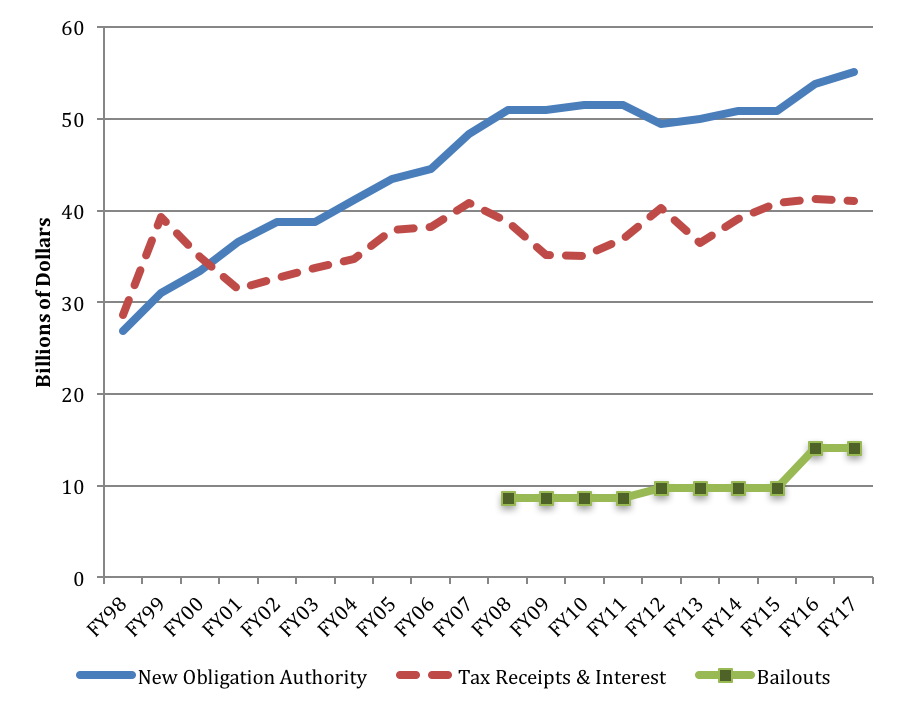

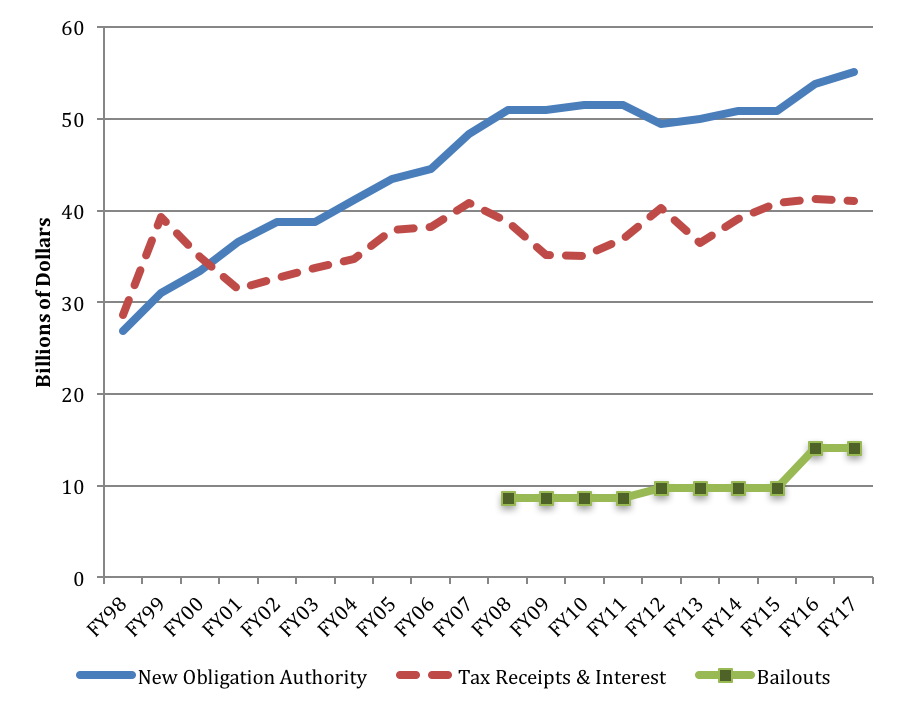

The following chart shows Highway Trust Fund annual new spending obligation authority granted by Congress (obligation limitations, exempt-from-obligation contract authority, and direct appropriations), net tax receipts, and average annual bailout transfers from the general fund or LUST Trust Fund (starting in 2008), in billions of dollars. Updated through actual FY 2017 tax receipts.

A note on FY 1999: Section 901 of the Taxpayer Relief Act of 1997 (P.L. 105-34) transferred 4.3 cents per gallon in motor fuels excise tax receipts (which had previously gone into the general fund for deficit reduction) into the Highway Trust Fund, effective in FY 1998, but for some reason, subsection 901(e) pushed back the transfer of fourth quarter tax receipts of FY 1998 taxes to October 5, 1998 (the first quarter of FY 1999), which is the reason for the misleading spike in revenues in FY 1999 – because FY 1999 had fifteen months of extra gas tax revenue.

How bailout averages were calculated: Bailouts are averaged by authorization period. $34.5 billion in the SAFETEA-LU/extension period (FY 2008-2011) averages $8.6 billion per year; $38.8 billion in the MAP-21/extension period (FY 2012-2015) averages $9.7 billion per year; and the annual average under the FAST Act ($70.3 billion over five years) is $14.1 billion per year.