5:40 a.m. 3/26/2020 update: Earlier this morning, the Senate passed H.R. 748, as amended with the coronavirus aid package, by a vote of 96 to 0, sending the bill to the House of Representatives for final disposition. The Senate does not intend to return to D.C. until April 20.

House Majority Leader Hoyer’s office sent out an advisory last night stating: “Members are advised that the House will convene at 9:00 a.m. on Friday, March 27, 2020 to consider the bill. Members are further advised that due to the limited flight options, Members participating in self-quarantine, and several states mandating stay-at-home orders, we expect the bill to pass by voice vote on Friday.”

10:45 p.m. 3/25/2020 update: The text of the final bill upon which the Senate is about to vote is here and the transportation portions are indeed identical to what is summarized below.

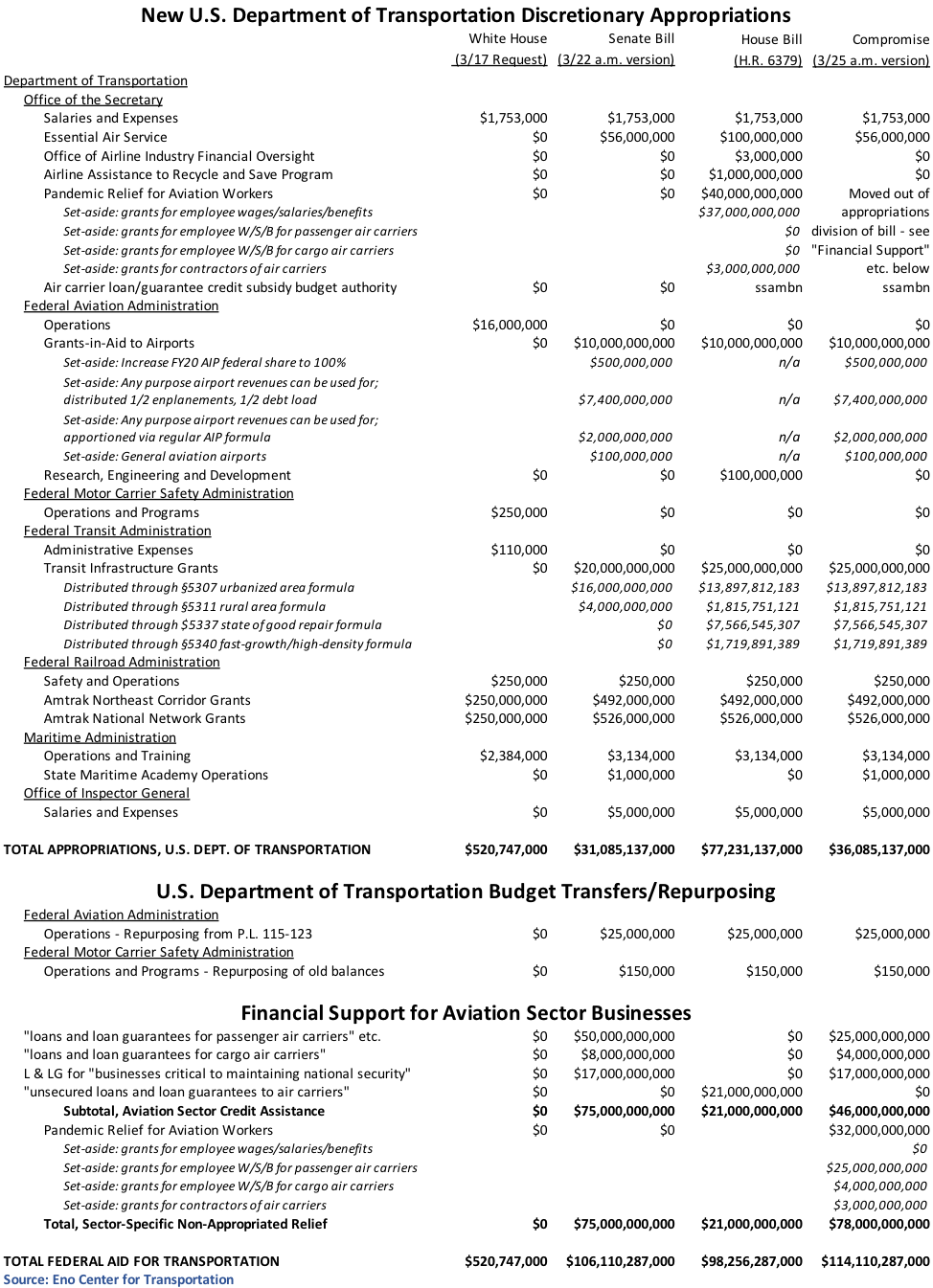

