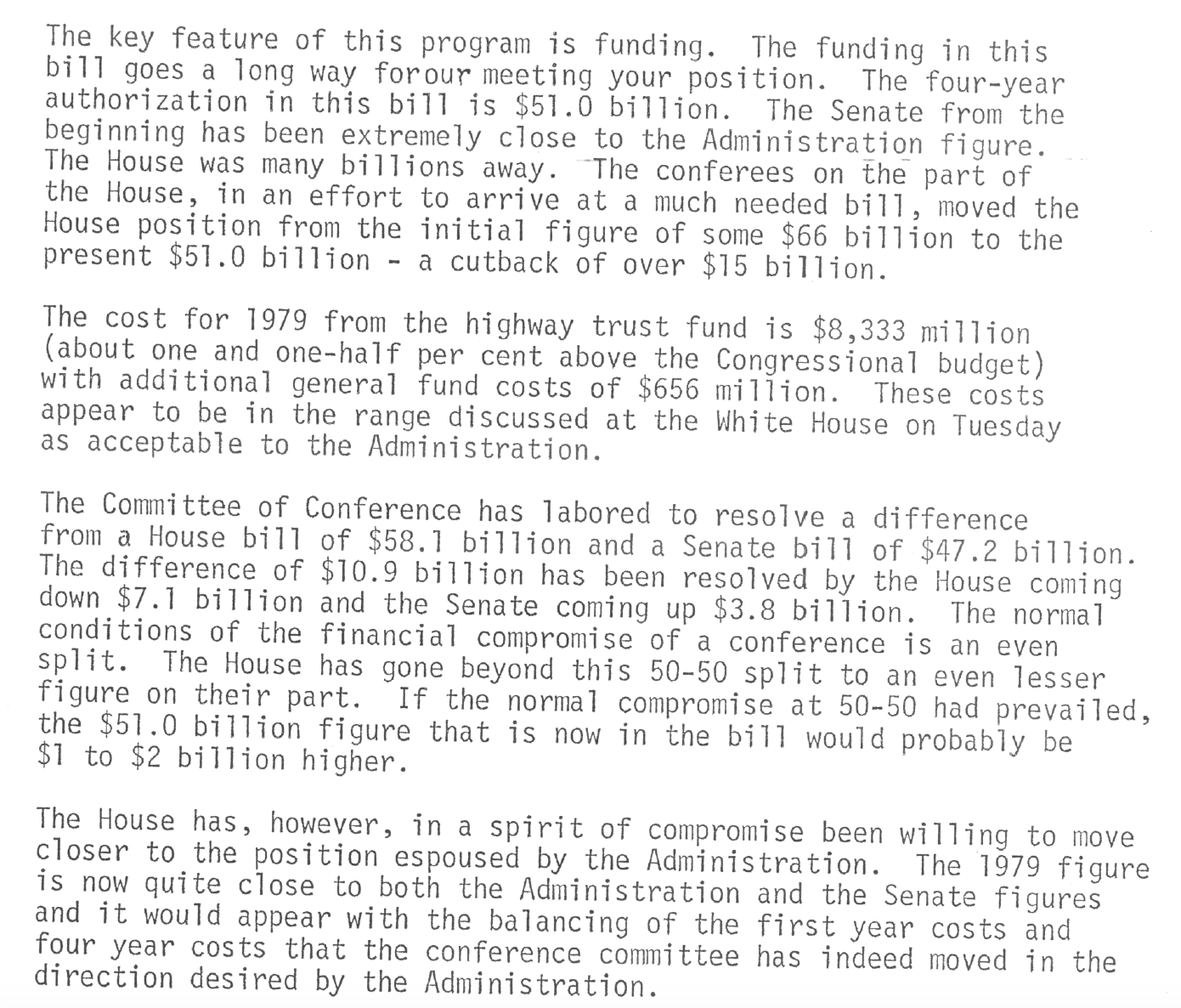

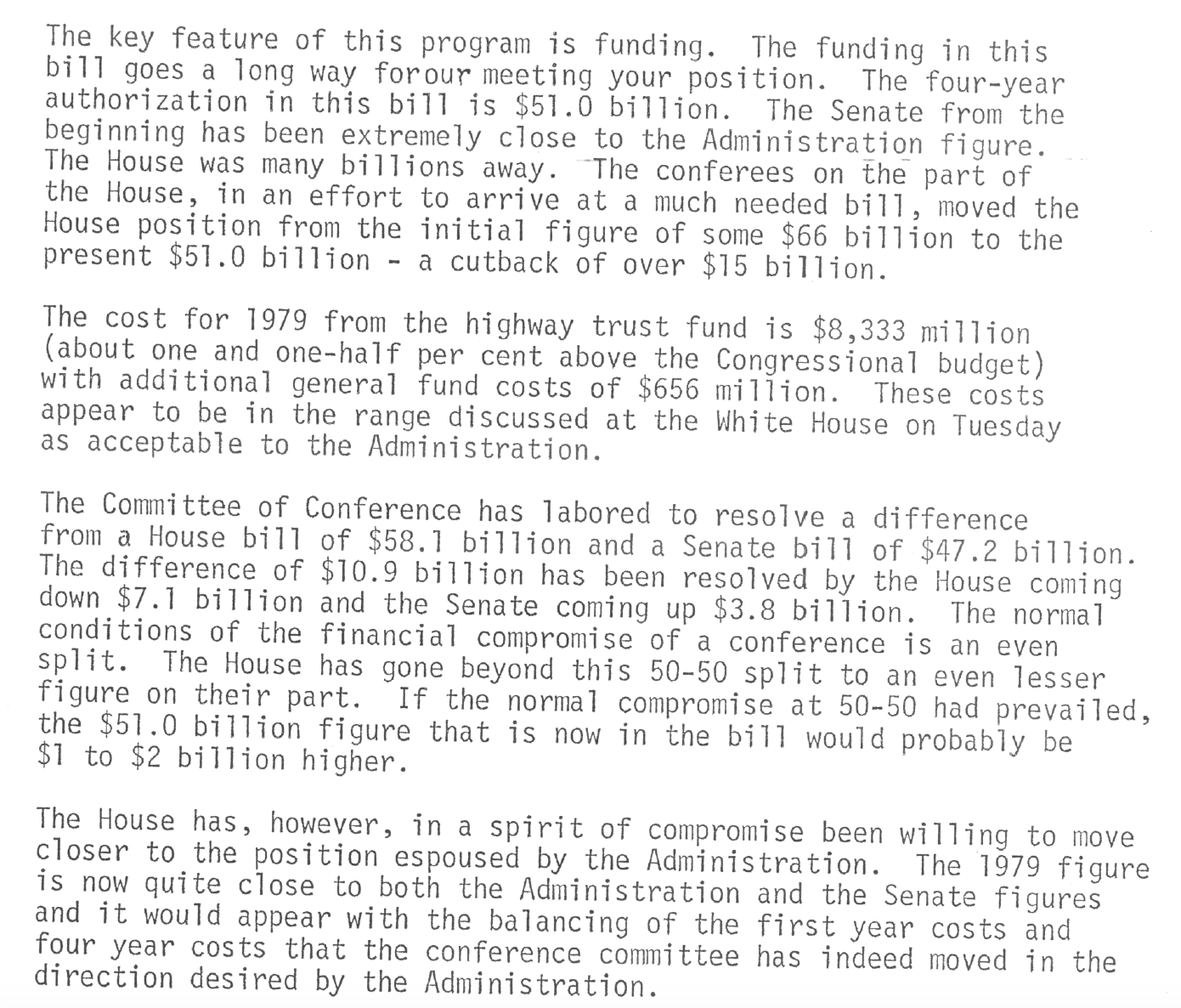

Would Carter sign the bill? On October 13 (Congress was in session 24-7 at this point), the lead conferees, House PWT chairman Bizz Johnson (D-CA) and Senate EPW chairman Randolph, sent President Carter a letter notifying him that they had reached agreement and urging him to sign the bill. The letter emphasized how much ground the House had given on the numbers:

