This week, the Federal Highway Administration updated its official measure of highway and bridge construction costs to indicate that those costs have increased by 20 percent in just one year (from the first quarter of calendar year 2021 to the first quarter of calendar year 2022).

This was the highest 1Q-on-1Q increase since this index was established in 2003.

| CY |

1Q NHCCI |

Change |

| 2003 |

1.00 |

|

| 2004 |

1.05 |

+5.0% |

| 2005 |

1.24 |

+18.1% |

| 2006 |

1.45 |

+16.9% |

| 2007 |

1.56 |

+7.6% |

| 2008 |

1.57 |

+0.6% |

| 2009 |

1.50 |

-4.5% |

| 2010 |

1.44 |

-4.0% |

| 2011 |

1.46 |

+1.4% |

| 2012 |

1.63 |

+11.6% |

| 2013 |

1.59 |

-2.5% |

| 2014 |

1.63 |

+2.5% |

| 2015 |

1.72 |

+5.5% |

| 2016 |

1.63 |

-5.2% |

| 2017 |

1.62 |

-0.6% |

| 2018 |

1.67 |

+3.1% |

| 2019 |

1.85 |

+10.8% |

| 2020 |

1.97 |

+6.5% |

| 2021 |

1.91 |

-3.0% |

| 2022 |

2.29 |

+20.0% |

In terms of increase over the previous quarter (4th quarter 2021), the first quarter 2022 index was up 4.9 percent.