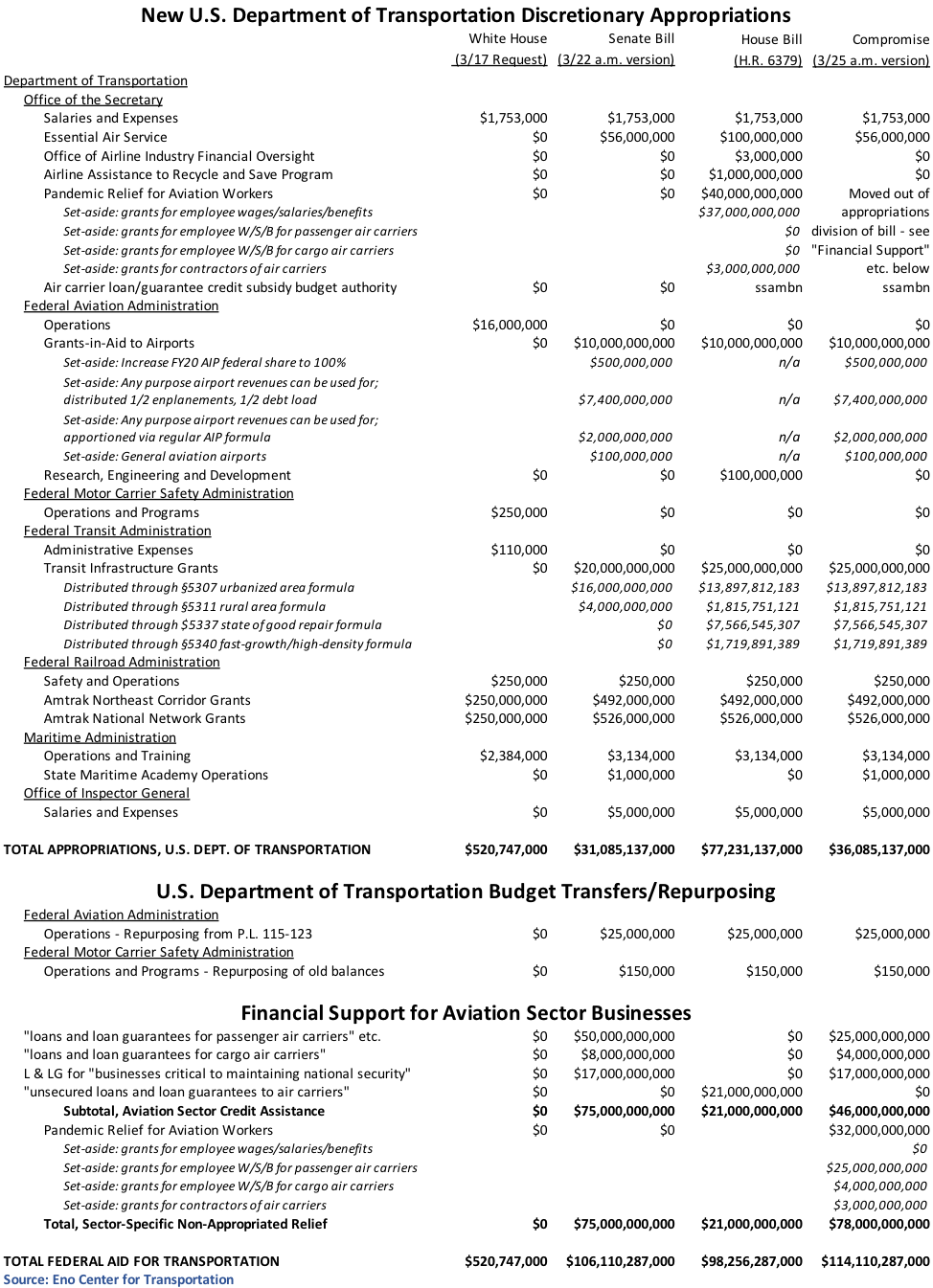

Original article: As of this writing (4:15 p.m. on Wed. 3/25/2020), the final legislative text of the $2 trillion (or thereabouts – who’s counting?) coronavirus response legislation has not yet been released. A last-minute holdup over whether or not unemployment benefits should be allowed to pay significantly more money than the job from which the recipient was laid off has stalled the bill rollout. (Three GOP Senators threatened to block the bill unless that was fixed, whereupon Bernie Sanders (I-VT) then promised to block the bill if the fix demanded by the GOP Senators was made.) But, by all accounts, the transportation specifics of the bill are locked in, and they provide $114 billion in specific federal aid to the transportation sector, as follows:

- $36.1 billion in discretionary appropriations for the U.S. Department of Transportation.