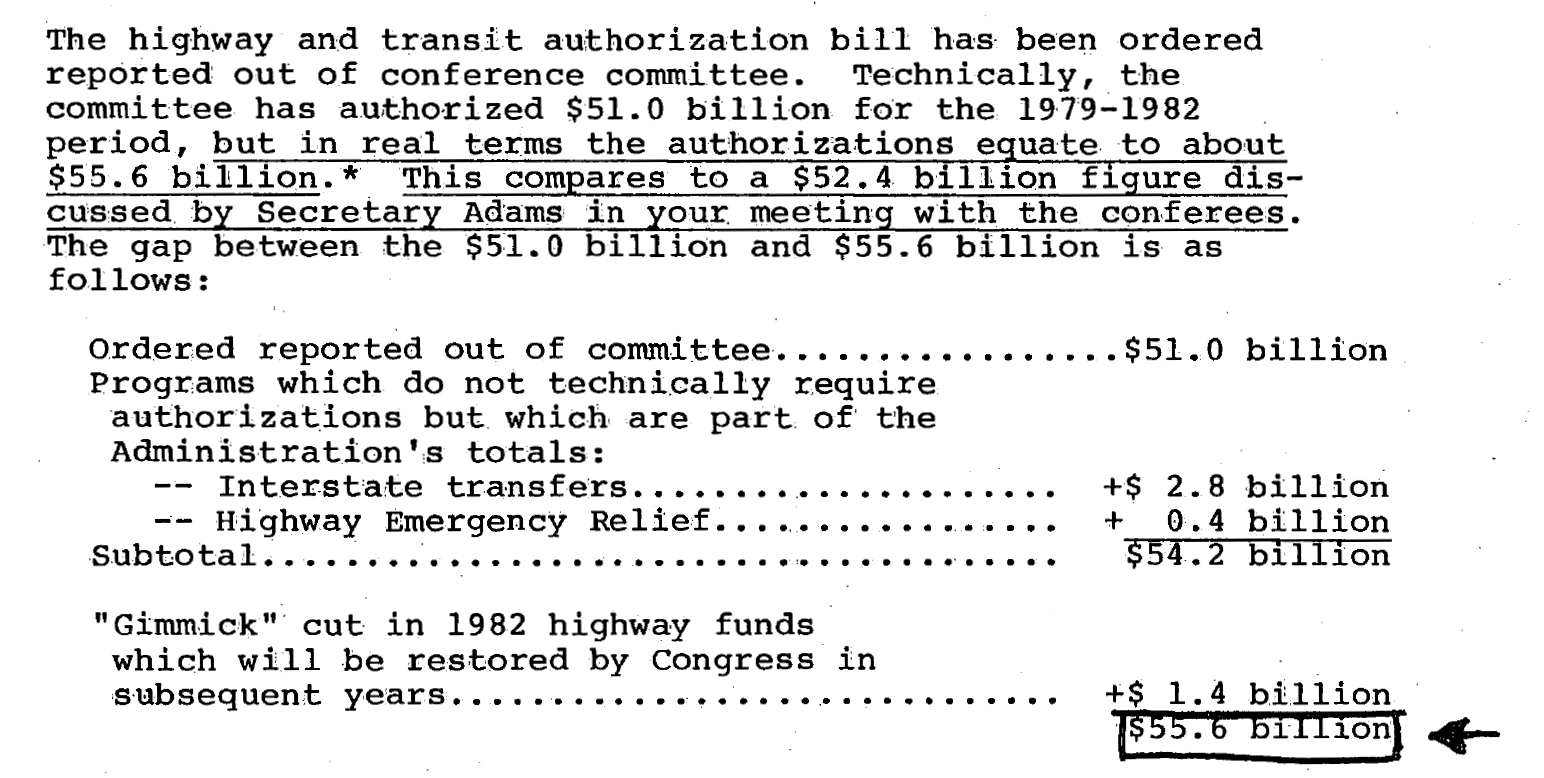

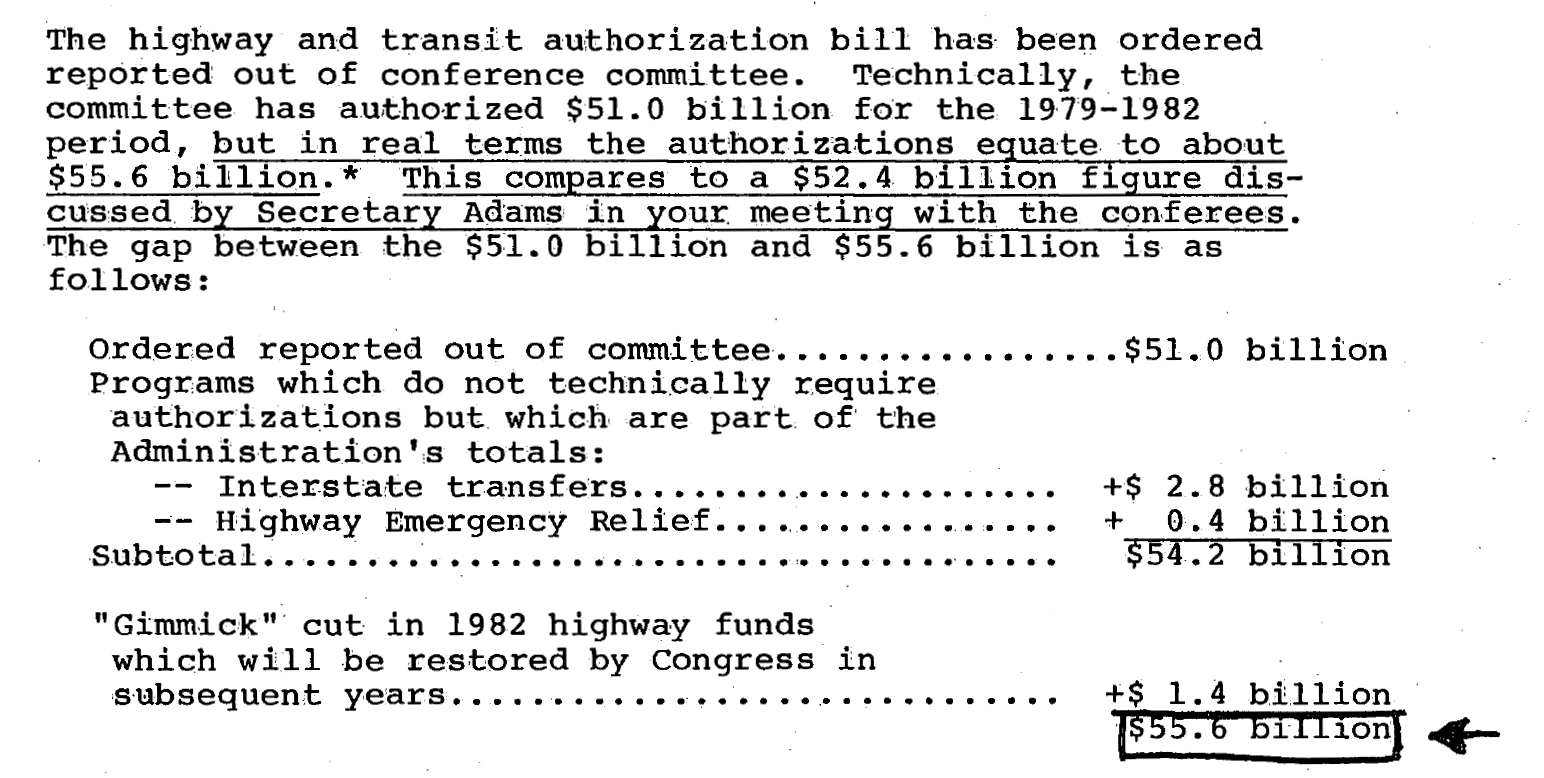

But over at the White House, President Carter’s team was already questioning the validity of those numbers. The text of the final conference report was not yet available, but on October 12, OMB Director Jim McIntyre sent Carter a memo alleging that the real total spending authorized under the bill was $55.6 billion, not the promised $51 billion:

OMB Director McIntyre explained that “the House Public Works Committee conferees proposed a $1.4 billion cut in 1982 highway trust fund authorizations. Consequently, trust fund authorizations would be $8.5 billion in 1979, $9.0 billion in 1980, $9.5 billion in 1981, but only $8. 2 billion in 1982. Clearly, it is the intent of the House conferees to provide supplemental funds for 1982 at a later date.” (This gimmick was later used by Congress in the 2005 SAFETEA-LU law and the 2015 FAST Act as a means of keeping bill totals down.)