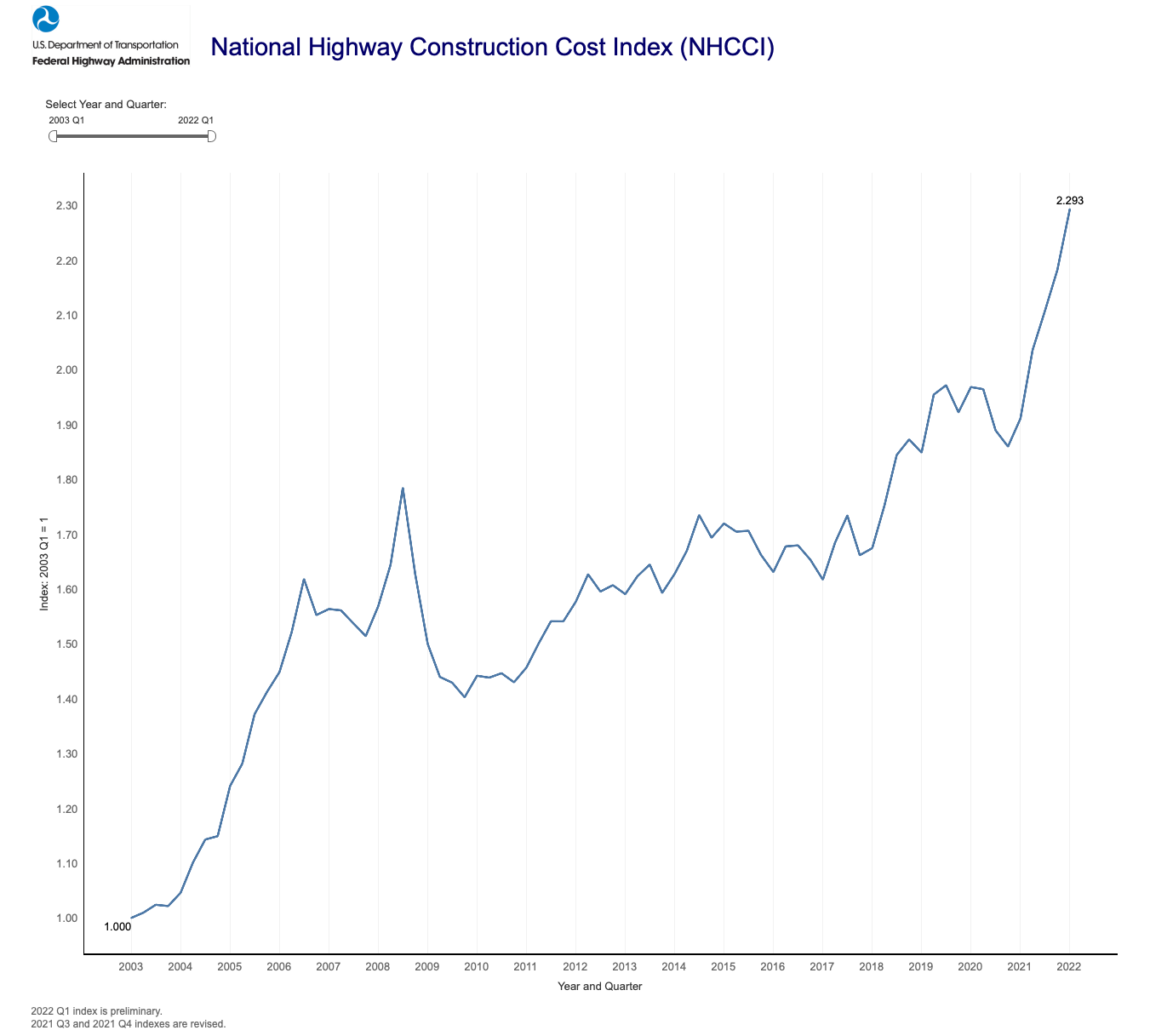

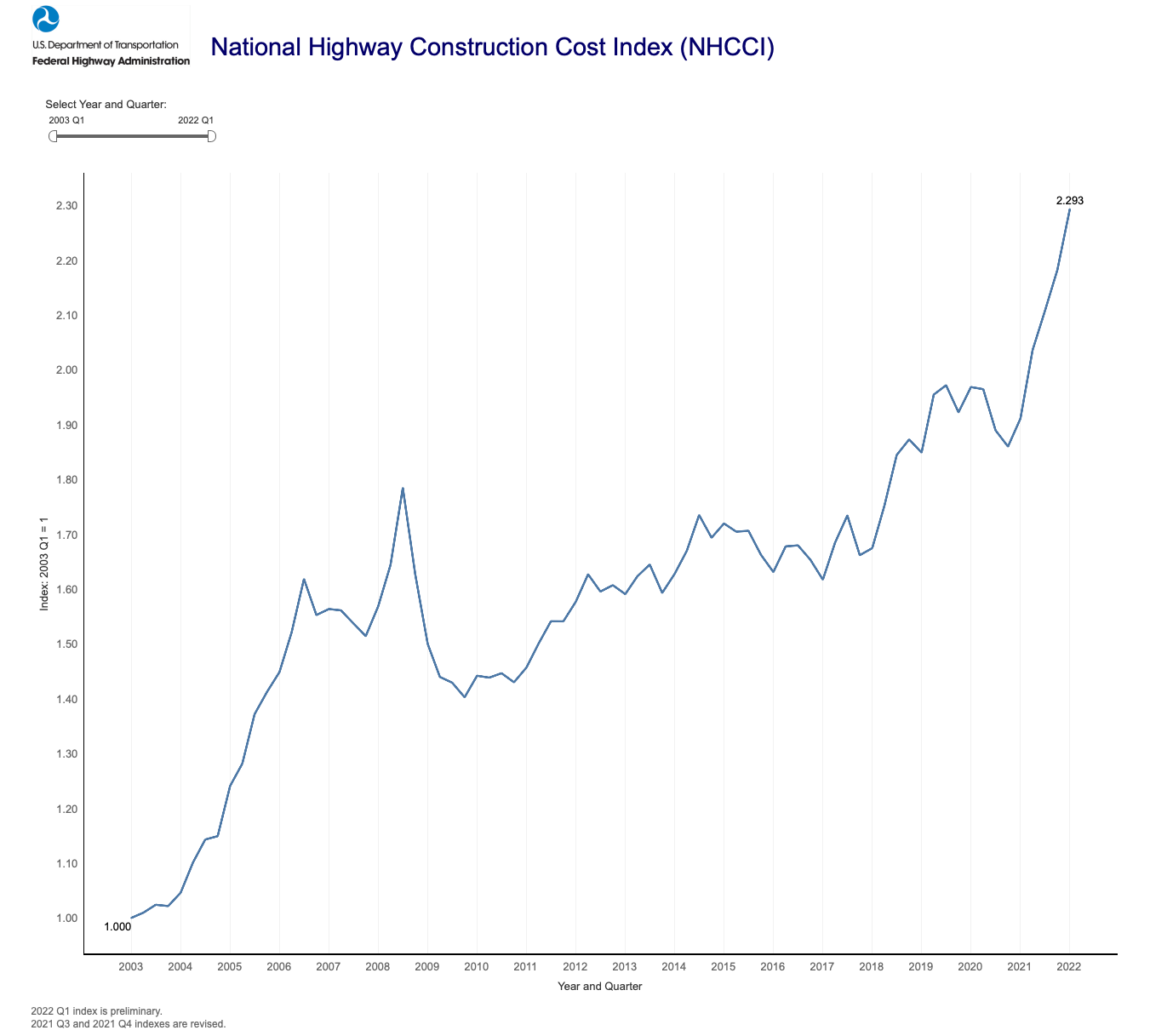

The official graph of the National Highway Construction Cost Index (NHCCI) through the first quarter of 2022 is below, and shows the huge increase in costs (many related to China’s entry into the WTO construction materials markets after 2002) early on in the period, followed by flux, and then the latest increase.