- $32 billion in grants for aviation sector businesses outside the appropriations process.

- Up to $46 billion in loans and loan guarantees for aviation sector businesses.

Senate leaders still hope to pass the bill today, with a House vote possible tomorrow. (House leaders are trying to thread the needle to get the farthest left-wing Democrats and the farthest right-wing Republicans to all hold their noses and let the bill pass by unanimous consent or by voice vote without demanding a roll call vote. A roll call which would push House passage to Friday (probably) and would upset a lot of House members who really don’t want to travel to D.C. right now).

On an account-level basis, the transportation aid in the tentative final draft bill looks like this:

Airline grants.

The bill provides $32 billion in direct grants for air carriers and related businesses (not via appropriations, but through mandatory non-appropriated budget authority), as follows:

- $25 billion for passenger air carriers.

- $4 billion for cargo air carriers.

- $3 billion for contractors performing catering, ground crew, and ticketing/check-in functions for Part 121 air carriers.

The Treasury Secretary (not the Transportation Secretary) shall administer the program and “shall provide financial assistance that shall exclusively be used for the continuation of payment of employee wages, salaries, and benefits…” Grants shall be distributed to individual carriers or other companies in proportion to the salaries and benefits those companies paid in the April 1 – September 30, 2019 biennium.

The Treasury is to issue program rules within 5 days of enactment and start cutting checks within 10 days of enactment. Grant recipients must agree not to cut pay or benefits, or issue involuntary furloughs, until after Sept. 30, 2020. Grant recipients are also forbidden from buying back their stock or paying stock dividends until after Sept, 30, 2021.

The Department of Transportation is authorized to force air carriers to maintain service to destinations served as of March 1, 2020 and maintain that service through March 1, 2022.

Aviation sector loans.

The tentative final bill establishes a $500 billion loan and loan guarantee program for business with 500 or more employees which can’t take advantage of the separate $349 billion small business loan program. Of that $500 billion. $46 billion is taken off the top for aviation sector businesses:

- Up to $25 billion for loans and loan guarantees for passenger air carriers, Part 145 repair stations, and ticket agents/brokers.

- Up to $4 billion for loans and loan guarantees for cargo air carriers.

- Up to $17 billion for loans and loan guarantees to ”businesses critical to maintaining national security” (a.k.a. Boeing).

The aviation sector loans have a much longer list of strings attached than do the grants. Loans can only be made if the Treasury Secretary determines that:

- Regular credit is not “reasonably available” for the applicant.

- The intended obligation is “prudently incurred.”

- The interest rate reflects market risk and is not less than a comparable pre-COVID rate.

- The loan duration is as short as practicable and no longer than 5 years.

- “the eligible business must have incurred or is expected to incur covered losses [directly or indirectly as a result of COVID] such that the continued operations of the business are jeopardized, as determined by the Secretary.”

Loan and loan guarantee agreements must contain the following:

- A prohibition on stock buybacks during the life of the loan unless already contractually obligated.

- A prohibition on dividend payments for the life of the loan plus one year.

- A requirement that recipient maintain March 24, 2020 employment levels “to the extent practicable” and under no circumstances can cut employment by more than 10 percent from that base.

- A certification that the recipient is based in the U.S. and has a a majority of its employees in the U.S.

- A freeze on compensation of executives who made over $425 thousand per year in 2019 (effective through 1 year after the end of the loan).

The loan program also gives the federal taxpayer “skin in the game” by requiring that the Secretary demand stock warrants (for publicly traded companies) or some other kind of debt instrument (for privately held companies) under “Such terms and conditions shall be designed to provide for a reasonable participation by the Secretary, for the benefit of taxpayers, in equity appreciation… ” The Treasury may sell such warrants “for the primary benefit of taxpayers.” Such warrants shall not give Treasury voting power.

Airline tax relief.

The tentative final bill suspends Airport and Airway Trust Fund excise taxes from the date of enactment through January 1, 2021.

This, combined with the slowdown in aviation activity, will probably drive the Trust Fund’s “uncommitted” balance below zero and begin to eat away at the $17 billion balance of money held in the Fund that is already obligated or otherwise committed but not yet spent. (In other words, it makes the AATF more like the Highway Trust Fund, which has a negative uncommitted balance.)

Airport grants.

The tentative final bill appropriates $10 billion from the general fund of the Treasury for grants-in-aid to airports, largely as proposed by the Senate bill.

- $500 million is to increase the federal share of FY 2020 Airport Improvement Program grants from as low as 80 percent up to 100 percent.

- $7.4 billion is for grants “for any purpose for which airport revenues can lawfully be used,” at a 100 percent federal share, apportioned 50% by 2018 enplanements and 50% by airport debt service costs.