Carter then called Brock Adams to ask what was going on. Adams wrote to President Carter on October 13 to tell him “As I indicated to you on the telephone yesterday, a figure of $55.6 billion does not truly reflect what has happened.” Adams pointed out that Carter really shouldn’t worry about the general fund authorizations, since he would have subsequent veto power over those, and the same went for the 1982 cut that Congress hoped to restore. Instead, “We can very realistically assume that the appropriations process will plan our spending into the $52 and $53 billion range we discussed with the conferees.”

Adams said that the most important thing was that “the Bill, as we see it, includes approximately $34 billion of Trust Fund contract authority (as compared with your request of $33 billion)…The Trust Fund expenditures are well within the Trust Fund revenues.”

Carter’s own domestic policy advisor, Stu Eizenstat, split the difference: “My own preliminary judgment is that the spending in the bill is somewhat above the $52.4 billion figure discussed with the conferees, but not as much as OMB argues.”

Mort Downey, the Assistant Secretary of Transportation for Budget and Programs at the time, recalls going to a long meeting in Eizenstat’s office on the morning of Saturday the 14th to figure out whether or not Carter should sign the bill, with DOT recommending yes and OMB recommending no. The decision was made that the President should sign the bill but that they should not tell anyone, because there were a lot of moving parts of the year’s legislative agenda still in play.

Congress held a long continuous session the weekend of October 14-15. The conference report on the transportation bill was finally filed. Jim Howard later told The Washington Post that late Saturday night, he met with Carter White House officials in the Capitol on the Administration’s energy bill (the top Carter priority) and asked if the President would sign the transportation bill. After the White House aides refused to commit on the transportation bill, Howard told them that if the President vetoed it, Howard and several New Jersey colleagues would vote “no” on the energy bill.

According to Howard’s account, Speaker O’Neill then called the President, and a call from O’Neill to the President shows up on the White House call log at 1:18 a.m. on Sunday October 15. The President told O’Neill that he would sign the transportation bill (which he was already was going to do anyway), and Howard was allowed to think he had sealed the deal for the transportation bill by leveraging energy bill votes. The conference report on the transportation bill was debated and adopted by the House and the Senate by voice vote in the wee hours of Sunday morning. Congress then adjourned for the elections. (Howard died in March 1988 still thinking that he had single-handedly leveraged enactment of the transportation bill with his vote on the energy bill.)

Congress did not present the final enrolled form of H.R. 11733 to the White House until October 27, which gave Carter ten days (not counting Sundays) to either sign the bill or veto it, lest it then become law without his signature.

Carter took his time with it. The bill would automatically become law on November 8, and Eizenstat sent Carter a summary memo dated November 5 indicating that all federal agencies concerned, and all White House staff, agreed that he should sign the bill. In addition, he noted that “In light of the Congressional view that the bill represents an Administration victory, it is very doubtful we would sustain a veto.”

The staff recommended that Carter “sign the bill by Monday, November 6, in order to generate some pre-election publicity that may be helpful to Jennings Randolph and other Democrats [in the November 7 elections].” Carter did sign the bill on Monday, November 6, but there was no ceremony (Carter was up at Camp David) and no signing statement.

White House staff had also recommended that Carter call Randolph and Howard when he signed the bill to notify and congratulate them, but Carter wrote “not done” next to that line of the memo. The bill became Public Law 95-599.

The enacted law:

- Did not contain the Morgan amendment language adopted unanimously by the Senate declaring a national policy “that annual authorizations for programs to be financed from Highway Trust Fund be closely related to anticipated annual receipts accusing to the fund.”

- Increased the federal share of non-Interstate highway projects from 70 percent to 75 percent. (It had been 50 percent from 1916 through 1970.)

