This week’s release of the January 2024 inflation report from the Bureau of Labor Statistics revealed three primary data points:

- The total Consumer Price Index for January 2024 was 3.1 percent higher than January 2023, and that 3.1 percent annual rate was almost below the traditional 3 percent target maximum, on its way to a level where the Federal Reserve might think about cutting interest rates later this year. Good news.

- Once you subtract food and energy costs, traditionally the most volatile variables, the remaining “core” inflation rate, January over January, was 3.9 percent, indicating that there is still work to be done. Not so good news.

- The core inflation jump was largely due to two things: a 6.0 percent increase in housing costs, and an astounding 20.6 percent increase in automobile insurance rates (both January 2024 versus one year earlier).

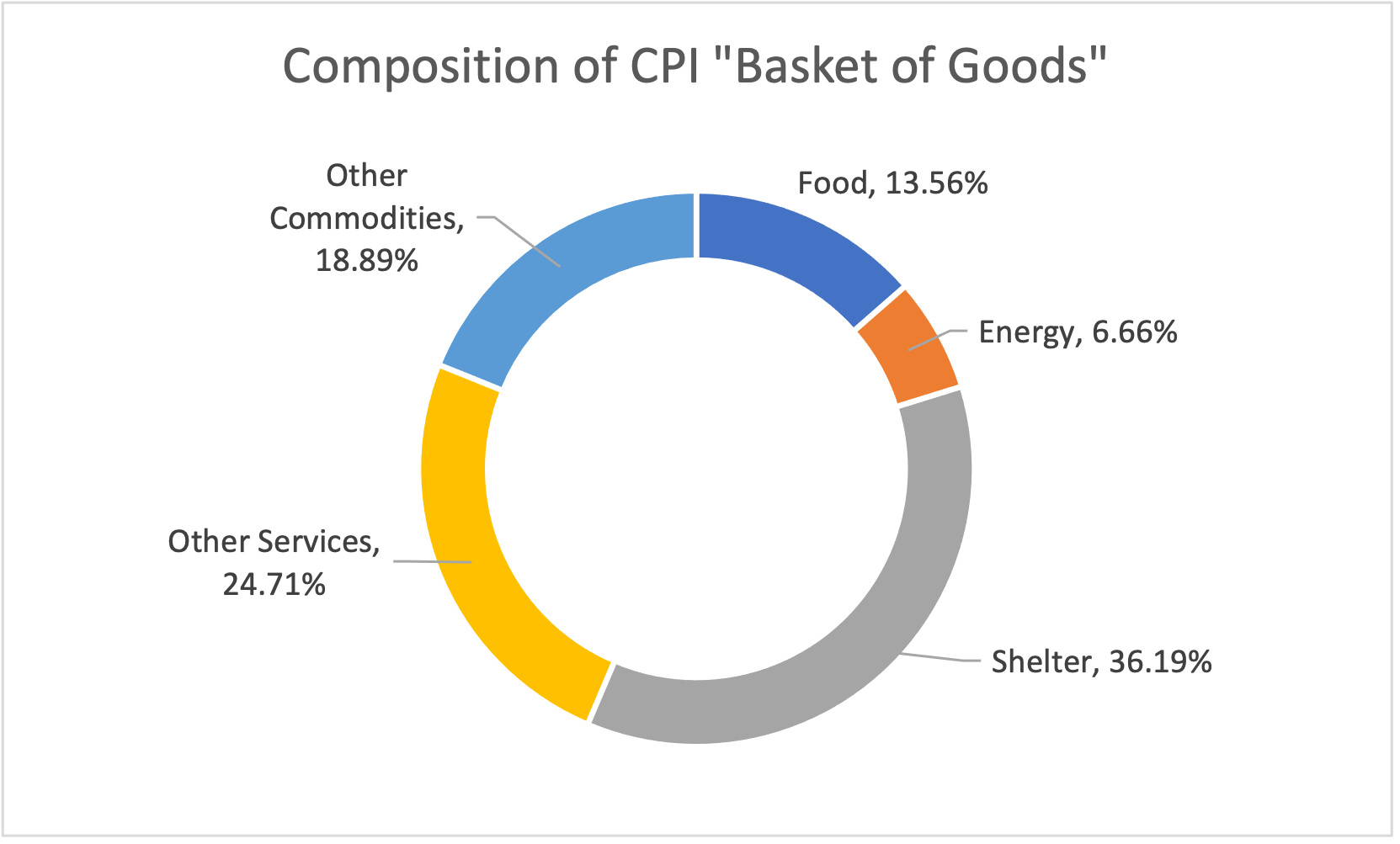

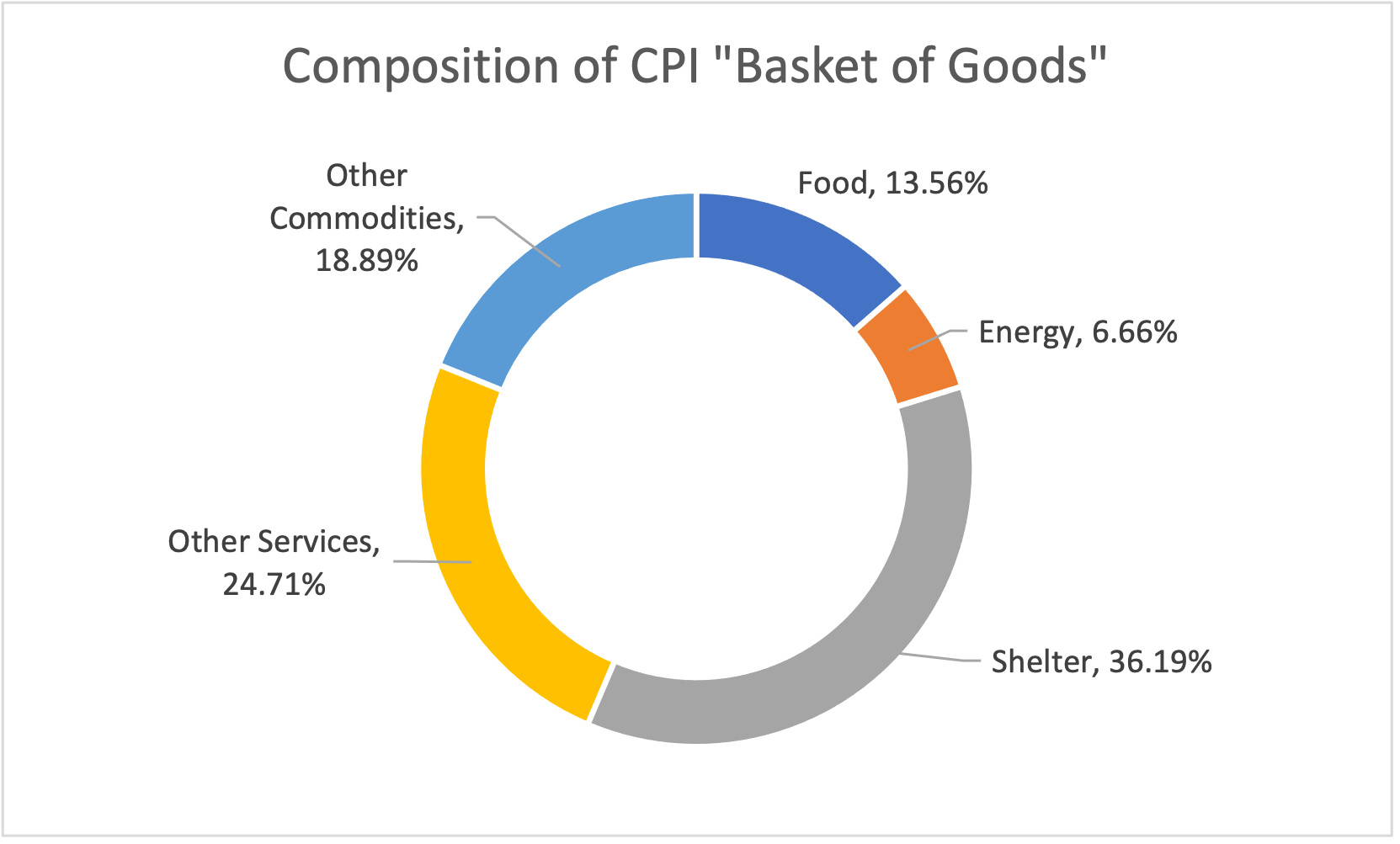

The notional “basket of goods,” the cost of which is measured by CPI, can be broken down into five categories:

On its own, since shelter is 36.19 percent of the weight of the total CPI, a 6.0 percent increase in shelter costs, on its own, would cause a 2.2 percent increase in the total CPI, subject to being possibly offset by decreases elsewhere in the CPI (0.3619 x .06 = .0216).

Transportation actually forms almost 16 percent of total household spending as measured by the CPI basket, with motor fuels from the “energy” category and everything else from “other commodities” or “other services,” to wit:

|

|

|

Jan. 2024 |

| Category |

Expense |

Weight |

vs Jan. 2023 |

| Energy |

Motor Fuel |

3.372% |

-6.6 |

| Other Commodities |

New Vehicles |

3.684% |

0.7 |

| Other Commodities |

Used Cars/Trucks |

2.012% |

-3.5 |

| Other Commodities |

Motor Vehicle Parts/Equipment |

0.469% |

-0.8 |

| Other Services |

Leased Cars/Trucks |

0.517% |

-1.6 |

| Other Services |

Rental of Cars/Trucks |

0.139% |

-14.1 |

| Other Services |

Motor Vehicle Maintenance/Repair |

1.233% |

6.5 |

| Other Services |

Motor Vehicle Insurance |

2.794% |

20.6 |

| Other Services |

Motor Vehicle Fees (incl. Parking) |

0.540% |

2.6 |

| Other Services |

Airline Fares |

0.751% |

-6.4 |

| Other Services |

Other Intercity Transportation |

0.089% |

-3.4 |

| Other Services |

Intracity Mass Transit |

0.224% |

2.1 |

| Total, Transportation Share of CPI Basket of Goods |

15.824% |

|

Motor vehicle insurance has gotten to the point that it forms 2.794 percent of the basket of goods (five years ago it was 2.415 percent of the basket, and ten years ago it was 2.213 percent). So that 20.6 percent increase in its cost over the last 12 months is equivalent to an 0.6 percent bump in total CPI.

Why is this happening?

There appear to be several reasons.

- CBS News covered a bankrate.com analysis that looked at auto insurance costs on a state-by-state basis and found that the biggest increases were in states that have had a lot of flooding in the last few years (Florida and Louisiana), or else have had a lot of tornado activity. This caused an increase in the percentage of insured vehicles getting totaled or else having very expensive claims filed.

- The Wall Street Journal published a story blaming part of the increase on the fact that electric vehicles cost so much more to repair than do internal combustion vehicles (an average of $6,587 per crash for EVs vs $4.215 for all vehicles). The number of EVs on road in the entire country probably isn’t enough to cause this kind of jump in total insurance costs (yet), but the article does note that EV owners “pay on average $357 a month for [insurance] coverage compared with $248 for gas vehicle owners.”

- It is well documented that a lot of people started driving like idiots during COVID and have not stopped, causing an increase in accidents, and the latest LexisNexis Auto Insurance Trends Report estimated that, since 2019, “Bodily Injury and Property Damage severity have increased by 35%” and ” Collision severity has increased by roughly 40%,” which also leads to more expensive claims.

- More anecdotally (and hyper-regionally), auto theft is way up post-COVID in many major cities (including here in Washington D.C.), which also trickles upwads to higher insurance rates eventually.

Put it all together in a place like California (with lots of natural disaster and the highest EV market penetration and lots of idiot drivers and a few high-crime large cities), and you get Allstate this week increasing their auto insurance rates in the Golden State by an average of 30 – thirty! – percent (they asked the regulatory board for a 35 percent increase).