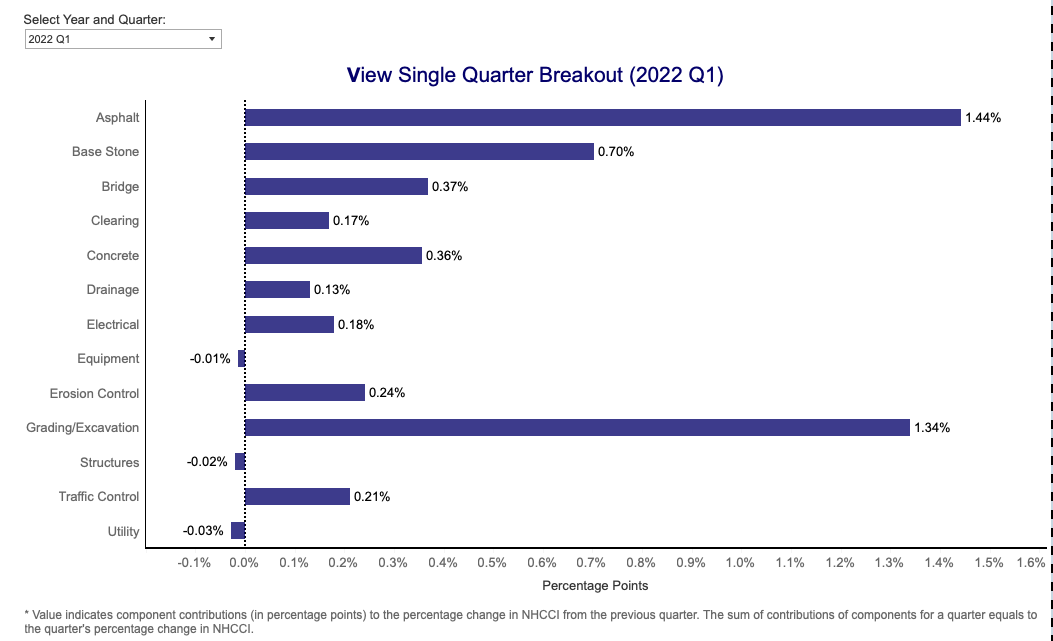

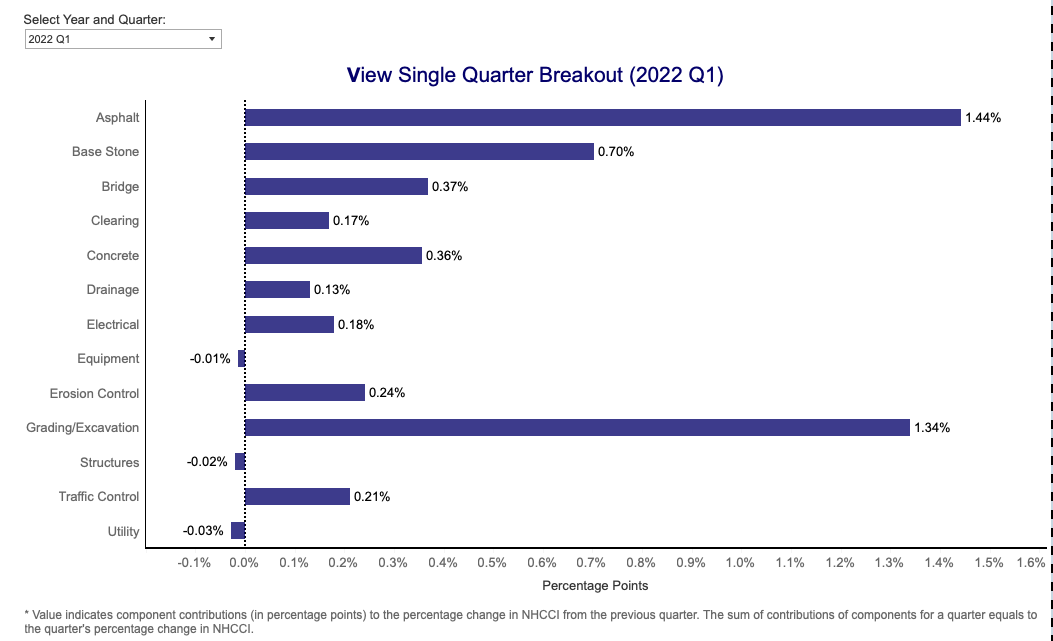

When looking at the specific components of the 1st quarter 2022 cost increases over the previous quarter, asphalt is the (predictable) standout. In a time of sharp fossil fuel cost increases, asphalt gets hit three ways:

- The asphalt binder itself is the heavy residue left after the rest of a barrel of crude oil has been refined, so high crude prices directly contribute.

- Asphalt has to be “hot mixed” at the plant, to around 300 Fahrenheit, which is usually done by natural gas (or sometimes diesel) heaters.

- The mixed asphalt then has to be kept warm all the way to the job site, usually done by portable diesel heaters.

The other major culprit was grading and excavation, which is (a) also at the whim of high energy prices because of the diesel fuel used by excavating and grading equipment, and (b) also subject to labor cost increases in a tight labor market.

Crude oil and its derivative prices peaked in the 2nd quarter of 2022 before declining, so to the extent that the NHCCI reflects those costs, the numbers announced three months from now are also certain to be bad.

But it is important to remember that we are talking about the laws of supply and demand here. While cost increases related to the supply of construction products may level off in six months, that will also be the time when the massive influx in new federal highway funding from the bipartisan infrastructure law will be starting to saturate the demand for those products, potentially causing demand-side inflation.

Although the infrastructure law (the IIJA) was signed in mid-November 2021, the permission for states to initiate a massive 24 percent increase in their annual highway formula contracting did not go through until after the accompanying 2022 transportation appropriations act was enacted in mid-March 2022. (The formal permission slip for states to start signing contracts with the IIJA funding increase went out on April 1, 2022 (Notice 4520.274), so that money could not officially affect the volume of contract signed in the first quarter of the year.)

When all formula and non-formula programs are included, the White House projects that total outlays (cash going out the door to pay off contracts) by the Federal Highway Administration in 2026 will be 42 percent greater than they were in 2021 ($69.1 billion in 2026 versus $48.7 billion in 2021). Can that spending increase be accomplished without significant additional increases in the cost of scarce construction components? We shall see.