- Created what is now called the “full funding grant agreement” model for funding new mass transit systems, whereby the Secretary could make not-legally-binding promises of future appropriations which might or might not ever be made. Section 302 of the act allowed USDOT to issue “letters of intent” which “shall be regarded as an intention to obligate from future available budget authority provided in an appropriation Act not to exceed an amount stipulated as the Secretary’s financial participation in the defined project under this section. The amount stipulated in the letter, when issued for a fixed guideway project, shall be sufficient to complete an operable segment. No obligation or administrative commitment may be made pursuant to such a letter of intent except as funds are provided in appropriations Acts.”

1978 vs 2005. In retrospect, the original House version of the 1978 bill was very much like the 2005 SAFETEA-LU law that bankrupted the Highway Trust Fund in that it was predicated on a complete “spend-down” of Trust Fund balances over the life of the bill, leaving the Congress in which the bill ended with hard choices of raising taxes, cutting spending, or bailing out the Trust Fund shortly after the expiration of the authorization period. But the attempt to enact such a spend-down strategy in 1978 failed, whereas in 2005 it succeeded. It is worth noting how the 1978 experience differed from 2005.

House-Senate solidarity. In 2005, the House and Senate committees both wanted the higher spending levels, but in 1978, the Senate committee sided with the President against unsustainable spending and the House was unable to budge them. This may also have had something to do with…

The role (and respect) of the Budget Committees. The fiscal 1979 budget process was only the third year of the new Congressional budget system. (They did a non-binding dry run in fiscal 1976 and the first full year was fiscal 1977.) Many legislators, particularly in the Senate, were committed to giving the budget process a chance. The fact that Congress had just voted for a budget resolution supporting the Senate numbers held a lot of sway with Senators at the time. (The complete collapse of the Congressional budget process in the subsequent decades has rendered the aggregate totals in the budget resolution a bit quaint, but even today, the Budget Committee gets a lot more respect in the Senate, if only because the points of order under their jurisdiction take no less than 60 votes to waive.)

