Guest Op-Ed by Chris White, Thompson Research Group

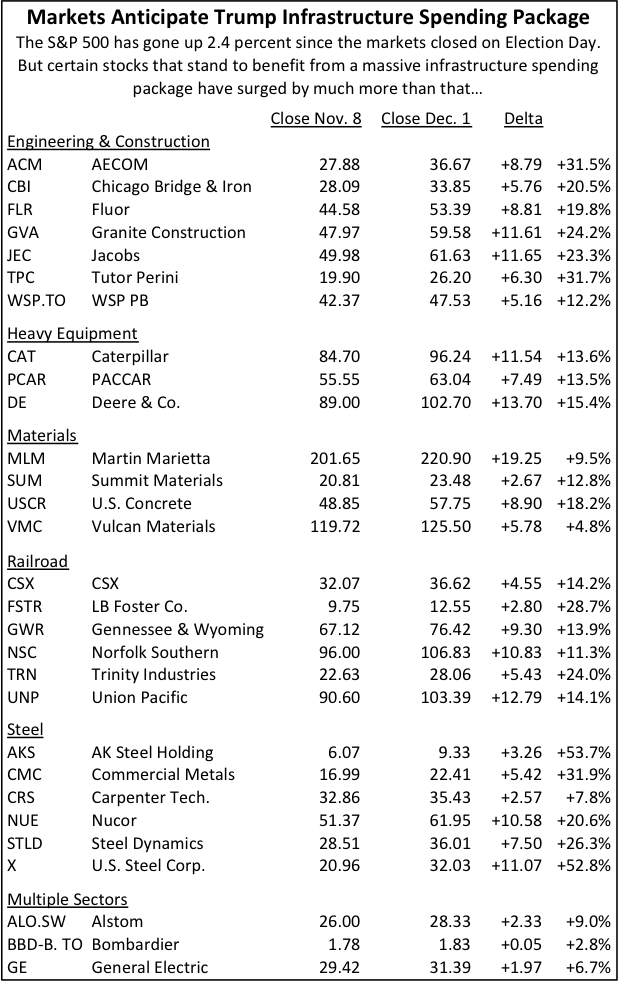

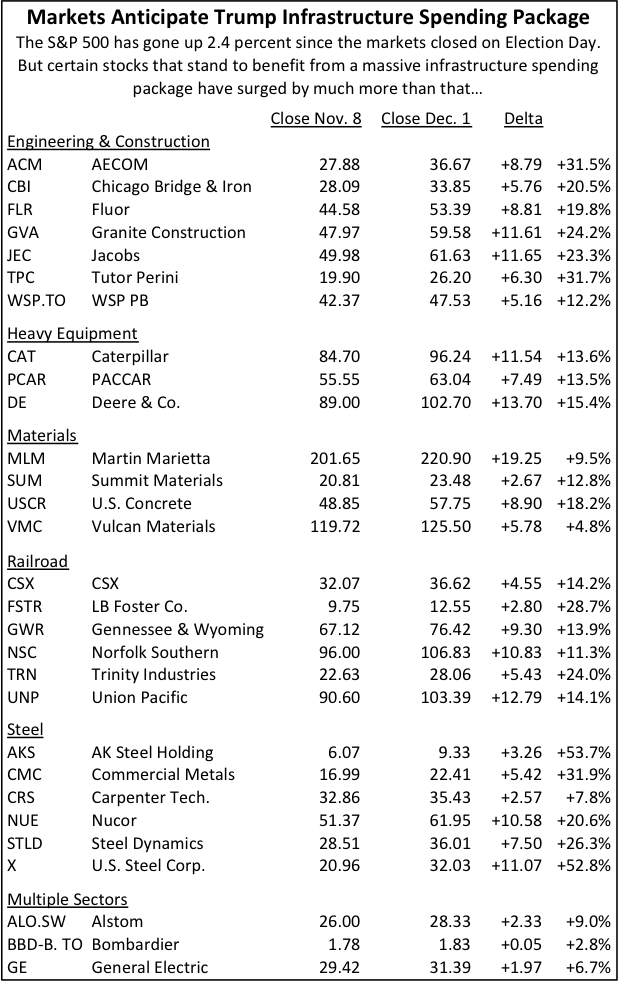

Shares of construction-related stocks have jumped since election night based on optimism a Trump administration will make improving the country’s infrastructure a priority. President-elect Trump has stated as much as $1 trillion could be spent upgrading roads, bridges, water systems, utility grids, airports, schools, and the list continues. But after 15-30% gains in many industry-related stock prices over the past couple of weeks, have investors built too lofty expectations into a potential stimulus plan for which details have yet to be defined? We believe two components need to be known: the details of a stimulus plan and an investor’s time horizon.