- $2.0 billion is for grants “for any purpose for which airport revenues can be lawfully used,” at a 100 percent federal share, apportioned by the regular AIP formula. (In the original Senate bill, this $2 billion was more restrictive and was just like regular AIP grant money – airside capital projects only, not operating or groundside costs. But in the tentative final bill, it looks pretty much the same as the $7.4 billion, just via a different formula.)

- $100 million is for grants to general aviation airports “for any purpose for which airport revenues can lawfully be used,” at a 100 percent federal share, apportioned by airport percentage of total NPIAS development costs.

In order to receive grants, primary airports must maintain at least 90 percent of their employment levels (measured against the employment level as of the day the bill gets signed into law) through December 31, 2020.

Mass transit grants.

The tentative final bill appropriates $25 billion from the general fund of the Treasury for grants to mass transit agencies, largely as in the House bill. This money is to go out the door quickly – apportionments must be made with 7 days of the bill being signed into law.

The original Senate bill provided $20 billion – $16 billion to be given out via the urbanized area formula and $4 billion via the rural area formula. The House (in cooperation with certain Senate Democrats) drastically altered this, giving a lot of money out via the state of good repair formula, which heavily benefits the handful of “legacy” rail transit system, particularly New York City. The final bill maintains the Senate formula distribution, amongst four different formulas. Here is how that $25 billion will be apportioned (before the $75 million oversight takedown):

| Formula |

Estimated Amount |

| §5307 Urbanized Area |

$13.8 billion |

| §5311 Rural Area |

$2.0 billion |

| §5337 State of Good Repair |

$7.5 billion |

| §5340 Fast-Growth & High-Density State |

$1.7 billion |

| TOTAL |

$25.0 billion |

Key point – with regards to the money in this bill, it doesn’t matter which formula is used to distribute the money. All of the $25 billion carries the same purpose spelled out in the text of the bill. Grants are to be “available for the operating expenses of transit agencies related to the response to a coronavirus public health emergency…beginning on January 20, 2020, reimbursement for operating costs to maintain service and lost revenue due to the coronavirus public health emergency, including the purchase of personal protective equipment, and paying the administrative leave of operations personnel due to reductions in service…” The grants carry a 100 percent federal cost share.

While the grants could, in theory, be used for capital programs or operating costs, it is expected that almost all of the $25 billion will go towards operating costs to make up for lost farebox and dedicated tax revenues.

Amtrak grants.

The tentative final bill appropriates $1.018 billion from the general fund for grants to Amtrak – $492 million for Northeast Corridor grants and $526 million for National Network grants (though Amtrak is given the authority to transfer funds between the two accounts). Both grants are “to prevent, prepare for, and respond to coronavirus.”

The bill provides that no state shall have to pay Amtrak more than 80% of its FY 2019 PRIIA sec. 209 payment this year, and sets aside $239 million of the National Network grant to be “made available for use in lieu of any increase in a State’s payment”

A separate general provision in the back of the bill requires Amtrak to recall furloughed employees when service is restored to the March 1, 2020 levels.

Harbor Maintenance Trust Fund.

Senate Appropriations chairman Richard Shelby (R-AL) has appears closer than ever to been able to get his long-sought HMTF budget fix provision into a bill making it to the President’s desk.

His provision reads: ”Sec. 14003. Any discretionary appropriation for the Corps of Engineers derived from the Harbor Maintenance Trust Fund (not to exceed the total amount deposited in the [HMTF] in the prior fiscal year) shall be subtracted from the estimate of discretionary budget authority and outlays [for any budget scoring purposes]…”

In a normal year, this would allow $1.6 billion or so of HMTF appropriations for harbor dredging to be effectively off-budget, and not counted towards the Budget Control Act spending caps or any other kind of fiscal ceiling.

(We say in a normal year because the HMTF is funded by an ad valorem tax on cargo imported through U.S. seaports, and the coronavirus has already damaged Pacific trade volume and value this year.)

The language does not appear to allow spend-down of the $9+ billion built-up HMTF balances, only annual receipts and interest. The provision takes effect the earlier of Jan. 1, 2021 or the date of enactment of the next water resources development authorization law.

Other transportation.

Also included in the bill:

- A $56 million appropriation for Essential Air Service subsidies.

- $25 million in previous FAA emergency appropriations repurposed for coronavirus response.

- A general provision allowing truck weight limits on the Interstate system to be exceeded through Sept. 30, 2020 for trucks carrying emergency supplies so long as the President’s disaster declaration is in effect.

- A general provision NHTSA highway traffic safety grant deadlines if delays in state or federal commitment is due to coronavirus.