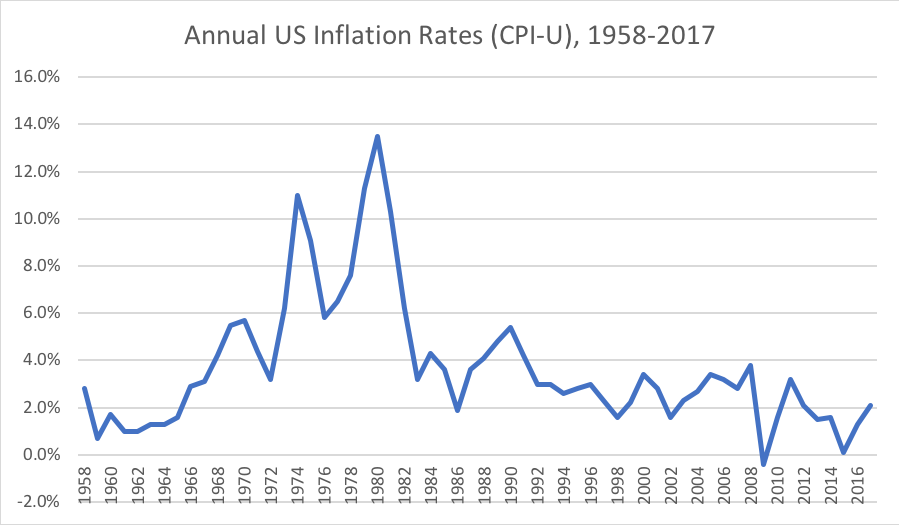

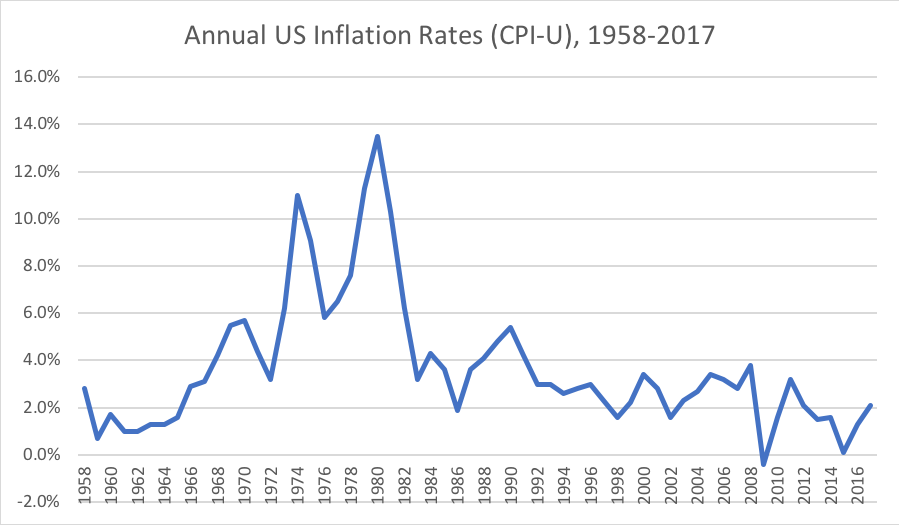

Inflation. It has now been over 30 years since Fed chairman Paul Volcker, with backing from Carter and then from Reagan, killed The Great Inflation by throttling it with high interest rates. But no discussion of any domestic politics from the late 1960s through the early 1980s can be held without discussing the 800-pound inflationary gorilla that was in every room dominating every fiscal argument. In 1978, annual inflation rates were back up to double digits on their way to a modern peak.

President Carter, like President Ford before him, prefaced all of his statements in opposition to higher federal spending in terms of the effect such spending would have on reinforcing inflation.

This was particularly true in the highway sector. FHWA started keeping the Bid Price Index in 1972, and over seven years, here is what had happened to the prices specific to highway construction:

| Construction Inflation in the 1970s |

|

HTF Outlays |

Excavation |

PC Concrete |

Asphalt |

Struc. Steel |

|

(Billion $) |

(cu. yd.) |

(sq. yd.) |

(ton) |

(lb.) |

| 1972 |

$ 4.69 |

$ 0.72 |

$ 6.42 |

$ 9.23 |

$ 0.34 |

| 1973 |

$ 4.81 |

$ 0.80 |

$ 7.00 |

$ 10.02 |

$ 0.37 |

| 1974 |

$ 4.60 |

$ 1.00 |

$ 8.88 |

$ 14.74 |

$ 0.55 |

| 1975 |

$ 4.84 |

$ 1.03 |

$ 8.88 |

$ 15.13 |

$ 0.55 |

| 1976 |

$ 6.52 |

$ 1.03 |

$ 8.92 |

$ 14.83 |

$ 0.48 |

| 1977 |

$ 6.15 |

$ 1.16 |

$ 9.95 |

$ 15.47 |

$ 0.52 |

| 1978 |

$ 6.06 |

$ 1.54 |

$ 11.90 |

$ 17.16 |

$ 0.60 |

| 7-year incr. |

+29% |

+114% |

+85% |

+86% |

+75% |

Although the inflation related to the 1973 OPEC oil embargo was part of the problem, the highway program itself played a role. When the Impoundment Control Act took effect in the spring of 1975, the floodgates opened and billions of dollars of highway contract authority that had been held back for years became available. That year, new highway obligations increased by almost 50 percent. Those outlays then hit the economy in fiscal 1976, going from $4.8 billion to $6.5 billion in a single year (a 35 percent increase).

Howard was then proposing another 40-something percent increase in highway spending on top of that. Infrastructure spending advocates love to talk about the economic stimulus and job creation brought by their spending increases. But they can’t take credit for the economic stimulus of such spending in times of low inflation and then deny partial blame for the effects of such spending in times of high inflation. Live by the theories of John Maynard Keynes, die by the theories of John Maynard Keynes.

Inflation was not a factor in 2005, nor is it a real political factor today. But it can always come back, and when it does, the political dynamics of government spending may change swiftly.

Deficits still mattered. In 1976, Jimmy Carter was running for President as the federal government was in the process of running a FY 1977 deficit of 4.1 percent of GDP – the highest since 1946. (The budget had been balanced as recently as 1969. Carter ran against the fiscal irresponsibility of the Ford Administration and on a campaign of deficit reduction.