What we currently know about a Trump infrastructure plan is limited: anywhere between $500 billion and $1 trillion over 5-10 years dedicated to various infrastructure projects that will be revenue-neutral, according to Trump senior advisors, relying heavily on private investors and tax credits. A big number, no doubt. But here is where details begin to matter. Private dollars will require a return for their investment. Are there enough infrastructure projects with a returning revenue stream to satisfy even a third of the proposed dollars?

The answer might lie in the fact that the current federal highway bill, the FAST Act enacted in December 2015, significantly reduced TIFIA funding (a program specifically designed to attract private investment dollars) from the previous highway bill, MAP-21, due in part to a limited number of potential revenue-generating projects. Many large users of the TIFIA program, such as Texas, have recently begun dedicating money specifically for non-toll road projects, as the need for many revenue-generating opportunities have already been met. State Departments of Transportation (DOT) sources also share that the number of revenue generating projects are very limited.

Ultimately, we believe Trump, the deal-maker, will agree to a bill containing billions in federal spending, as well. As one Trump senior economic advisor acknowledged recently, Democratic votes from both the Senate and House will be necessary for an infrastructure stimulus bill to pass Congress. The use of federal dollars will help gain Democratic votes by broadening the pool of eligible projects and providing additional assurance of job creation.

Decision-making authority and flexibility outlined in a Trump stimulus plan given to states will be critical. Under the Obama stimulus plan, ARRA passed in 2009, state DOTs were forced to use funding for “shovel ready” projects that would begin within 90 days. Those requirements, ultimately, led to nearly 75% of highway and bridge funding to be used for resurfacing. While states were grateful for the funding, few would say it was the best use of $27.5 billion. DOTs are hoping for fewer strings attached to a potential stimulus plan, allowing states to address projects that have been shelved for years due to lack of funding, many of which are state-owned and managed roads which prohibit federal dollar funding. Given fewer restrictions, state DOTs have billions of dollars in project backlogs waiting for funding.

Until more clarity is provided, however, DOTs cannot begin planning for future projects. Many states will hope for an “allocation-based” distribution of funds, similar to the federal highway bill. As noted by one state DOT official, providing funds solely to states that have shunned transportation investments in the past, allowing bridges to deteriorate for example, fails to recognize the commitment made by other states that have invested in maintaining their assets.

Another subject on DOT and investor minds, alike, is the timing of funding availability and when will project work actually “hit the road.” Assuming Congress can agree on funding sources and a bill can be passed in the first 100 days of the new administration, it is likely significant construction and corresponding dollar outlays, will not be seen until late-2017 and more significantly in 2018 and 2019. For larger road projects, either expansion or new, the construction cycle can be as long as 4 years, with peak outlays in years 2 and 3. Given the sharp rise in construction-related stocks since the election, however, investors are confident a stimulus plan will be passed and that significant dollars will be flowing to industry participants.

Who will be the biggest winners? We believe companies in the aggregate industry, companies that extract rock from the ground, have the most upside for several reasons. First, aggregates are used in nearly every type of construction. Whether stimulus dollars go toward highway work, government buildings (such as education or health care), water infrastructure, airports or transit, aggregates will be an integral part of the construction process as there are few alternatives. In addition, unlike other construction materials such as cement or even wallboard, aggregates are a local business, as the cost of transportation normally prevents hauling rock greater than 100 miles, and certainly from overseas. Should President-elect Trump’s tax cuts take hold, consumers will have additional money in their pockets for investing in housing, another large use of aggregates.

Top players in the aggregate industry are Vulcan Materials, Martin Marietta, Eagle Materials, Summit Materials, and US Concrete. In a sign of the demand and attractiveness of the industry, Headwaters, which provides a supplement to cement mixture, announced it was being acquired by Australian firm Boral for $2.6 billion, a 20% premium to its close price on November 10. Finally, aggregate companies also have the tailwind of significant funding increases at the state-level where 25 states have recently passed some type of transportation funding increase giving industry participants a clear view of revenue streams for years to come.

Chris White is Co-founder of Thompson Research Group which provides financial research on public equities. The company has no conflicts of interests on the companies mentioned above. For further information, please contact Thompson Research Group. His views are his own and do not necessarily reflect those of the Eno Center for Transportation.