Contrast this with 2005, where the 2001 and 2003 Bush tax cuts and the 2003 Medicare prescription drug benefit law had both contributed to massive deficits and all but destroyed Republican credibility on the issue.

Earmarks. Just looking at the text of the laws, the biggest difference between the 1978 law and the 2005 law is that the former had almost no earmarks (it had ten highway earmarks, to be precise). The 2005 law had over 6,000. This functioned not only as the equivalent of vote-buying amongst rank-and-file members, giving them something tangible they could take home to their state or district, but it also helped the highway committees subvert the people who were supposed to be the guardians of the Trust Fund and of the Treasury in general.

Responsibility for Highway Trust Fund solvency is actually the purview of the House Ways and Means Committee, not the House Transportation and Infrastructure Committee. But the astounding $750 million in earmarks that Ways and Means chairman Bill Thomas (R-CA) got in the 2005 bill may have been on his mind more than was the long-term solvency of the Trust Fund. Likewise, House Budget chairman Jim Nussle (R-IA) got $35 million for a bridge he desperately needed. Not to mention that House Speaker Dennis Hastert (R-IL), who mediated between Congress and the White House on the overall parameters of the bill, secretly owned real estate close to his $200 million Prairie Parkway earmark, and the Chicago Tribune reported that he made $3 million personally from selling the land after the earmark was secured.

Lessons learned? At a minimum, presentations of Highway Trust Fund finances from OMB, CBO and DOT should do a much clearer job at identifying cumulative long-term liabilities and identifying how much future excise tax revenues those liabilities equal.

The budget presentation of the Airport and Airway Trust Fund has, for decades, included a line showing the “uncommitted” balance in that Trust Fund as well as the cash balance, which usually demonstrates that most of the cash surplus is already spoken for and awaiting eventual expenditure.

By contrast, if you have access to the detailed Highway Trust Fund projections from CBO and OMB and dig down into the line items for each account, you can piece together that there are at least $100 billion in future outlays that must take place from the Trust Fund due to binding legal obligations entered into before right this minute – but there isn’t any kind of public budget presentation that really spells this out.

Perhaps the Highway Trust Fund could benefit from an additional kind of presentation from CBO and OMB that shows unobligated and uncommitted balances to date weighed against current cash balances and projected tax revenues through the scheduled end of those taxes (a variant on what the old Byrd Test used to represent, only with obligation authority instead of contract authority) so that the relationship between proposed new spending authority and extensions of taxes and other deposits is more clear.

At this time, the only bill before the Senate was the highway bill – S. 3073 did not contain any mass transit authorizations, which were being produced by the Banking Committee in a separate bill (S. 2441, 95th Congress). So, in the context of a highway-only bill, and in a budget situation where mass transit was no longer guaranteed multi-year funding, Sen. Ted Kennedy (D-MA) proposed to abolish the Highway Trust Fund entirely.

At this time, the only bill before the Senate was the highway bill – S. 3073 did not contain any mass transit authorizations, which were being produced by the Banking Committee in a separate bill (S. 2441, 95th Congress). So, in the context of a highway-only bill, and in a budget situation where mass transit was no longer guaranteed multi-year funding, Sen. Ted Kennedy (D-MA) proposed to abolish the Highway Trust Fund entirely.

In the end, Budget chairman Giamo was only able to convince 110 of his colleagues to support his amendment limiting Highway Trust Fund funding to the level called for in the budget resolution. The vote was 111 yeas, 238 nays (with 83 absentees). Giamo drew support from most of his Budget colleagues (though not those who also served on Public Works, like Jim Wright (D-TX) and Norm Mineta (D-CA)), and some members of Ways and Means and of Appropriations. But it was no match for Public Works and the powerful highway lobby.

In the end, Budget chairman Giamo was only able to convince 110 of his colleagues to support his amendment limiting Highway Trust Fund funding to the level called for in the budget resolution. The vote was 111 yeas, 238 nays (with 83 absentees). Giamo drew support from most of his Budget colleagues (though not those who also served on Public Works, like Jim Wright (D-TX) and Norm Mineta (D-CA)), and some members of Ways and Means and of Appropriations. But it was no match for Public Works and the powerful highway lobby.